Morning Call For Friday, May 5

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM17 +0.05%) are little changed this morning ahead of the U.S. April payroll report and Sunday's French presidential election. The Euro Stoxx 50 index is down -0.25% as European stocks have turned a little more cautious after Thursday's exuberance with the +1.16% rally to a new 1-3/4 year high. Asian stocks today closed mostly lower. Global equities remain on edge as the markets ponder whether there is some macro-level significance to Thursday's plunge in commodity prices such as weakening global economic growth, or whether the sell-off was simply driven by specific factors in each commodity market. This morning's U.S. April payroll report is expected to recover to a trend increase of +190,000 after ideas that the weak March payroll report of +98,000 was mostly weather-induced.

The markets are generally confident that centrist Emmanuel Macron will win Sunday's French presidential against far-right Marine Le Pen since the polls are holding steady at a wide margin of about 60%-40%. That spread is much wider than the 1-3 point poll spreads for the Brexit and Trump votes, meaning that an upset by Ms. Le Pen would be far more difficult than it was in the case of Brexit and Trump. The latest betting odds at Oddchecker are 91%-14% in favor of Mr. Macron.

Asian stocks today closed mostly lower, led by a -0.78% drop in the Shanghai Composite. Chinese stocks were hit again today by concern about the government's crackdown on leverage and also about Thursday's rout in commodities. Other Asian stock markets today closed mostly lower: Hong Kong -0.84%, Taiwan -0.68%, Australia -0.68%, Singapore +0.03%, India -0.89%. The Japanese and South Korean stock markets were closed today for holidays.

There are some geopolitical tensions this morning after an overnight claim by North Korea that the CIA and South Korean intelligence tried to assassinate Kim Jong-un with a "bio-chemical attack." That charge was likely just paranoid propaganda but North Korea could nevertheless be planning to use the charge as a justification for another weapons test or some other type of provocation.

U.S. STOCK PREVIEW

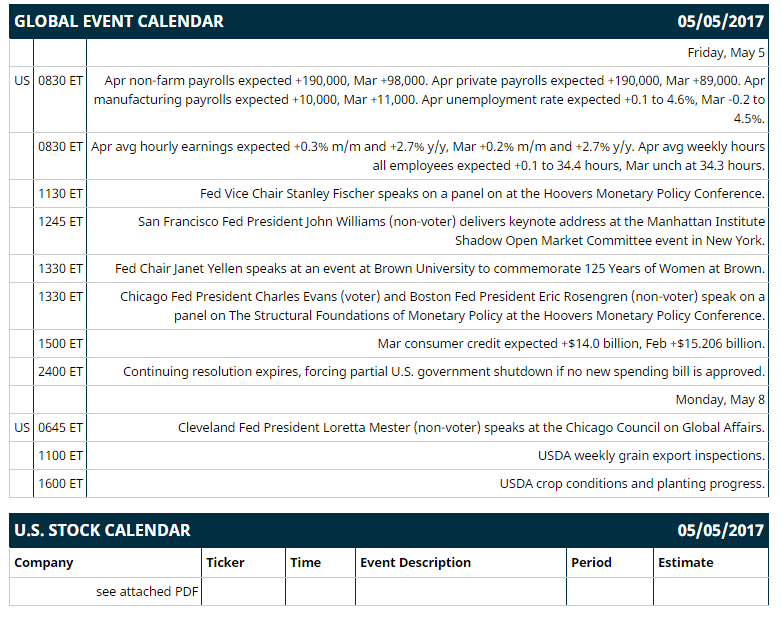

Key U.S. news today includes: (1) Apr non-farm payrolls (expected +190,000, Mar +98,000) and Apr unemployment rate (expected +0.1 to 4.6%, Mar -0.2 to 4.5%), (2) Apr avg hourly earnings (expected +0.3% m/m and +2.7% y/y, Mar +0.2% m/m and +2.7% y/y), (3) Fed Vice Chair Stanley Fischer speaks on a panel on at the Hoover’s Monetary Policy Conference, (4) San Francisco Fed President John Williams (non-voter) delivers keynote address at the Manhattan Institute Shadow Open Market Committee event in New York, (5) Fed Chair Janet Yellen speaks at an event at Brown University to commemorate "125 Years of Women at Brown," (6) Chicago Fed President Charles Evans (voter) and Boston Fed President Eric Rosengren (non-voter) speak on a panel on “The Structural Foundations of Monetary Policy” at the Hoover’s Monetary Policy Conference, (7) Mar consumer credit (expected +$14.0 billion, Feb +$15.206 billion).

