Morning Call For Friday, January 5

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.30%) this morning are up +0.29% at a new record nearest-futures high as global stock markets continue their rallies in the first week of the new year. Expectations for a strong U.S. Dec payroll report this morning is pushing U.S. stock indexes further into record territory and European stocks are up +0.99% at a 2-week high as signs of stronger growth and slack inflation push European stocks higher. German Nov retail sales jumped +2.3% m/m, the biggest increase in 13-months, and Eurozone Dec core CPI rose a less-than-expected +0.9% y/y. Asian stocks settled mostly higher: Japan +0.89%, Hong Kong +0.25%, China +0.18%, Taiwan +0.29%, Australia +0.74%, Singapore -0.33%, South Korea +1.35%, India +0.54%. The rally in U.S. equity markets to new record highs Thursday gave Asian markets a lift as China's Shanghai Composite rose to a 1-1/4 month high and Japan's Nikkei Stock Index climbed to a new 26-year high. Japanese stocks also garnered support from a weak yen that boosts the earnings prospects of exporters after USD/JPY rose to a 1-week high.

The dollar index (DXY00 +0.19%) is up +0.19%. EUR/USD (^EURUSD) is down -0.15%. USD/JPY (^USDJPY) is up +0.43% at a 1-week high.

Mar 10-year T-note prices (ZNH18 -0.04%) are down -3 ticks.

Eurozone Nov PPI of +0.6% m/m and +2.8% y/y was stronger than expectations of +0.3% m/m and +2.5% y/y with the +0.6% m/m gain the largest monthly increase in 10 months.

The Eurozone Dec CPI estimate rose +1.4% y/y, right on expectations. The Dec core CPI rose +0.9% y/y, weaker than expectations of +1.0% y/y.

German Nov retail sales rose +2.3% m/m, stronger than expectations of +1.0% m/m and the largest increase in 13 months.

U.S. STOCK PREVIEW

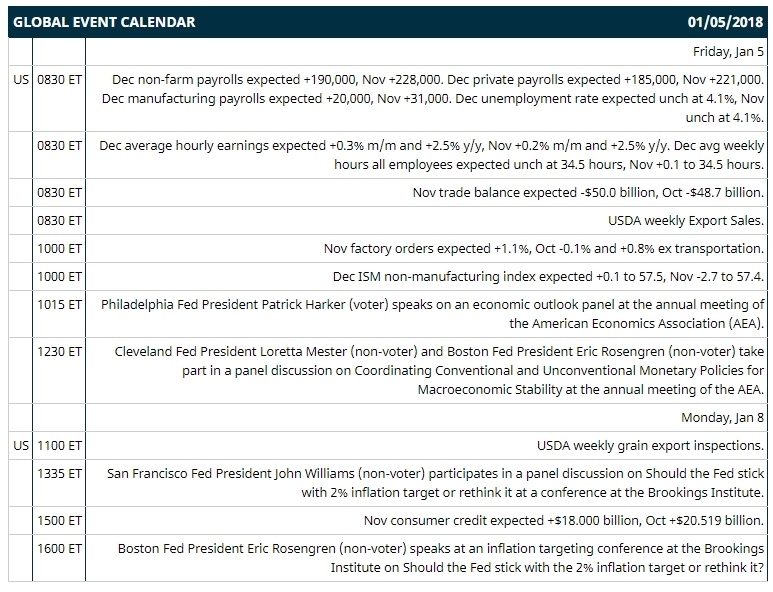

Key U.S. news today includes: (1) Dec non-farm payrolls (expected +190,000, Nov +228,000) and Dec unemployment rate (expected unch at 4.1%, Nov unch at 4.1%), (2) Dec average hourly earnings (expected +0.3% m/m and +2.5% y/y, Nov +0.2% m/m and +2.5% y/y), (3) Nov trade balance (expected -$50.0 billion, Oct -$48.7 billion), (4) USDA weekly Export Sales, (5) Nov factory orders (expected +1.1%, Oct -0.1% and +0.8% ex transportation), (6) Dec ISM non-manufacturing index (expected +0.2 to 57.6, Nov -2.7 to 57.4), (7) Philadelphia Fed President Patrick Harker (voter) speaks on an economic outlook panel at the annual meeting of the American Economics Association (AEA), (8) Cleveland Fed President Loretta Mester (non-voter) and Boston Fed President Eric Rosengren (non-voter) take part in a panel discussion on ‘Coordinating Conventional and Unconventional Monetary Policies for Macroeconomic Stability’ at the annual meeting of the AEA.

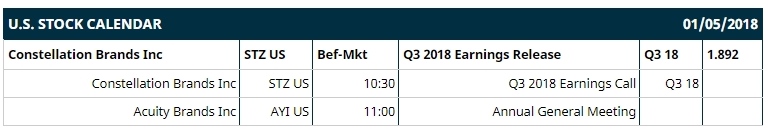

Notable Russell 1000 earnings reports today include: Constellation Brands (consensus $1.89).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Cisco Systems (CSCO -0.46%) rose over 2% in pre-market trading after it was upgraded to 'Buy' from 'Neutral' at Bank of America/Merrill Lynch with a target price of $46.

Cheniere Energy (LNG -0.47%) was rated a new 'Buy' at Stifel with a 12-month target price of $65.

