Morning Call For February 25, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 -0.15%) this morning are down -0.11% and European stocks are down -0.26% as the market consolidates Tuesday's rally that pushed the S&P 500 up to a record high and European stocks up to a 6-1/2 year high. Losses were negligible after a gauge of Chinese manufacturing activity unexpectedly expanded at the fastest pace in 4 months. Global bond markets rallied as the 10-year government bond yields in Spain, Italy, Portugal and Ireland all fell to record lows after Fed Chair Yellen yesterday made it clear that no Fed interest rate increase was imminent. Germany sold 3.28 billion euros of 5-year notes at an average yield of negative -0.08%, the lowest yield ever for 5-year debt in the Eurozone. Asian stocks closed mixed: Japan -0.10%, Hong Kong +0.11%, China -1.24%, Taiwan +0.73%, Australia +0.30%, Singapore +0.09%, South Korea +0.67%, India +0.01%. Commodity prices are mixed. Apr crude oil (CLJ15 +0.57%) is up +0.39% and Apr gasoline (RBJ15 +0.18%) is down -0.12%. Apr gold (GCJ15 +0.98%) is up +0.94%. Mar copper (HGH15 -0.08%) is down -0.13%. Agriculture prices are weaker. The dollar index (DXY00 -0.24%) is down-0.19%. EUR/USD (^EURUSD) is up +0.04%. USD/JPY (^USDJPY) is down -0.12%. GBP/USD is up +0.23% at a 1-3/4 month high against the dollar after BOE policy maker Weale said interest rate may need to rise earlier than markets expect. Mar T-note prices (ZNH15 +0.05%) are up +1.5 ticks at a 2-week high.

The China Feb HSBC flash manufacturing PMI unexpectedly rose +0.4 to 50.1, stronger than expectations of -0.2 to 49.5 and the fastest pace of expansion in 4 months.

U.S. STOCK PREVIEW

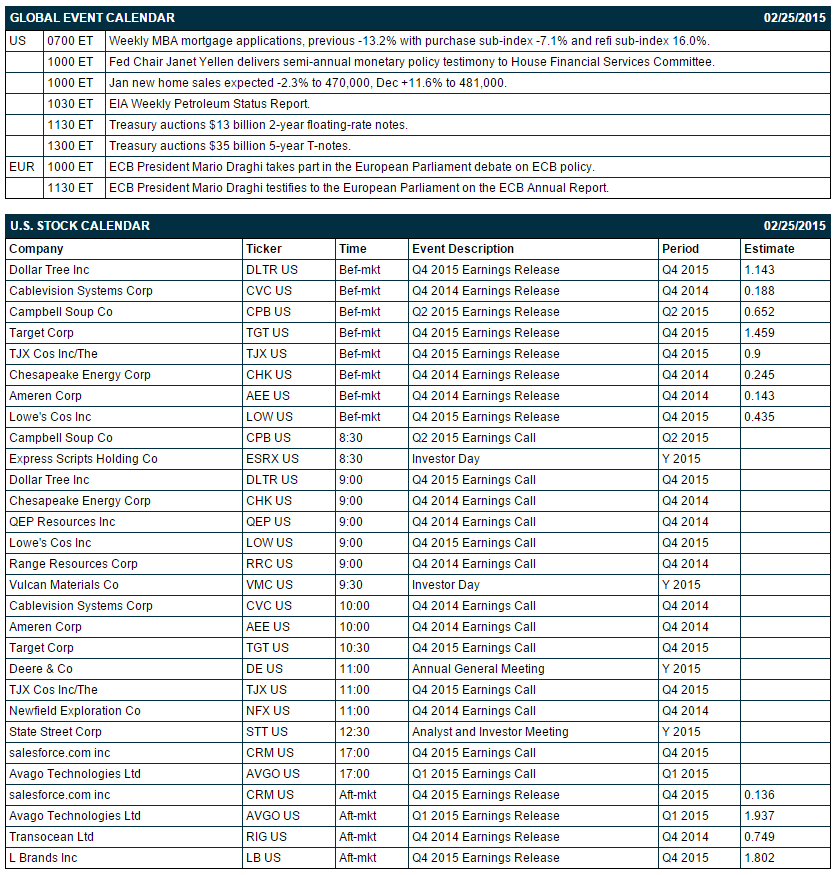

Fed Chair Yellen today will present her semi-annual testimony before the House Financial Services Committee. Today’s Jan new home sales report is expected to show a small decline of -2.3% to 470,000, settling back after the +11.6% surge to the 6-1/2 year high of 481,000 seen in December. The Treasury today will sell $35 billion of 5-year T-notes and $13 billion of 2-year floating rate notes. There are 12 of the S&P 500 companies that report earnings today with notable reports including: Lowe's (consensus $0.44), Dollar Tree (1.14), Target (1.46), TJX (0.90), Transocean (0.75), and L Brands (1.80).

