Morning Call For May 11, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.01%) this morning are down -0.06% as stocks consolidate after Friday's sharp rally. European stocks are down -1.09% as Greek government officials meet with Eurozone finance ministers in Brussels today in an attempt to hammer out a debt deal. Signs that a deal to resolve the Greek debt crisis is not imminent undercut European stocks after Dutch Finance Minister Dijsselbloem said that an accord "will surely not be reached at the today's meeting of Eurozone finance ministers." Greece is due to make a 750 million-euro payment to the IMF on Tuesday. On the positive side, Asian markets rallied after China ramped up stimulus efforts and cut interest rates for the third time in six months. Asian stocks closed mostly higher: Japan +1.25%, Hong Kong +0.51%, China +3.04%, Taiwan -0.29%, Australia -0.17%, Singapore +0.54%, South Korea +0.26%, India +1.48%.

Commodity prices are mostly lower. Jun crude oil (CLM15 -0.40%) is down -0.44% and Jun gasoline (RBM15 -0.25%) is down -0.21%. Metals prices are lower. Jun gold (GCM15 -0.23%) is down -0.37% on fund selling after long positions in ETFs fell to a 3-3/4 month low Friday. Jul copper (HGN15-0.51%) is down -0.39%. Agriculture prices are mostly higher.

The dollar index (DXY00 +0.34%) is up +0.30%. EUR/USD (^EURUSD) is down -0.37%. USD/JPY (^USDJPY) is up +0.12%.

Jun T-note prices (ZNM15 -0.13%) are down -5.5 ticks.

As expected, the BOE at the conclusion of today's policy meeting kept its benchmark interest rate at a record low 0.50% and maintained its asset purchase target at 375 billion pounds.

The PBOC cut the 1-year lending rate by -0.25 to 5.10%, and cut the 1-year deposit rate by the same amount to 2.25% effective today. The PBOC also raised the deposit-rate ceiling to 150% of the benchmark rate and said that the "economy faces relatively large downward pressure."

U.S. STOCK PREVIEW

Key U.S. reports today include: none.

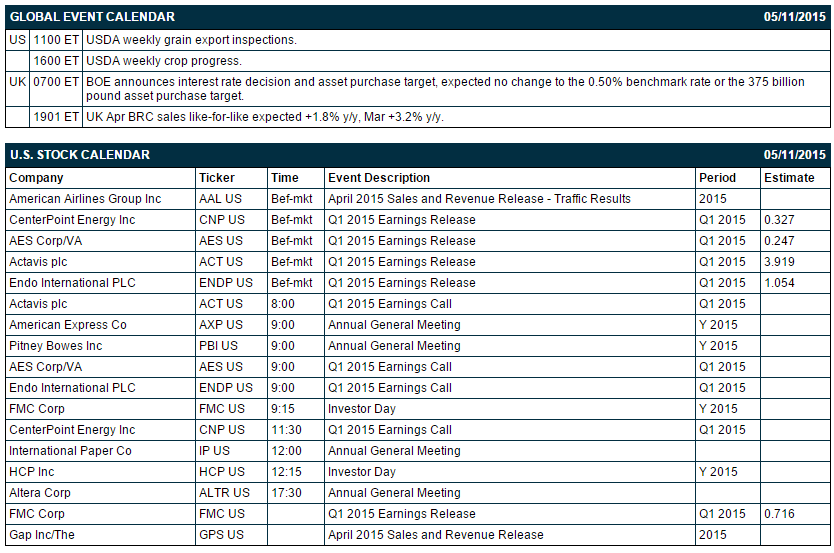

There are 5 of the S&P 500 companies that report earnings today: CenterPoint Energy (consensus $0.33), AES (0.25), Actavis (3.92), Endo International (1.05), FMC Corp (0.72).

U.S. IPO's scheduled to price today include: Biondvax Pharmaceuticals (BVXV).

Equity conferences today include: Credit Suisse Shale Symposium on Mon, Macquarie Extreme Services Conference on Mon, Mitsubishi UFJ Securities Energy Tour on Mon, Janney Montgomery Scott - Company Marketing: Consulting & IT Outsourcing - Milw on Mon, Sanford C. Bernstein & Co Disruptive Trends in Financial Services Conference on Mon-Tue, Bank of America Merrill Lynch Global Metals, Mining & Steel Conference on Tue, Deutsche Bank Clean Tech, Utilities & Power Conference on Tue, SunTrust Robinson Internet & Digital Media Conference on Tue, Jefferies TMT Conference on Tue, Goldman Sachs Global Staples Summit on Tue, Janney Montgomery Scott - Company Marketing : Gaming & Lodging - Columbus, OH on Tue, Janney Montgomery Scott - Company Marketing : Insurance - Columbus, OH on Tue-Wed, Citi Global Energy and Utilities Conference on Tue-Wed, Jefferies Global Technology, Media and Telecom Conference on Tue-Wed, Oppenheimer Industrials Conference on Tue-Wed, Bank of America Merrill Lynch Health Care Conference on Tue-Thu, Jefferies Global Technology, Media and Telecom Conference on Tue-Thu, Morgan Stanley E&P and Oil Services Conference on Tue-Thu, Bank of America Merrill Lynch Small-Mid Cap Conference on Wed, UBS Financial Services Conference on Wed, Credit Suisse Disruptive Technology Conference on Wed, JP Morgan Business Services Conference on Wed, Janney Montgomery Scott - Company Marketing : Biotechnology - Southeast on Wed, MoffettNathanson Media & Communications Summit on Wed-Thu, Bank of America Merrill Lynch Transportation Conference on Thu, Barclays Biotech CEO/CFO Conference on Thu, Royal Bank of Canada Aerospace & Defense Investor Day on Thu.

