Morning Call For Monday, Dec. 18

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.36%) this morning are up +0.33% at a new record nearest-futures high and European stocks are up +1.20% at a 1-week high. Optimism U.S. lawmakers will pass legislation to reduce corporate and individual tax rates is fueling gains in equities. The House and Senate will vote on the tax reform plan mid-week with expectations that the Republican majority has the votes to pass the legislation. Asian stocks settled higher: Japan +1.55%, Hong Kong +0.70%, China +0.05%, Taiwan +0.14%, Australia +0.70%, Singapore -0.06%, South Korea +0.11%, India +0.41%. Asian stock markets found support from Friday's rally in U.S. equities to record highs. Japanese stocks also gained after trade data showed Japan Nov exports rose more than expected. China's Shanghai Composite recovered from a 4-month low to eke out a small gain as homebuilding stocks and property developers rose after China Nov new home prices declined in fewer cities than in Oct.

The dollar index (DXY00 -0.27%) is down -0.27%. EUR/USD (^EURUSD) is up +0.38% on hawkish comments from ECB Governing Council member Liikanen who said the strong recovery in the Eurozone supports inflation converging towards the ECB's target. USD/JPY (^USDJPY) is down -0.07%.

Mar 10-year T-note prices (ZNH18 -0.16%) are down -5.5 ticks.

ECB Governing Council member Liikanen said "the strong recovery in the Eurozone and reduction of economic slack support confidence in inflation converging towards our inflation aim in due course."

The UK Dec CBI trends total orders was unchanged at 17, stronger than expectations of -2 to 15. Dec CBI trends selling prices rose +6 to a 6-month high of 23.

China Nov new-home prices rose in 50 of 70 cities tracked by the government, unch from Oct. Nov new-home prices fell in 10 cities, less than 14 that fell in Oct.

The Japan Nov trade balance shrank to a surplus of +113.4 billion yen, more than expectations of a -$40.0 billion-yen deficit. Nov exports rose +16.2% y/y, stronger than expectations of 14.7% y/y. Nov imports rose +17.2% y/y, weaker than expectations of +18.0% y/y.

U.S. STOCK PREVIEW

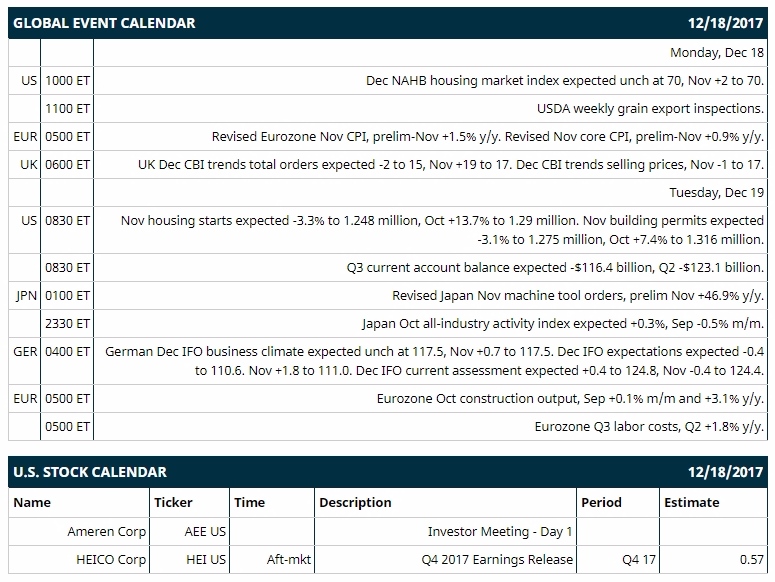

Key U.S. news today includes: (1) Dec NAHB housing market index (expected unch at 70, Nov +2 to 70), (2) USDA weekly grain export inspections.

Notable Russell 1000 earnings reports today include: HEICO Corp (consensus $0.57).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Discover Financial Services (DFS +1.25%) was upgraded to 'Buy' from 'Neutral at Bank of America/Merrill Lynch.

Costco Wholesale (COST +3.32%) was upgraded to 'Outperform' from 'Market Perform' at BMO Capital Markets with a price target of $215.

Capital One Financial (COF +2.39%) was upgraded to 'Buy' from 'Neutral at Bank of America/Merrill Lynch.

Phillips 66 Partners (PSX +0.37%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

VMware (VMW +2.10%) was upgraded to 'Overweight' from 'Sector Weight' at KeyBanc Capital Markets with a 12-month target price of $142.

