Morning Call For Friday, August 18

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.05%) this morning are little change, up +0.01%, as stock prices stabilize following Thursday's plunge to a 5-week low. The markets remain on edge about whether President Trump will be able to muster the support needed to pass his economic agenda following the exodus of CEOs from his economic councils this week due to his remarks on the violent protests in Virginia. The terrorist attacks in Barcelona on Thursday also contributed to liquidation in equity markets. European stocks are down -0.82% as they play catch up to Thursday's losses in U.S. equity markets. Investors continue to flock to the safe-haven of precious metals with Dec COMEX gold (GCZ17 +0.69%) up +0.67% at a 2-1/4 month high. Asian stocks settled mostly lower: Japan -1.18%, Hong Kong -1.08%, China +0.01%, Taiwan -0.46%, Australia -0.56%, Singapore -0.52%, South Korea -0.20%, India -0.85%. Japan's Nikkei Stock Index sank to a 3-1/2 month low as exporter stocks sold off on concern over earnings as the global market turmoil boosted demand for the yen. China's Shanghai Composite recovered from early losses and rallied to a 1-week high as construction stocks and builders gained after China's National Development and Reform Commission said it will submit a plan to build a city cluster that connects Hong Kong, Macau and the Guangdong province.

The dollar index (DXY00 -0.11%) is down -0.12%. EUR/USD (^EURUSD) is up +0.21%. USD/JPY (^USDJPY) is down -0.48%.

Sep 10-year T-note prices (ZNU17 +0.06%) are up +1.5 ticks.

China Jul new home prices rose in 56 of 70 cities tracked by the government, down from 60 cities that rose in Jun.

German Jul PPI rose +0.2% m/m and +2.3% y/y, stronger than expectations of unch m/m and +2.2% y/y.

U.S. STOCK PREVIEW

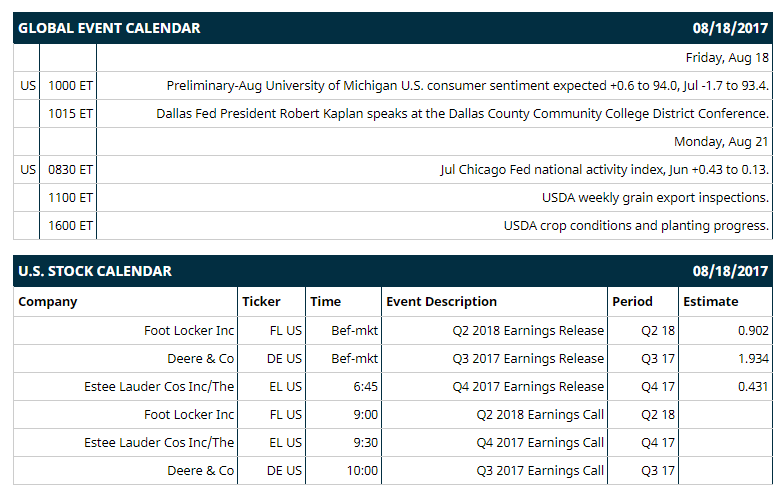

Key U.S. news today includes: (1) Preliminary-Aug University of Michigan U.S. consumer sentiment expected +0.6 to 94.0, Jul -1.7 to 93.4, (2) Dallas Fed President Robert Kaplan speaks at the Dallas County Community College District Conference..

Notable Russell 1000 earnings reports today include: Foot Locker (consensus $0.90), Deere & Co. $1.93, Estee Lauder $0.43.

U.S. IPO's scheduled to price today: None.

Equity conferences this week: None.

OVERNIGHT U.S. STOCK MOVERS

Transocean (RIG -3.96%) was upgraded to 'Buy' from 'Hold' at Pareto Securities with a 12-month target price of $11.

Deere & Co. (DE -2.09%) fell nearly 5% in pre-market trading after it reported Q3 net sales of $6.83 billion, weaker than consensus of $6.91 billion.

Foot Locker (FL -1.79%) plunged 11% in pre-market trading after it reported Q2 adjusted EPS of 62 cents, well below consensus of 90 cents.

Valero Energy Partners (VLP -0.97%) was downgraded to 'Hold' from 'Overweight' at U.S. Capital Advisors.

United Rentals (URI -0.13%) was upgraded to 'Buy' from 'Hold' at Stifel with a 12-month target price of $133.

Ross Stores (ROST -1.91%) jumped over 10% in after-hours trading after it reported Q2 EPS of 82 cents, higher than consensus of 77 cents, and then raised guidance on full-year EPS to $3.16-$3.23 from a prior view of $3.07-$3.17, above consensus of $3.16.

