Morning Call For March 23, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.12%) this morning are down -0.21% and European stocks are down -0.89% as a drop in the price of crude oil undercuts energy producers that are leading the overall market lower. Greek Prime Minister Tsipras is set to meet German Chancellor Merkel today to spell out economic measures his country plans to take to receive long-withheld aid payments that will keep Greece from default. Asian stocks closed mostly higher: Japan +0.99%, Hong Kong +0.49%, China +2.04%, Taiwan +0.09%, Australia -0.32%, Singapore -0.07%, South Korea +0.10%, India -0.24%. China's Shanghai Stock Index rose to the highest in 6-3/4 years and closed higher for the ninth consecutive session on speculation the government won't allow economic growth to fall below this year's target of 7.0%. Japan's Nikkei Stock Index soared to a 14-3/4 year high on speculation that three Japanese retirement funds with 30.3 trillion yen ($253 billion) in assets would adopt similar allocation targets as the Japan Government Pension Investment Fund and increase their allocations of equities from bonds. Commodity prices are mixed. May crude oil (CLK15 -1.48%) is down -1.85% after Saudi Arabian Oil Minister Ali al-Naimi said that Saudi Arabia won't repeat the mistakes of the 1980s when it cut production as oil prices fell and that oil is unlikely to return to $100 a barrel as that level would draw higher-cost producers into the market. May gasoline (RBK15 -0.77%) is down -1.05%. Apr gold (GCJ15 -0.30%) is down -0.29%. May copper (HGK15 +0.63%) is up +0.33% at a 2-1/2 month high on signs of stronger demand from China, the world's biggest copper consumer, after weekly Shanghai copper inventories Friday declined for the first time in four weeks. Agriculture prices are stronger. The dollar index (DXY00 -0.52%) is down -0.36%. EUR/USD (^EURUSD) is up +0.37%. USD/JPY (^USDJPY) is down -0.14%. Jun T-note prices (ZNM15 +0.10%) are up +3.5 ticks.

Cleveland Fed President Mester who was speaking in France said that she "sees some strength in the U.S. economy" and that headwinds to the economy are abating. She added that it is appropriate for the Fed to raise interest rates this year, although the Fed doesn't necessarily need to move on interest rates in June.

Christian Noyer, ECB Governing Council member and France's central bank president, said that "the ECB's asset-purchase program which will last until Sep 2016, is an important and clear signal of the expansion of monetary policy stance over an extended horizon." Noyer added that "many analysts were worried that the expansion of the monetary base would trigger inflationary pressures and that central banks would lose control over price stability. As we all know, the reverse has happened."

U.S. STOCK PREVIEW

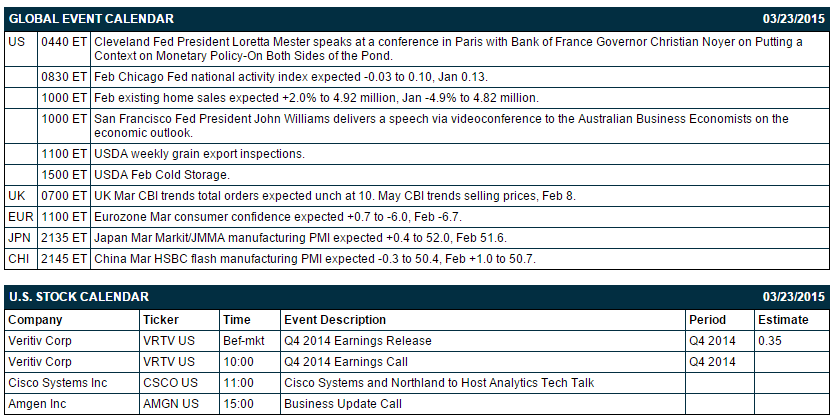

Today’s Feb existing home sales report is expected to show a +2.0% increase to 4.92 million, recovering part of the -4.9% decline to 4.82 million seen in January. There is one of the Russell 1000 companies that reports earnings today: Veritiv Corp (consensus $0.35).

