Morning Call For January 22, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.21%) this morning are up +0.22% at a 1-week high and European stocks are up +0.15% at a 4-month high ahead of the ECB decision later today in which the central bank is expected to announce an asset-purchase program. The market expects the ECB to commit to a quantitative-easing program that may exceed 1 trillion euros, and if the amount is smaller or if the ECB fails to give full details of the program, equity markets may be disappointed. Russia's Micex Stock Index soared over 3% to a 3-1/3 year high today as the prospects for additional ECB stimulus prompts investors to seek out risk and higher returns, which boosts the appeal of Russian stocks. Bank of America also recommended that investors "reduce short positions in Russia going into the ECB meeting as Russia may be, counterintuitively, the main beneficiary of credible quantitative easing." Asian stocks closed mostly higher: Japan +0.28%, Hong Kong +0.70%, China +0.53%, Taiwan +0.53%, Australia +0.49%, Singapore +0.47%, South Korea -0.05%, India +0.41%. Chinese stocks received a boost after the PBOC conducted its first reverse-repurchase operation this year, adding money to the financial system, after it said it rolled over a 269.5 billion yuan ($43.4 billion) lending facility to banks ahead of next month's Chinese New Year holiday. Commodity prices are mixed. Mar crude oil (CLH15 +2.43%) is up +1.42%. Mar gasoline (RBH15 +2.01%) is up +1.27%. Feb gold (GCG15-0.94%) is down -0.51%. Mar copper (HGH15 -1.03%) is down -0.86%. Agriculture prices are higher. The dollar index (DXY00 -0.38%) is down -0.36%. EUR/USD (^EURUSD) is up +0.24%. USD/JPY (^USDJPY) is down -0.28%. Mar T-note prices (ZNH15 -0.34%) are down -13 ticks at a 1-week low.

The UK Jan CBI trends total orders unexpectedly fell -1 to 4, weaker then expectations of unchanged at 5. The Jan CBI trends selling prices fell -13 to -6, the lowest in 5 years. Jan CBI business optimism rose +7 to 15.

U.S. STOCK PREVIEW

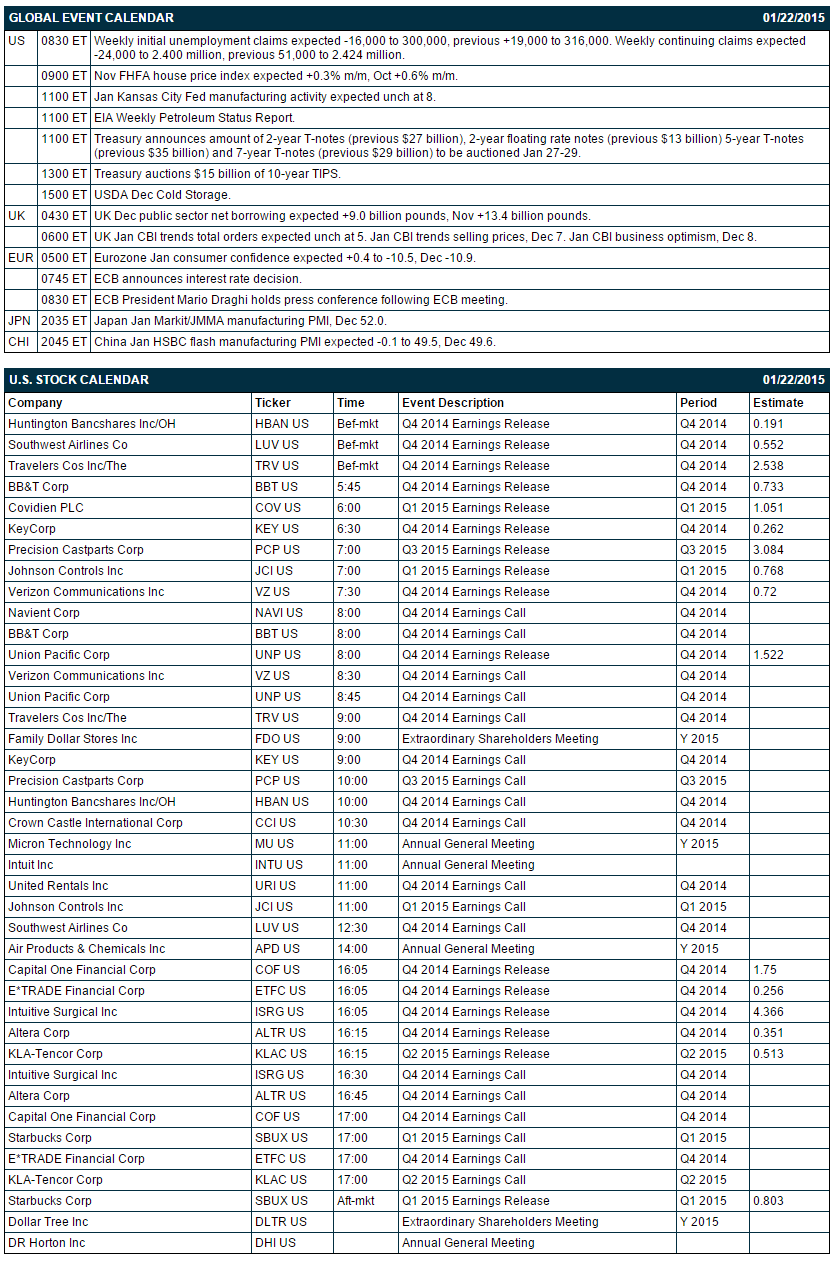

Today’s initial unemployment claims report is expected to show a decline of -16,000 to 300,000, reversing most of last week’s rise of +19,000 to 316,000. Meanwhile, today’s continuing claims report is expected to show a decline of -24,000 to 2.400 million, adding to last week’s decline of -51,000 to 2.424 million. Today’s Nov FHFA house price index is expected to show an increase of +0.3% m/m, adding to October’s increase of +0.6% m/m. The Treasury today will sell $15 billion of 10-year inflation-protected TIPS securities.

