Morning Call For May 4, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 -0.61%) are down -0.69% and European stocks are down -0.81%, both at 3-week lows on economic growth concerns. Eurozone Mar retail sales declined -0.5% m/m, the biggest monthly decline in 1-1/2 years, and the Eurozone Apr Markit services PMI was revised downward to 53.1, the slowest pace of growth in 1-1/4 years. Mining stocks and raw-material producers were weaker as the price of copper (HGN16-0.97%) is down -1.17% at a 2-week low. Asian stocks settled lower: Japan closed for holiday, Hong Kong -0.73%, China -0.05%, Taiwan -1.31%, Australia -1.54%, Singapore -1.36%, South Korea -0.40%, India -0.51%.

The dollar index (DXY00 +0.19%) is up +0.32%. EUR/USD (^EURUSD) is down -0.03%. USD/JPY (^USDJPY) is up +0.10%. GBP/USD is down -0.28%at a 1-week low after the UK Apr Markit/CIPS construction PMI fell -2.2 to 53.0, the slowest pace of expansion in 2-3/4 years.

Jun T-note prices (ZNM16 +0.02%) are up +1.5 ticks.

The Eurozone Apr Markit services PMI was revised downward to 53.1 from the originally reported 53.2 and matched March's level as the slowest pace of expansion in 15 months.

Eurozone Mar retail sales of -0.5% m/m and +2.1% y/y was weaker than expectations of -0.1% m/m and +2.6% y/y with the -0.5% m/m drop the largest monthly decline in 1-1/2 years.

U.S. STOCK PREVIEW

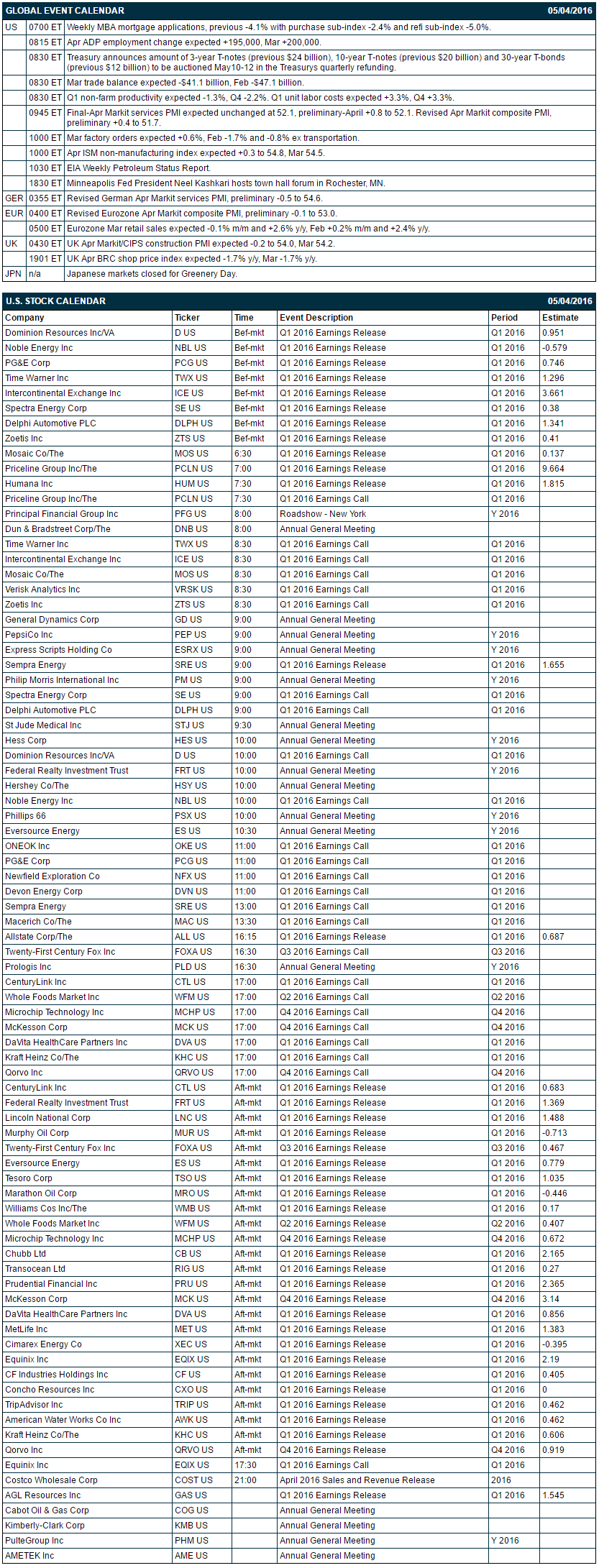

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -4.1% with purchase sub-index -2.4% and refi sub-index -5.0%), (2) Apr ADP employment change (expected +195,000, Mar +200,000), (3) Mar trade deficit (expected -$41.1 billion, Feb -$47.1 billion), (4) Q1 non-farm productivity (expected -1.3%, Q4 -2.2%) and Q1 unit labor costs (expected +3.3%, Q4 +3.3%), (5) final-Apr Markit services PMI (expected unchanged at 52.1, preliminary-April +0.8 to 52.1), (6) Mar factory orders (expected +0.6%, Feb -1.7% and -0.8% ex transportation), (7) Apr ISM non-manufacturing index (expected +0.3 to 54.8, Mar 54.5), (8) Minneapolis Fed President Neel Kashkari hosts town hall forum in Rochester, MN, and (9) EIA Weekly Petroleum Status Report.

