Morning Call For Friday, June 9

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.08%) this morning are up +0.08% and European stocks are up +0.11%. U.S. stock indexes recovered from early losses and European equities moved higher even after UK Prime Minister May's Conservative Party lost its majority in parliament, which weakens her hand in Brexit talks with the European Union that are scheduled to begin in 10 days. GBP/USD fell -1.56% to a 1-1/2 month low on the fallout from the surprise UK election results, but the impact on the rest of the global markets was muted. A positive for U.S. bank stocks was the passage late yesterday by the U.S. House to repeal many of the regulations of the Dodd-Frank law, which would exempt banks from stricter supervision if they hold more capital. The measure now heads to the Senate for a vote. European stocks found support on signs of strength in the German economy, the Eurozone's largest, after trade date showed German Apr exports and imports rose more than expected. Asian stocks settled mostly higher: Japan +0.52%, Hong Kong -0.13%, China +0.26%, Taiwan -0.26%, Australia +0.02%, Singapore +0.53%, South Korea +1.02%, India +0.16%. Expectations of a hung parliament in the UK failed to dent optimism in Asian markets as China's Shanghai Composite rose to a 1-1/2 month high and found support on an as-expected increase in China consumer prices and a slower-than-expected pace of increase in Chinese producer prices.

The dollar index (DXY00 +0.49%) is up +0.50% at a 1-week high. EUR/USD (^EURUSD) is down -0.30% at a 1-week low. USD/JPY (^USDJPY) is up +0.32%.

Sep 10-year T-note prices (ZNU17 -0.06%) are down -1 tick.

The German Apr trade balance was in surplus by +18.1 billion euros, narrower than expectations of +23.0 billion euros. Apr exports rose +0.9% m/m, stronger than expectations of +0.3% m/m. Apr imports unexpectedly rose +1.2% m/m, stronger than expectations of -0.5% m/m.

UK Apr industrial production of +0.2% m/m and -0.8% y/y was weaker than expectations of +0.7% m/m and -0.3% y/y.

UK Apr manufacturing production of +0.2% m/m and unch y/y was weaker than expectations of +0.8% m/m and +0.7% y/y.

China May CPI rose +1.5% y/y, right on expectations. May PPI rose +5.5% y/y, weaker than expectations of +5.6% y/y.

U.S. STOCK PREVIEW

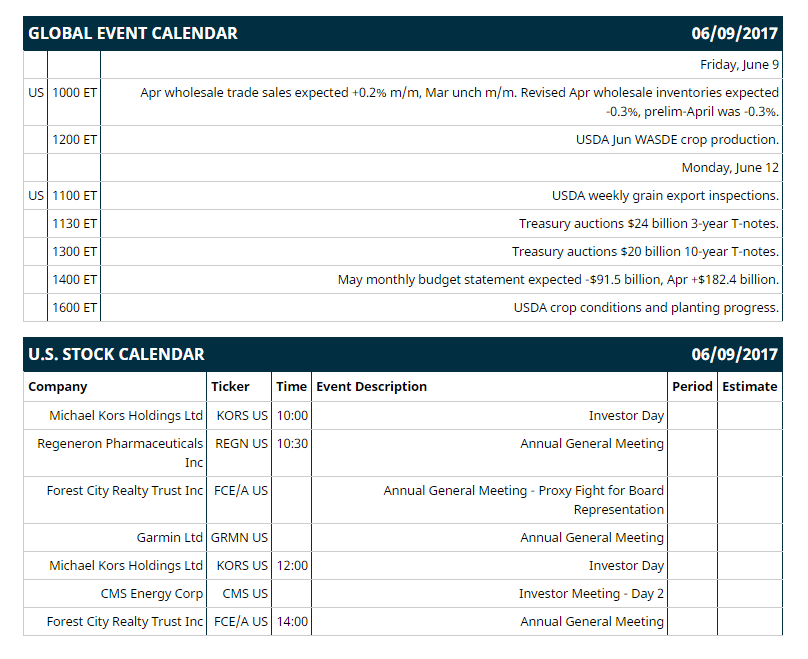

Key U.S. news today includes: (1) Apr wholesale trade sales (expected +0.2% m/m, Mar unch m/m) and revised Apr wholesale inventories (expected -0.3%, prelim-April was -0.3%), (2) USDA Jun WASDE crop production.

Notable Russell 2000 earnings reports today include: None.

U.S. IPO's scheduled to price today: None.

Equity conferences: Jefferies Global Health Care Conference on Tue-Fri, Goldman Sachs European Financial Conference on Wed-Fri, Citi Small and Mid Cap Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Nvidia (NVDA +7.26%) rose over 2% in pre-market trading after Citigroup said the stock may double over the next 12-months in a bull-case scenario.

