Morning Call For Friday, Oct. 13

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 +0.08%) this morning are up +0.06% and European stocks are up +0.15% on the prospects that that the ECB will extend its QE program for 9 months until Sep 2018. According to the report, an unnamed official said the ECB will reduce its bond purchases in half to 30 billion euros a month from the current 60 billion euros starting in Jan, but will extend the program until Sep of 2018. EUR/USD weakened on the report and the 10-year German bund yield dropped to a 2-1/2 week low of 0.415%. Strength in the Chinese economy is also positive for global growth after China Sep imports rose a more-than-expected +18.7% y/y, the largest increase in 6-months. Mining stocks are higher as Dec COMEX copper (HGZ17 +0.21%) climbs +0.46% to a new 1-month high on strong Chinese demand after China Sep copper imports rose +10% m/m and +26.5% y/y to 430,000 MT. Energy stocks are higher as well with Nov WTI crude oil (CLX17 +1.92%) up +1.84% at a 1-1/2 week high. Crude prices rallied on strength in Chinese demand after China Sep crude imports rose +13% m/m to 9.04 million bpd, the second-highest on record. Asian stocks settled mostly higher: Japan +0.96%, Hong Kong +0.06%, China +0.13%, Taiwan +0.12%, Australia +0.34%, Singapore +0.49%, South Korea -0.23%, India +0.78%. Japan's Nikkei Stock Index rallied over 21,000 to a 20-3/4 year high and found support on comments from BOJ Governor Kuroda who said the BOJ will keep up current monetary easing to hit its 2% inflation target, even as that goal remains a distance away.

The dollar index (DXY00 +0.13%) is up +0.01%. EUR/USD (^EURUSD) is down -0.05%. USD/JPY (^USDJPY) is down -0.12% to a 2-week low.

Dec 10-year T-note prices (ZNZ17 -0.05%) are down -0.5 of a tick.

The ECB is considering reducing its QE program by half starting in Jan and extending the program for 9-months, according to unnamed officials because the deliberations are private. The ECB will reduce the pace of its asset purchases to 30 billion euros ($36 billion) a month from the current pace of 60 billion euros a month. The ECB will announce the future of their bond-buying program when they meet next on Oct 26.

The China Sep trade balance shrank to a surplus of $28.47 billion, smaller than expectations of +$38.00 billion and the smallest surplus in 6-months. Sep exports rose +8.1% y/y, weaker than expectations of +10.0% y/y. Sep imports rose +18.7% y/y, stronger than expectations of +14.7% y/y and the biggest increase in 6-months.