Equity conferences this week include: 2nd Annual Remote Area Power Supply Conference on Mon, Capital Link International Shipping & Offshore Forum on Mon, World Rubber Summit 2015 on Mon, Barclays Emerging Payments Forum on Mon-Tue, Goldman Sachs Houston Chemical Intensity Days on Mon-Tue, Howard Weil Energy Conference on Mon-Tue, BioPharma Asia Convention 2015 on Mon-Wed, Canaccord Genuity Musculoskeletal Conference on Tue, Barclays Select Series Metals & Materials Cross Asset Forum on Tue, Excellence in Data Analytics for Shared Services and Outsourcing 2015 on Tue-Wed, Telsey Advisory Group (TAG) Spring Consumer Conference on Tue-Wed, Leerink Booth Tours At American Academy of Orthopaedic Surgeons on Wed-Thu, CIBC Real Estate Conference on Thu, Nomura - Conference: Global Chemicals Industry Leaders Conference - London on Thu, Jefferies Animal Health Summit on Thu, Gabelli Specialty Chemicals Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Gilead Sciences (GILD +0.84%) fell over 2% in pre-market trading after it issued a drug warning and said that nine patients that were taking its hepatitis C medicine along with the heart treatment amiodarone devleoped abnormally slow heartbeats ond one died of cardiac arrest.

Biogen (BIIB +9.76%) was downgraded to 'Hold' from 'Buy' at Stifel.

Staples (SPLS +1.25%) was upgraded to 'Buy' from 'Neutral' at UBS.

NetApp (NTAP +1.69%) was downgraded to 'Neutral' from 'Overweight' at Piper Jaffray.

Sherwin-Williams (SHW +1.94%) was downgraded to 'Sell' from 'Neutral' at UBS.

NVIDIA (NVDA +1.08%) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

Darden Restaurants (DRI +2.90%) was upgraded to 'Outperform' from 'Market Perform' at Telsey Advisory.

Carnival Cruise Lines (CCL +0.43%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Hennessy Capital Partners reported a 13.4% stake in Blue Bird (BLBD +5.77%) .

Lowe's (LOW +0.90%) announced new $5 billion share repurchase program.

Discovery Group reported a 5.5% stake in Bazaarvoice (BV +0.17%) .

Meridian Venture Partners reported a 20.7% stake in ANI Pharmaceuticals (ANIP -2.25%) .

Glenhill Advisors reported a 5.2% passive stake in Pier 1 Imports (PIR +4.85%) .

MARKET COMMENTS

Jun E-mini S&Ps (ESM15 -0.12%) this morning are down -4.50 points (-0.21%). The S&P 500 index on Friday rallied to a 2-1/2 week high and closed higher: S&P 500 +0.90%, Dow Jones +0.94%, Nasdaq +0.72%. Bullish factors included (1) carry-over support from a rally in Chinese stocks to a 6-3/4 year high on speculation the Chinese government will expand stimulus to be sure that economic growth won’t fall below this year’s target of 7.0%, (2) carry-over support from a rally in European stocks to a 6-3/4 year high on reduced Greek default concerns after an EU official said that Greece could receive an infusion of bailout money within the next week, and (3) a rally in crude oil which boosted beaten-down energy-producer stocks.

Jun 10-year T-notes (ZNM15 +0.10%) this morning are up +3.5 ticks. Jun 10-year T-note futures prices on Friday closed higher. Closes: TYM5 +15.00, FVM5 +11.00. Bullish factors included (1) carry-over support from Wednesday’s FOMC meeting that bolstered the outlook for the Fed to take its time on raising interest rates, and (2) a research paper from Chicago Fed President Evans saying said interest rates should remain near zero for longer amid “substantial uncertainty” about inflation and employment.

The dollar index (DXY00 -0.52%) this morning is down -0.351 (-0.36%). EUR/USD (^EURUSD) is up +0.0040 (+0.37%). USD/JPY (^USDJPY) is down-0.17 (-0.14%). The dollar index on Friday closed lower: Dollar index -1.351 (-1.36%), EUR/USD +0.01595 (+1.50%), USD/JPY -0.757 (-0.63%). Bearish factors included (1) strength in EUR/USD on optimism that the EU will reach agreement with Greece on a deal for Greece to receive aid funds after an EU official said that Greece could get an infusion of bailout money within the next week if Prime Minister Tsipras can deliver an adequate package of reforms, and (2) reduced safe-haven demand for the dollar as global equity markets rallied.

May WTI crude oil (CLK15 -1.48%) this morning is down -86 cents (-1.85%) and May gasoline (RBK15 -0.77%) is down -0.0188 (-1.05%). May crude oil and gasoline prices on Friday closed higher: CLK5 +0.74 (+1.63), RBK5 +0.0088 (+0.50%). Bullish factors included (1) a weaker dollar, and (2) a rally in global stock markets, which boosted optimism in the economic outlook and energy demand.

Disclosure: None.