Morning Call For Monday, Dec. 11

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.09%) this morning are up +0.08% and European stocks are down -0.12%. Most global stocks markets moved higher ahead of central bank meetings this week from the Fed, ECB and BOE. U.S. equity gains were limited and European stocks were down -0.12% on weakness in energy stocks with Jan WTI crude oil (CLF18 -0.30%) down -0.45% after data from Baker Hughes on Friday showed the number of active U.S. oil rigs rose to a 3-month high. Losses in European stocks were contained on upbeat comments from ECB Governing Council member Nowotny who said growth prospects are "looking up." Asian stocks settled higher: Japan +0.56%, Hong Kong +1.14%, China +0.98%, Taiwan +0.72%, Australia +0.07%, Singapore +1.05%, South Korea +0.13%, India +0.62%. Chinese stocks closed higher after China's Nov credit growth exceeded estimates and Japan's Nikkei Stock Index rose to a 1-week high after a gauge of Japan Q4 large company business conditions climbed to a 2-year high.

The dollar index (DXY00 -0.13%) is down -0.14%. EUR/USD (^EURUSD) is up +0.15%. USD/JPY (^USDJPY) is down -0.11%.

Mar 10-year T-note prices (ZNH18 +0.15%) are up +4 ticks.

ECB Governing Council member Nowotny said "thanks to the broad-based economic expansion we see today, growth prospects are looking up, not just at the global but in particular the European level."

China Nov CPI rose +1.7% y/y, weaker than expectations of +1.8% y/y. Nov PPI rose +5.8% y/y, right on expectations.

China Nov new yuan loans rose +1.12 trillion yuan, stronger than expectations of +800 billion yuan. Nov aggregate financing rose +1.60 trillion yuan, stronger than expectations of +1.25 trillion yuan.

Japan Q4 BSI business conditions large company all-industry rose +1.1 to a 2-year high of 6.2, stronger than expectations of +0.7 to 5.8.

U.S. STOCK PREVIEW

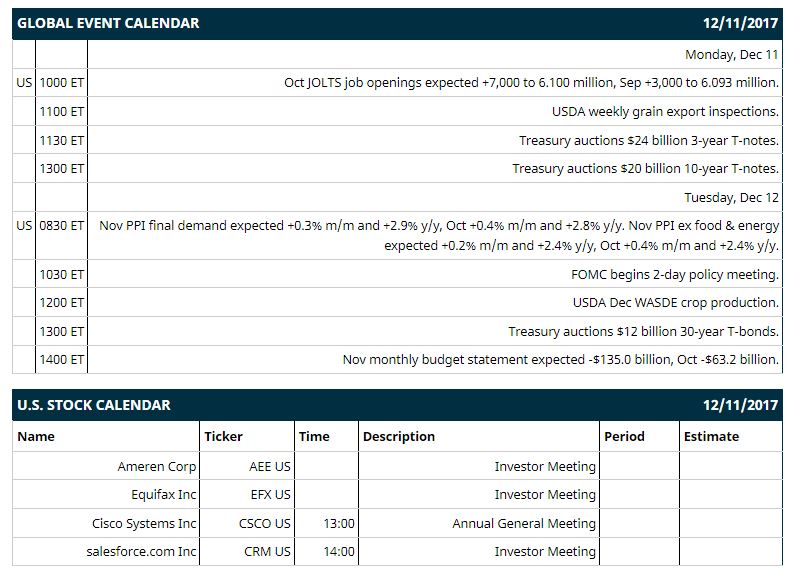

Key U.S. news today includes: (1) Oct JOLTS job openings (expected +7,000 to 6.100 million, Sep +3,000 to 6.093 million), (2) USDA weekly grain export inspections, (3) Treasury auctions $24 billion of 3-year T-notes and $20 billion of 10-year T-notes.

Notable Russell 1000 earnings reports today include: none.

U.S. IPO's scheduled to price today: none.

Equity conferences this week: American Society of Hematology Meeting on Mon, Capital Link Greek Investor Forum on Mon, Macquarie Bigger Data Corporate Day on Mon, Cowen Technology, Media & Telecom Conference on Tue, TechTaipei Industry & Smart Factory Conference on Tue, Cowen Security and Networking Conference on Wed, Guggenheim Securities Boston Health Care Conference on Wed, BMO Capital Markets Prescriptions for Success Healthcare Conference on Thu, Jefferies Office & Industrial Summit on Thu, SunTrust Financial, Technology, Business & Government Services conference on Thu, Cowen Energy & Natural Resources Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Automatic Data Processing (ADP +0.12%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs with a price target of $135.

DaVita (DVA +0.85%) was upgraded to 'Buy' from 'Neutral' at Citigroup.

First Solar (FSLR +2.32%) was upgraded to 'Outperform' from 'Neutral' at Baird with a price target of $82.

