Morning Call For June 22, 2015

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU15 +0.73%) are up +0.72% and European stocks are up +2.79% at a 1-week high on speculation European officials will break a stalemate in talks over a Greek bailout. The 10-year yield on the Greek bond tumbled over 140 bp to a 1-week low of 11.09% and Greece's ASE Stock Index surged +7.61% after Greek Prime Minister Tsipras introduced a new plan to unlock bailout funds. Greek bank stocks also rallied sharply after the ECB today raised the ceiling of maximum potential Emergency Liquidity Assistance (ELA) available to Greek banks for the third time in less than a week. Asian stocks closed higher on the Greek debt news as well: Japan +1.20%, Hong Kong +1.20%, China closed for holiday, Taiwan +1.34%, Australia +0.24%, Singapore +0.43%, South Korea +0.46%, India +1.52%.

Commodity prices are mixed. Jul crude oil (CLN15 +0.64%) is up +0.75%, Jul gasoline (RBN15 -0.24%) is down -0.09%. Metals prices are mixed. Aug gold (GCQ15 -0.75%) is down -0.63%. Jul copper (HGN15 +0.10%) is up +0.18%. Agricultural prices are mixed.

The dollar index (DXY00 +0.23%) is up +0.17%. EUR/USD (^EURUSD) is down -0.01%. USD/JPY (^USDJPY) is up +0.39%.

Sep T-note prices (ZNU15 -0.40%) are down -14 ticks on reduced safe-haven demand for T-notes with the sharp rally in global stocks.

According to a person familiar with the situation, the ECB raised emergency funding for Greek banks for the third time in less than a week. The ECB's Governing Council increased the limit on Emergency Liquidity Assistance (ELA) in a telephone conference today and said it stands ready to reassess the liquidity of Greek lenders in a new call whenever needed. The ECB had raised the limit of ELA to the Greek central bank by 1.1 billion euros last Wednesday and an additional 1.8 billion euros Friday to a total 85.9 billion euros before today's increase.

U.S. STOCK PREVIEW

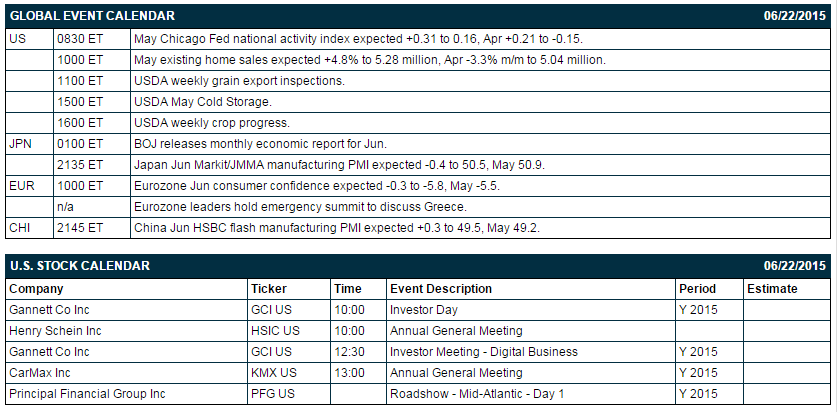

Key U.S. news today includes: (1) May Chicago Fed national activity index (expected +0.31 to 0.16 after April's +0.21 to -0.15), and (2) May existing home sales (expected +4.8% to 5.28 million after April's -3.3% m/m to 5.04 million).

None of the Russell 1000 companies report earnings today.

U.S. IPO's scheduled to price today include: none.

Equity conferences this week include: Global Hunter Securities Energy Conference on Tue-Wed, Jefferies Global Consumer Conference on Tue-Wed, Oppenheimer Consumer Conference on Tue-Wed, 3rd Annual Mobile Pharma Summit on Wed, and Sanford C. Bernstein Media Summit on Wed.

OVERNIGHT U.S. STOCK MOVERS

MetLife (MET -0.90%) was upgraded to 'Outperform' from 'Sector Perform' at RBC Capital.

Piper Jaffray keeps an 'Overwweight' on shares of Facebook (FB -0.47%) and raises the price target on the stock to $120 from $92.

Symantec (SYMC -1.59%) was downgraded to 'Sell' from 'Neutral' at UBS.

Marsh & McLennan (MMC -0.69%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

STMicroelectronics (STM -1.36%) was upgraded to 'Equal Weight' from 'Underweight' at Barclays.

SanDisk (SNDK -1.98%) was upgraded to 'Buy' from 'Hold' at Summit Research.

Micron (MU unch) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

Cigna (CI -0.74%) jumped over 9% in pre-market trading after the company rejected a $37 billion takeover bid from Anthem Inc.

Williams Cos. (WMB -1.29%) surged 26% in pre-market trading afer the company rejected a $48 billion stock-based takeover from Kelcy Warren.

Carnival (CCL +0.62%) rose over 3% in pre-market trading after Deutsche Bank raised its recommendation on the stock to 'Buy' saying the company may beat forecasts for Q2 earnings.

AK Steel (AKS -3.89%) lowered guidance on Q2 EPS to a loss of -37 cents to -42 cents, a larger loss than consensus of -27 cents.

Mario Investments reported a 16.6% stake in MRC Global (MRC +0.13%) .

Baxalta (BXLT) will replace QEP Resources (QEP -0.49%) in the S&P 500 as of the close of trading Tuesday, June 30.

Glazer Capital reported a 6.1% passive stake in Global Defense & National Security Systems (GDEF +0.57%) .

Indus Capital reported an 8.13% passive stake in Jamba (JMBA +0.57%) .

Point72 Asset reported a 5.0% passive stake in WPX Energy (WPX -1.56%) .

Discovery Group reported a 5.1% stake in Aerohive (HIVE -3.47%) .

MARKET COMMENTS

September E-mini S&Ps (ESU15 +0.73%) this morning are up +15.00 points (+0.72%). Friday's closes: S&P 500 -0.53%, Dow Jones -0.55%, Nasdaq-0.41%. The S&P 500 on Friday closed lower on the ongoing Greek debt crisis and on San Francisco Fed President Williams' comment that he sees an interest rate hike sometime this year as the job market is "nearly healed."

Sep 10-year T-notes (ZNU15 -0.40%) this morning are down -14 ticks. Friday's closes: TYU5 +23.00, FVU5 +11.25. Sep T-notes on Friday climbed to a 2-week high and closed higher on safe-haven demand from the sell-off in stocks and from the Greek crisis.

The dollar index (DXY00 +0.23%) this morning is up +0.164 (+0.17%). EUR/USD (^EURUSD) is down -0.0001 (-0.01%). USD/JPY (^USDJPY) is up +0.48 (+0.39%). Friday's closes: Dollar Index +0.043 (+0.05%), EUR/USD -0.00094 (-0.08%), USD/JPY -0.299 (-0.24%). The dollar index on Friday settled higher on increased safe haven demand for the dollar as Greece's debt crisis remains unresolved and on the weaker-than-expected German May PPI, which pressured EUR/USD.

July WTI crude oil (CLN15 +0.64%) this morning is up +45 cents (+0.75%). July gasoline (RBN15 -0.24%) is down -0.0019 (-0.09%). Friday's closes: CLN5 -0.84 (-1.39%), RBN5 -0.0515 (-2.33%). Jul crude oil and gasoline on Friday closed lower on the stronger dollar and on comments from Saudi Arabian Oil Minister Ali al-Naimi who said that Saudi Arabia has 1.5-2.0 million bpd of spare production capacity and will pump more oil if demand rises.

Disclosure: None.