There are 16 the S&P 500 companies that report earnings today with notable reports including: Capital One (consensus $1.75), Starbucks (0.80), Southwest Airlines (0.55), Johnson Controls (0.77), Union Pacific (1.52), Verizon (0.72). There are no equity conferences during the remainder of this week.

OVERNIGHT U.S. STOCK MOVERS

Netflix (NFLX +17.34%) was initiated with a 'Buy' at Pivotal Research with a price target of $550.

Travelers (TRV -0.78%) reported Q4 EPS of $3.07, well above consensus of $2.54.

Verizon Communucations (VZ +0.15%) reported Q4 EPS of 71 cents, below consensus of 72 cents.

Endo (ENDP -1.51%) climbed over 3% in after-hours trading after it was announced that it will replace Covidien (COV -0.90%) in the S&P 500 as of the close of trading on Jan 26.

eBay (EBAY -0.56%) rose nearly 3% in after-hours trading after it reported Q4 adjusted EPS of 90 cents, better than consensus of 89 cents.

Kinder Morgan (KMI +0.43%) reported Q4 EPS of 8 cents, wel below consensus of 34 cents.

Ingersoll-Rand (IR +1.20%) was initiated with a 'Buy' at UBS with a price target of $80.

3M Company (MMM +0.37%) was initiated with a 'Buy' at UBS with a price target of $195.

General Electric (GE +0.80%) was initiated with a 'Buy' at UBS with a price target of $30.

Tyco (TYC unch) was initiated with a 'Sell' at UBS with a price target of $40.

United Rentals (URI +3.66%) moved up over 1% in after-hours trading after it reported Q4 adjusted EPS of $2.19, higher than consensus of $2.07.

Discover (DFS -0.05%) fell over 3% in after-hours trading after it reported Q4 adjusted EPS of $1.19, less than consensus of $1.30.

F5 Networks (FFIV -0.24%) reported Q1 adjusted EPS of $1.55, better than consensus of $1.49.

SanDisk (SNDK +2.08%) rose 1% in after-hours trading after it reported Q4 EPS $1.30, higher than consensus of $1.27, and then said it will expand its stock repurchase program by $2.5 billion.

American Express (AXP +0.47%) reported Q4 EPS of $1.39, better than consensus of $1.38.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.21%) this morning are up +4.50 points (+0.22%) at a new 1-week high. The S&P 500 index on Wednesday shook off early losses and climbed to a 1-week high and closed higher: S&P 500 +0.47%, Dow Jones +0.22%, Nasdaq +0.50%. Bullish factors included (1) carry-over support from a rally in European stocks on expectations the ECB on Thursday will announce a QE program, and (2) the +4.4% increase in U.S. Dec housing starts to 1.089 million, stronger than expectations of +1.2% to 1.040 million. Stocks had opened lower after comments from ECB Governing Council member Nowotny dampened speculation the ECB will announce a large-scale asset purchase program when he said “one should not get overexcited” about one policy meeting.

Mar 10-year T-notes (ZNH15 -0.34%) this morning are down -13 ticks at a 1-week low. Mar 10-year T-note futures prices on Wednesday closed lower. Closes: TYH5 -13.50, FVH5 -6.50. Negative factors included (1) the strongr-than-expected increase in U.S. Dec housing starts, and (2) reduced safe-haven demand for T-notes after the S&P 500 rallied to a 1-week high.

The dollar index (DXY00 -0.38%) this morning is down -0.333 (-0.36%). EUR/USD (^EURUSD) is up +0.0028 (+0.24%). USD/JPY (^USDJPY) is down-0.33 (-0.28%). The dollar index on Wednesday closed lower: Dollar index -0.142 (-0.15%), EUR/USD +0.00602 (+0.52%), USD/JPY -0.852 (-0.72%). Bullish factors included (1) weakness in USD/JPY as the yen strengthened after the BOJ refrained from expanding stimulus following its 2-day policy meeting, and (2) short-covering in EUR/USD ahead of Thursday’s ECB meeting. The dollar recovered from its worst levels after two unnamed ECB officials said the ECB on Thursday will propose purchasing as much as 1.3 trillion euros (50 billion euros per month) in asset purchases through 2016 in an attempt to spur growth and stave off deflation risks.

Mar WTI crude oil (CLH15 +2.43%) this morning is up +68 cents (+1.42%) and Mar gasoline (RBH15 +2.01%) is up +0.0173 (+1.27%). Mar crude oil and Mar gasoline on Wednesday closed higher: CLH5 +1.31 (+2.82%), RBH5 +0.0126 (+0.94%). Bullish factors included (1) a weaker dollar, and (2) signs of slower U.S. crude output after data from Baker Hughes showed the number of active U.S. oil rigs fell to 1,366 in the week ended Jan 16, the lowest level in 15 months. Gains in crude were muted on expectations that Thursday’s weekly EIA inventory data will show U.S. crude inventories rose +2.5 million bbl.

Disclosure: None.