Equity conferences during the remainder of this week include: JPMorgan High Yield & Leveraged Finance Conference on Mon-Wed, Credit Suisse Energy Summit on Tue-Wed, RBC Capital Markets Global Healthcare Conference on Tue-Wed, Robert W. Baird Business Solutions Conference on Tue-Wed, Wells Fargo Cyber Security Forum on Wed, Bank of America Merrill Lynch Global Agriculture Conference on Wed-Thu, Auerbach Grayson & Morgan Stanley's Inaugural Frontier Markets Conference on Thu, Gabelli & Company Pump, Valve & Water Systems Symposium on Thu, Gabelli & Company Inaugural Waste & Environmental Services Symposium on Fri.

OVERNIGHT U.S. STOCK MOVERS

Lowe's (LOW +1.25%) reported Q4 EPS of 46 cents, better than consensus of 44 cents.

Masonite (DOOR -0.48%) reported Q4 EPS of 6 cents, less than consensus of 9 cents.

Papa John's (PZZA -0.24%) slid 4% in after-hours trading after it reported reported Q4 EPS of 52 cents, better than consensus of 50 cents, but then lowered guidance on fiscal 2015 EPS to $1.98-$2.06, below consensus of $2.11.

HealthSouth (HLS +0.15%) reported Q4 EPS with items of 41 cents, less than consensus of 48 cents, and then lowered guidance on fiscal 2015 EPS to $2.24-$2.29, below consensus of $2.44.

Dycom (DY -1.79%) reported Q2 EPS of 27 cents, well above consensus of 10 cents.

QEP Resources (QEP -0.62%) reported Q4 adjusted EPS of 22 cents, below consensus of 25 cents.

Range Resources (RRC -0.21%) reported Q4 adjusted EPS of 39 cents, better than consensus of 28 cents.

Alleghany (Y -0.63%) reported Q4 EPS of $8.61, higher than consensus of $8.36.

Verisk Analytics (VRSK +0.16%) reported Q4 adjusted EPS of 65 cents, better than consensus of 63 cents.

Matson (MATX +0.98%) reported Q4 EPS of 63 cents, above consensus of 58 cents.

First Solar (FSLR +10.19%) reported Q4 GAAP EPS of $1.89, over double consensus of 76 cents.

Chicago Bridge & Iron (CBI +2.18%) rose 3% in after-hours trading after it reported Q4 adjusted EPS of $1.47, better than consensus $1.44.

Hewlett-Packard (HPQ +0.79%) dropped 7% in after-hours trading after it reported Q1 revenue of $26.8 billion, below consensus of $27.34 billion, and then lowered guidance on fiscal 2015 EPS view to $3.53-$3.73 from $3.83.-$4.03, well below consensus of $3.95.

Edison International (EIX +0.26%) reported Q4 EPS of $1.08, well above consensus of 83 cents.

Century Aluminum (CENX +0.45%) reported Q4 EPS of 63 cents, less than consensus of 64 cents.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 -0.15%) this morning are down -2.25 points (-0.11%). The S&P 500 index on Tuesday posted a new all-time high and closed higher: S&P 500 +0.28%, Dow Jones +0.51%, Nasdaq +0.03%. Bullish factors included (1) comments from Fed Chair Yellen that signaled an increase in interest rates was unlikely before mid-year as inflation and wage growth remain too low, and (2) carry-over support from a rally in European stocks after Eurozone finance ministers approved an extension of bailout funds to Greece. Strength is stocks was muted after the U.S. Feb consumer confidence (Conference Board) fell -7.4 to 96.4, weaker than expectations of -3.4 to 99.5.

Mar 10-year T-notes (ZNH15 +0.05%) this morning are up +1.5 ticks at a 2-week high. Mar 10-year T-note futures prices on Tuesday closed higher. Closes: TYH5 +21.50, FVH5 +14.25. Bullish factors included (1) comments from Fed Chair Yellen who said the Fed will be “patient” on when to raise interest rates and that an increase is unlikely for “at least the next couple” of FOMC meetings, and (2) the weaker-than-expected U.S. Feb consumer confidence.

The dollar index (DXY00 -0.24%) this morning is down -0.176 (-0.19%). EUR/USD (^EURUSD) is up +0.0005 (+0.04%). USD/JPY (^USDJPY) is down-0/14 (-0.12%). The dollar index on Tuesday posted a 2-week high but then fell back and closed lower: Dollar index -0.076 (-0.08%), EUR/USD +0.00056 (+0.05%), USD/JPY +0.15 (+0.13%). Negative factors included (1) comments from Fed Chair Yellen that signaled the Fed is in no hurry to raise interest rates, and (2) the weaker-than-expected U.S. Feb consumer confidence report. A bullish factor for the dollar was the rally in the S&P 500 to a record high that reduced the safe-haven demand for the yen and sent USD/JPY up to a 2-week high.

Apr WTI crude oil (CLJ15 +0.57%) this morning is up +19 cents (+0.39%) and Apr gasoline (RBJ15 +0.18%) is down -0.0021 (-0.12%). Apr crude and Apr gasoline prices on Tuesday closed lower: CLJ5 -0.17 (-0.34%), RBJ5 -0.0207 (-1.13%). Bearish factors included (1) comments by an unnamed OPEC delegate that despite the plunge in oil prices, OPEC has had no concrete discussions about holding an emergency meeting, and (2) expectations for Wednesday’s weekly EIA data to show crude stockpiles increased by +4.0 million bbl.

Disclosure: None.