Morning Call For June 16, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16 -0.48%) are down -0.34% at a 3-week low and European stocks are down -0.56% at a 3-3/4 month low as central banks express concern about the global economic outlook due to the June 23 Brexit referendum. Fed Chair Yellen said next week's UK vote on European Union membership was a factor in the Fed's decision yesterday to hold interest rates steady, and the BOJ refrained from expanding stimulus on concern any fallout from a Brexit vote would leave its policy moves ineffective. Gold prices (GCQ16 +1.57%) surged to a 1-3/4 year high as the outlook for low U.S. interest rates and Brexit concerns fueled safe-haven demand for gold. The BOE as expected kept its benchmark interest rate at 0.50% and maintained its asset purchase target at 375 billion pounds. Crude oil dropped to a 4-week low as most commodities followed world equity markets lower, while global government bond markets rallied sharply with 10-year yields in Japan, Australia, South Korea and Germany all falling to record lows. Asian stocks settled lower: Japan -3.05%, Hong Kong -2.10%, China -0.50%, Taiwan -1.30%, Australia -0.02%, Singapore -0.82%, South Korea -0.69%, India -0.75%. Japan's Nikkei Stock Index tumbled to a 3-3/4 month low after the BOJ refrained from additional stimulus measures along with the slide in USD/JPY to a 1-3/4 year low, which undercut exporter stocks.

The dollar index (DXY00 +0.36%) is up +0.21%. EUR/USD (^EURUSD) is down -0.52%. USD/JPY (^USDJPY) is down -1.63% at a 1-3/4 year low.

Sep T-note prices (ZNU16 +0.19%) are up +7.5 ticks at a new contract high on carryover support from yesterday's Fed decision along with rallies in world bond markets.

The BOJ kept its benchmark interest rate at -0.1% and maintained its annual asset purchase target at 80 trillion yen ($764 billion). The yen surged to a 1-3/4 year high against the dollar and the Japan 10-year bond yield fell to a record low -0.21% after the BOJ's decision. BOJ Governor Kuroda said the BOJ was carefully monitoring moves in financial markets and was in touch with counterparts including the BOE, amid Brexit concerns that he said had had an impact in the bond market.

U.S. STOCK PREVIEW

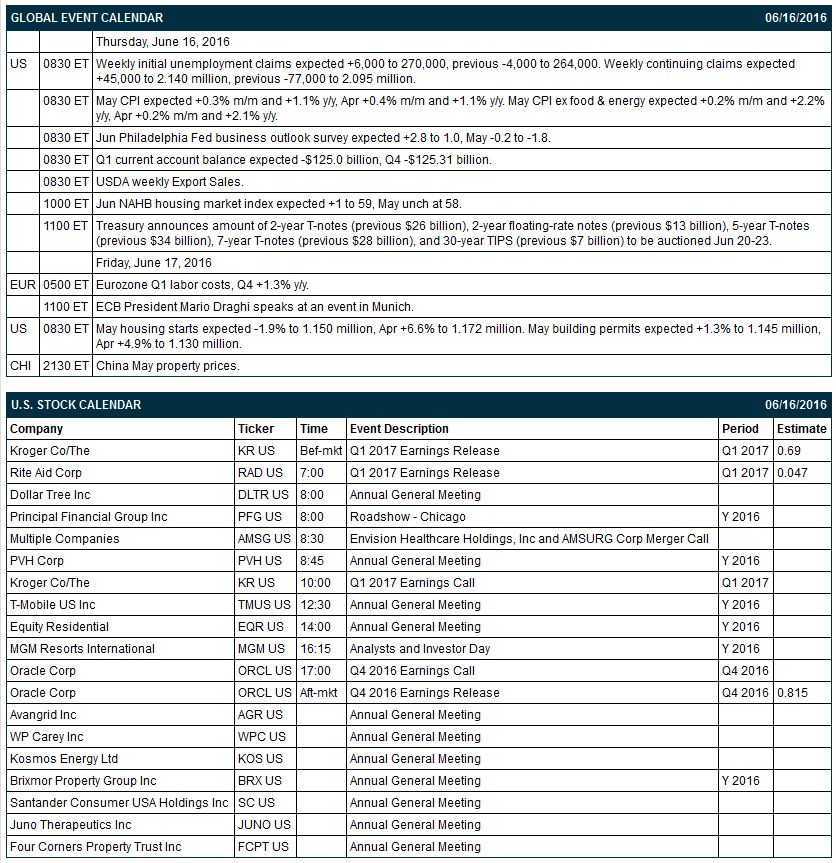

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +6,000 to 270,000, previous -4,000 to 264,000) and continuing claims (expected +45,000 to 2.140 million, previous -77,000 to 2.095 million), (2) May CPI (expected +0.3% m/m and +1.1% y/y, Apr +0.4% m/m and +1.1% y/y) and May CPI ex food & energy (expected +0.2% m/m and +2.2% y/y, Apr +0.2% m/m and +2.1% y/y), (3) Jun Philadelphia Fed business outlook survey (expected +2.8 to 1.0, May -0.2 to -1.8), (4) Q1 current account deficit (expected -$125.0 billion, Q4 -$125.31 billion), and (5) Jun NAHB housing market index (expected +1 to 59, May unch at 58), and (6) USDA weekly Export Sales.

