Morning Call For January 27, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 -0.57%) this morning are down -0.54%, led by a 4% decline in Microsoft, as a drop in the company's Q2 commercial-license revenue dragged the stock and the overall market lower. European stocks are down -1.18% due to disappointing earnings results from Siemens AG and Philips NV. Another negative for European stocks was the slower-than-expected pace of UK growth in Q4. Asian stocks closed mixed: Japan +1.72%, Hong Kong -0.41%, China -0.92%, Taiwan +0.46%, Australia +0.83%, Singapore +0.40%, South Korea +0.82%, India +1.00%. India's BSE Sensex 30 Stock Index climbed to a record high after Prime Minister Nodi and President Obama reached an agreement that could spur nuclear energy projects in India. Chinese stocks closed lower after industrial profits declined the most in at least 3 years last month. Commodity prices are mixed. Mar crude oil (CLH15 -0.16%) is down -0.24%. Mar gasoline (RBH15 -0.13%) is down -0.35%. Feb gold (GCG15 +0.10%) is up +0.13%. Mar copper (HGH15 -1.53%) is down -1.34%. Agriculture prices are mixed. The dollar index (DXY00 -0.22%) is down -0.12%. EUR/USD (^EURUSD) is up +0.38%. USD/JPY (^USDJPY) is down -0.42%. Mar T-note prices (ZNH15 +0.10%) are up +5 ticks.

China Dec industrial profits fell -8.0% y/y, the third straight monthly decline and the biggest drop since the data series began in 2011.

UK Q4 GDP rose +0.5% q/q and +2.7% y/y, less than expectations of +0.6% m/m and +2.8% y/y.

UK Nov index of services rose +0.1% m/m and +0.8% 3-mo/3-mo, less than expectations of +0.3% m/m and +0.9% 3-mo/3-mo.

Japan Dec PPI services rose +3.6% y/y, unch from Nov and higher than expectations of +3.5% y/y and matched the fastest pace of increase in 24 years.