Netgear (NTGR +2.41%) was upgraded to 'Outperform' from 'Market Perform' at Raymond James with a 12-month target price of $62.

Twitter (TWTR -1.55%) was upgraded to 'Overweight' from 'Neutral' at JPMorgan Chase with a price target of $27.

Kellogg (K -0.09%) announced after the close Friday that its board has authorized a buyback of up to $1.5 billion in company stock.

TD Ameritrade (AMTD +2.16%) gained almost 3% in after-hours trading after it said it will offer Cboe Bitcoin futures on Monday.

Snyder’s-Lance (LNCE +5.34%) rose 5% in after-hours trading after CNBC reported that Campbell Soup is in advanced talks to acquire the company.

Akamai Technologies (AKAM +1.76%) jumped over 13% in after-hours trading after holder Elliot Associates reported a 6.5% stake in the company and said it seeks talks with management as it believes the shares are undervalued.

Sunrun (RUN +3.41%) fell 4% in after-hours trading after it filed to sell $328.7 million of mixed securities.

Aratana Therapeutics (PETX +2.69%) dropped 9% in after-hours trading after it said its AT-016 did not achieve efficacy success in a study of Osteoarthritis on dogs.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.36%) this morning are up +8.75 points (+0.33%) at a fresh record nearest-futures high. Friday's closes: S&P 500 +0.90%, Dow Jones +0.58%, Nasdaq +1.20%. The S&P 500 index on Friday soared to a new record high and closed higher on indications that the Senate is close to an agreement on a tax reform package after Senator Rubio, who had voiced opposition to the plan, said he would now support it after his demand for an increased child tax credit was met. There was also strength in technology stocks led by a +2.5% jump in Microsoft to a record high.

Mar 10-year T-note prices (ZNH18 -0.16%) this morning are down -5.5 ticks. Friday's closes: TYH8 -4.50, FVH8 -4.25. Mar 10-year T-notes on Friday closed lower on the rally in the S&P 500 to a new record high, which curbs the safe-haven demand for T-notes, and on the improved prospects for Congress to pass the Republican tax-reform plan after Senators Rubio and Corker said they would support the bill.

The dollar index (DXY00 -0.27%) this morning is down -0.251 (-0.27%). EUR/USD (^EURUSD) is up +0.0045 (+0.38%) and USD/JPY (^USDJPY) is down -0.08 (-0.07%). Friday's closes: Dollar Index +0.443 (+0.47%), EUR/USD -0.0029 (-0.25%), USD/JPY +0.21 (+0.19%). The dollar index on Friday closed higher on the improved prospects for the Republican tax-reform plan to be passed after Florida Senator Rubio dropped his opposition to the plan. The dollar was also supported by the increase in T-note yields, which boosts the dollar's interest rate differentials.

Jan crude oil (CLF18 +0.42%) this morning is up +17 cents (+0.30%) and Jan gasoline (RBF18 +0.78%) is +0.0110 (+0.66%). Friday's closes: Jan WTI crude +0.26 (+0.46%), Jan gasoline -0.0159 (-0.95%). Jan crude oil and gasoline on Friday settled mixed. Crude oil prices were supported by carry-over support from the ongoing closure of the Forties Pipeline System that has underpinned Brent crude prices and by news that U.S. active oil rigs in the week ended Dec 15 fell by 4 to 747 rigs. Crude oil prices were undercut by a stronger dollar and by the fall in the crack spread to a 5-3/4 month low, which may crimp refinery demand for crude to refine into gasoline.

Metals prices this morning are mixed with Feb gold (GCG18 +0.33%) +4.4 (+0.35%), Mar silver (SIH18 +0.48%) +0.097 (+0.60%) and Mar copper (HGH18 -0.46%) -0.013 (-0.41%). Friday's closes: Feb gold +0.4 (+0.03%), Mar silver +0.129 (+0.81%), Mar copper +0.0620 (+2.02%). Metals on Friday closed higher with Mar copper at a 2-week high. Metals prices were boosted by signs of strength in the global economy that is positive for industrial metals demand after the Bundesbank raised its German 2017 and 2018 GDP estimates. Copper prices were boosted by the -16,016 MT ton decline in weekly Shanghai copper inventories to a 6-week low of 142,129 MT. Metals prices were undercut by a stronger dollar.

Disclosure: None.