Morning Call For Friday, Sept. 15

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.11%) this morning are down -0.15% and European stocks are down -0.14% as a rise in geopolitical risks undercuts stock prices. North Korea launched a missile over Japan, although market reaction was muted as gold prices gave up their gains and USD/JPY (^USDJPY) recovered its losses and rallied to a 1-1/2 month high. Global terrorist concerns also weighed on U.S. and European stock prices after a bomb exploded on a London subway train. German 10-year bunds gave up early gains and fell to a 4-week low after ECB Executive Board member Lautenschlaeger said "it is time to take a decision now on scaling back our bond purchases at the beginning of next year." GBP/USD rallied for a second day and is up +1.35% at a 14-1/2 month high and 10-year UK gilts dropped to a 7-1/4 month low after the BOE on Thursday signaled that it may tighten monetary policy in the coming months. Asian stocks settled mixed: Japan +0.52%, Hong Kong +0.11%, China -0.53%, Taiwan +0.25%, Australia -0.76%, Singapore -0.35%, South Korea +0.37%, India +0.10%. China's Shanghai Composite fell to a 2-week low, although Japan's Nikkei Stock Index rallied to a 5-week high, led by strength in exporter stocks, after USD/JPY jumped +0.88% to a 1-1/2 month high, which boosts the earnings prospects of exporters.

The dollar index (DXY00 -0.34%) is down -0.29%. EUR/USD (^EURUSD) is up +0.29% on hawkish comments from ECB Executive Board member Lautenschlaeger. USD/JPY (^USDJPY) is up +0.88% to a 1-1/2 month high.

Dec 10-year T-note prices (ZNZ17 -0.06%) are down -2.5 ticks.

ECB Executive Board member Lautenschlaeger said that there is "little doubt" that buoyant growth and monetary accommodation "will take us back to an inflation rate which is in line with our goal," and "it is time to take a decision now on scaling back our bond purchases at the beginning of next year."

China Aug new yuan loans were up 1.09 trillion yuan, stronger than expectations of 950 billion yuan. Aug aggregate financing rose 1.48 trillion yuan, stronger than expectations of 1.28 trillion yuan.

U.S. STOCK PREVIEW

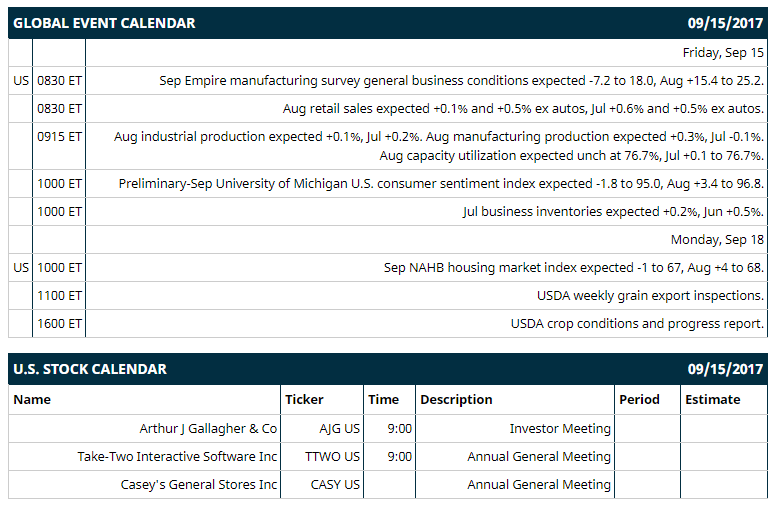

Key U.S. news today includes: (1) Sep Empire manufacturing general business conditions index (expected -7.2 to 18.0, Aug +15.4 to 25.2), (2) Aug retail sales (expected +0.1% and +0.5% ex autos, Jul +0.6% and +0.5% ex autos), (3) Aug industrial production (expected +0.1%, Jul +0.2%) and Aug manufacturing production (expected +0.3%, Jul -0.1%), (4) preliminary-Sep University of Michigan U.S. consumer sentiment index (expected -1.8 to 95.0, Aug +3.4 to 96.8), (5) Jul business inventories (expected +0.2%, Jun +0.5%).

Notable Russell 1000 earnings reports today include: none.

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Carnival Cruise Lines (CCL +0.47%) slid 3% in pre-market trading after it was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

Morgan Stanley (MS +0.43%) was upgraded to 'Buy' from 'Hold' at HSBC with a price target of $53.

Southwest Airlines (LUV -0.57%) was upgraded to 'Overweight' from 'Neutral' at JP Morgan Chase with a price target of $66

Celgene (CELG -0.46%) was initiated a 'Top Pick' at RBC Capital Markets with a 12-month target price of $176.

Caesars Entertainment (CZR +1.28%) rose almost 2% in after-hours trading after it was initiated as a 'Buy' at SunTrust Robinson Humphrey with an 18-month target price of $14.

Intercept Pharmaceuticals (ICPT -3.68%) gained almost 1% in after-hours trading after it was rated a new 'Outperform' at RBC Capital Markets with a price target of $244.

