Morning Call For Friday, Nov. 4

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 -0.04%) are little changed, up +0.02%, and European stocks are down -0.78% at a 1-month low ahead of this morning's monthly U.S. payrolls report for October that may provide clues as to the timing of the Fed's next rate hike. Uncertainty ahead of Tuesday's U.S. Presidential election weighed on equity prices as did weakness in energy producing stocks as crude oil prices (CLZ16 +0.20%) are down % at a 5-week low. Oil prices have sold-off this week after last weekend's meeting in Vienna between OPEC and non-OPEC members failed to come up with an agreement to stabilize global oil production levels. European stocks were also dragged lower as bank stocks retreated with Erste Group Bank AG, Austria's biggest bank, down over 5% after it forecast flat revenue next year "at best," and Commerzbank AG is sown over 1% after it reported a Q3 loss. Asian stocks settled mostly lower: Japan -1.34%, Hong Kong -0.18%, China -0.12%, Taiwan +0.01%, Australia -0.86%, Singapore -0.47%, South Korea -0.13%, India -0.57%.

The dollar index (DXY00 +0.03%) is up +0.06%. EUR/USD (^EURUSD) is down -0.09%. USD/JPY (^USDJPY) is down -0.02%.

Dec 10-year T-note prices (ZNZ16 +0.13%) are up +4 ticks.

The Eurozone Sep PPI of +0.1% m/m and -1.5% y/y was stronger than expectations of unch m/m and -1.7% y/y with the -1.5 y/y fall the smallest year-on-year decline in 1-3/4 years.

The Eurozone Oct Markit composite PMI was revised downward to 53.3 from the originally reported 53.7, still the fastest pace of expansion in 9 months.