F5 Networks (FFIV +2.30%) gained over 1% in pre-market trading after it was upgraded to 'Buy from 'Neutral' at Bank of America/Merrill Lynch with a target price of $157.

PriceSmart (PSMT +1.68%) dropped nearly 7% in after-hours trading after it reported Q1 net income fell -10% y/y to $22.5 million from $24.9 million a year ago.

Cantor Fitzgerald assumed coverage of Intuitive Surgical (ISRG -1.80%) with a recommendation of 'Overweight' with a 12-month target price of $410.

Sonic (SONC -0.36%) climbed 6% in after-hours trading after it reported Q1 adjusted EPS of 30 cents, above consensus of 25 cents.

Henry Schein (HSIC +0.06%) was rated a new 'Outperform' at Evercore ISI with a 12-month target price of $81.

Evercore ISI initiated coverage of Laboratory Corp (LH -0.36%) with a recommendation of 'Outperform' with a 12-month target price of $176.

Franklin Covey (FC +0.92%) jumped nearly 10% in after-hours trading after it reported Q1 revenue of $47.93 million, better than consensus of $43.50 million.

ViewRay (VRAY -0.21%) rose 4% in after-hours trading after Cantor Fitzgerald assumed coverage of the stock with a recommendation of 'Overweight' and a 12-month target price of $13.

Datawatch (DWCH -2.65%) rallied 15% in after-hours trading after Reuters reported three sources said DWCH hired a financial adviser when it received expressions of interest from potential acquirers.

Francesca's Holdings (FRAN unch) slumped 16% in after-hours trading after it said holiday sales were "disappointing" as it cut its Q4 sales estimate to $137 million-$139 million from a previous estimate of $145 million-$150 million.

Barnes & Noble (BKS -2.26%) slid 3% in after-hours trading after it reported holiday comparable-store sales fell -6.4% y/y.

T2 Biosystems (TTOO +0.65%) gained 4% in after-hours trading after it said it expects FDA clearance of its T2Bacteria Panel in Q1 of this year.

Novan (NOVN -1.40%) tumbled 10% in after-hours trading after it announced that it intends to sell $30 million in shares of its common stock and accompanying warrants to purchase shares in an underwritten public offering.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.30%) this morning are up +8.00 points (+0.29%) at a new record nearest-futures high. Thursday's closes: S&P 500 +0.40%, Dow Jones +0.61%, Nasdaq +0.13%. The S&P 500 on Thursday rallied to a fresh record high and closed higher on carry-over support from a rally in European stocks to a 2-week high after the Eurozone Dec Markit composite PMI was revised upward to a 6-3/4 year high of 58.1. U.S. stocks were also boosted by strength in the U.S. labor market that bodes well for Friday's monthly payroll report after the Dec ADP employment report rose +250,000, stronger than expectations of +190,000 and the biggest increase in 9 months.

Mar 10-year T-note prices (ZNH18 -0.04%) this morning are down -3 ticks. Thursday's closes: TYH8 -3.50, FVH8 -3.75. Mar 10-year T-notes on Thursday fell to a 2-week low and closed lower on the larger-than-expected +250,000 increase in the U.S. Dec ADP employment report and the surge in the S&P 500 to a new record high, which reduces safe-haven demand for T-notes.

The dollar index (DXY00 +0.19%) this morning is up +0.173 (+0.19%). EUR/USD (^EURUSD) is down -0.0018 (-0.15%) and USD/JPY (^USDJPY) is up +0.49 (+0.43%) at a 1-week high. Thursday's closes: Dollar Index -0.309 (-0.34%), EUR/USD +0.0053 (+0.44%), USD/JPY +0.24 (+0.21%). The dollar index on Thursday closed lower on the unexpected +3,000 increase in U.S. weekly jobless claims to a 7-week high of 250,000 and strength in EUR/USD which rose to a 3-3/4 month high after the Eurozone Dec Markit composite PMI was revised upward to a 6-3/4 year high of 58.1.

Feb crude oil (CLG18 -0.95%) this morning is down -58 cents (-0.94%) and Feb gasoline (RBG18 -0.95%) is -0.0176(-0.97%). Thursday's closes: Feb WTI crude +0.38 (+0.62%), Feb gasoline +0.0093 (+0.52%). Feb crude oil and gasoline on Thursday closed higher with Feb crude at a 2-1/2 year high. Crude oil prices were boosted by a weaker dollar, the -7.42million bbl decline in EIA crude inventories to a 2-1/3 year low (vs expectations of -5.0 million bbl) and the -2.44 million bbl plunge in crude supplies at Cushing to a 2-3/4 year low.

Metals prices this morning are weaker with Feb gold (GCG18 -0.26%) -3.8 (-0.29%), Mar silver (SIH18 -0.40%) -0.074(-0.43%) and Mar copper (HGH18 -0.64%) -0.019 (-0.57%). Thursday's closes: Feb gold +3.1 (+0.24%), Mar silver +0.002 (+0.01%), Mar copper +0.0055 (+0.17%). Metals on Thursday closed higher on a weaker dollar and optimism in the global economy that is positive for industrial metals demand after the U.S. Dec ADP employment change rose at the fastest pace in 9 months and after the Eurozone Dec Markit composite PMI was revised upward to its fastest pace of expansion in 6-3/4 years.

Disclosure: None.