Nordstrom (JWN +10.25%) was downgraded to 'Neutral' from 'Buy' at Guggenheim Securities.

Starbucks (SBUX -1.98%) was initiated with a 'Buy' at Mizuho Securities USA with a 12-month target price of $75.

Hasbro (HAS +0.10%) was initiated with a 'Buy' at Jeffries with a 12-month target price of $125.

McDonald's (MCD -0.34%) was initiated with a 'Buy' at Mizuho Securities USA with a 12-month target price of $168.

Actuant (ATU +2.45%) slid nearly 6% in after-hours trading after it lowered guidance on Q3 adjusted EPS to 30 cents-33 cents from a March 22 view of 38 cents-43 cents.

VeriFone Systems (PAY +2.12%) lost over 2% in after-hours trading after it said it sees Q3 adjusted EPS of 35 cents-36 cents, below consensus of 40 cents, and then said it sees full-year adjusted EPS of $1.32-$1.34, weaker than consensus of $1.37.

Monroe Capital (MRCC -0.26%) slid over 1% in after-hours trading after it announced that it had commenced an underwritten public offering of shares of its common stock, although no size was given.

Limoneira (LMNR +6.29%) climbed 4% in after-hours trading after it reported Q2 EPS of 24 cents, better than consensus of 18 cents, and then raised guidance on fiscal 2017 EPS to 51 cents-55 cents from a March 13 view of 48 cents-52 cents.

Endo Pharmaceuticals (ENDP +11.13%) dropped over 13% in after-hours trading after he FDA asked that Endo pull its Opana ER painkiller from the market due to abuse risks.

Collegium Pharmaceutical (COLL +2.77%) rose 5% in after-hours trading after the FDA asked Endo Pharmaceuticals to remove its Opana ER painkiller from the market due to abuse risks. Collegium sells Xtamza ER, an abuse-deterrent form of oxycodone.

Applies Genetic Technologies (AGTC +3.09%) climbed almost 4% in after-hours trading after it said it will announce top-line safety data from its Phase 1/2 X-linked retinoschisis study on June 10 at the Macula Society annual meeting in Singapore.

Zynga (ZNGA -0.28%) gained almost 3% in after-hours trading after it was upgraded to 'Overweight' from 'Equal-Weight' by Morgan Stanley.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.08%) this morning are up +2.00 points (+0.08%). Thursday's closes: S&P 500 +0.03%, Dow Jones +0.04%, Nasdaq +0.13%. The S&P 500 on Thursday closed slightly higher on carry-over support from a rally in European stocks after the ECB raised its Eurozone 2017 GDP estimate to 1.7% from a Mar estimate of 1.6% and ECB President Draghi signaled that the ECB will continue with its accomodative monetary policy.

Sep 10-year T-notes (ZNU17 -0.06%) this morning are down -1 tick. Thursday's closes: TYU7 -2.50, FVU7 -2.00. Sep 10-year T-notes on Thursday closed lower on reduced safe-haven demand for T-notes after former FBI Director Comey's testimony to a Senate committee contained no big surprises. There was also some supply pressures after the Treasury announced that it will auction $56 billion in T-notes and T-bonds next Monday and Tuesday.

The dollar index (DXY00 +0.49%) this morning is up +0.483 (+0.50%) at a 1-week high. EUR/USD (^EURUSD) is down 0.0034 (-0.30%) at a 1-week low and USD/JPY (^USDJPY) is up +0.35 (+0.32%). Thursday's closes: Dollar index +0.17 (+0.18%), EUR/USD -0.0043 (-0.38%), USD/JPY +0.20 (+0.18%). The dollar index on Thursday closed higher on weakness in EUR/USD which fell to a 1-week low after the ECB cut its Eurozone inflation forecasts for 2017 through 2019 and ECB President Draghi said that "a very substantial degree of accommodation is still needed." There was also weakness in the yen as USD/JPY rose after Japan Q1 GDP was unexpectedly revised downward to +1.0% (q/q annualized) from +2.2% (q/q annualized).

Jul WTI crude oil prices (CLN17 +0.11%) this morning are up +22 cents (+0.48%) and July gasoline (RBN17 +0.03%) is +0.0061 (+0.41%). Thursday's closes: Jul crude -0.08 (-0.17%), Jul gasoline +0.0006 (+0.04%). Jul crude oil and gasoline on Thursday recovered from 5-week lows and settled mixed. Crude oil prices were undercut by a stronger dollar and by negative carry-over from Wednesday's EIA data that showed an unexpected +3.295 million bbl increase in EIA crude inventories (vs expectations for a -3.0 million bbl).

Disclosure: None.