Kimberly-Clark (KMB +0.29%) was downgraded to 'Sell' from 'Neutral' at Citigroup.

Hologic (HOLX +2.42%) was upgraded to 'Outperform' from 'Market Perform' at Cowen with a price target of $51.

Flowserve (FLS -1.22%) was downgraded to 'Hold' from 'Buy' at Stifel.

Waste Management ({=WM =}) was upgraded to 'Buy' from 'Hold' at Stifel with a price target of $95.

Overstock.com (OSTK -1.25%) climbed nearly 4% in after-hours trading after Morgan Stanley reported an 11.4% passive stake in the company.

Cytokinetics (CYTK -1.23%) dropped 5% in after-hours trading after it said that the results of a Phase 3 trial of its Tirasemtiv in patients with amyorophic lateral sclerosis did not meet primary or secondary endpoints.

UTStarcom Holdings (UTSI +0.77%) rallied almost 8% in after-hours trading after Tonghao Group reported a 9.9% stake in the company.

Fate Therapeutics (FATE -0.48%) rose over 6% in after-hours trading after it announced the dosing of its first subject in the "Apollo" study of FATE-NK100 as a monotherapy for the treatment of refractory or relapsed acute myelogenous leukemia.

Akari Therapeutics PLC (AKTX -2.78%) jumped 14% in after-hours trading after is said a Phase II trial of its Coversin in patients with paroxysmal nocturnal hemoglobinuria met its primary endpoint.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.09%) this morning are up +2.00 points (+0.08%). Friday's closes: S&P 500 +0.55%, Dow Jones +0.49%, Nasdaq +0.45%. The S&P 500 on Friday closed higher on reduced Chinese economic concerns after trade data showed China Nov imports and exports rose more than expected. Stocks were also boosted by the +228,00 increase in U.S. Nov non-farm payrolls, stronger than expectations of +195,000. There was also strength in energy stocks as crude oil prices rose +1.18%. On the negative side, the University of Michigan U.S. Dec consumer sentiment unexpectedly fell -1.7 to 96.8, weaker than expectations of +0.5 to 99.0.

Mar 10-year T-note prices (ZNH18 +0.15%) this morning are up +4 ticks. Friday's closes: TYH8 -0.50, FVH8 +0.75. Mar 10-year T-notes on Friday closed lower on the bigger-than-expected +228,000 increase in U.S. Nov non-farm payrolls and on the rally in stocks, which curbed safe-haven demand for T-notes. T-notes found support on news that U.S. Nov average hourly earnings rose by a less than expected +2.5% y/y.

The dollar index (DXY00 -0.13%) this morning is down -0.135 (-0.14%). EUR/USD (^EURUSD) is up +0.0018 (+0.15%) and USD/JPY (^USDJPY) is down -0.12 (-0.11%). Friday's closes: Dollar Index +0.106 (+0.11%), EUR/USD unch, USD/JPY +0.39 (+0.34%). The dollar index on Friday rallied to a 2-1/2 week high and closed higher on the larger-than-expected increase in U.S. Nov non-farm payrolls and on the rally in USD/JPY to a 3-week high as strength in global equity markets reduced the safe-haven demand for the yen.

Jan crude oil (CLF18 -0.30%) this morning is down -26 cents (-0.45%) and Jan gasoline (RBF18 -0.01%) is -0.0043 (-0.25%). Friday's closes: Jan WTI crude +0.67 (+1.18%), Jan gasoline +0.0166 (+0.98%). Jan crude oil and gasoline on Friday closed higher on strength in Chinese crude demand after China Nov crude imports rose +23% m/m to 9.05 million bpd, and on the rally in global equity markets, which bolsters confidence in the economic outlook and is supportive for fuel demand. Crude oil prices were undercut by the climb in the dollar index to a 2-1/2 week high.

Metals prices this morning are higher with Feb gold (GCG18 +0.29%) +3.8 (+0.30%), Mar silver (SIH18 +0.33%) +0.052 (+0.33%) and Mar copper (HGH18 +0.07%) +0.005 (+0.15%). Friday's closes: Feb gold -4.7 (-0.38%), Mar silver +0.021 (+0.13%), Mar copper +0.0014 (+0.47%). Metals on Friday settled mixed with Feb gold at a 4-1/2 month low. Precious metals prices were undercut by the rally in the dollar index to a 2-1/2 week high and by the the stronger-than-expected U.S. Nov non-farm payroll report, which bolstered expectations for Fed tightening. Copper closed higher on signs of strength in China's economy after China Nov exports and imports rose more than expected, along with stronger Chinese copper demand after China Nov copper imports of 470,000 MT were up +42% m/m and +23.7% y/y.

(Click on image to enlarge)

Disclosure: None.