There are 3 of the Russell 1000 companies that report earnings today: Oracle (consensus $0.82), Kroger (0.69), Rite Aid (0.05).

U.S. IPO's scheduled to price today: PSAV Inc (PSAV).

Equity conferences today include: William Blair & Company Growth Stock Conference on Tue-Thu and RBC Capital Markets Global Financial Technology Investor Day on Thu.

OVERNIGHT U.S. STOCK MOVERS

Chubb Ltd. (CB -0.10%) was downgraded to 'Underweight' from 'Neutral' at Atlantic Equities.

Aetna (AET +0.30%) was rated a new 'Outperform' at Bernstein with a price target of $142.

Yahoo! (YHOO -0.21%) was upgraded to 'Buy' from 'Neutral' at Citigroup with a price target of $43.

Ctrip.com International Ltd. (CTRP -2.14%) climbed 5% in after-hours trading after it reported Q1 net revenue of $648 million, higher than consensus of $629 million.

Kansas City Southern (KSU -1.58%) was rated a new 'Outperform' at Oppenheimer with an 18-month price target of $103.

Cal-Maine Foods (CALM -0.37%) was upgraded to 'Hold' from 'Underweight' at BB&T Capital Markets.

Hannon Armstrong Sustainable Infrastructure (HASI +0.48%) slid over 4% in after-hours trading after it started a 3.9 million share secondary offering

Culp (CFI +1.50%) reported Q4 net sales of $77.3 million, below consensus of $79.1 million, and said it sees Q1 comparable sales slightly lower y/y.

Jabil Circuit (JBL -0.32%) slumped 8% in after-hours trading after it said it expects Q4 core EPS between 15 cents and 35 cents, well below consensus of 53 cents.

Korn/Ferry (KFY -2.51%) lost over 1% in after-hours trading after it said it sees Q1 adjusted EPS of 50 cents-58 cents, below consensus of 58 cents.

Cavium (CAVM +3.81%) will acquire QLogic ({=QLGC for about $1.36 billion in cash and stock.

Clarcor (CLC +0.65%) reported Q2 adjusted EPS of 73 cents. better than consensus of 68 cents.

Tonix Pharmaceuticals Holding Corp. (TNXP -2.77%) dropped 12% in after-hours trading after it announced a proposed public offering of common stock.

MARKET COMMENTS

September E-mini S&Ps (ESU16 -0.48%) this morning are down -7.00 points at a new 3-week low. Wednesday's closes: S&P 500 -0.18%, Dow Jones -0.20%, Nasdaq -0.35%. The S&P 500 on Wednesday closed lower on the -0.4% decline in U.S. May manufacturing production (weaker than expectations of -0.1%) and on the FOMC's cut in its U.S. 2016 GDP forecast to 2.0% from 2.2%. Stocks received support from reduced concern about a Fed rate hike after the number of FOMC members who see only one rate hike this year rose to 6 from 1 in March. Stocks were also boosted by a rally in mining stocks and raw-material producers after the price of copper jumped to a 1-week high and silver rose to a 1-month high. Another supportive factor was the +15.3 point increase in the U.S. Jun Empire manufacturing survey to 6.01, stronger than expectations of +4.12 to -4.90.

Sep 10-year T-note prices (ZNU16 +0.19%) this morning are up +7.5 ticks at a fresh contract high. Wednesday's closes: TYU6 +9.50, FVU6 +6.25. Sep T-notes on Wednesday rose to a fresh contract high and closed higher on the FOMC's reiteration of its plan to raise interest rates at only a "gradual" pace and its cut in its U.S. 2016 GDP estimate to 2.0% from 2.2%. T-notes were also supported by the bigger-than-expected decline in U.S. May industrial and manufacturing production and by reduced inflation expectations as the 10-year T-note breakeven inflation rate fell to a 3-month low.

The dollar index (DXY00 +0.36%) this morning is up +0.196 (+0.21%). EUR/USD (^EURUSD) is down -0.0058 (-0.52%). USD/JPY (^USDJPY) is down -1.73 (-1.63%) a t 1-3/4 year low. Wednesday's closes: Dollar Index -0.318 (-0.33%), EUR/USD +0.0053 (+0.47%), USD/JPY -0.10 (-0.09%). The dollar index on Wednesday closed lower on the weaker-than-expected U.S. May industrial and manufacturing production reports and the dovish outcome of the FOMC meeting, which hurt U.S. interest rate differentials.

July WTI crude oil (CLN16 -1.44%) this morning is down -64 cents (-1.33%) at a 4-week low. July gasoline (RBN16 -0.53%) is down -0.0075 (-0.50%). Wednesday's closes: CLN6 -0.48 (-0.99%), RBN6 -0.0199 (-1.31%). July crude oil and gasoline prices on Wednesday closed lower with July crude at a 3-week low and July gasoline at a 1-month low. Crude oil prices were undercut by the -933,000 bbl decline in weekly EIA crude inventories (vs expectations of -2.35 million bbl) and the +904,000 bbl increase in crude oil supplies at Cushing. Crude oil prices found support from news that U.S. crude oil production in the week ended Jun 10 fell -0.3% to a 1-3/4 year low of 8.716 million bpd.

(Click on image to enlarge)

Disclosure: None.