OVERNIGHT U.S. STOCK MOVERS

FMC Corp. (FMC +2.52%) reported Q1 EPS of 62 cents, below consensus of 72 cents.

Activis Plc (ACT +1.92%) reported Q1 EPS of $4.30, better than consensus of $3.92.

Endo International Plc (ENDO +0.76%) reported Q1 EPS of $1.17, higher than consensus of $1.05.

Noble Energy (NBL +2.08%) acquires Rosetta Resources (ROSE +1.20%) in an all-stock deal valued at $2.1 billion.

Joy Global (JOY +0.84%) was upgraded to 'Outperform' from 'Neutral' at Baird.

Monster Beverage (MNST -10.47%) was upgraded to 'Buy' from 'Neutral' at Citigroup.

DISH (DISH -0.21%) reported Q1 EPS of 76 cents, stronger than consensus of 40 cents, although Q1 revenue of $3.72 billion was below consensus of $3.74 billion.

National Oilwell Varco (NOV +2.42%) was downgraded to 'Sell' from 'Neutral' at Citigroup.

Syngenta (SYT +11.36%) was upgraded to 'Buy' from 'Neutral' at UBS, saying Monsanto is likely to raise its takeover bid for the company.

Nokia (NOK +3.12%) was upgraded to 'Outperform' from 'Neutral' at Exane BNP Paribas.

General Electric (GE +1.18%) was awarded a $2 billion government contract for the T700 701D/401C engine in support of the U.S. Army, Navy, Air Force, foreign military sales, and other government agency program requirements.

Reuters reports that Mylan (MYL +1.31%) executive chairman Robert Coury said it is not willing to sell itself to Teva Pharmaceuticals Industries (TEVA+0.90%) but would consider buying Teva "down the road."

ESW Capital reported a 6.6% passive stake in Broadvision (BVSN +1.36%) .

Cyrus Capital Partners reported an 18.1% stake in Overseas Shipholding Group (OSGB +0.25%) .

MARKET COMMENTS

June E-mini S&Ps (ESM15 -0.01%) this morning are down -1.25 points (-0.06%). Friday's closes: S&P 500 +1.35%, Dow Jones +1.49%, Nasdaq +1.30%. The S&P 500 on Friday closed sharply higher on hopes for a delayed Fed rate hike after April payrolls rose by only +223,000 and March payrolls were revised lower to a 2-3/4 year low of +85,000 from +126,000. In addition, SPX Q1 earnings have been better than expected and Q1 earnings expectations are now at +0.2% y/y versus -5.6% at the beginning of the earnings season.

Jun 10-year T-notes (ZNM15 -0.13%) this morning are down -5.5 ticks. Friday's closes: TYM5 +14.00, FVM5 +11.25. Jun T-notes on Friday closed with solid gains after the lackluster April payroll report of +223,000 and the downward revision in March payrolls to +85,000 from +126,000, which reduced concerns about Fed tightening. In addition, the 10-year T-note breakeven inflation rate fell to a 2-week low.

The dollar index (DXY00 +0.34%) this morning is up +0.287 (+0.30%). EUR/USD (^EURUSD) is down -0.0041 (-0.37%). USD/JPY (^USDJPY) is up +0.14 (+0.12%). Friday's closes: Dollar Index +0.548 (+0.58%), EUR/USD -0.00657 (-0.58%), USD/JPY -0.022 (-0.02%). The dollar index on Friday closed slightly higher on the rally in U.S. stocks and on weakness in EUR/USD after German Mar industrial production unexpectedly fell -0.5% m/m, weaker than expectations of +0.4% m/m. However, dollar gains were limited by the April unemployment report, which bolstered speculation that the Fed will be in no hurry to raise interest rates.

Jun WTI crude oil (CLM15 -0.40%) this morning is down -26 cents (-0.44%) and Jun gasoline (RBM15 -0.25%) is down -0.0042 (-0.21%). Friday's closes: CLM5 +0.45 (+0.76%), RBM5 +0.0077 (+0.39%). Jun crude oil and gasoline on Friday closed higher on continued support from Wednesday's EIA report, which showed a -3.88 million bbl decline in EIA crude oil inventories, the first decline in 17 weeks, and a -4,000 bpd decline in U.S. crude production in the week ended May 1, the third decline in the past four weeks.

Disclosure: None