Jazz Pharmaceuticals PLC (JAZZ -0.94%) lost over 1% in after-hours trading after it announced an offering of $500 million of exchangeable senior notes due 2024.

Applied Materials (AMAT -3.01%) rose 3% in after-hours trading after it reported Q3 adjusted EPS of 86 cents, better than consensus of 84 cents, and then said it sees Q4 adjusted EPS of 86 cents-94 cents, above consensus of 82 cents.

The Gap (GPS +0.49%) climbed over 6% in after-hours trading after it reported Q2 adjusted EPS of 58 cents, better than consensus of 52 cents.

Zoe's Kitchen (ZOES +8.32%) fell 2% in after-hours trading after it reported Q2 revenue of $74.3 million, below consensus of $75 million.

OPKO Health (OPK -2.97%) gained almost 2% in after-hours trading after it was initiated a new 'Overweight' at Cantor Fitzgerald with a 12-month target price of $20.

Sportsman's Warehouse Holdings (SPWH -3.35%) surged 15% in after-hours trading after it reported Q2 adjusted EPS of 15 cents, above consensus of 12 cents, and then said it sees full-year adjusted EPS of 60 cents-66 cents, the midpoint above consensus of 61 cents.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 -0.05%) this morning are little changed, up +0.25 of a point (+0.01%). Thursday's closes: S&P 500 -1.54, Dow Jones -1.24%, Nasdaq -2.95%. The S&P 500 on Thursday sold-off to a 5-week low and closed sharply lower on an unexpected -0.1% decline in U.S. Jul manufacturing production, weaker than expectations of +0.2%. Also, long liquidation pressures emerged on concern that President Trump lacks the support he needs to pass his pro-growth policy agenda after he disbanded two advisory councils staffed by CEOs who were critical of his remarks regarding racial protests in Virginia.

Sep 10-year T-note prices (ZNU17 +0.06%) this morning are up +1.5 ticks. Thursday's closes: TYU7 +6.50, FVU7 +2.75. Sep 10-year T-notes on Thursday closed higher after U.S. Jul manufacturing production unexpectedly fell -0.1%, weaker than expectations of +0.2%, and after stocks plunged, which boosted the safe-haven demand for T-notes. Gains were limited on signs of labor market strength after U.S. weekly unemployment claims fell to a 5-1/2 month low.

The dollar index (DXY00 -0.11%) this morning is down -0.115 (=0.12%). EUR/USD (^EURUSD) is up +0.0025 (+0.21%) and USD/JPY (^USDJPY) is down -0.53 (-0.48%). Thursday's closes: Dollar Index +0.08 (+0.09%), EUR/USD -0.0044 (-0.37%), USD/JPY -0.62 (-0.56%). The dollar index on Thursday closed higher: after the larger-than-expected decline in U.S. weekly jobless claims to a 5-1/2 month low bolstered the case for the Fed to keep raising interest rates. Weakness in the euro was also dollar positive after EUR/USD fell to a 3-week low when the minutes of the Jul 20 ECB meeting showed members expressed concern that EUR/USD may strengthen more than justified by an improving economy, which may prompt the ECB to delay tapering QE.

Sep crude oil (CLU17 +0.23%) this morning is up +12 cents (+0.25%) and Sep gasoline (RBU17 +0.80%) is +0.0138 (+0.87%). Thursday's closes: Sep WTI crude +0.31 (+0.66%), Sep gasoline +0.0231 (+1.48%). Sep crude oil and gasoline on Thursday recovered from 3-week lows and closed higher after weekly U.S jobless claims fell to a 5-1/2 month low, which signals economic strength that may lead to increased energy demand. Energy prices also garnered support from an increase in the crack spread to a 4-session high, which gives incentive for refiners to purchase crude oil to refine into gasoline.

Metals prices this morning are higher with Dec gold (GCZ17 +0.69%) +8.6 (+0.67%) at a 2-1/4 month high, Sep silver (SIU17 +0.74%) +0.122 (+0.72%) at a 2-month high and Sep copper (HGU17 +0.09%) +0.003 (+0.10%). Thursday's closes: Dec gold +9.5 (+0.74%), Sep silver +0.113 (+0.67%), Sep copper -0.0155 (-0.52%). Metals on Thursday settled mixed as a slide in stocks boosted safe-haven demand for precious metals, while gold found support on speculation the ECB may delay tapering its QE program after the minutes of the Jul 20 ECB meeting showed policy makers were concerned that EUR/USD may strengthen more than justified by an improving economy. Copper prices fell after U.S. Jul manufacturing production unexpectedly declined -0.1%, which is negative for industrial metals demand.

Disclosure: None.