Morning Call For January 21, 2016

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH16 -0.46%) are down -0.58% and European stocks are up +0.63% ahead of today's outcome of the ECB meeting and ECB President Draghi's press conference to follow. Weakness in crude oil prices has undercut energy producers who are leading U.S. stock index futures lower, while Italian banks rallied and are leading European stocks higher after Italian Prime Minister Renzi said that the domestic banking system is more solid than people think. The Russian ruble weakened to a record 85.9573 per dollar. Asian stocks settled mostly lower: Japan -2.43%, Hong Kong -1.82%, China -3.23%, Taiwan -0.46%, Australia +0.46%, Singapore -1.06%, South Korea -0.33%, India -0.41%. Japan's Nikkei Stock Index fell to a 14-1/2 month low as exporters led the overall market lower on reduced earnings prospects after the yen rallied to a 1-year high against the dollar.

The dollar index (DXY00 -0.01%) is down -0.08%. EUR/USD (^EURUSD) is up +0.10%. USD/JPY (^USDJPY) is down -0.10%.

Mar T-note prices (ZNH16 +0.19%) are up +5.5 ticks.

The PBOC added 400 billion yuan ($61 billion) to the financial system using reverse-repurchase agreements, the biggest increase in 3 years. China is trying to hold down borrowing costs and add liquidity ahead of the Chinese New Year holiday, when banks will be closed for the week starting Feb 8.

U.S. STOCK PREVIEW

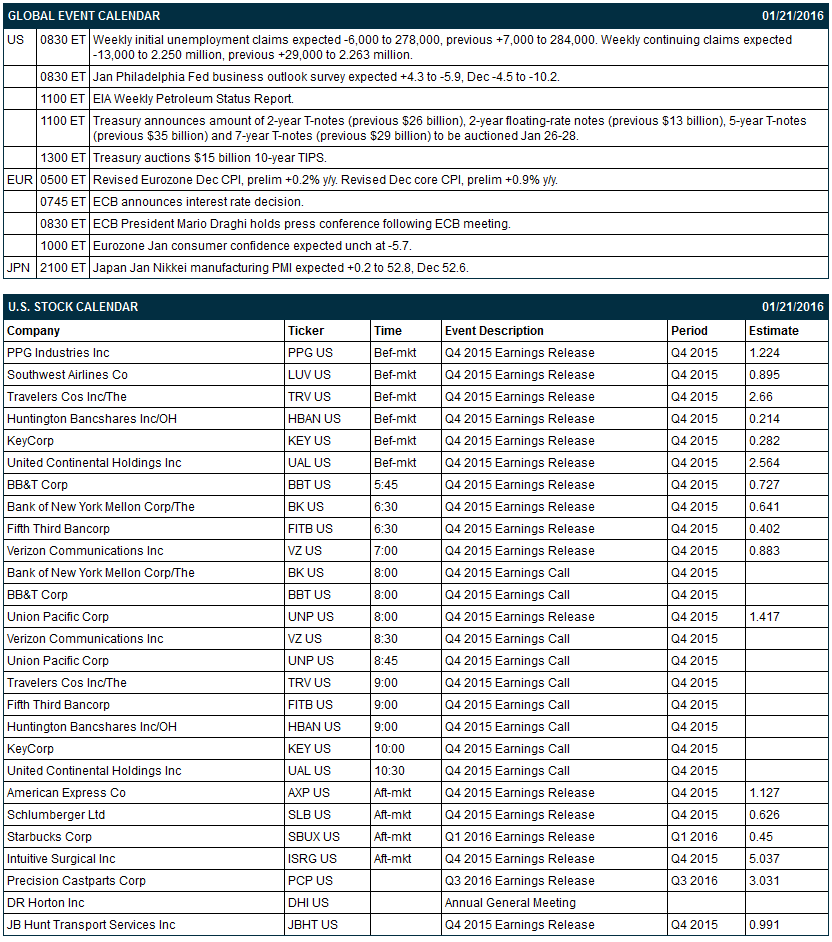

Key U.S. news today includes: (1) weekly initial unemployment claims (expected -6,000 to 278,000, previous +7,000 to 284,000) and continuing claims (expected -13,000 to 2.250 million, previous +29,000 to 2.263 million), (2) Jan Philadelphia Fed business outlook survey (expected +4.3 to -5.9, Dec -4.5 to -10.2), and (3) the Treasury's auction of $15 billion of 10-year TIPS.

There are 19 of the S&P 500 companies that report earnings today with notable reports including: American Express (consensus $1.13), Starbucks (0.45), Verizon (0.88), Union Pacific (1.42), E-Trade (0.30), JB Hunt Transport (0.99), Schlumberger (0.63).

U.S. IPO's scheduled to price today: Elevate Credit (ELVT).

Equity conferences during the remainder of this week: none.

OVERNIGHT U.S. STOCK MOVERS

United Continental Holdings (UAL -0.13%) reported Q4 adjusted EPS of $2.54, below consensus of $2.56.

