Morning Call For Friday, Sept. 22

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.14%) this morning are down -0.09% on heightened North Korean tensions after North Korean President Kim Jong Un promised the "highest level of hardline" countermeasures against the U.S. and his foreign minister suggested that could include testing of a hydrogen bomb in the Pacific Ocean. European stocks are up +0.36% at a 2-3/4 month high on signs the European economy continues to expand after the Eurozone Sep Markit manufacturing PMI unexpectedly rose +0.8 to 58.2, the highest since the data series began in 2014. German voters go to the polls this Sunday where Chancellor Merkel is expected to secure a fourth term, although she may not win an outright majority. Asian stocks settled mostly lower: Japan -0.25%, Hong Kong -0.82%, China -0.16%, Taiwan -1.22%, Australia +0.47%, Singapore +0.20%, South Korea -0.48%, India -1.38%. Asian markets retreated on Chinese economic concerns a day after China's sovereign credit rating was cut due to excessive debt levels. Dec COMEX copper (HGZ17 -0.20%) is down -0.41% to a 1-1/4 month low on Chinese demand concerns.

The dollar index (DXY00 -0.36%) is down -0.32%. EUR/USD (^EURUSD) is up +0.23%. USD/JPY (^USDJPY) is down -0.40%.

Dec 10-year T-note prices (ZNZ17 +0.16%) are up +6.5 ticks.

The German Sep Markit/BME manufacturing PMI unexpectedly rose +1.3 to 60.6, stronger than expectations of -0.3 to 59.0 and the fastest pace of expansion in 6-1/4 years.

The Eurozone Sep Markit manufacturing PMI unexpectedly rose +0.8 to 58.2, stronger than expectations of -0.2 to 57.2 and the highest since the data series began in 2014.

The Eurozone Sep Markit composite PMI rose +1.0 to 56.7, stronger than expectations of -0.1 to 55.6 and a 4-month high.

U.S. STOCK PREVIEW

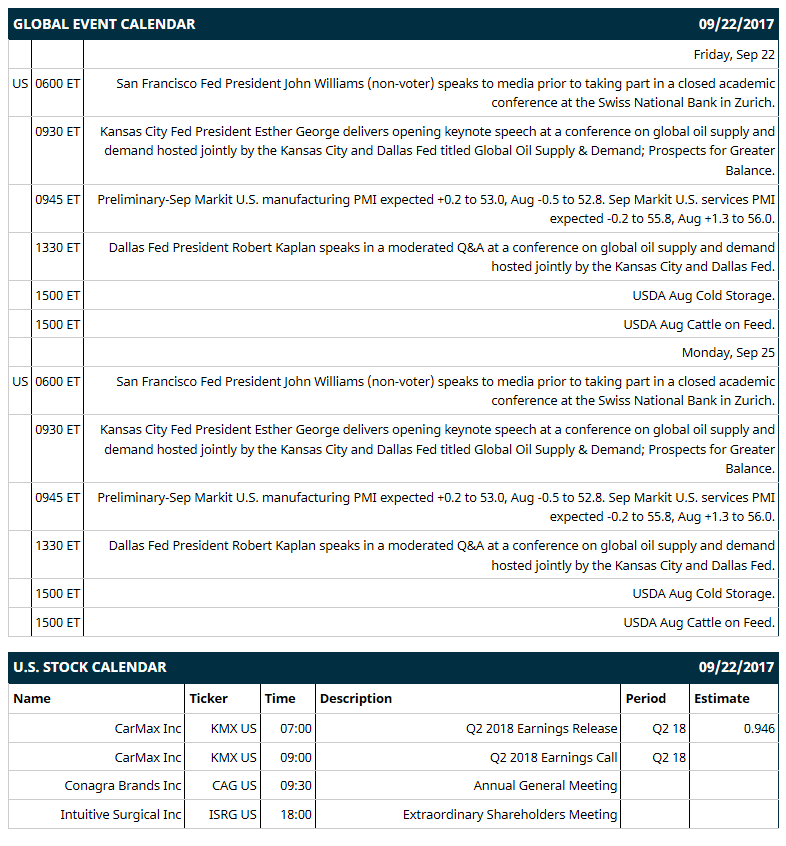

Key U.S. news today includes: (1) San Francisco Fed President John Williams (non-voter) speaks to media prior to taking part in a closed academic conference at the Swiss National Bank in Zurich, (2) Kansas City Fed President Esther George delivers opening keynote speech at a conference on global oil supply and demand hosted jointly by the Kansas City and Dallas Fed titled “Global Oil Supply & Demand; Prospects for Greater Balance,” (3) preliminary-Sep Markit U.S. manufacturing PMI (expected +0.2 to 53.0, Aug -0.5 to 52.8) and Sep Markit U.S. services PMI (expected -0.2 to 55.8, Aug +1.3 to 56.0), (4) Dallas Fed President Robert Kaplan speaks in a moderated Q&A at a conference on global oil supply and demand hosted jointly by the Kansas City and Dallas Fed, (5) USDA Aug Cold Storage, (6) USDA Aug Cattle on Feed.

