Morning Call For June 22, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16 +0.10%) are up +0.08% and European stocks are up +0.45% at a 1-1/2 week high ahead of tomorrow's vote by the UK on whether to remain in the European Union. Energy producers are stronger and are leading the overall market higher as the price of crude oil rose to a 1-week high after API data late yesterday showed U.S. crude inventories fell -5.2 million bbls last week. Weekly EIA data later today are expected to show U.S. crude supplies fell -1.5 million bbl. The easing of Brexit concerns has undercut gold and boosted copper prices with gold falling to a 1-1/2 week low and copper climbing to a 2-week high. Asian stocks settled mixed: Japan -0.64%, Hong Kong +0.61%, China +0.94%, Taiwan +0.36%, Australia -0.06%, Singapore -0.12%, South Korea +0.57%, India -0.18%.

The dollar index (DXY00 -0.22%) is down -0.24%. EUR/USD (^EURUSD) is up +0.46%. USD/JPY (^USDJPY) is down -0.16%.

Sep T-note prices (ZNU16 -0.01%) are little changed, up +0.5 of a tick.

China's 14-day repurchase rate, a gauge of interbank funding availability, jumped to 2.92% today, a 1-3/4 month high, as banks hoard cash ahead of quarter-end. The PBOC has pumped in a net 180 billion yuan ($27 billion) via reverse repos this week, more than last week's total of 105 billion yuan.

U.S. STOCK PREVIEW

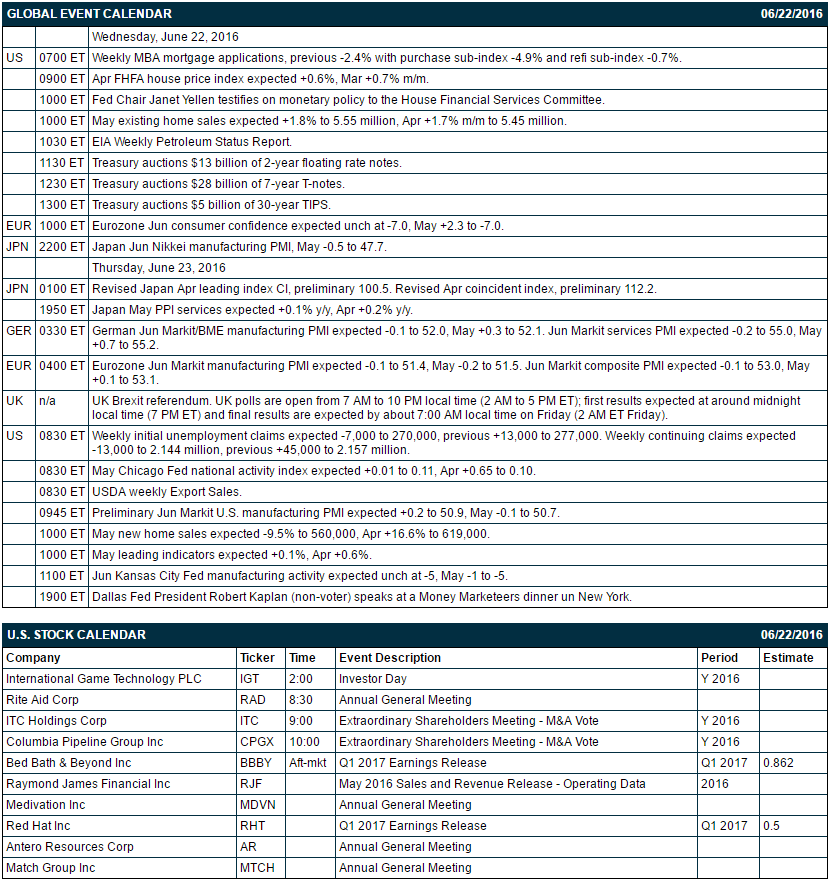

Key U.S. news today includes: (1) MBA mortgage applications (previous -2.4% with purchase sub-index -4.9% and refi sub-index -0.7%), (2) Apr FHFA house price index (expected +0.6%, Mar +0.7% m/m), (3) Fed Chair Janet Yellen testifies on monetary policy to the House Financial Services Committee, (4) May existing home sales (expected +1.8% to 5.55 million, Apr +1.7% m/m to 5.45 million), (5) the Treasury's sale of $13 billion of 2-year floating rate notes, $28 billion of 7-year T-notes, and $5 billion of 30-year TIPS, and (6) EIA Weekly Petroleum Status Report.

There are 2 of the Russell 1000 companies that report earnings today: Bed, Bath & Beyond (consensus $0.86), Red Hat (0.50).

U.S. IPO's scheduled to price today: none.

