Morning Call For Monday, August 14

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.52%) this morning are up +0.56% and European stocks are up +1.09% after comments from top U.S. security officials eased concern that tensions with North Korea would escalate into armed conflict. Speaking on Sunday, C.I.A. Director Pompeo and national security advisor McMaster both sought to tamp down fears of imminent nuclear conflict with North Korea. Global stocks rallied, while gold prices and government bond prices retreated as geopolitical risks from North Korea eased. Asian stocks settled mostly higher: Japan -0.98%, Hong Kong +1.36%, China +0.90%, Taiwan -1.01%, Australia +0.65%, Singapore +0.88%, South Korea +0.73%, India +0.75%. Japan's Nikkei Stock Index fell to a 2-3/4 month low as Japanese markets reopened after Friday's holiday and caught up to losses in other global bourses. Japanese stocks fell despite signs of stronger growth after Japan Q2 GDP accelerated at a +4.0% (q/q annualized) pace, the fastest pace of growth in over 2-years.

The dollar index (DXY00 +0.27%) is up +0.30%. EUR/USD (^EURUSD) is down -0.26%. USD/JPY (^USDJPY)is up +0.51%.

Sep 10-year T-note prices (ZNU17 -0.23%) are down -10.5 ticks.

Eurozone Jun industrial production fell -0.6% m/m, weaker than expectations of -0.5% m/m and the biggest decline in 6 months.

Japan Q2 GDP rose +4.0% (q/q annualized), stronger than expectations of +2.5% (q/q annualized) and the fastest pace of growth in over 2-years. The Q2 GDP deflator fell -0.4%, stronger than expectations of -0.5%. Q2 GDP private consumption rose +0.9% q/q, stronger than expectations of +0.5% q/q and the biggest increase in 3-years. Q2 GDP business spending rose +2.4% q/q, stronger than expectations of +1.2% q/q and the biggest increase in 3-years.

China Jul industrial production rose +6.4% y/y, weaker than expectations of +7.1% y/y and the smallest pace of increase in 7 months.

U.S. STOCK PREVIEW

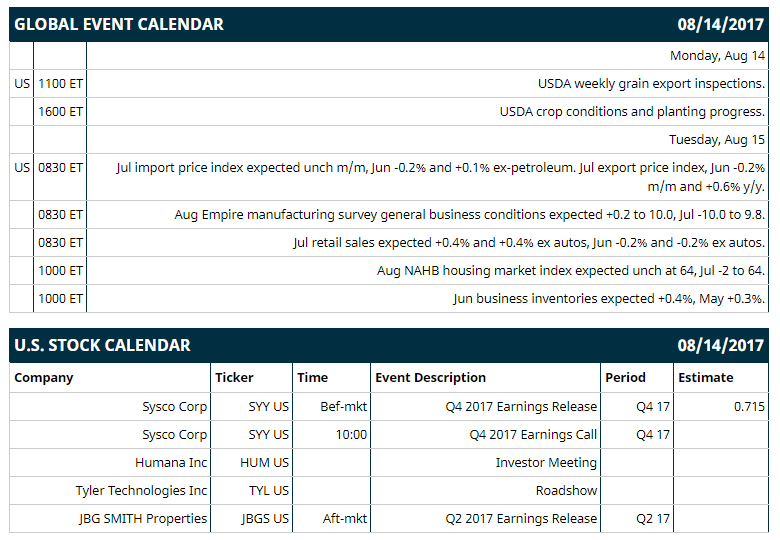

Key U.S. news today includes: (1) USDA weekly grain export inspections, (2) USDA crop conditions and planting progress.

Notable Russell 1000 earnings reports today include: Sysco (consensus $0.72).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: EnerCom Oil & Gas Conference on Mon, D. A. Davidson & Co Technology Forum on Tue, Nomura Holdings Inc Instinet Media Telecom Conference on Tue, Citi Insurance & Asset Managers Forum on Wed, Barclays Kohler Conference on Wed, Wedbush Pacgrow Health Care Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

International Paper (IP +0.73%) was upgraded to 'Buy' from 'Neutral' at D.A. Davidson.