U.S. STOCK PREVIEW

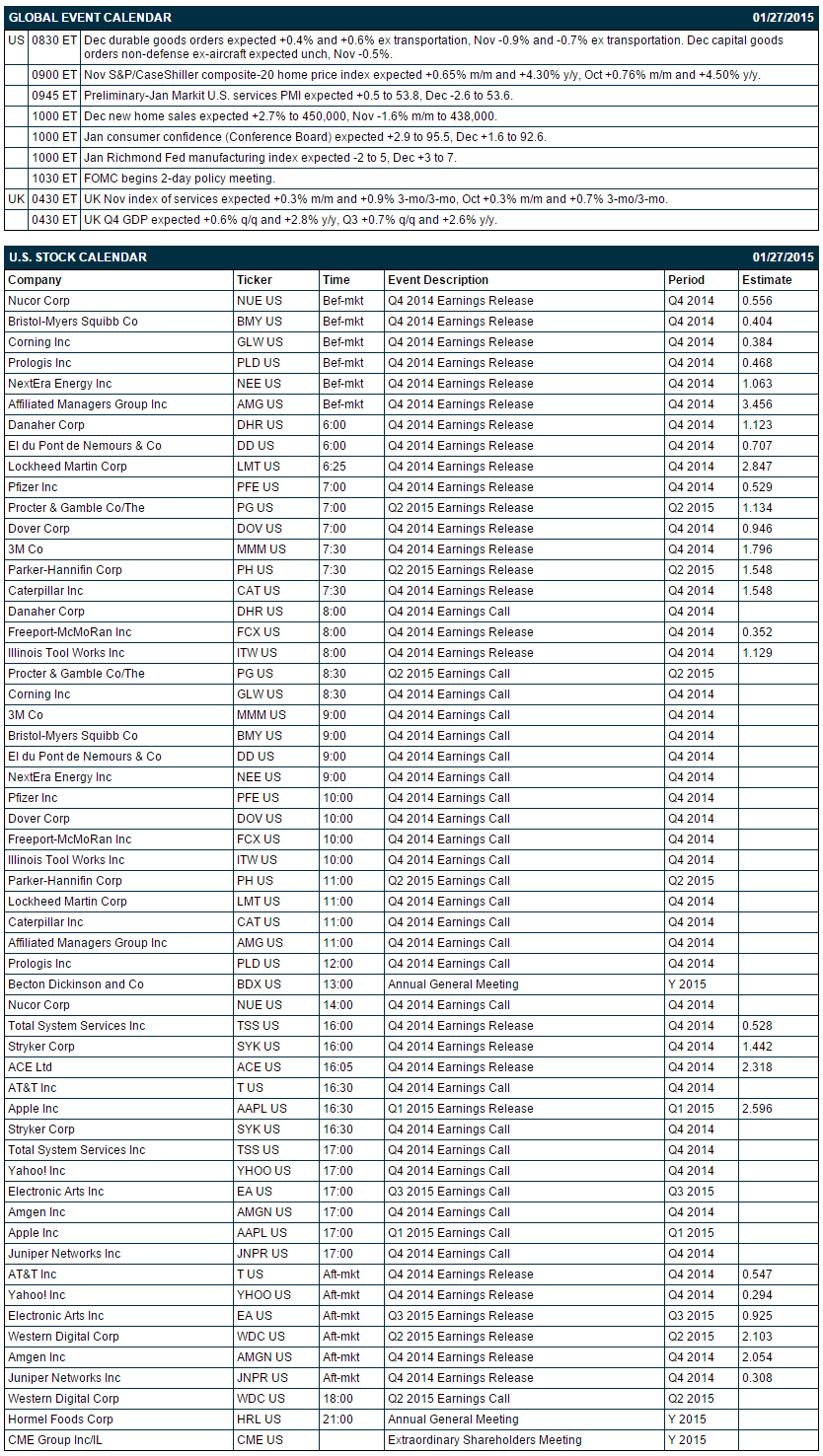

Today’s Dec durable goods orders report is expected to show an increase of +0.4% and +0.6% ex-transportation, improving from November’s -0.9%and -0.7% ex-transportation. Today’s Nov CaseShiller Composite-20 home price index is expected to show a solid increase of +0.65% m/m and +4.30% y/y, just modestly below October’s report of +0.76% m/m and +4.50% y/y. Today’s Dec new home sales report is expected to show an increase of +2.7% to 450,000, more than overcoming November’s decline of -1.6% m/m to 438,000. Today’s Jan consumer confidence index from the Conference Board is expected to show a +2.9 point increase to 95.5, adding to December’s increase of +1.6 to 92.6. The market consensus is that the FOMC at its 2-day meeting that begins today will leave its interest rate and policy guidance unchanged.

There are 27 of the S&P 500 companies that report earnings today with notable reports including: Apple (consensus $2.60), AT&T (0.55), Yahoo (0.29), Pfizer (1.13), Caterpillar (1.55), Amgen (2.05). Equity conferences this week include: Phacilitate Immunotherapy Forum on Mon-Wed, and PCC 2015. CBI's Pharmaceutical Compliance Congress on Tue.

OVERNIGHT U.S. STOCK MOVERS

Procter & Gamble (PG -0.56%) reported Q2 core EPS of $1.06, below consensus of $1.13.

Pfizer (PFE +1.08%) fell nearly 3% in pre-market trading after it reported Q4 adjusted EPS of 54 cents, better than consensus of 53 cents, but then lowered guidance on fiscal 2015 adjusted EPS to $2.00-$2.10, less than consensus of $2.18.

Bristol-Myers (BMY +0.63%) reported Q4 EPS of 46 cents, better than consensus of 41 cents.

Dunkin' Brands (DNKN +0.04%) authorized a new $700 million share repurchase program, but then lowered guidance on fiscal 2015 adjusted EPS to $1.83-$1.87 from $1.88-$1.91, below consensus of $1.92.

TechCrunch reported that International Business Machines (IBM +0.31%) will lay off 12,000 employees.

Brown & Brown (BRO +0.25%) reported Q4 adjusted EPS of 36 cents, over double consensus of 15 cents.

