Morning Call For Friday, May 26

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 -0.19%) this morning are down -0.09% as prices consolidate following the rally this week to Thursday's new record high. European stocks are down -0.72% to a 1-week low as German automakers slide after comments from President Trump. Volkswagen AG, Daimler-Benz and BMW are all down 1% after Der Spiegel reported that President Trump in a closed-door meeting with EU officials chided German automakers for selling too many vehicles in the U.S. saying that contributes to a huge German trade surplus that is hurting the U.S. economy and that "we are going to stop that." Asian stocks settled mixed: Japan -0.64%, Hong Kong +0.03%, China +0.07%, Taiwan -0.06%, Australia -0.66%, Singapore -0.46%, South Korea +0.57%, India +0.90%. China's Shanghai Composite erased early losses and climbed to a 3-week high on reports of state-sponsored buying of stocks. The yuan rose to a 4-month high against the dollar after at least two Chinese banks sold dollars in the offshore market. Speculation the PBOC is intervening in the forex market to prop up the yuan has led to short-covering after Moody's earlier this week cut China's sovereign debt rating.

The dollar index (DXY00 -0.06%) is down -0.17%. EUR/USD (^EURUSD) is up +0.09%. USD/JPY (^USDJPY) is down -0.85%.

Jun 10-year T-note prices (ZNM17 +0.15%) are up +5.5 ticks on dovish comments from St. Louis Fed President Bullard who said the Fed is "very close" to where it needs to be on policy rate.

Japan Apr national CP rose +0.4% y/y, right on expectations. Apr national CPI ex-fresh food rose +0.3% y/y, weaker than expectations of +0.4% y/y. Apr national CPI ex fresh food & energy was unch y/y, right on expectations.

St. Louis Fed President Bullard said the Fed is "very close" to where it needs to be on policy rate. He said he could be persuaded to do another rate increase at some point, but objects to the idea that the U.S. needs 200 bps of more normalization to get inflation near the Fed's 2% target.

U.S. STOCK PREVIEW

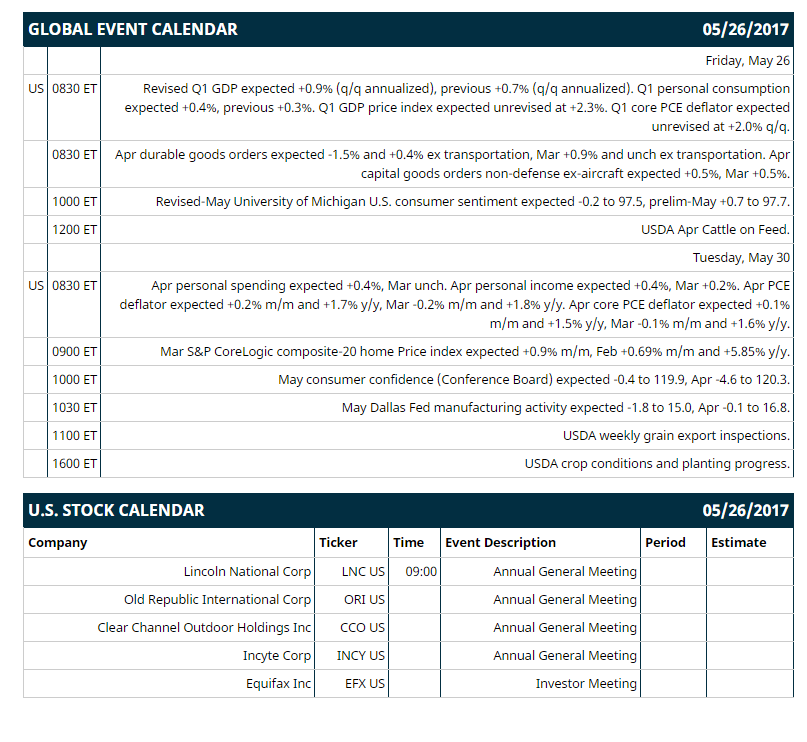

Key U.S. news today includes: (1) revised Q1 GDP (expected +0.9% vs last +0.7%), (2) Apr durable goods orders (expected -1.5% and +0.4% ex transportation, Mar +0.9% and unch ex transportation), (3) revised-May University of Michigan U.S. consumer sentiment (expected -0.2 to 97.5, prelim-May +0.7 to 97.7), (4) USDA Apr Cattle on Feed, (5) 2-day G-7 Summit in Sicily begins.

Notable Russell 2000 earnings reports today include: none.

U.S. IPO's scheduled to price today: none.

Equity conferences: none.

OVERNIGHT U.S. STOCK MOVERS

Chevron (CVX -1.05%) was downgraded to 'Underperform' from 'Neutral' at Exane BNP Paribas with its price target lowered to $100 from $105.

Red Robin Gourmet Burgers (RRGB -0.35%) was upgraded to 'Buy' from 'Hold' at Canaccord Genuity with a price target of $90.

