Morning Call For July 29, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16 -0.13%) this morning are trading slightly lower by -0.15% on some nervousness ahead of today's GDP report, but the market is seeing support from overnight rallies in Alphabet and Amazon.com following positive quarterly earnings news for those companies after Thursday's close. The U.S. markets are mainly looking ahead to today's U.S. Q2 GDP report, where the market consensus yesterday fell by about 1/2 point to +2.0% due to the release of additional inventory and trade data.

The Euro Stoxx 50 index is up +0.44% today on support from a rally in banking shares on some positive bank earnings results. Traders are awaiting the release of the European bank stress tests after today's U.S. close at 4PM ET. Eurozone Q2 GDP rose +0.3% q/q and +1.6% y/y, in line with market expectations but down from the Q1 pace of +0.6% q/q. The Eurozone June unemployment rate was unchanged at 10.1%. Eurozone July core inflation was unchanged at +0.9% y/y.

The Nikkei today closed +0.56% after a volatile day of trading on the BOJ's less-than-expected monetary stimulus measures. However, Japanese banks rallied on the news that the BOJ did not cut its policy rate further into negative territory. The Bank of Japan today announced an expansion of its asset purchase program by raising the size of its ETF purchase plan by 2.7 trillion ($26 billion) a year. The BOJ also expanded a dollar-lending facility to $24 billion. However, the BOJ left its policy rate unchanged at -0.10% and left its target unchanged for expanding the monetary base by 80 trillion yen. The BOJ said it will conduct a "comprehensive assessment" of its monetary policy at its next meeting on Sep 20-21. The BOJ said it will not change its goal of achieving a 2% inflation goal at the earliest possible time.

Other Asian stock markets today closed mostly lower: Hong Kong -1.28%, China Shanghai -0.50%, Taiwan -1.02%, Australia +0.10%, Singapore -1.71%, South Korea -0.15%, India -0.56%, Turkey -0.13%.

The Russian central bank today left its key rate unchanged at 10.5%, which was in line with market expectations.

Sep 10-year T-notes (ZNU16 -0.05%) this morning are down -3.5 ticks, undercut by a -0.27 point sell-off in Sep bunds and some disappointment about the BOJ's QE program.

The dollar index (DXY00 -0.55%) is down -0.52 points (-0.54%) this morning mainly because of a sharp -1.98 yen (-1.88%) sell-off in USD/JPY (^USDJPY). The yen rallied sharply today after the BOJ disappointed on its limited new monetary stimulus measures. EUR/USD (^EURUSD) is up +0.0037 (+0.33%).

Commodity prices are down -0.53% this morning. Sep WTI crude oil (CLU16 -0.85%) is down by -0.40 (-0.95%) as the rout continues on high inventories and rising U.S. oil production. Sep gasoline (RBU16 -1.35%) is down -0.0154 (-1.18%). Aug gold (GCQ16 +0.05%) is up +0.6 (+0.05%) but Sep silver (SIU16 -0.46%) is down -0.107 (-0.53%) and Sep copper (HGU16 -0.38%) is down -0.011 (-0.48%) as industrial metals were undercut by the BOJ's disappointing stimulus plans. Grains this morning are lower with Dec corn down -2.25 (-0.66%), Nov beans down -8.00 (-0.82%), and Sep wheat down -4.00 (-0.98%). Softs are mixed with Oct sugar up +0.04 (+0.21%), Sep coffee -1.00 (-0.70%), Sep cocoa up +16 (+0.56%), and Dec cotton down -0.98 (-1.34%).