Oracle (ORCL -0.02%) slid nearly 5% in after-hours trading after it gave guidance for Q2 EPS of 64 cents-68 cents, the midpoint below consensus of 68 cents.

Amicus Therapeutics (FOLD -0.74%) gained over 1% in after-hours trading after Health Canada approved the company's Galafold for long-term treatment of adults with Fabry disease.

Emirati Therapeutics (MRTX -1.04%) soared over 50% in after-hours trading after it said the combination of intravaginal and volume in patients with non-small cell lung cancer demonstrated 3 confirmed partial responses in the first 11 evaluable patients.

T2 Biosystems (TTOO -10.32%) plunged 19% in after-hours trading after it announced that it is commencing an underwritten public offering of 2.5 million shares of its common stock.

Clara (OCLR -2.01%) rose 2% in after-hours trading after it was initiated as a 'Strong Buy' at Raymond James with a price target of $12.

Marinus Pharmaceuticals (MRNS +2.56%) lost over 2% in after-hours trading after it announced that it intends to offer $30 million of its common stock in an underwritten public offering.

Genworth Financial (GNW -0.75%) climbed over 5% in after-hours trading after the Virginia Bureau of Insurance approved the proposed acquisition by China Oceanwide Holdings of Genworth's Virginia based insurance companies.

Flightpath Technologies (LPTH -6.59%) jumped 14% in after-hours trading after it reported Q4 revenue of $9.0 million, better than consensus of $8.8 million.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.11%) this morning are down -3.75 points (-0.15%). Thursday's closes: S&P 500 -0.11%, Dow Jones +0.20%, Nasdaq -0.59%. The S&P 500 on Thursday eked out a new record higher but fell back and closed lower on concern that slower economic growth in China may undercut global growth prospects after China Aug industrial production rose +6.0% y/y, weaker than expectations of +6.6% y/y and the smallest pace of increase this year. Another negative factor was the bellicose comments from North Korea who threatened to use a nuclear weapon against Japan and threatened to turn the U.S. into "ashes and darkness" for agreeing on fresh United Nations sanctions against them this week. Losses were contained as energy stocks gained after crude oil prices rose +1.20% to a 3-1/2 month high.

Dec 10-year T-note prices (ZNZ17 -0.06%) this morning are down -2.5 ticks. Thursday's closes: TYZ7 -1.50, FVZ7 -2.50. Dec 10-year T-notes on Thursday fell to a 4-week low and closed lower on negative carry-over from a plunge in British 10-year gilts to a 6-week low after the BOE said it sees scope to taper stimulus in the coming months. A surge in crude oil prices to a 3-1/2 month high that boosted inflation expectations and was another negative for T-note prices as that pushed the 10-year T-note breakeven inflation rate to a 3-3/4 month high.

The dollar index (DXY00 -0.34%) this morning is down -0.264 (-0.29%). EUR/USD (^EURUSD) is up +0.0035 (+0.29%) and USD/JPY (^USDJPY) is up +0.97 (+0.88%) at a 1-1/2 month high. Thursday's closes: Dollar Index -0.396 (-0.43%), EUR/USD +0.0034 (+0.29%), USD/JPY -0.25 (-0.23%). The dollar index on Thursday closed lower on concern that a slowdown in Chinese growth will undercut the global economy and keep the Fed from further raising interest rates after China Aug industrial production rose +6.0% y/y, the slowest pace this year. A rally in GBP/USD to a 1-year high was also dollar negative after the BOE said it sees scope for stimulus reduction in the coming months.

Oct crude oil (CLV17 +0.18%) this morning is up +8 cents (+0.16%) and Oct gasoline (RBV17 +1.01%) is +0.0091 (+0.56%). Thursday's closes: Oct WTI crude +0.59 (+1.20%), Oct gasoline -0.0186 (-1.13%). Oct crude oil and gasoline on Thursday settled mixed. Oct crude rallied to a 3-1/2 month nearest-futures high on a weaker dollar along with OPEC data that showed its compliance with production cuts rose to 96% in Aug from 91% in Jul. Gasoline closed lower on demand concerns after the crack spread fell to a 2-week low, which may curb refinery demand for crude to refine into gasoline.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.14%) -1.0 (-0.08%), Dec silver (SIZ17 -0.16%) -0.029 (-0.16%) and Dec copper (HGZ17 -0.03%) +0.003 (+0.10%). Thursday's closes: Dec gold +1.3 (+0.10%), Dec silver -0.078 (-0.44%), Dec copper -0.0235 (-0.79%). Metals on Thursday settled mixed with Dec copper at a 3-1/2 week low. Gold closed higher due to a weaker dollar and increased inflation expectations after the 10-year T-note breakeven inflation rate rose to a 3-3/4 month high, which may boost demand for gold as an inflation hedge. Copper closed lower on the weaker than expected China Aug industrial production, which raises concern about Chinese copper demand, and on the +29,450 MT jump in LME copper inventories to a 4-week high, which eases copper supply concerns.

Disclosure: None.