Ulta Beauty (ULTA +4.47%) gained 4% in after-hours trading after it reported Q1 EPS of $2.05, higher than consensus of $1.80, and then raised guidance on full-year EPS growth to mid-20%, higher than a prior view of low 20%.

Costco Wholesale (COST +0.99%) rose 2% in after-hours trading after it reported Q3 EPS of $1.59, well above consensus of $1.31.

Splunk (SPLK +1.39%) dropped 5% in after-hours trading after it reported Q1 GAAP gross margin of 76% contracted from last quarter's 81%.

Deckers Outdoor (DECK -2.60%) rallied 13% in after-hours trading after it reported an unexpected profit of 11 cents, better than consensus for a -6 cent a share loss.

Veeva Systems (VEEV +1.10%) climbed almost 4% in after-hours trading after it reported Q1 adjusted EPS of 22 cents, better than consensus of 18 cents, and then said it sees full-year adjusted EPS of 82 cents-84 cents, above consensus of 77 cents.

GameStop (GME +4.01%) fell over 5% in after-hours trading after it said it sees full-year EPS of $3.10 to $3.40, the midpoint below consensus of $3.29.

Tegna (TGNA +1.11%) gained over 1% in after-hours trading after dealReporter said a Newstar executive recently spoke with investors concerning a possible bid for Tegna.

Nutanix (NTNX +0.69%) jumped 11% in after-hours trading after it reported Q3 revenue of $191.8 million, higher than consensus of $186.35 million, and then said it sees Q4 revenue of $215 million to $220 million, better than consensus of $204.71 million.

Marvel Technology Group Ltd (MRVL +0.95%) rose nearly 2% in after-hours trading after it reported Q1 adjusted EPS of 24 cents, better than consensus of 21 cents, and then said it sees Q2 adjusted EPS from continuing operations of 26 cents to 30 cents, higher than consensus of 25 cents.

Zoe's Kitchen (ZOES -1.10%) slumped 10% in after-hours trading after it reported Q1 revenue of $90.56 million, below consensus of $92.57 million, and then said it sees full-year revenue of $314 million to $322 million, weaker than consensus of $324 million.

Targa Resources (TRGP -2.24%) fell over 3% in after-hours trading after it announced that it had commenced a registered underwritten public offering of 17 million shares of its common stock.

Aerie Pharmaceuticals (AERI +33.95%) lost over 1% in after-hours trading after it announced that it had commenced a registered underwritten public offering of $50 of shares of its common stock.

8x8 Inc (EGHT +0.38%) rose over 4% in after-hours trading after it reported Q1 adjusted EPS of 5 cents, better than consensus of 3 cents, and then said it sees full-year revenue of $296 million to $300 million, above consensus of $294.4 million.

Trillium Therapeutics (TRIL -2.68%) dropped 6% in after-hours trading after it said it is offering common shares and convertible preferred shares, although no size was given.

MARKET COMMENTS

June E-mini S&Ps (ESM17 -0.19%) this morning are down -2.25 points (-0.09%). Thursday's closes: S&P 500 +0.44%, Dow Jones +0.34%, Nasdaq +0.84%. The S&P 500 on Thursday rallied to a new all-time high and settled higher on carry-over support from Wednesday's May 2-3 FOMC minutes which were bullish for T-notes because the Fed said it would begin reducing its balance sheet slowly. Stocks were also boosted by upbeat comments from Fed Governor Brainard who said the global economy is "brighter" than it has been in the past few years.

June 10-year T-notes (ZNM17 +0.15%) this morning are up +5.5 ticks. Thursday's closes: TYM7 +3.50, FVM7 +1.00. Jun 10-year T-notes on Thursday closed higher on reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 1-week low and on comments from Chicago Fed President Evans who said that "stubborn" inflation has been slow to hit its target.

The dollar index (DXY00 -0.06%) this morning is down -0.17 (-0.17%). EUR/USD (^EURUSD) is up +0.0010 (+0.09%) and USD/JPY (^USDJPY) is down -0.95 (-0.85%). Thursday's closes: Dollar index +0.01 (+0.01%), EUR/USD -0.0009 (-0.08%), USD/JPY +0.35 (+0.31%). The dollar index on Thursday closed higher on the rally in the S&P 500 to a new all-time high, which boosted USD/JPY on reduced safe-haven demand for the yen.

July WTI crude oil prices (CLN17 -0.29%) this morning are up +12 cents (+0.25%) and July gasoline (RBN17 -0.27%) is up +0.0025 (+0.16%). Thursday's closes: Jul crude -2.46 (-4.79%), Jul gasoline -0.0457 (-2.77%). Jul crude oil and gasoline on Thursday closed sharply lower. Crude oil prices fell sharply on buy-the-rumor sell-the-fact market action after OPEC went ahead with its 9-month production-cut extension. There was also negative carry-over from Wednesday's EIA data that showed a +0.2% increase in U.S. crude production in the week of May 19 to 9.32 million bpd, a 1-3/4 year high.

Disclosure: None.