Orbital ATK (OA +0.70%) was upgraded to 'Buy' from 'Hold' at Argus Research with a price target of $120.

Weyerhaeuser (WY +0.31%) was downgraded to 'Market Perform' from 'Outperform' at BMO Capital Markets.

Masimo (MASI +1.88%) was upgraded to 'Buy' from 'Neutral' at BTIG with a price target of $100.

Temper Sealy (TPX +1.55%) was upgraded to 'Overweight' from 'Neutral' at Piper Jaffray with a price target of $80.

CNO Financial Group (CNO -1.66%) was downgraded to 'Underweight' from 'Equalweight' at Morgan Stanley.

CenterPoint Energy (CNP -1.06%) was upgraded to 'Neutral' from 'Underperform' at Credit Suisse.

Pure Storage (PSTG +1.04%) was downgraded to 'Hold' from 'Buy' at Maxim.

Intuitive Surgical (ISRG +1.38%) gained 1% in after-hours trading after its board approved a 3-for-1 stock split for each shareholder as of September 29. Trading will start on a split-adjusted basis on October 6.

Lockheed Martin (LMT +0.16%) was awarded an $8 billion-dollar contract from the U.S. Department of Defense for Special Operations Forces Global Logistics Support Services.

Fly Leasing Ltd. (FLY +0.99%) filed to sell a $1 billion shelf of mixed securities.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.52%) this morning are up +13.75 points (+0.56%). Friday's closes: S&P 500 +0.13%, Dow Jones +0.07%, Nasdaq +0.75%. The S&P 500 on Friday closed higher on subdued U.S. inflation after the Jul core CPI rose +0.1% m/m and +1.7% y/y, slightly weaker than expectations of +0.2 m/m and +1.7% y/y, with the +1.7% y/y gain matching May and Jun as the slowest year-on-year pace of increase in 2-1/2 years. Stocks also moved higher as U.S.-North Korea tensions eased slightly after the VIX volatility index fell back from a 9-month high and closed lower.

Sep 10-year T-note prices (ZNU17 -0.23%) this morning are down -10.5 ticks. Friday's closes: TYU7 +8.00, FVU7 +7.25. Sep 10-year T-notes on Friday rallied to a 1-1/2 month high and settled higher on increased safe-haven demand for T-notes from the geopolitical risks from North Korea along with slack inflation pressures after U.S. Jul core CPI rose +1.7% y/y, right on expectations but below the Fed's +2.0% target and the slowest pace of increase in 2-1/2 years. T-notes held their gains on dovish Fed commentary from Dallas Fed President Kaplan and Minneapolis Fed President Kashkari who both said the Fed can wait to see if inflation picks up before it raises interest rates again.

The dollar index (DXY00 +0.27%) this morning is up +0.277 (+0.30%). EUR/USD (^EURUSD) is down -0.0031 (-0.26%) and USD/JPY (^USDJPY) is up +0.56 (+0.51%). Friday's closes: Dollar Index -0.332 (-0.36%), EUR/USD +0.0049 (+0.42%), USD/JPY -0.01 (-0.01%). The dollar index on Friday closed lower on the benign U.S. Jul CPI, which bolsters the case for the Fed to refrain from further tightening monetary policy. The dollar was also under pressure from the North Korean tensions that boosted the safe-haven demand for yen and sent USD/JPY down to a fresh 1-3/4 month low, and on the fall on the 10-year T-note yield to a 1-1/2 month low, which reduced the dollar's interest rate differentials.

Sep crude oil (CLU17 -0.57%) this morning is down -33 cents (-0.68%). Sep gasoline (RBU17 -0.86%) is -0.0162 (-1.00%). Friday's closes: Sep WTI crude +0.23 (+0.47%), Sep gasoline +0.0102 (+0.64%). Sep crude oil and gasoline on Friday closed higher on a weaker dollar and on the increase in the crack spread to a 4-session high, which gives incentive for refiners to purchase crude oil to refine into gasoline. A bearish factor is the outlook for increased U.S. crude production after U.S. active oil rigs in the week ended Aug 11 rose +3 to 768, the most in 2-1/3 years.

Disclosure: None.