Notable Russell 1000 earnings reports today include: Carmax (consensus $0.95).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

US Steel (X -4.38%) was downgraded to 'Underperform' from 'Market Perform' at Cowen with a price target of $20.

Intercept Pharmaceuticals (ICPT -24.89%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo Securities.

Cubic (CUB +1.30%) was upgraded to 'Strong Buy' from 'Outperform' at Raymond James with a price target of $60.

McDonald's (MCD -0.53%) boosted its quarterly dividend to $1.01 a share from 94 cents, better than consensus of 99 cents.

Aecom (ACM -0.17%) announced that its board had authorized a new $1billion stock repurchase program.

CommerceHub (CHUBA -0.26%) was initiated a 'Buy' at D.A. Davidson with a 12-month target price of $27.

LivePerson (LPSN +0.37%) was initiated with a 'Buy' at Needham & Co with an 18-month target price of $16.

Carvana (CVNA -4.43%) was initiated a 'Sell' at B Riley & Co with a 12-month target price of $12.

Yelp (YELP -1.27%) was initiated with a 'Buy' at D.A. Davidson with an 18-month target price of $51.

Texas Instruments (TXN +0.26%) gained almost 1% in after-hours trading after it raised its quarterly cash dividend to 62 cents a share from 50 cents, and said its board authorized an additional $6 billion in share buybacks.

Aaron's (AAN -0.99%) lost 1% in after-hours trading after it said it is "difficult" to predict when operations will be back to normal in its Florida stores due to the business interruptions from Hurricane Irma.

Versartis (VSAR -1.14%) plummeted 80% in after-hours trading after its Phase 3 trial of somavaratan in pediatric growth hormone deficiency did not meet its primary endpoint of non-inferiority.

Presidio (PSDO -0.43%) dropped nearly 7% in after-hours trading after it reported Q4 revenue of $729.3 million, below consensus of $736.6 million.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.14%) this morning are down -2.25 points (-0.09%). Thursday's closes: S&P 500 -0.30%, Dow Jones -0.24%, Nasdaq -0.65%. The S&P 500 on Thursday closed lower on Chinese economic concerns after S&P Global Ratings cut China's sovereign credit rating by one step to A+ from AA-, citing economic risks from rising debt. There was also weakness in technology stocks, led by losses in Apple which fell for a second day to a 1-1/2 month low.

Dec 10-year T-note prices (ZNZ17 +0.16%) this morning are up +6.5 ticks. Thursday's closes: TYZ7 unch, FVZ7 -1.00. Dec 10-year T-notes on Thursday closed little changed. T-notes found support on reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 1-week low. T-note prices were undercut by the unexpected -23,000 decline in U.S. weekly initial unemployment claims, which suggested that business disruptions from Hurricanes Harvey and Irma might be less severe than expected.

The dollar index (DXY00 -0.36%) this morning is down -0.299 (-0.32%). EUR/USD (^EURUSD) is up +0.0028 (+0.23%) and USD/JPY (^USDJPY)is down -0.45 (-0.40%). Thursday's closes: Dollar Index -0.249 (-0.27), EUR/USD +0.0049 (+0.41%), USD/JPY +0.26 (+0.23%). The dollar index on Thursday closed lower on strength in EUR/USD after Eurozone Sep consumer confidence rose +0.3 to -1.2, a 16-1/3 year high. The dollar was also boosted by the increase in the 10-year bund yield to a 1-1/2 month high, which supported the euro's interest rate differentials versus the dollar.

Nov crude oil (CLX17 -0.26%) this morning is up +5 cents (+0.10%) and Nov gasoline (RBX17 +0.30%) is +0.0082 (+0.51%). Thursday's closes: Nov WTI crude -0.14 (-0.28%), Nov gasoline -0.0092 (-0.57%). Nov crude oil and gasoline on Thursday closed lower on comments from Kuwaiti Oil Minister Issam Almarzooq who said OPEC won't look at an extension of its production cuts when it meets on Friday. Crude oil prices were also undercut by the slump in the crack spread to a 4-week low, which may curb refinery demand for crude to refine into gasoline and distillate products. Crude oil prices found some support on the weaker dollar.

Metals prices this morning are mixed with Dec gold (GCZ17 +0.35%) +4.6 (+0.36%), Dec silver (SIZ17 +0.10%) +0.027 (+0.16%) and Dec copper (HGZ17 -0.20%) -0.012 (-0.41%) at a 1-1/4 month low. Thursday's closes: Dec gold -21.6 (-1.64%), Dec silver -0.316 (-1.82%), Dec copper -0.0345 (-1.16%). Metals on Thursday sold off with Dec gold and Dec silver at 3-1/2 week lows and Dec copper at a 1-month low. Metals prices were undercut by the FOMC's hawkish stance at the Tue/Wed FOMC meeting. There was also concern about Chinese commodity demand after S&P Global Ratings cut China's sovereign credit rating, citing economic risks from rising debt.

(Click on image to enlarge)

Disclosure: None.