Morning Call For February 24, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 unch) this morning are up +0.02% ahead of testimony from Fed Chair Yellen to U.S. lawmakers and European stocks are up +0.23% at a 6-1/2 year high on optimism Eurozone finance ministers will agree to Greece's list of debt-reduction policies. The markets will be watching for clues on the timing of a Fed interest rate hike when Fed Chair Yellen delivers her semi-annual monetary policy testimony later today before the Senate Banking Committee. Greece's ASE Stock Index soared over 7% to a 2-1/2 month high and the yield on Greece's 10-year bond fell to a 4-week low of 8.85% after a European Union source said that Greece's creditors; the European Commission, the ECB and the IMF were all satisfied with the reforms submitted by the Greek government in its bid for a bailout extension. Asian stocks closed mostly higher: Japan +0.74%, Hong Kong -0.35%, China closed for holiday, Taiwan +1.05%, Australia +0.32%, Singapore +0.48%, South Korea +0.19%, India +0.10%. Japan's Nikkei Stock Index posted a 14-3/4 year high, led by strength in exporters, after the yen fell to a 1-week low against the dollar. Commodity prices are mostly higher. Apr crude oil (CLJ15 +0.44%) is up +0.61% and Apr gasoline (RBJ15 +0.33%) is up +0.39%. Apr gold (GCJ15 -0.14%) is down -0.19%. Mar copper (HGH15 +0.25%) is up +0.25%. Agriculture prices are higher. The dollar index (DXY00 +0.16%) is up +0.18%. EUR/USD (^EURUSD) is down -0.11%. USD/JPY (^USDJPY) is up +0.61% at a 1-week high. Mar T-note prices (ZNH15 -0.10%) are down -4.5 ticks.

Eurozone Jan CPI fell -1.6% m/m, right on expectations and the biggest monthly decline since the euro currency was introduced in 1999. The Jan CPI was left unrevised at -0.6% y/y and the Jan core CPI was also left unrevised at +0.6% y/y.

The German Q4 GDP was left unrevised at +0.7% q/q and +1.6% y/y (nsa).

Japan Jan PPI services rose +3.4% y/y, less than expectations of +3.6% y/y and the smallest pace of increase in 6 months.

U.S. STOCK PREVIEW

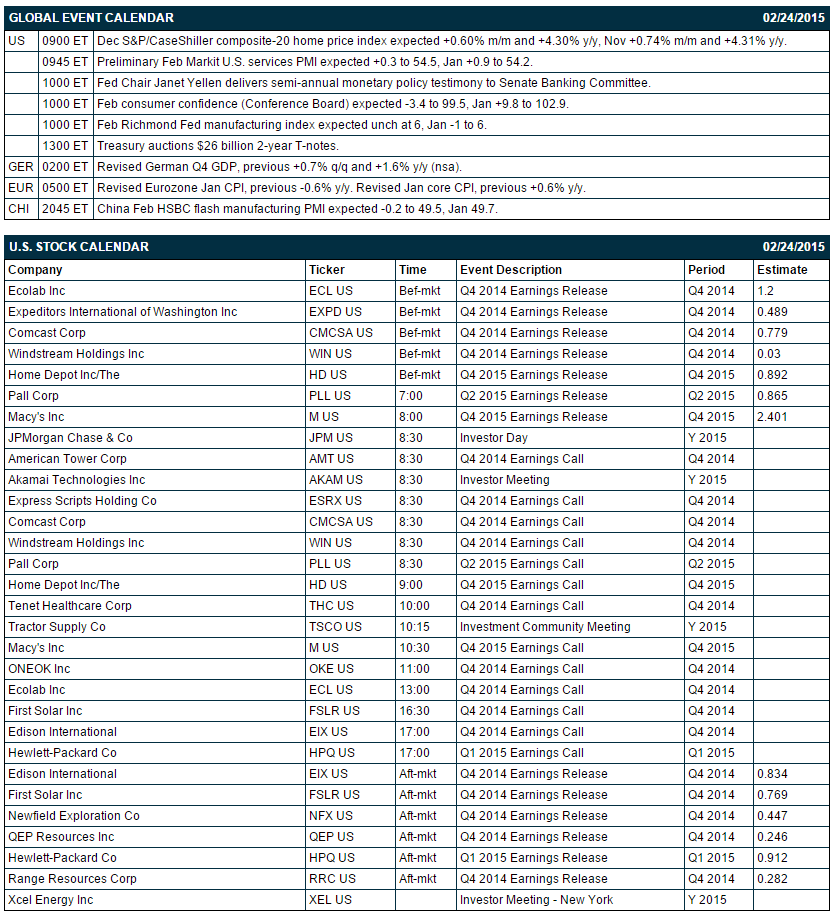

Fed Chair Yellen will present her semi-annual testimony today before the Senate Banking Committee and tomorrow before the House Financial Services Committee. Today’s Dec S&P/CaseShiller Composite-20 home price index is expected to show another solid increase of +0.60% m/m, which would be just slightly weaker than the Nov report of +0.74%. Today’s Feb U.S. consumer confidence index from the Conference Board is expected to show a -3.4 point decline to 99.5, giving back part of the +9.8 point surge to the 7-1/2 year high of 102.9 seen in January.