Notable S&P 500 earnings reports today include: Berkshire Hathaway (consensus $2705), Moody's (1.24), Welltower (1.05), Cognizant Technology (0.83), Cigna (2.45), CenterPoint Energy (0.34).

U.S. IPO's scheduled to price today: none.

Equity conferences: none.

OVERNIGHT U.S. STOCK MOVERS

Universal Display Corp (OLED -0.72%) rallied 13% in after-hours trading at a Q1 EPS beat.

Wingstop (WING -0.58%) rallied 12% in after-hours trading at a positive Q1 earnings report.

Callaway Golf (ELY +1.00%) rallied 11% in after-hours trading on positive Q2 sales guidance.

Zynga (ZNGA -2.07%) rallied 6% in after-hours trading after beating Q1 revenue and EPS forecasts.

HerbaLife (HLF -0.35%) rallied 5% in after-hours trading on higher than expected EPS guidance.

Shake Shack (SHAK -2.67%) fell 5% in after-hours trading due to a Q1 sales miss on reduced traffic tied to bad weather.

Activision Blizzard (ATVI +0.49%) fell 1.3% in after-hours trading after issuing a cautious outlook.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.05%) are little changed. Thursday's closes: S&P 500 +0.06%, Dow Jones -0.03%, Nasdaq +0.05%. The S&P 500 on Thursday closed slightly higher on the sharp +1.2% rally in European stocks on increased confidence that centrist Emmanuel Macron will win Sunday's French presidential election. Stocks were also boosted by the -0.42% sell-off in the dollar index and by the passage by the House of its Obamacare repeal-and-replace bill, which slightly increased the odds for a larger corporate tax reform package. Stocks were undercut by the +3.6 bp rise in the 10-year T-note yield to a new 3-week high of 2.35% and by weakness in commodity-related stocks with the Thomson-Reuters Commodity Index (CCI) falling sharply to a new 1-year low.

June 10-year T-notes (ZNM17 -0.05%) this morning are down -1 tick Thursday's closes: TYM7 -12.00, FVM7 -5.75. Jun 10-year T-notes on Thursday closed lower on the increased odds for a Fed rate hike at its next meeting in June after the FOMC on Wednesday brushed off weak Q1 GDP growth. T-notes were also undercut by reduced safe-haven demand on increased odds that Emmanuel Macron will win Sunday's French presidential election.

The dollar index (DXY00 +0.07%) this morning is trading slightly higher by +0.066 (+0.07%). EUR/USD (^EURUSD) is down -0.0025 (-0.23%) as the market reverses some of Thursday's +0.91% surge to a new 6-month high. USD/JPY (^USDJPY) is slightly lower by -0.09 (-0.08%). Thursday's closes: Dollar index -0.412 (-0.42%), EUR/USD +0.0099 (+0.91%), USD/JPY -0.29 (-0.26%). The dollar index on Thursday closed lower on the sharp +0.91% rally in EUR/USD on expectations that centrist Macron will easily beat far-right Le Pen in Sunday's election and pave the way for the ECB to start planning its QE exit. The dollar had some underlying support from improved dollar interest rate differentials with Thursday's rise in Treasury yields and from this week's boost in expectations for a June Fed rate hike.

June WTI crude oil prices (CLM17 -0.13%) this morning are little changed while June gasoline (RBM17 +0.24%) is up +0.0034 (+0.23%). Thursday's closes: Jun crude -2.30 (-4.81%), Jun gasoline -0.0526 (-3.43%). Jun crude oil and gasoline on Thursday closed sharply lower on heavy technical selling and underlying concern about the steady rise in U.S. crude oil production and the fact that the OPEC production cut agreement is not bringing down the massive world glut of oil fast enough.

Disclosure: None.