U.S. STOCK PREVIEW

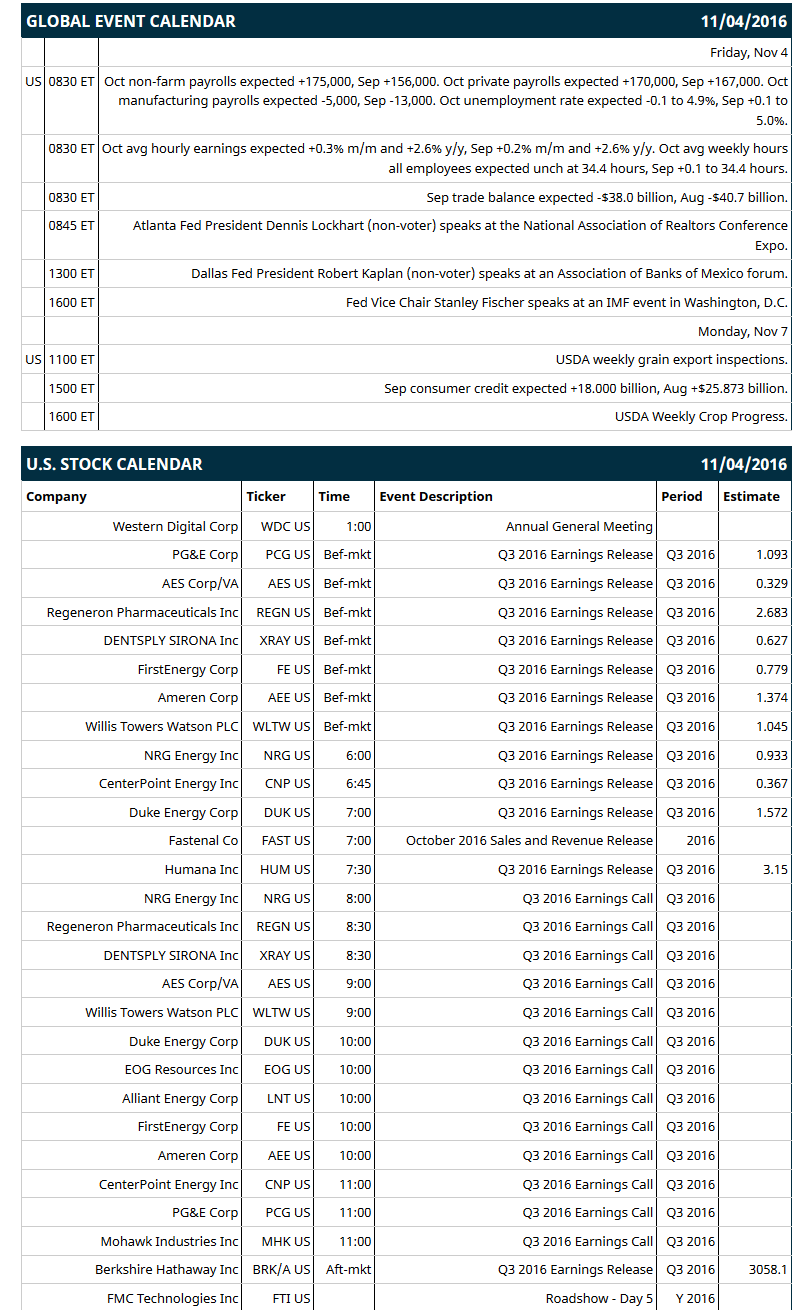

Key U.S. news today includes: (1) Oct non-farm payrolls (expected +175,000, Sep +156,000) and Oct unemployment rate (expected -0.1 to 4.9%, Sep +0.1 to 5.0%), (2) Oct avg hourly earnings (expected +0.3% m/m and +2.6% y/y, Sep +0.2% m/m and +2.6% y/y) and Oct avg weekly hours (expected unch at 34.4 hours, Sep +0.1 to 34.4 hours), (3) Sep trade balance (expected -$38.0 billion, Aug -$40.7 billion), (4) Atlanta Fed President Dennis Lockhart (non-voter) speaks at the National Association of Realtors Conference Expo, (5) Dallas Fed President Robert Kaplan (non-voter) speaks at an Association of Banks of Mexico forum, (6) Fed Vice Chair Stanley Fischer speaks at an IMF event in Washington, D.C.

Notable S&P 500 earnings reports today include: Berkshire Hathaway (consensus $3058), Humana (3.15), Duke Energy (1.75), PG&E ((1.09), Regeneron (2.68), NRG Energy (0.93), among others.

U.S. IPO's scheduled to price today: none.

Equity conferences during the remainder of this week include: BancAnalysts Association of Boston Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Monster Beverage (MNST -2.83%) dropped over 6% in pre-market trading after it reported Q3 EPS of 99 cents, weaker than consensus of $1.12.

Starbucks (SBUX -2.28%) gained over 1% in pre-market trading after it reported Q4 adjusted EPS of 56 cents, higher than consensus of 55 cents

Las Vegas Sands (LVS -1.48%) climbed over 3% in after-hours trading after it reported Q3 adjusted EPS of 72 cents, higher than consensus of 60 cents.

Activision Blizzard (ATVI +1.81%) lost 1% in after-hours trading after it said it sees Q4 adjusted EPS of 74 cents, below consensus of 80 cents.

Twilio (TWLO -4.54%) fell almost 3% in after-hours trading after it said it sees a full-year adjusted loss of -21 cents to -23 cents a share, a wider loss than consensus of -19 cents a share.

Fossil Group (FOSL -4.00%) lost over 4% in after-hours trading after it reported Q3 comparable sales down -3%, weaker than consensus of -1.2%.

GoPro (GPRO -7.01%) sank nearly 20% in after-hours trading after it reported a Q3 adjusted loss of -60 cents a share, wider than consensus of -36 cents, and then said it sees Q4 adjusted EPS of 25 cents-35 cents, below consensus of 42 cents.

Lannet (LCI -26.60%) rallied over 5% in after-hours trading after it reported Q1 adjusted EPS of 77 cents, stronger than consensus of 71 cents.

FireEye (FEYE -2.74%) jumped 15% in after-hours trading after it reported a Q3 adjusted loss of 18 cents a share, narrower than consensus of -31 cents, and then lowered its 2016 adjusted EPS loss estimate to -$1.14-$1.16 from an August 4 view of -$1.28-$1.32,

Weight Watchers International (WTW -1.48%) climbed over 2% in after-hours trading after it reported Q3 EPS of 53 cents, higher than consensus of 45 cents, and then raised guidance on full-year EPS to 95 cents-$1.05 from an August 4 view of 90 cents-$1.05.