U.S. STOCK PREVIEW

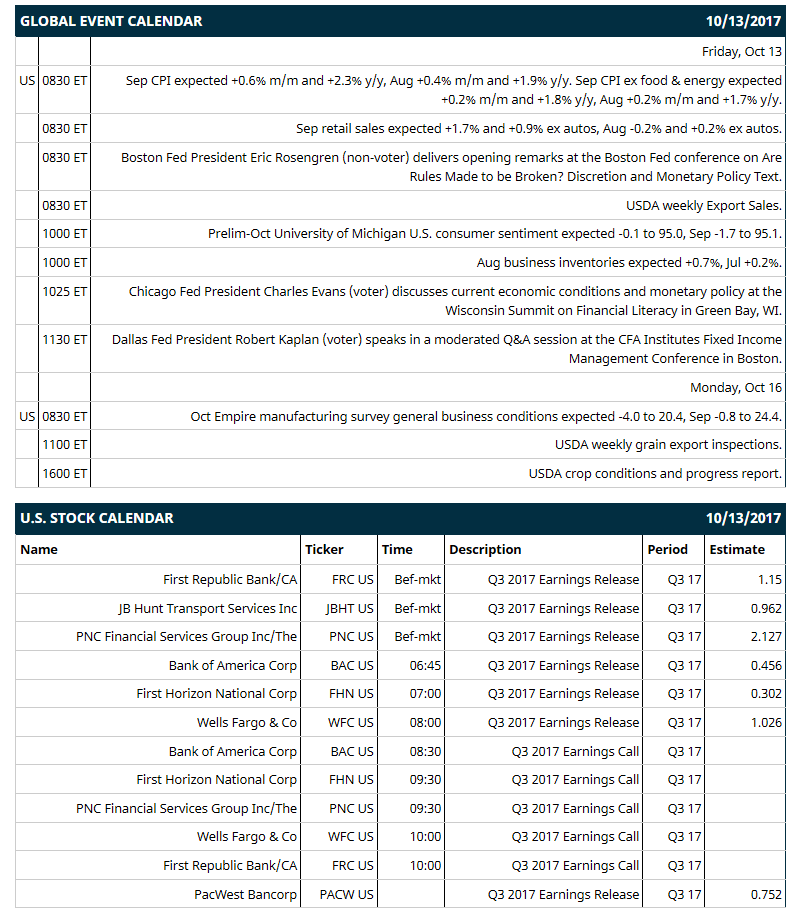

Key U.S. news today includes: (1) Sep CPI (expected +0.6% m/m and +2.3% y/y, Aug +0.4% m/m and +1.9% y/y) and Sep CPI ex food & energy (expected +0.2% m/m and +1.8% y/y, Aug +0.2% m/m and +1.7% y/y), (2) Sep retail sales (expected +1.7% and +0.9% ex autos, Aug -0.2% and +0.2% ex autos), (3) Boston Fed President Eric Rosengren (non-voter) delivers opening remarks at the Boston Fed conference on “Are Rules Made to be Broken? Discretion and Monetary Policy Text,” (4) prelim-Oct University of Michigan U.S. consumer sentiment (expected -0.1 to 95.0, Sep -1.7 to 95.1), (5) Aug business inventories (expected +0.7%, Jul +0.2%), (6) Chicago Fed President Charles Evans (voter) discusses current economic conditions and monetary policy at the Wisconsin Summit on Financial Literacy in Green Bay, WI, (7) Dallas Fed President Robert Kaplan (voter) speaks in a moderated Q&A session at the CFA Institute’s Fixed Income Management Conference in Boston, (8) USDA weekly Export Sales.

Notable Russell 1000 earnings reports today include: Bank of America (consensus $0.46), Wells Fargo (1.03), First Republic Bank (1.15), PNC Financial Services (2.13), First Horizon National Bank (0.30), PacWest Bancorp (0.75), JB Hunt Transport (0.96).

U.S. IPO's scheduled to price today:

Equity conferences this week: HR Technology Conference on Tue-Fri.

OVERNIGHT U.S. STOCK MOVERS

General Motors (GM -1.28%) was upgraded to 'Overweight' from 'Equal-weight' at Barclays with a price target of $55.

Saratoga Investment (SAR +1.46%) was upgraded to 'Buy' from 'Neutral' at Compass Point Research & Trading LLS with a price target of $23.

Dollar Tree (DLTR +0.15%) was downgraded to 'Hold' from ‘Buy' at Loop Capital Markets.

Ford Motor (F -2.10%) was downgraded to 'Equal-weight' from 'Overweight' at Barclays.

Hostess Brands (TWNK -0.37%) was downgraded to 'Sell' from 'Neutral' at UBS with a price target of $11.

Nanometrics (NANO +0.03%) dropped nearly 6% in after-hours trading after it reported preliminary Q3 EPS of 20 cents-22 cents weaker than consensus of 27 cents.

Spark Therapeutics (ONCE -0.62%) rallied over 5% in after-hours trading after an FDA advisory committee voted 16-0 in favor of Spark's Luxturna for treatment in patients with vision loss due to balletic mutation-associated retinal dystrophy.

Applied Optoelectronic (AAOI -4.23%) tumbled over 15% in after-hours trading after it announced preliminary Q3 revenue of $88 million-$89 million, below prior guidance of $107 million-$115 million.

