Morning Call For Friday, Dec. 15

OVERNIGHT MARKETS AND NEWS

Mar. E-mini S&Ps (ESH18 +0.22%) this morning are up +0.16% and European stocks are down -0.34% at a 1-week low. Investors continue to pour money into U.S. equity funds at the expense of European stock funds. According to Bank of America Merrill Lynch. data from EPFR Global fund flow shows stock funds tracking U.S. stocks attracted $7.8 billion in the week to Dec 13, the largest inflow in 6-months, while investors withdrew -$2.1 billion from European funds, the most in more than a year. Losses in retail sticks are undercutting European shares after Hennes $ Mauritz AB plunged 15% when it reported a slump in quarterly sales. European stocks declined even after the Bundesbank raised its German GDP forecasts for this year and next year. Asian stocks settled mostly lower: Japan -0.62%, Hong Kong -1.09%, China -0.80%, Taiwan -0.44%, Australia -0.24%, Singapore -0.55%, South Korea +0.46%, India +0.65%. Japan's Nikkei Stock Index fell to a 1-week low, despite an increase in business confidence after the Q4 Tankan large manufacturing business conditions rose +3 to an 11-year high of 25, which boosted the yen and undercut exporter companies.

The dollar index (DXY00 +0.05%) is up +0.03%. EUR/USD (^EURUSD) is up +0.20%. USD/JPY (^USDJPY) is down -0.20% to a 1-week low.

Mar 10-year T-note prices (ZNH18 -0.06%) are down -4 ticks.

The Bundesbank raised its German 2017 GDP forecast to 2.6% from a prior estimate of 1.9% and raised its 2018 GDP forecast to 2.5% from an earlier estimate of 1.7%. The Bundesbank also kept its German 2017 core inflation estimate unchanged at 1.3% and lowered its 2018 core inflation estimate to 1.6% from a prior estimate of 1.7%.

The Japan Q4 Tankan large manufacturing business conditions rose +3 to an 11-year high of 25, stronger than expectations of +2 to 24.

U.S. STOCK PREVIEW

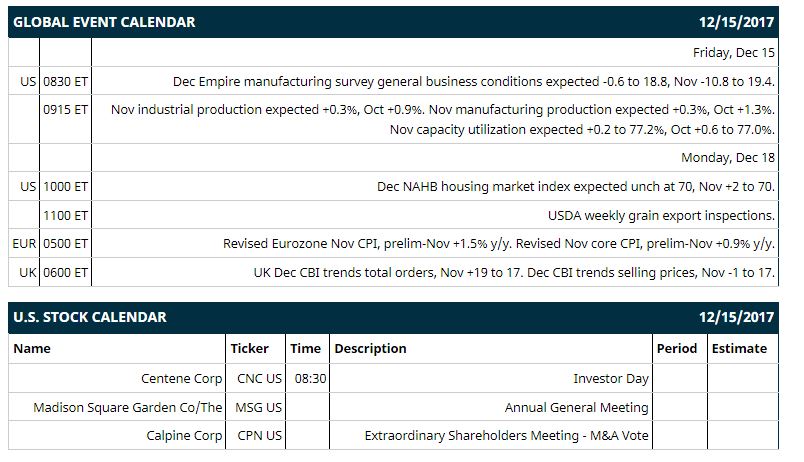

Key U.S. news today includes: (1) Dec Empire manufacturing general business conditions index (expected -0.6 to 18.8, Nov -10.8 to 19.4), (2) Nov industrial production (expected +0.3%, Oct +0.9%) and Nov manufacturing production (expected +0.3%, Oct +1.3%).

Notable Russell 1000 earnings reports today include: none.

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Cowen Energy & Natural Resources Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Adobe Systems (ADBE -1.03%) gained nearly 3% in pre-market trading after it reported Q4 revenue of $2.01 billion, better than consensus of $1.95 billion, and then raised guidance on full-year revenue to $8.73 billion from a prior view of $8.70 billion, above consensus of $8.71 billion.

Centene (CNC -2.14%) rose over 3% in after-hours trading after it said it sees 2018 total revenue of $60.0 to $60.8 billion, well above consensus of $52 billion.

Oracle (ORCL +0.28%) dropped 4% in after-hours trading after it reported Q2 cloud revenue of $1.52 billion, below consensus of $1.56 billion.

Jabil (JBL -3.79%) gained 2% in after-hours trading after it reported Q1 core EOS of 80 cents, better than consensus of 78 cents, and then said it sees full-year core EPS of $2.60, higher than consensus of $2.57.