There are 39 of the S&P 500 companies that report earnings today with notable reports including: Time Warner (consensus $1.30), ICE (3.66), Priceline (9.66), Humana (1.66), Allstate (0.69), Murphy Oil (-0.71), Marathon Oil (-0.45), Whole Foods (0.41), TripAdvisor (0.46).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: Deutsche Bank Health Care Conference on Wed-Thu, ACI Renewable & Bio-based Chemicals Summit on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

KB Home (KBH -2.97%) was downgraded to 'Sell' from Neutral' at UBS.

Under Armour (UA -2.31%) was downgraded to 'Hold' from 'Buy' at Brean Capital.

CBS Corp. (CBS -1.43%) climbed almost 2% in after-hours trading after it reported Q1 adjusted EPS continuing operations of $1.02, higher than consensus of 94 cents.

Illumina (ILMN -1.67%) fell nearly 3% in after-hours trading after it reported Q1 adjusted EPS of 71 cents, below consensus of 72 cents, and said it sees Q2 adjusted EPS of 72 cents-74 cents, weaker than consensus of 83 cents.

Avis Budget Group (CAR -4.43%) gained over 2% in after-hours trading after it said it sees 2016 revenue of $8.75 billion-$8.9 billion, higher than consensus of $8.69 billion.

Papa John's International (PZZA -3.47%) fell over 3% in after-hours trading after it reported Q1 revenue of $428.6 million, below consensus of $441 million.

Match Group (MTCH -1.15%) rose 5% in after-hours trading after it reported Q1 adjusted EPS of 11 cents, better than consensus of 8 cents.

Paycom Software (PAYC -1.72%) rallied over 5% in after-hours trading after it reported Q1 adjusted EPS of 33 cents, above consensus of 20 cents, and then raised guidance on 2016 revenue to $320 million-$322 million from a prior estimate of $309 million-$311 million.

Lannett (LCI -1.87%) rose nearly 8% in after-hours trading after it reported Q3 adjusted EPS of 75 cents, above consensus of 69 cents.

Plantronics (PLT -1.16%) jumped nearly 7% in after-hours trading after it reported Q4 adjusted EPS of 64 cents, better than consensus of 56 cents, and said it sees Q1 non-GAAP EPS of 63 cents-73 cents, higher than consensus of 62 cents.

Cray (CRAY -1.09%) slumped over 15% in after-hours trading after it said there's now "an increased level of risk" to hitting its full-year sales target of $825 million on "reliance on key third-party components, some of which have already been delayed, and the level and timing of new orders."

Zillow Group (ZG -0.96%) climbed over 10% in after-hours trading after it raised guidance on fiscal 2016 revenue to $825 million-$835 million from a February 11 estimate of $805 million-$815 million.

Nutrisystem (NTRI +0.71%) rallied 14% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to $1.17-$1.27 from a prior view of $1.09-$1.19, above consensus of $1.11.

Glaukos (GKOS +0.46%) surged over 20% in after-hours trading after it boosted its 2016 sales forecast to $100 million-$102 million from a March 1 estimate of $91.9 million.

Etsy (ETSY -1.29%) climbed over 5% in after-hours trading after it reported Q1 revenue of $81.8 million, higher than the highest estimate of $77.0 million.

Callidus Software (CALD -1.92%) slumped over 12% in after-hours trading after it lowered guidance on fiscal 2016 revenue to $206 million-$210 million from a February 9 estimate of $210 million-$215 million.

MARKET COMMENTS

June E-mini S&Ps (ESM16 -0.61%) this morning are down -14.25 points (-0.69%) at a 3-week low. Tuesday's closes: S&P 500 -0.87%, Dow Jones-0.78%, Nasdaq -0.91%. The S&P 500 on Tuesday sold off and closed lower on Chinese growth concerns after the China Apr Caixin manufacturing PMI unexpectedly fell -0.3 to 49.4, weaker than expectations of +0.1 to 49.8. In addition, there was negative carryover from a slide in European stocks to a 2-1/2 week low after the European Commission cut its Eurozone 2016 GDP estimate to 1.6% from Feb's 1.7% forecast.

June 10-year T-note prices (ZNM16 +0.02%) this morning are up +1.5 ticks. Tuesday's closes: TYM6 +19.00, FVM6 +10.75. Jun T-notes on Tuesday climbed to a 1-1/2 week high and closed higher on increased safe-haven demand for T-notes afer the slump in stocks and on reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 1-week low.

The dollar index (DXY00 +0.19%) this morning is up +0.293 (+0.32%). EUR/USD (^EURUSD) is down -0.0004 (-0.03%). USD/JPY (^USDJPY) is up +0.11 (+0.10%). Tuesday's closes: Dollar Index +0.318 (+0.34%), EUR/USD -0.0038 (-0.33%), USD/JPY +0.19 (+0.18%). The dollar index on Tuesday posted a new 1-1/4 year low but recovered and closed higher on short-covering after Atlanta Fed President Lockhart said that a Fed rate increase in June was "a real option." In addition, there was weakness in EUR/USD which fell back from an 8-1/4 month high and closed lower after the European Commission cut its Eurozone 2016 and 2017 GDP estimates.

June WTI crude oil (CLM16 +0.25%) this morning is up +10 cents (+0.23%). June gasoline (RBM16 +0.83%) is up +0.0121 (+0.80%). Tuesday's closes: CLM6 -1.13 (-2.52%), RBM6 -0.0528 (-3.38%). June crude oil and gasoline on Tuesday closed lower on a recovery in the dollar and on expectations that Wednesday's EIA data will show that U.S. crude stockpiles increased by +750,000 bbl.

Disclosure: None.