Morning Call For January 25, 2016

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH16 -0.13%) are down -0.24% and European stocks are down -0.32% as a -3.63% slide in crude oil prices (CLH16 -2.64%) undercuts energy producers. European stocks also moved lower after a gauge of German business confidence fell for a second month in January to the lowest in 11 months. Losses in European stocks were limited on signs the ECB may be leaning toward increasing stimulus after comments from ECB Governing Council member Knot who said the ECB may need to expand stimulus if the recent oil price drop starts to influence inflation elsewhere in the economy. Asian stocks settled higher: Japan +0.90%, Hong Kong +1.36%, China +0.75%, Taiwan +1.78%, Australia +1.84%, Singapore +0.22%, South Korea +0.62%, India +0.21%.

The dollar index (DXY00 -0.10%) is down -0.14%. EUR/USD (^EURUSD) is up +0.20%. USD/JPY (^USDJPY) is down -0.29% after comments from BOJ Governor Kuroda lowered expectations the BOJ will boost stimulus measures when it meets this Thursday and Friday when he said "we don't think the current market situation has been affecting corporate behavior unduly."

Mar T-note prices (ZNH16 +0.06%) are up +4 ticks.

ECB Governing Council member Knot said that "if the oil price drop starts to influence inflation elsewhere in the economy and takes a foothold in the economy, it would be a reason to revisit monetary policy."

The German Jan IFO business climate fell -1.3 to 107.3, weaker than expectations of -0.3 to 108.4 and the lowest in 11 months.

U.S. STOCK PREVIEW

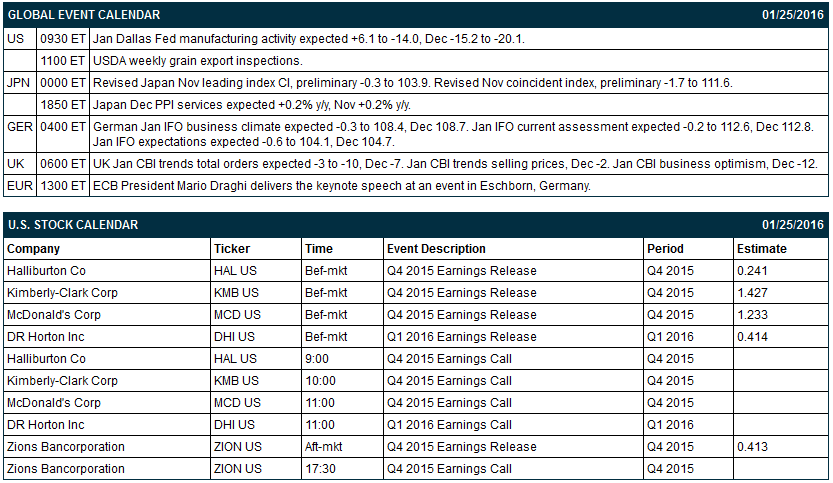

Key U.S. news today includes: (1) Jan Dallas Fed manufacturing activity (expected +6.1 to -14.0, Dec -15.2 to -20.1).

There are 5 of the S&P 500 companies that report earnings today: McDonalds (consensus $1.23), Halliburton (0.24), Kimberly-Clark (1.43), DR Horton (0.41), Zions Bancorporation (0.41).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Cleantech Forum San Francisco on Tue-Wed, Real Estate Capital Markets 2016 Seminar on Wed.

OVERNIGHT U.S. STOCK MOVERS

JPMorgan Chase (JPM +3.08%) was downgraded to 'Neutral' from 'Buy' at Nomura.

Halliburton (HAL +3.07%) reported Q4 EPS of 31 cents, better than consesnus of 24 cents.

Kimberly Clark (KMB +1.42%) reported Q4 EPS of 92 cents, below consensus of $1.43.

DR Horton (DHI +3.98%) reported Q1 EPS of 42 cents, higher than consensus of 41 cents.

Goldman Sachs (GS +3.44%) was upgraded to 'Buy' from 'Neutral at Nomura.

Whole Foods Markets (WFM +4.57%) was downgraded to 'Underperform' from 'Market Perform' at BMO Capital Markets.

Sandisk (SNDK +1.80%) was downgraded to 'Underperform' from 'Outperform' at CLSA.

Pinnacle Financial Partners (PNFP +2.07%) was upgraded to 'Market Perform' from 'Underperform' at Hovde Group with a 12-month price target of $51.

JB Hunt Transport Services (JBHT +1.84%) was upgraded to a 'Buy' from 'Hold' at BB&T with a price target of $83.

Tyco International Plc (TYC +2.00%) jumped over 7% in pre-market trading after people familiar with the matter said that Johnson Controls is discussing a merger with TYco.

Amazon.com (AMZN +3.71%) was upgraded to 'Buy' from 'Hold' at Edward Jones.

Science Applications International Corp. ( +0.77%) was downgraded to 'Hold' from 'Buy at Jeffries.

Caterpillar (CAT +2.16%) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

Thor Industries (THO +1.85%) was downgraded to 'Hold' from 'Buy' at Wellington Shields.

MARKET COMMENTS

Mar E-mini S&Ps (ESH16 -0.13%) this morning are down -4.50 points (-0.24%). Friday's closes: S&P 500 +2.03%, Dow Jones +1.33%, Nasdaq +2.83%. The S&P 500 on Friday closed sharply higher on strength in energy producers after the +9% surge in crude oil prices, the +14.7% jump in U.S. Dec existing home sales to 5.46 million (stronger than expectations of +9.2% to 5.20 million), and speculation that the BOJ may boost stimulus measures when it meets Jan 28-29 after the Nikkei Asian Review reported that the BOJ is considering steps to counter the hit to inflation from the recent plunge in crude oil.

Mar 10-year T-notes (ZNH16 +0.06%) this morning are up +4 ticks. Friday's closes: TYH6 -9.50, FVH6 -6.50. Mar T-notes on Friday closed lower on reduced safe-haven demand with the sharp rally in global stocks and on the stronger-than-expected U.S. Dec existing home sales and U.S. Jan Markit manufacturing PMI reports.

The dollar index (DXY00 -0.10%) this morning is down -0.143 (-0.14%). EUR/USD (^EURUSD) is up +0.0022 (+0.20%). USD/JPY (^USDJPY) is down -0.35 (-0.29%). Friday's closes: Dollar Index +0.518 (+0.52%), EUR/USD -0.0078 (-0.72%), USD/JPY +1.08 (+0.92%). The dollar index on Friday closed higher on strength in USD/JPY after reduced safe-haven demand for the yen due to the rally in stocks, and on weakness in EUR/USD after the Jan Eurozone Markit manufacturing PMI fell more than expected.

Mar crude oil (CLH16 -2.64%) this morning is down -$1.17 a barrel (-3.63%) and Mar gasoline (RBH16 -1.29%) is down -0.0200 (-1.80%). Friday's closes: CLH6 +2.66 (+9.01%), RBH6 +0.0532 (+5.04%). Mar crude oil and gasoline on Friday closed sharply higher with Mar gasoline at a 1-week high. Crude oil prices rallied on short-covering, the stronger-than-expected U.S. Dec existing home sales and Jan Markit U.S. manufacturing PMI reports, and the decline in U.S. oil rigs by 5 rigs to a 5-3/4 year low of 510 rigs in the week ended Jan 22, which should soon lead to lower U.S. oil production.

Disclosure: None.