U.S. STOCK PREVIEW

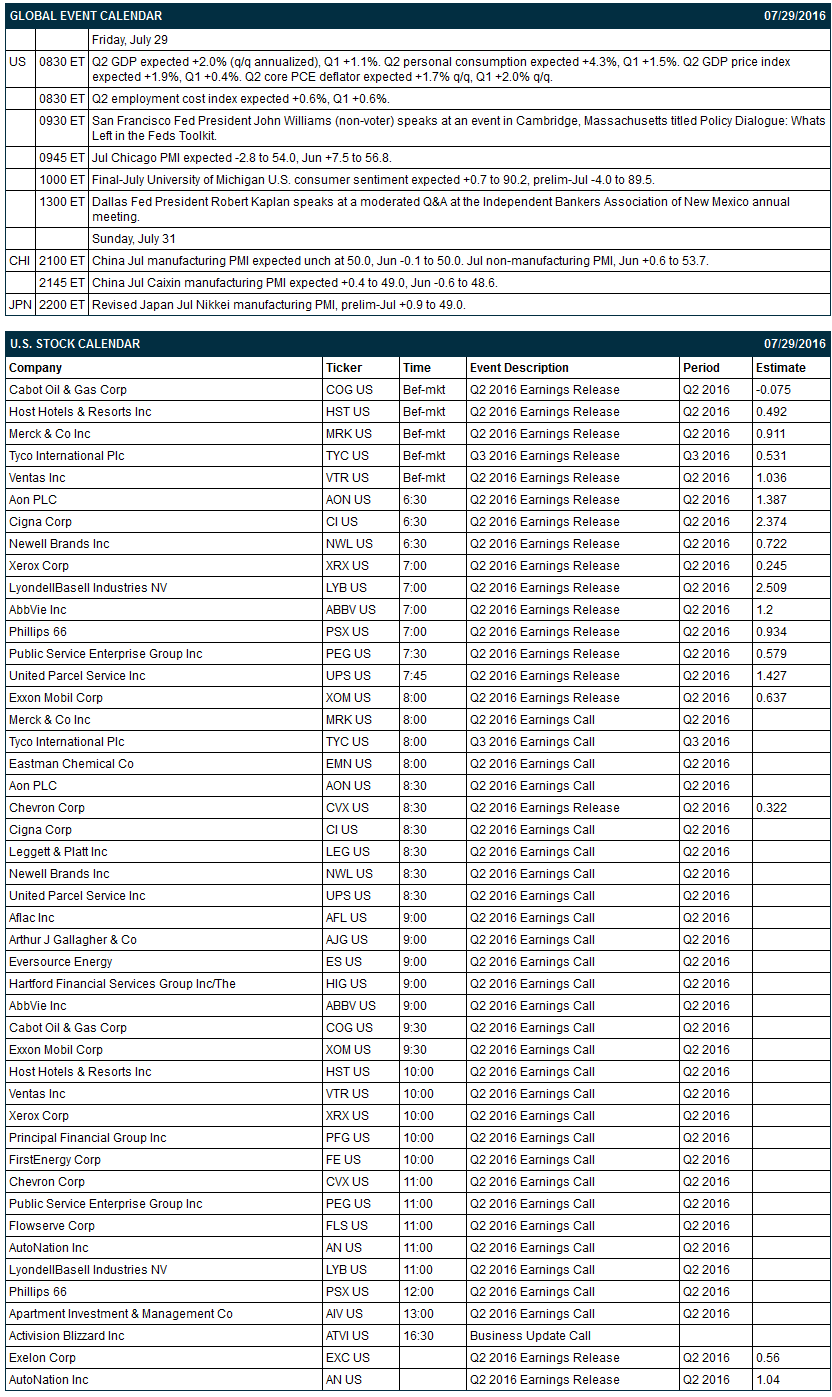

Key U.S. news today includes: (1) Q2 GDP (expected +2.0% q/q annualized, Q1 +1.1%), (2) Q2 employment cost index (expected +0.6%, Q1 +0.6%), (3) San Francisco Fed President John Williams (non-voter) speaks at an event in Cambridge, Massachusetts titled “Policy Dialogue: What’s Left in the Fed’s Toolkit,” (4) Jul Chicago PMI (expected -2.8 to 54.0, Jun +7.5 to 56.8), (5) final-July University of Michigan U.S. consumer sentiment (expected +0.7 to 90.2, prelim-Jul -4.0 to 89.5), (6) Dallas Fed President Robert Kaplan speaks at a moderated Q&A at the Independent Bankers Association of New Mexico annual meeting.

There are 18 of the S&P 500 companies that report earnings today with notable reports including: UPS (consensus 1.43), Exxon (0.64), Chevron (0.32), AbbVie (1.20), Merck (0.91).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: none.

