Morning Call For December 16, 2014

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 -0.67%) this morning are down -0.18% and European stocks are down -0.35% at a 1-3/4 month low on Chinese economic concerns after a gauge of Chinese manufacturing activity contracted for the first time in 7 months. Losses were limited after Eurozone Dec manufacturing activity expanded at the fastest pace in 5 months and after a gauge of German investor expectations climbed at the fastest pace in 8 months. The Russian ruble plunged to a record low of 73.8238 per dollar even after the Bank of Russia unexpectedly raised its key interest rate to 17.0% from 10.5% as the plunge in oil prices exacerbates the collapse in the ruble. Asian stocks closed mostly lower: Japan -2.01%, Hong Kong-1.55%, China +2.68%, Taiwan -0.39%, Australia -0.65%, Singapore -2.40%, South Korea -0.75%, India -1.97%. Japan's Nikkei Stock Index fell to a 1-month low after exporters sold-off as the yen rallied to a 4-week high against the dollar, which reduces the earnings prospects of exporters. Chinese stocks bucked the trend and closed higher on speculation economic weakness will prompt the government into expanding stimulus. Commodity prices are weaker. Jan crude oil (CLF15 -2.99%) is down -3.02% at a 5-1/2 year low as the rout in crude prices continues. Jan gasoline (RBF15 -2.91%) is down -3.10% % at a 5-1/2 year low. Feb gold (GCG15 +0.60%) is down -0.16%. Mar copper (HGH15 -0.47%) is down -0.56%. Agriculture prices are mostly lower. The dollar index (DXY00 -0.73%) is down -0.77% at a 2-week low. EUR/USD (^EURUSD) is up +0.90% at a 2-1/2 week high. USD/JPY (^USDJPY) is down -1.80% at a 4-week low. Mar T-note prices (ZNH15 +0.64%) are up +20.5 ticks at a 2-month high as the plunge in crude oil to a 5-1/2 year low undercuts inflation expectations along with carry-over support from a rally in German bunds as the 10-year bund yield sank to a record low of 0.566%.

The China Dec HSBC manufacturing PMI fell -0.5 to 49.5, a bigger decline than expectations of -0.2 to 49.8 and the slowest pace of expansion in 7 months.

The German Dec ZEW survey expectations of economic growth rose +23.4 to 34.9, a much larger increase than expectations of +8.5 to 20.0 and the highest in 8 months. The Dec ZEW survey current situation climbed +6.7 to 10.0, a larger increase than expectation sf +1.7 to 5.0

The Eurozone Dec Markit manufacturing PMI rose +0.7 to 50.8, more than expectations of +0.4 to 50.5 and the fastest pace of expansion in 5 months. The Eurozone Dec composite PMI rose +0.6 to 51.7, a larger increase than expectations of +0.4 to 51.5.

Bundesbank President Weidmann said there's no need for the ECB to expand monetary stimulus into sovereign-bond buying even if slumping oil prices cause deflation, saying "such a development initially requires no monetary response, as long as no second round effects are to be seen."

UK Nov CPI unexpectedly fell -0.3% m/m, weaker than expectations of unch m/m and matched July's decline as the biggest monthly fall in 10 months. On an annual basis, Nov CPI rose +1.0% y/y, less than expectations of +1.2% y/y and the slowest pace of increase in 12-1/3 years. Nov core CPI rose +1.2%, less than expectations of +1.5% y/y and the smallest increase in 5-3/4 years.