There are 13 of the S&P 500 companies that report earnings today with notable reports including: Macy's (consensus $2.40), HP (0.91), Comcast (0.78), Home Depot (0.89), First Solar (0.77). Equity conferences during the remainder of this week include: JPMorgan High Yield & Leveraged Finance Conference on Mon-Wed, BMO Capital Markets Global Metals & Mining Conference on Mon-Tue, Cantor Fitzgerald 2nd Annual Internet and Technology Conference on Tue, Susquehanna Semi, Storage & Tech Summit on Tue, Credit Suisse Energy Summit on Tue-Wed, RBC Capital Markets Global Healthcare Conference on Tue-Wed, Robert W. Baird Business Solutions Conference on Tue-Wed, Wells Fargo Cyber Security Forum on Wed, Bank of America Merrill Lynch Global Agriculture Conference on Wed-Thu, Auerbach Grayson & Morgan Stanley's Inaugural Frontier Markets Conference on Thu, Gabelli & Company Pump, Valve & Water Systems Symposium on Thu, Gabelli & Company Inaugural Waste & Environmental Services Symposium on Fri.

OVERNIGHT U.S. STOCK MOVERS

Home Depot (HD +0.04%) reported Q4 EPS of $1.00, stronger than consensus of 89 cents.

Comcast (CMCSA -0.50%) reported Q4 EPS of 77 cents, below consensus of 78 cents.

Valspar (VAL -0.14%) reported Q1 adjusted EPS of 85 cents, more than consensus of 76 cents.

Werner (WERN +0.25%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank.

Worthington (WOR -1.67%) was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

Office Depot (ODP -0.53%) reported Q4 adjusted EPS of 7 cents, higher than consensus of 4 cents.

First Solar (FSLR +1.26%) rose 9% and SunPower (SPWR -0.82%) jumped 11% in after-hours trading after both companies said they are in talks to form a joint venture called YieldCo.

Alliant Energy (LNT +0.74%) reported Q4 adjusted EPS of 54 cents, less than consensus of 55 cents.

Quad/Graphics (QUAD -1.46%) reported Q4 adjusted EPS of 96 cents, better than consensus of 94 cents.

American Tower (AMT +0.83%) reported Q4 EPS of 42 cents, below consensus of 51 cents, and then lowered guidance on fuscal 2015 revenue to $4.25 billion-$4.33 billion, well below consensus of $4.62 billion.

The Soros Fund reported a 9.95% passive stake in Oclaro (OCLR +1.99%) .

Kaman (KAMN -1.31%) reported Q4 adjusted EPS of 76 cents, more than consensus of 70 cents.

Dillard's (DDS +0.62%) reported Q4 EPS of $3.17, less than consensus of $3.18.

Texas Roadhouse (TXRH +2.48%) gained almost 2% in after-hours trading after it reported Q4 EPS of 26 cents, right on consensus, although Q4 revenue of $404.43 million was higher than consensus of $399.63 million.

Express Scripts (ESRX +0.74%) rose over 2% in after-hours trading after it reported Q4 EPS of 1.39, better than consensus of $1.38.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 unch) this morning are .up +0.50 of a point (+0.02%) The S&P 500 index on Monday closed slightly lower: S&P 500 -0.03%, Dow Jones -0.13%, Nasdaq +0.14%. Bearish factors included (1) the -4.9% decline in U.S. Jan existing home sales to 4.82 million, weaker than expectations of -1.8% to 4.95 million and the lowest level in 9 months, and (2) weakness in energy producers after crude oil prices fell to a 2-week low. Stocks recovered from their worst levels after health-care stocks rallied on increased M&A activity when Valeant Pharmaceuticals said it would purchase Salix Pharmaceuticals for $10.1 billion.

Mar 10-year T-notes (ZNH15 -0.10%) this morning are down -4.5 ticks. Mar 10-year T-note futures prices on Monday closed higher. Closes: TYH5 +19.50, FVH5 +9.75. Bullish factors included (1) the larger-than-expected decline in U.S. Jan existing home sales to the lowest level in 9 months, and (2) speculation that Fed Chair Yellen will keep a dovish tilt to her comments when she delivers her semi-annual monetary policy testimony to the Senate Banking Committee Congress on Tuesday.

The dollar index (DXY00 +0.16%) this morning is up +0.173 (+0.18%). EUR/USD (^EURUSD) is down -0.0012 (-0.11%). USD/JPY (^USDJPY) is up +0.72 (+0.61%) at a 1-week high. The dollar index on Monday posted a 1-week high and closed higher: Dollar index +0.316 (+0.34%), EUR/USD-0.00454 (-0.40%), USD/JPY -0.191 (-0.16%). Bullish factors included (1) short covering in the dollar ahead of Fed Chair Yellen’s semi-annual monetary policy testimony to Congress on Tuesday, and (2) the weaker-than-expected increase in the German Feb IFO business climate, which was negative for EUR/USD.

Apr WTI crude oil (CLJ15 +0.44%) this morning is up +30 cents (+0.61%) and Apr gasoline (RBJ15 +0.33%) is up +0.0072 (+0.39%). Apr crude and Apr gasoline prices on Monday settled mixed with Apr crude at a 2-week low: CLJ5 -1.36 (-2.68%), RBJ5 +0.0018 (+0.10%). Bearish factors included (1) the rally in the dollar index to a 1-week high and (2) expectations for Wednesday’s weekly EIA data to show crude stockpiles increased by +3.75 million bbl. Gasoline closed higher due to the ongoing strike by the United Steelworkers union that represents more than 30,000 oil refinery workers and 13% of U.S. refining output, which will reduce gasoline and distillate production.

Disclosure: None.