Morning Call For March 29, 2016

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM16 -0.23%) this morning are trading slightly lower by -3.25 points (-0.16%) on Tuesday's -1.28% sell-off in China's stock market and on a renewed sell-off in crude oil prices this morning. May WTI crude oil futures are down -0.61 (-1.55%) this morning on expectations for a 3.0 million bbl build in Wednesday's weekly API report. The market is also cautious ahead of a speech by Fed Chair Yellen late this morning. Meanwhile, European stocks are mildly higher after reopening from Monday's holiday. The Euro Stoxx 50 index is up +0.34%. Asian stocks today settled mixed: Japan -0.18%, Hong Kong +0.10%, China Shanghai -1.28%, Taiwan -0.84%, Australia -1.57%, Singapore -0.40%, South Korea +0.65%, India -0.26%, and Turkey +0.57%.

The dollar index (DXY00 -0.04%) this morning is little changed. EUR/USD (^EURUSD) is slightly higher by +0.04% and USD/JPY (^USDJPY) is up +0.18%. The forex market is treading water ahead of today's Yellen comments. June 10-year T-note prices (ZNM16 +0.02%) this morning are slightly higher by +1 tick.

Commodity prices this morning are down by an average -0.37% due to a sell-off in energy and metals. May WTI crude (CLK16 -1.90%) is down -0.61 at $38.78 (-1.55%) and May gasoline (RBK16 -1.84%) is down -0.0236 (-1.58%). May natural gas (NGK16 -0.21%) is slightly higher by +0.10%. Metals prices are lower with April gold (GCJ16 +0.02%) down -0.20%, May silver (SIK16 -0.03%) down -0.56%, and May copper (HGK16 -1.36%) down-1.49%. Grains are higher with May corn up +0.13%, May soybeans up +0.19%, and May wheat up +0.58%. Softs are lower with May sugar down-0.63%, May coffee down -0.70%, May cocoa down -0.07%, and May cotton down -0.07%.

There is some negative geopolitical news this morning after an EgyptAir flight was hijacked to Cyprus and after North Korea fired another short-range missile along its coast.

San Francisco Fed President John Williams, speaking today in Singapore, said that the Fed's future pace of interest rate hikes "will be, as we've said repeatedly, gradual and thoughtful." He said the Fed will not go to negative rates in the "foreseeable future." He said that "on the inflation side, we're not quite where I'd like us to be, but recent developments have been very encouraging and add to my confidence that we're on course to reach our goal." He also said that Brexit is clearly a risk scenario that the Fed is worried about.

The Bank of England warned on Brexit risks and is tightening some banking rules.

U.S. STOCK PREVIEW

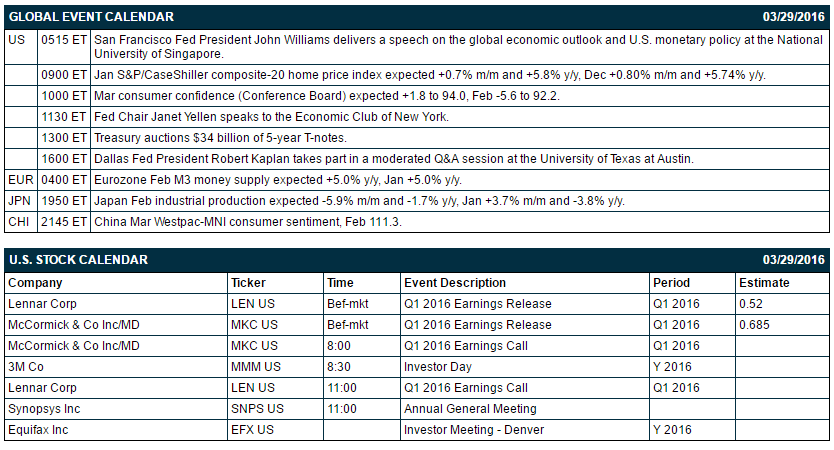

Key U.S. news today includes: (1) San Francisco Fed President John Williams' speech on the global economic outlook and U.S. monetary policy at the National University of Singapore, (2) Jan S&P/CaseShiller composite-20 home price index (expected +0.7% m/m and +5.8% y/y, Dec +0.80% m/m and +5.74% y/y), (3) Conference Board's Mar U.S. consumer confidence index (expected +1.8 to 94.0, Feb -5.6 to 92.2), (4) Fed Chair Janet Yellen's speech to the Economic Club of New York, (5) the Treasury's auction of $34 billion of 5-year T-notes, and (6) Dallas Fed President Robert Kaplan's participation in a moderated Q&A session at the University of Texas at Austin.