U.S. STOCK PREVIEW

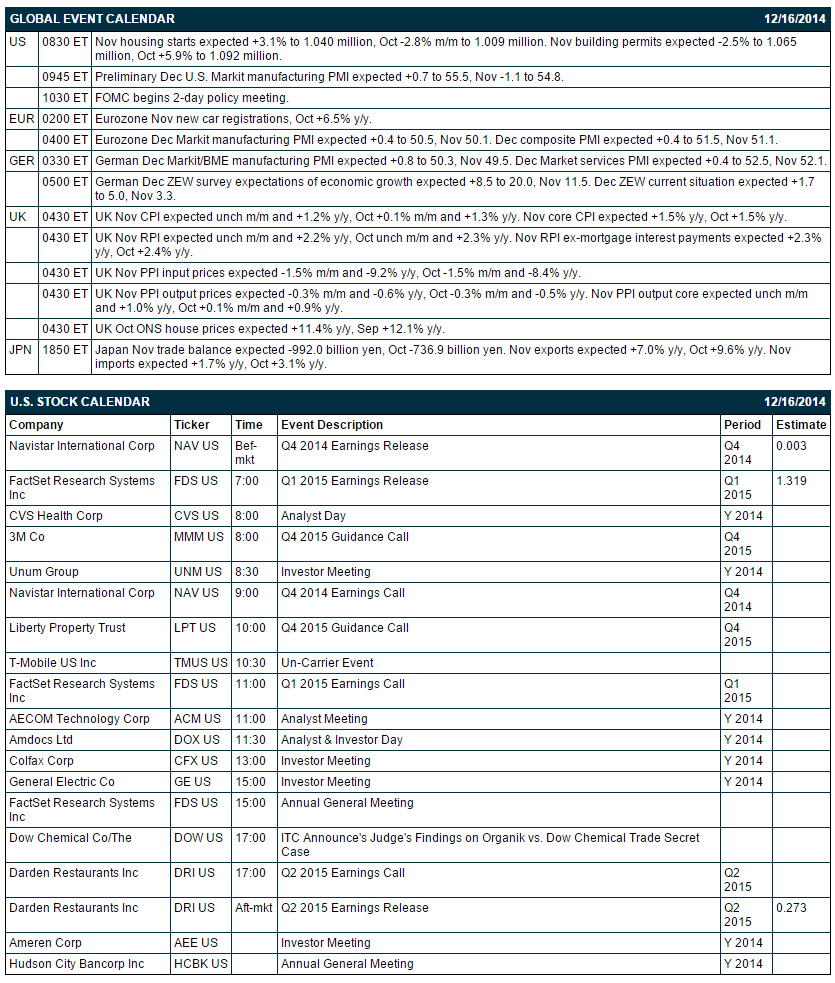

The 2-day FOMC meeting begins today. The market is expecting today’s Nov housing starts report to show an increase of +3.1% to 1.040 million units, more than reversing October’s -2.8% m/m decline to 1.009 million units. There are 3 the Russell 1000 companies that report earnings today: Navistar (consensus $0.0), FactSet (1.32), Darden Restaurants (0.27). Equity conferences this week include: Macquarie Mobile Corporate Day on Tue, and Sanford C. Bernstein Technology Innovation Summit on Tue-Wed.

OVERNIGHT U.S. STOCK MOVERS

Microsoft (MSFT -0.60%) was downgraded to 'Underperform' from 'Neutral' at BofA/Merrill Lynch.

Hess Corp. (HES -1.62%) and EOG Resources (EOG -1.19%) were both downgraded to 'Equal Weight' from 'Overweight' at Morgan Stanley.

According to The New York Times, thw Royal Bank of Scotland (RBS -2.75%) and Lloyds (LYG -1.28%) failed a stress test performed by the Bank of England.

Dollar Tree (DLTR +0.68%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Macerich (MAC -0.37%) was downgraded to 'Neutral' from 'Buy' at Citigroup.

Autodesk (ADSK -1.14%) was downgraded to 'Underperform' from 'Neutral' at BofA/Merrill Lynch.

Bloomberg reported that Olam (OLMIY -1.98%) will acquire Archer Daniel's (ADM -0.04%) cocoa business for $1.3 billion.

Boeing (BA +1.08%) climbed 2.7% in pre-market trading after it raised its dividend 25% and authorized a $12 billion share repurchase plan.

Goldman Sachs (GS -1.74%) was initiated with a 'Buy' at Guggenheim with a price target of $215.

Bank of America (BAC -1.63%) was initiated with a 'Buy' at Guggenheim with a price target of $20.

VeriFone (PAY +0.15%) reported Q4 EPS of 44 cents, higher than consensus of 41 cents.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 -0.67%) this morning are down -3.50 points (-0.18%). The S&P 500 index on Monday slipped to a 1-1/2 month low and closed lower: S&P 500 -0.63%, Dow Jones -0.58%, Nasdaq -1.00%. Bearish factors included (1) weakness in energy producers after crude oil slumped to a 5-1/2 year low, and (2) the unexpected -13.24 point drop in the Dec Empire manufacturing index to -3.58, weaker than expectations of +2.24 to 12.40 and the slowest pace of expansion in 23 months. A positive for stocks was the strong +1.3% increase in U.S. Nov industrial production, the largest increase in 4-1/2 years.

Mar 10-year T-notes (ZNH15 +0.64%) this morning are up +20.5 ticks at a fresh 2-month high. Mar 10-year T-note futures prices on Monday retreated from a 2-month high and closed lower: TYH5 -9.50, FVH5 -8.00. Bearish factors included (1) the stronger-than-expected U.S. Nov industrial production, and (2) long liquidation pressures ahead of the Tue/Wed FOMC meeting. Supportive factors included (1) the plunge in crude oil to a 5-1/2 year low, which prompted the 10-year breakeven inflation expectations rate to tumble to a 4-1/4 year low, and (2) increased safe-haven demand for Treasuries after the S&P 500 fell to a 1-1/2 month low.

The dollar index (DXY00 -0.73%) this morning is down -0.679 (-0.77%) at a 2-week low. EUR/USD (^EURUSD) is up +0.0112 (+0.90%) at a 2-1/2 week high. USD/JPY (^USDJPY) is down -2.12 (-1.80%) at a 4-week low. The dollar index on Monday closed higher. Closes: Dollar index +0.097 (+0.11%), EUR/USD -0.00251 (-0.10%), USD/JPY -0.923 (-0.78%). Bullish factors included (1) weakness in emerging market currencies as the Brazilian real fell to a 9-3/4 year low and the Russian ruble plunged to a record low against the dollar, and (2) speculation the FOMC will prepare the markets for an interest rate hike with a hawkish post-FOMC meeting statement on Wednesday.

Jan WTI crude oil (CLF15 -2.99%) this morning is down -$1.69 a barrel (-3.02%) at a new 5-1/2 year low and Jan gasoline (RBF15 -2.91%) is down-0.0488 (-3.10%) at a 5-1/2 year low. Jan crude and Jan gasoline prices Monday slumped to 5-1/2 year lows and closed lower. Closes: CLF5 -1.90(-3.29%), RBF5 -0.0209 (-1.31%). Bearish factors included (1) a stronger dollar, and (2) comments from UAE Energy Minister Al-Mazrouei that OPEC will stand by its decision not to cut oil output even if crude prices fall as low as $40 a barrel and will wait at least three months before considering an emergency meeting.

Disclosure: None