Equity conferences during the remainder of this week include: Jefferies Consumer Conference on Tue-Wed, Wells Fargo West Coast Energy Conference on Tue-Wed, Panagora Pharma - Mobile Pharma Summit on Tue-Wed, Bernstein Global Future of Media & Telecommunications Summit on Wed, Oppenheimer Global Consumer Conference on Wed, Citigroup Insurance Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Adobe Systems (ADBE +1.77%) dropped over 5% in pre-market trading after it reported Q2 adjusted EPS of 71 cents, higher than consensus of 68 cents, but said it expects Q3 revenue of $1.42 billion-$1.47 billion, below consensus of $1.47 billion.

Fortune Brands Home & Security (FBHS -0.12%) gained over 1% in after-hours trading after it was announced that it will replace Cablevision Systems in the S&P 500 after the close of trading on June 23.

SolarCity (SCTY -3.15%) surged over 23% in after-hours trading after Tesla offered to buy the company for $2.86 billion. Other solar stocks also rallied on the news with SunPower (SPWR -1.06%) and Vivint Solar (VSLR -1.80%) up over 3% and First Solar (FSLR -0.83%) up 2%.

Tesla (TSLA -0.04%) fell over 8% in after-hours trading after it offered to buy SolarCity for $2.86 billion.

American Railcar Industries (ARII -0.88%) was rated a new 'MArket Perform' at Cowen with a 12-month price target of $40.

McDonald's (MCD -0.64%) was downgraded to 'Neutral' from 'Buy' at Nomura.

HP Inc (HPQ +1.99%) shed gains and fell over 3% in after-hours trading after it said it will reinvest $285 million from previously announced marketing optimization asset divestiture back into its printing business. The stock has climbed 3% in after-hours trading after it said it sees Q3 adjusted EPS continuing operations of 43 cents-46 cents, higher than consensus of 39 cents.

KB Home (KBH +0.35%) climbed over 2% in after-hours trading after it reported Q2 adjusted EPS of 24 cents, better than consensus of 18 cents and said Q2 net orders were up +8% y/y, higher than consensus of +2.2% y/y.

Intercontinental Hotels Group Plc (IHG +0.59%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

Universal American (UAM +0.85%) tumbled 4% in after-hours trading after it proposed a $100 million offering of convertible senior notes due in 2021.

Cott Corp. (COT -0.38%) fell 3% in after-hours trading after it priced a 13.1 million share common stock offering at $15,25.

QEP Resources (QEP +1.85%) slid nearly 3% in after-hours trading after it offered 20 million shares of common stock to fund its purchase of oil and gas properties in the Permian Basis for $600 million.

MARKET COMMENTS

September E-mini S&Ps (ESU16 +0.10%) this morning are up +1.75 points (+0.08%). Tuesday's closes: S&P 500 +0.27%, Dow Jones +0.14%, Nasdaq +0.30%. The S&P 500 on Tuesday closed higher on comments from Fed Chair Yellen who said the odds of the U.S. being in recession by the end of this year are "quite low." Stocks were also boosted by strength in technology stocks led by a +1.1% advance in Microsoft and a +0.8% gain in Apple.

Sep 10-year T-note prices (ZNU16 -0.01%) this morning are up +0.5 of a tick. Tuesday's closes: TYU6 -6.50, FVU6 -5.00. Sep T-notes on Tuesday fell to a 1-1/2 week low and closed lower on reduced safe-haven demand with the rally in stocks and on weak demand for the Treasury's $34 billion 5-year T-note auction that had a 2.29 bid-to-cover ratio, below the 12-auction average of 2.45.

The dollar index (DXY00 -0.22%) this morning is down -0.223 (-0.24%). EUR/USD (^EURUSD) is up +0.0052 (+0.46%). USD/JPY (^USDJPY) is down-0.17 (-0.16%). Tuesday's closes: Dollar Index +0.406 (+0.43%), EUR/USD -0.0072 (-0.64%), USD/JPY +0.81 (+0.78%). The dollar index on Tuesday closed higher on upbeat comments from Fed Chair Yellen who said the U.S. economy is doing well and the odds of a recession are low. There was also weakness in EUR/USD on speculation the ECB may expand stimulus after ECB President Draghi said that inflation dynamics in the Eurozone remain "rather subdued."

Aug WTI crude oil (CLQ16 +0.30%)this morning is up +40 cents (+0.80%) at a 1-week high. Aug gasoline (RBQ16 +0.21%) is up +0.0090 (+0.56%) at a 1-week high. Tuesday's closes: CLQ6 -0.11 (-0.22%), RBQ6 +0.0080 (+0.50%). Aug crude oil and gasoline on Tuesday settled mixed. Crude oil prices were undercut by a stronger dollar and long liquidation ahead of Thursday's Brexit vote. Crude oil prices were boosted by strong refinery demand after the crack spread rose to a 2-week high and expectations that Wednesday's weekly EIA data will show crude inventories fell -1.5 million bbl last week.

Disclosure: None.