There are 2 of the Russell 1000 companies that report earnings today: Lennar Corp (consensus $0.52), McCormick (0.69).

U.S. IPO's scheduled to price today: Sensus Healthcare (SRTS).

Equity conferences this week include: Barclays Global Cross-Asset Class Materials Conference on Tue, Hart Energy Energy Capital Conference on Tue, Jefferies Animal Health Summit on Thu, William Blair Cancer Immunotherapy A Long-Awaited Reality Conference on Thu.

June E-mini S&Ps this morning are trading slightly lower by -3.25 points (-0.16%) on Tuesday's -1.28% sell-off in China's stock market and on a renewed sell-off in crude oil prices this morning. Monday's closes: S&P 500 -0.04%, Dow Jones +0.08%, Nasdaq +0.07%. The S&P 500 on Monday closed little changed. Stocks received support from Friday's upward revision in Q4 GDP to +1.4% from +1.0%, Monday's +0.2% increase in U.S. Feb personal spending (stronger than expectations of +0.1%), and Monday's +3.5% m/m and +5.1% y/y increase in U.S. Feb pending home sales (stronger than expectations of +1.2% m/m and -0.4% y/y. Stocks were undercut by negative carryover from Monday's -0.73% decline in China's Shanghai Composite to a 1-week low and by weakness in energy producers as the price of crude oil fell mildly by -0.18%.

OVERNIGHT U.S. STOCK MOVERS

- Cleco Corp (CNL +0.51%) is up 13% this morning on news that the Macquarie-led group's takeover of Cleco was approved by Louisiana.

- SunEdison (SUNE +4.13%) is down 30% in pre-market trading on a WSJ report that the SEC is probing its cash liquidity disclosures.

- TerraForm Global (GLBL -2.72%) is down -20% this morning on news that it will delay its 10-K filing.

- Monro Muffler Brake (MNRO +1.59%) was rated a new 'Outperform' at Oppenheimer with a price target of $80.

- HealthStream (HSTM -0.96%) was rated a new 'Outperform' at FBR Capital Markets with a 12-month price target of $27.

- Synnex (SNX +0.60%) dropped nearly 7% in after-hours trading after it reported Q1 adjusted EPS of $1.37, right on consensus, but said Q2 adjusted EPS will be $1.27-$1.33, well below consensus of $1.57.

- Iconix Brand Group (ICON +2.39%) slipped almost 3% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to $1.15-$1.30 from a February forecast of $1.35-$1.50, below consensus of $1.41.

- Foot Locker (FL +2.73%) climbed nearly 2% in after-hours trading after it was announced that it will replace Cameron International in the S&P 500 after the close of trading on Friday, April 1.

- Lions Gate Entertainment (LGF +1.60%) was rated a new 'Overweight' at Pacific Crest with a 12-month price target of $27.

- The U.S. Justice Department will withdraw legal action against Apple (AAPL -0.45%) after it said it successfully gained access to the data on the iPhone used by a man in the San Bernadino, CA, terrorism attack.

MARKET COMMENTS

Jun 10-year T-notes this morning are slightly higher by 1 tick awaiting today's consumer confidence report and Yellen speech. Monday's closes: TYM6 +6.00, FVM6 +3.50. Jun T-notes on Monday closed higher on the +1.7% y/y increase in the U.S. Feb core PCE deflator (weaker than expectations of +1.8% y/y) and reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 1-week low.

The dollar index this morning is little changed. EUR/USD is slightly higher by +0.04% and USD/JPY is up +0.18%. The forex market is treading water ahead of today's Yellen comments. Monday's closes: Dollar Index -0.312 (-0.32%), EUR/USD +0.0029 (+0.26%), USD/JPY +0.37 (+0.33%). The dollar index on Monday closed lower on the smaller-than-expected +1.7% y/y increase in the Feb core PCE deflator (weaker than expectations of +1.8% y/y), which gives the Fed less reason for an imminent rate hike, and San Francisco Fed President Williams' comment that the global economy has a "huge impact" on the Fed's inflation and employment goals.

May WTI crude is down -0.61 at $38.78 (-1.55%) and May gasoline is down -0.0236 (-1.58%). Monday's closes: CLK6 -0.07 (-0.18%), RBK6 +0.0010 (+0.07%). May crude and gasoline on Monday settled mixed. Crude oil prices were undercut by concern that OPEC and non-OPEC oil producers will not be able to curb crude output when they meet on Apr 17 to discuss a production freeze since Iran and Libya are not even attending the meeting. Crude oil prices were underpinned by a weaker dollar and the outlook for U.S. crude production to decline after Baker Hughes reported last Friday that active U.S. oil rigs fell -15 to a 6-1/3 year low of 372 rigs.

Disclosure: None.