El Pollo Loco Holdings (LOCO +1.67%) slid nearly 8% in after-hours trading after it reported Q3 revenue of $95.8 million, below consensus of $97.3 million, and then cut its high end full-year EPS estimate to 67 cents-68 vents from a prior view of 68 cents-72 cents.

Herbalife Ltd. (HLF +1.12%) gained nearly 1% in after-hours trading after holder Carl Icahn boosted his stake in the company to 23.05% from 21.08%.

Nanophononics (NPTN +0.97%) tumbled 16% in after-hours trading after it reported Q3 adjusted EPS of 6 cents, well below consensus of 14 cents, and then said it sees Q4 adjusted EPS of 13 cents-21 cents, weaker than consensus of 23 cents.

Insulet (PODD -4.18%) jumped 15% in after-hours trading after it raised its fell-year revenue estimate to $362 million-$365 million from an August 3 estimate of $345 million-$355 million.

MDC Partners (MDCA +0.60%) plunged over 20% in after-hours trading after it cut its full-year revenue view to $1.365 billion-$1.375 billion from a prior view of $1.39 billion-$1.42 billion, and then suspended its quarterly dividend.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 -0.04%) this morning are up +0.50 of a point (+0.02%). Thursday's closes: S&P 500 -0.44%, Dow Jones -0.16%, Nasdaq -1.01%. The S&P 500 on Thursday dropped to a fresh 3-3/4 month low and closed lower on angst ahead of next Tuesday's U.S. election and on weakness in energy-producer stocks after the price of crude oil tumbled -2.85% to a 5-week low. Stocks found some underlying support from the +0.3% gain in U.S. Sep factory orders (slightly stronger than expectations of +0.2%) and from the +3.1% increase in U.S. Q3 non-farm productivity (stronger than expectations of +2.1% and the biggest increase in 2 years).

Dec 10-year T-notes (ZNZ16 +0.13%) this morning are up +4 ticks. Thursday's closes: TYZ6 unch, FVZ6 +0.25. Dec 10-year T-notes Thursday fell back from a 1-week high and closed little changed. T-notes were undercut by a rebound in stocks, which curbed the safe-haven demand for T-notes. T-notes were boosted by the big +3.1% increase in U.S. Q3 non-farm productivity and by the slide in crude oil to a 5-week low, which reduced inflation expectations as the 10-year T-note breakeven rate fell to a 1-week low.

The dollar index (DXY00 +0.03%) this morning isup +0.060 (+0.06%) . EUR/USD (^EURUSD) is down -0.0010 (-0.09%). USD/JPY (^USDJPY) is down -0.02 (-0.02%). Thursday's closes: Dollar index -0.241 (-0.25%), EUR/USD +0.0007 (+0.06%), USD/JPY -0.32 (-0.31%). The dollar index on Thursday fell to a 3-week low and closed lower on uncertainty about next Tuesday's U.S. presidential election and on the unexpected increase in U.S. weekly jobless claims to a 2-3/4 month high.

Dec crude oil prices (CLZ16 +0.20%) are down -1 cent (-0.02%) at a fresh 5-week low and Dec gasoline (RBZ16 -1.27%) is down -0.0161 (-1.13%) at a 1-month low. Thursday's closes: Dec crude -0.67 (-1.48%), Dec gasoline -0.0313 (-2.16%). Dec crude oil and gasoline on Thursday closed lower with Dec crude at a 5-week low. Crude oil prices were hurt by negative carryover from Wednesday's EIA data that showed U.S. crude inventories rose +14.42 million bbl (versus expectations of +2.0 million bbl) and from Wednesday's news that Russia Oct crude production rose to a post-Soviet record of 11.2 million bpd and OPEC Oct crude production rose to a record 34.02 million bpd.

(Click on image to enlarge)

Disclosure: None.