Crane (CR +1.83%) reported Q4 EPS ex-items of $1.13, right on consensus, but then lowered guidance on fiscal 2015 EPS ex-items to $4.45-$4.65, below consensus of $4.79.

Packaging Corp. (PKG +1.87%) slipped nearly 6% in after-hours trading after it reported Q4 adjusted EPS of $1.16, less than consensus of $1.17.

ESW Capital reported a 19% passive stake in Upland Software (UPLD -0.51%) .

Texas Instruments (TXN -0.02%) reported Q4 EPS of 76 cents, above consensus of 69 cents.

Oaktree Capital reported a 5.9% passive stake in Century Communities (CCS +2.35%) .

Marathon Oil (MRO +2.83%) and Colbalt (CIE +3.86%) were both downgraded to 'Neutral' from 'Buy' at UBS.

Plum Creek Timber ({=PCL lowered guidance on Q1 EPS to 20 cents-25 cents, weaker than consensus of 27 cents.

Sanmina (SANM +1.39%) reported Q1 adjusted EPS of 61 cents, better than consensus of 58 cents.

Microsoft (MSFT -0.36%) fell over 4% in pre-market trading after it reported Q2 EPS of 71 cents, right on consensus, but said that commercial-licesnse revenuing fell.

United Technologies (UTX -1.03%) reported Q4 EPS of $1.62, right on consensus, but then lowered guidance on fiscal 2015 EPS to $6.85-$7.05 from $7.00-$7.20, below consensus of $7.19.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 -0.57%) this morning are down -11.00 points (-0.54%). The S&P 500 index on Monday closed higher: S&P 500 +0.26%, Dow Jones +0.03%, Nasdaq -0.06%. Bullish factors included (1) carry-over support from a rally in European stocks to a 6-1/3 year high on reduced Greek sovereign debt concerns after Greek Prime Minister-elect Tsipras pledged to keep Greece within the Eurozone as he negotiates a write-down of Greek debt, and (2) stellar Q4 company earnings results thus far ash 77% of the S&P 500 companies that already released results have beat earnings projections. On the negative side, technology stocks fell after Seagate Technology plunged when it projected quarterly revenue that trailed market estimates.

Mar 10-year T-notes (ZNH15 +0.10%) this morning are up +5 ticks. Mar 10-year T-note futures prices on Monday closed lower. Closes: TYH5 -5.50, FVH5 -4.75. Negative factors included (1) reduced safe-haven demand for T-notes as stocks recovered from their worst levels after Greek sovereign debt concerns eased when newly elected Greek opposition leader Tsipras pledged to keep Greece within the Eurozone, and (2) supply pressures as the Treasury auctions $105 billion of T-notes this week.

The dollar index (DXY00 -0.22%) this morning is down -0.114 (-0.12%). EUR/USD (^EURUSD) is up +0.0043 (+0.38%). USD/JPY (^USDJPY) is down-0.50 (-0.42%). The dollar index on Monday posted an 11-1/3 year high but fell back and closed little changed: Dollar index +0.040 (+0.04%), EUR/USD +0.00383 (+0.34%), USD/JPY +0.698 (+0.59%). Bearish factors included (1) strength in EUR/USD which recovered from an 11-1/3 year low and closed higher after newly elected Greek opposition leader Tsipras pledged to keep Greece within the Eurozone as he negotiates a write-down of Greek debt, and (2) the larger-than-expected increase in the German Jan IFO business climate to a 6-month high, which is euro supportive.

Mar WTI crude oil (CLH15 -0.16%) this morning is down -11 cents (-0.24%) and Mar gasoline (RBH15 -0.13%) is down -0.0047 (-0.35%). Mar crude oil and Mar gasoline on Monday closed lower with Mar crude at a 1-1/2 week low: CLH5 -0.44 (-0.97%), RBH5 -0.0282 (-2.05%). Bearish factors included (1) the action from Saudi Arabia's new ruler, King Salman Bin Abdulaziz Al Saud, to keep Ali al-Naimi in his post as Saudi oil minister, which signals that current Saudi oil policy will remain unchanged, and (2) speculation that a blizzard on the U.S. East Coast will undercut gasoline demand as roads close and people refrain from driving.

Disclosure: None.