Hess Corp (HES -3.24%) rallied 6% in after-hours trading after the WSJ reported that Elliot Management is hoping to remove John Hess as CEO or push him to consider selling all or part of the company due to the company's continued underperformance.

T-Mobile (TMUS -1.99%) was upgraded to 'Outperform' from 'Neutral' at Macquarie.

Discovery Communications (DISCA +1.26%) climbed nearly 5% in after-hours trading after director John Malone disclosed his purchase pf 332,523 shares of DISCA at a weighted average price of $19.715 on December 13.

Global Blood Therapeutic (GBT +2.74%) slid nearly 4% in after-hours trading after it announced that it intends to offer $100 million in shares of its common stock in an underwritten public offering.

FormFactor (FORM -0.33%) rose 2% in after-hours trading after it was upgraded to 'Strong Buy' from 'Buy' at Needham & Co with a price target of $22.

Retail Properties of America (RPAI -0.53%) gained 1% in after-hours trading after it said it will buy back up $250 million of Class A shares.

DDR Corp. (DDR -1.36%) jumped 10% in after-hours trading after it said it will spin off a portfolio of 50 assets into a publicly traded REIT.

Verastem (VSTM -3.95%) dropped 8% in after-hours trading after it announced that it intends to offer $25 million of its common stock in an underwritten public offering.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.22%) this morning are up +4.25 points (+0.16%). Thursday's closes: S&P 500 -0.41%, Dow Jones -0.31%, Nasdaq -0.07%. The S&P 500 on Thursday closed lower on concern about passage of the tax bill after several Republican Senators criticized the current overhaul as tax cuts for the rich. There was also some weakness in technology stocks. Stocks were supported by the unexpected decline in U.S. weekly jobless claims by -11,000 to an 8-week low of 225,000 and by the strong U.S. Nov retail sales report of +0.8% and +1.0% ex autos, stronger than expectations of +0.3% and +0.6% ex autos.

Mar 10-year T-note prices (ZNH18 -0.06%) this morning are down -4 ticks. Thursday's closes: TYH8 -1.50, FVH8 -3.50. Mar 10-year T-notes on Thursday closed lower on negative carry-over from a slide in German bunds to a 1-week low and from the the stronger-than-expected U.S. economic data on weekly jobless claims and Nov retail sales.

The dollar index (DXY00 +0.05%) this morning is up +0.026 (+0.03%). EUR/USD (^EURUSD) is up +0.0023 (+0.20%) and USD/JPY (^USDJPY) is down -0.22 (-0.20%) at a 1-week low. Thursday's closes: Dollar Index +0.060 (+0.06%), EUR/USD -0.0048 (-0.41%), USD/JPY -0.15 (-0.13%). The dollar index on Thursday closed higher on signs of U.S. economic strength after weekly initial unemployment claims fell -11,000 to an 8-week low and Nov retail sales rose more than expected. There was also weakness in EUR/USD after ECB President Draghi made the dovish comment that an "ample degree" of stimulus is still needed in the Eurozone as "domestic price pressures remain muted overall."

Jan crude oil (CLF18 +0.60%) this morning is up +33 cents (+0.58%) and Jan gasoline (RBF18 +0.77%) is +0.0131 (+0.78%). Thursday's closes: Jan WTI crude +0.44 (+0.78%), Jan gasoline +0.0240 (+1.46%). Jan crude oil and gasoline on Thursday closed higher on the increase in OPEC Nov compliance with crude output cuts to 121% from 101% in Oct, and on the ECB's hike in its Eurozone 2017 and 2018 GDP estimates, which signals stronger energy demand. Crude oil prices were undercut by the slightly higher dollar.

Metals prices this morning are higher with Feb gold (GCG18 +0.28%) +3.2 (+0.25%), Mar silver (SIH18 +0.57%) +0.086 (+0.54%) and Mar copper (HGH18 +0.21%) +0.009 (+0.28%) at a 1-1/2 week high. Thursday's closes: Feb gold +8.5 (+0.68%), Mar silver +0.065 (+0.41%), Mar copper +0.0190 (+0.62%). Metals on Thursday closed higher with Mar copper at a 1-week high. Metals prices were boosted by the dovish comment by ECB President Draghi that an "ample degree" of stimulus is still needed in the Eurozone. Industrial metals prices were supported by signs of strength in the global economy after the Fed and ECB this week both substantially raised their 2018 GDP estimates.

(Click on image to enlarge)

Disclosure: None.