Endocyte (ECYT +0.41%) dropped 9% in after-hours trading after it filed to sell $150 million in a mixed-securities shelf offering.

EXFO Inc (EXFO +0.75%) jumped 12% in after-hours trading after it reported Q4 revenue of $63 million, above consensus of $60.9 million.

Antares Pharma (ATRS -5.33%) plunged 30% in after-hours trading after the FDA said as part of their ongoing review of the company's New Drug Application for its Xyosted injection that it has identified deficiencies that preclude the continuation of labeling and postmarking requirements at this time.

Tandem Diabetes Care (TNDM -17.89%) slumped over 25% in after-hours trading after it offered 3.2 million shares of common stock at $3.50 each, a 25% discount to Thursday's close.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 +0.08%) this morning are up +1.50 points (+0.06). Thursday's closes: S&P 500 -0.17%, Dow Jones -0.14%, Nasdaq -0.19%. The S&P 500 on Thursday closed lower on weakness in energy stocks as crude oil prices fell -1.36% and on the +2.2% y/y rise in the U.S. Sep core PPI report (the largest year-on-year rise in 5-1/2 years) that was hawkish for Fed policy. A positive factor for stocks was the -15,000 decline in U.S. weekly jobless claims to 243,000, a bigger decline than -10,000 to 250,000.

Dec 10-year T-note prices (ZNZ17 -0.05%) this morning are down -0.5 of a tick. Thursday's closes: TYZ7 +5.00, FVZ7 +2.00. Dec 10-year T-notes on Thursday closed higher on carry-over support from a rally in German bunds after ECB Executive Board member Praet said "underlying inflation pressures are still too weak."

The dollar index (DXY00 +0.13%) this morning is up +0.008 (+0.01%). EUR/USD (^EURUSD) is -0.0006 (-0.05%) and USD/JPY (^USDJPY) is down -0.13 (-0.12%) at a 2-week low. Thursday's closes: Dollar Index +0.042 (+0.05%), EUR/USD -0.0029 (-0.24%), USD/JPY -0.22 (-0.20%). The dollar index on Thursday closed higher on the larger-than-expected increase in U.S. Sep core PPI, which was hawkish for Fed policy, and the larger-than-expected decline in U.S. weekly jobless claims, a sign of economic strength.

Nov crude oil (CLX17 +1.92%) this morning is up +93 cents (+1.84%) at a 1-1/2 week high and Nov gasoline (RBX17 +2.34%) is +0.0342 (+2.16%). Thursday's closes: Nov WTI crude -0.70 (-1.36%), Nov gasoline -0.0260 (-1.62%). Nov crude oil and gasoline on Thursday closed lower on a stronger dollar and the +1.32 million bbl increase in crude supplies at Cushing to a 4-1/2 month high. Gasoline prices were supported by the +2.49 million bbl increase in EIA gasoline stockpiles, more than expectations of +200,000 bbl. Crude oil found some support on the -0.8% decline in U.S. crude production to 9.48 million bpd in the week ended Oct 6.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.15%) -0.06 (-0.05%), Dec silver (SIZ17 -0.24%) -0.016 (-0.09%) and Dec copper (HGZ17 +0.21%) up +0.015 (+0.46%) at a 1-month high. Thursday's closes: Dec gold +7.6 (+0.59%), Dec silver +0.133 (+0.78%), Dec copper +0.0245 (+0.79%). Metals prices on Thursday closed higher with Dec gold and Dec silver at 2-week highs and Dec copper at a 1-month high. Metals prices were boosted by carry-over support from Wednesday afternoon's minutes of the Sep 19-20 FOMC meeting, which were released after metals markets closed, that Fed members were concerned about low inflation, which was dovish for Fed policy. Metals prices were also boosted by the stronger-than-expected U.S. Sep core PPI, which boosted demand for gold as an inflation hedge, and by tighter copper supplies after LME copper inventories fell -1,025 MT to a 4-week low of 285,900 MT.

(Click on image to enlarge)

Disclosure: None.