Raymond James Financial (RJF -2.31%) reported Q1 EPS of 73 cents, weaker than consensus of 84 cents and said it sees Q2 "adversely" affected by equity market declines "coupled with seasonal factors that are expected in the first calendar quarter."

Oracle (ORCL -1.77%) jumped 9% in pre-market trading after Goldman Sachs said that current trends around Oracle's cloud business are on track.

Briggs & Stratton (BGG +2.07%) reported Q2 adjusted EPS of 34 cents, well above consensus of 18 cents, and then raised guidance on fiscal 2016 EPS to $1.25-$1.41 from a prior estimate of $1.20-$1.36.

Belmond Ltd. (BEL unch) will replace UTi Worldwide in the S&P SmallCap 600 as of the close of trading Friday, January 22.

FireEye (FEYE -2.36%) rose 5% in after-hours trading after it raised guidance on preliminary Q4 billings to between $257 million-$258 million, above previous guidance of $240 million-$260 million.

LifeLock (LOCK +1.98%) slid 3% in after-hours trading after founder and CEO Todd Davis said he will step down effective March 1 and be replaced by president Hilary Schneider.

Xilinx (XLNX +0.68%) rallied over 7% in after-hours trading after it reported Q3 net revenue of $566.2 million, above consensus of $554.6 million.

Sallie Mae (SLM +0.56%) dropped 3% in after-hours trading after it lowered guidance on 2016 core EPS to 49 cents=51 cents, well below consensus of 65 cents.

Endocyte (ECYT +3.90%) jumped 10% in after-hours trading after it was rated a new 'Outperform' at Credit Suisse with a price target of $11.

Medivation (MDVN +3.72%) gained over 1% in after-hours trading after it was rated a new 'Outperform' at Credit Suisse with a price target of $49.

F5 Networks (FFIV -3.72%) rose almost 2% in after-hours trading after it reported Q1 adjusted EPS of $1.73, higher than consensus of $1.60.

Kinder Morgan (KMI -4.30%) fell 3% in after-hours trading after it reported Q4 revenue of $3.64 billion, below consensus of $3.91 billion, and said it sees 2016 capex of $3.3 billion, below a December 9 estimate of $4.2 billion.

MARKET COMMENTS

Mar E-mini S&Ps (ESH16 -0.46%) this morning are down -10.75 points (-0.58%). Wednesday's closes: S&P 500 -1.17%, Dow Jones -1.56%, Nasdaq -0.25%. The S&P 500 on Wednesday sold off to a 1-3/4 year low and closed lower on a slide in energy producers as March WTI crude oil slumped to a 12-1/2 year low, weakness in technology stocks led by a nearly 5% drop in IBM after its 2016 profit forecast missed projections, and the unexpected -2.5% decline in U.S. Dec housing starts to 1.149 million, weaker than expectations of a +2.3% increase to 1.200 million. Stocks recovered from their worst levels after short-covering emerged near the lows.

Mar 10-year T-notes (ZNH16 +0.19%) this morning are up +5.5 ticks. Wednesday's closes: TYH6 +15.50, FVH6 +9.00. Mar T-notes on Wednesday climbed to a 3-month high and closed higher on the plunge in the S&P 500 to a 1-3/4 year low, which boosted the safe-haven demand for T-notes, and on the fall in crude oil to a 12-1/2 year low, which undercut inflation expectations as the 10-year T-note breakeven inflation expectations rate sank to a 6-1/2 year low.

The dollar index (DXY00 -0.01%) this morning is down -0.084 (-0.08%) EUR/USD (^EURUSD) is up +0.0011 (+0.10%). USD/JPY (^USDJPY) is down -0.12 (-0.10%). Wednesday's closes: Dollar Index +0.100 (+0.10%), EUR/USD -0.0018 (-0.17%), USD/JPY -0.70 (-0.60%). The dollar index on Wednesday closed higher on the slide in crude oil to a 12-1/2 year low, which pushed the the Canadian dollar down to a 12-3/4 year low against the dollar and pushed the Russian ruble to a record low against the dollar. The dollar was undercut by the fall in USD/JPY to a 1-year low as the sell-off in global stocks boosted the safe-haven demand for the yen and by heightened speculation that the ongoing financial turmoil in global markets will keep the Fed from raising interest rates further.

Mar crude oil (CLH16 -0.71%) this morning is down -42 cents (-1.48%) and Mar gasoline (RBH16 -0.44%) is down -0.0087 (-0.83%). Wednesday's closes: CLH6 -1.24 (-4.19%), RBH6 -0.0170 (-1.61%). Mar crude oil and gasoline prices on Wednesday closed sharply lower with Mar crude at a 12-1/2 year low. Crude oil prices were undercut by the deluge of new Iranian oil, doubts about the global economy as the S&P 500 sank to a 1-3/4 year low, and expectations for Thursday's weekly EIA report to show that U.S. crude supplies rose +2.5 million bbl.

(Click on image to enlarge)

Disclosure: None.