Sep E-mini S&Ps this morning are trading slightly lower by -0.15% on some nervousness ahead of today's GDP report, but the market is seeing support from overnight rallies in Alphabet and Amazon.com following positive quarterly earnings news for those companies after Thursday's close. Thursday's closes: S&P 500 +0.16%, Dow Jones -0.09%, Nasdaq +0.30%. The S&P 500 on Thursday closed slightly higher on carry-over support from Wed's FOMC post-meeting statement suggesting that a rate hike is not likely until at least December. Stocks also received a boost from expectations for the BOJ on Friday to announce new monetary stimulus measures. Stocks were undercut by new Census Bureau data that produced a 1/2 point cut in forecasts for Friday's U.S. Q2 GDP report. In addition, petroleum companies saw continued weakness as Sep crude oil fell by another -1.9% to a new 3-month low.

OVERNIGHT U.S. STOCK MOVERS

- Alphabet (GOOG +0.56%) is up +3% in overnight trading after reporting Q2 adjusted EPS of $8.42 late Thursday, above the consensus of $8.03, on mobile adds and cost controls.

- Amazon.com (AMZN +2.16%) rallied as much as +4% in after-hours trading yesterday and is up +1.4% this morning after Q3 revenue guidance was stronger than expected.

- NextEra Energy (NEE) agreed to buy the Oncor Electric Delivery Co. LLC utility unit from Energy Future Holdings in a deal worth $18.4 billion as part of the process of allowing Energy Future Holdings to emerge from bankruptcy.

- Wynn Resorts (WYNN +2.37%) fell -5% in after-hours trading on disappointment about a 24% drop in Macau betting.

- Stamps.com (STMP +1.63%) rallied by +5% in after-hours trading after management raised its full-year revenue and EPS guidance.

- Expedia (EXPE +1.77%) fell -6% in after-hours trading after saying that there was some lost booking time involved in moving Orbitz to its back-end technology platform, causing a Q2 revenue miss.

- Earnings reports this morning have been mostly positive with reports including UPS (UPS -0.06%) (1.43 vs 1.427), Merck (MRK -0.29%) (0.93 vs 0.91), Tyco (TYC -0.72%) (0.54 vs 0.53), Xerox (XRX -0.90%) (0.30 vs 0.25), Ventas (VTR +1.33%) (1.04 vs 1.034), Phillips 66 (PSX +1.13%) (0.94 vs 0.933). Disappointing reports include Cigna (CI -1.55%) (1.98 vs 2.37) and Public Service Enterprise Group (PEG -0.16%) (0.17 vs 0.58)

MARKET COMMENTS

Sep 10-year T-notes this morning are down -3.5 ticks. Thursday's closes: TYU6 +0.5, FVU6 +0.5. Sep 10-year T-notes on Thursday closed slightly higher on carryover support from Wednesday's FOMC post-meeting statement that did not suggest an imminent Fed rate hike. In addition, new Census Bureau data released on Thursday resulted in a 1/2 point cut in expectations for Friday's Q2 GDP report.

The dollar index is down -0.52 points (-0.54%) this morning mainly because of a sharp -1.98 yen (-1.88%) sell-off in USD/JPY. The yen rallied sharply today after the BOJ disappointed on its limited new monetary stimulus measures. EUR/USD is up +0.0037 (+0.33%). Thursday's closes: Dollar index -0.383 (-0.39%), EUR/USD +0.0019 (+0.17%), USD/JPY -0.13 (-0.12%). The dollar index on Thursday closed moderately lower on the market's dovish interpretation of Wednesday's FOMC's post-meeting statement. Meanwhile, USD/JPY closed mildly lower as the market waits to see if the BOJ on Friday will announce aggressive new stimulus measures as expected.

Sep WTI crude oil this morning is down by -0.40 (-0.95%) as the rout continues on high inventories and rising U.S. oil production. Sep gasoline is down -0.0154 (-1.18%). Thursday's closes: CLU6 -0.78 (-1.86%), RBU6 -0.0161 (-1.22%). Sep crude oil and gasoline on Thursday closed lower with Sep crude oil posting another new 3-month low. Crude oil continued to be undercut by Wed's EIA report that showed a +1.67 million bbl rise in U.S. crude oil inventories (vs expectations of -2.5 million bbls) and a +0.2% increase in U.S. oil production to 8.515 million bpd, the third straight weekly gain that now totals +1.0%.

(Click on image to enlarge)

Disclosure: None.