Morning Call For August 31, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16) are down -0.05%, led by losses in energy producing stocks with crude oil (CLV16 -0.80%) down -0.67% at a 2-week low. European stocks are up +0.48% at a 2-week high as bank stocks rallied on possible increased M&A activity with Commerzbank AG up 4% after Manager Magazine reported that rival Deutsche Bank AG is considering the possibility of a merger. Also, a jump in German Jul retail sales by the most in 2-years shows strength in Europe's largest economy. Asian stocks settled mixed: Japan +0.97%, Hong Kong -0.17%, China +0.35%, Taiwan -0.46%, Australia -0.83%, Singapore -0.28%, South Korea -0.24%, India +0.39%. Japan's Nikkei Stock Index rallied up to a 2-week high, on strength in exporter stocks, after USD/JPY pushed up to 1-month high.

The dollar index (DXY00 +0.04%) is down -0.02%. EUR/USD (^EURUSD) is down -0.05% after Eurozone Aug CPI rose less than expected. USD/JPY (^USDJPY) is up +0.32% at a 1-month high.

Sep T-note prices (ZNU16 -0.07%) are down -2 ticks.

Boston Fed President Rosengren (voter) said with the U.S. likely to reach the Fed's inflation/employment goals “relatively soon," keeping rates low for long "is not without risks," citing rising commercial real estate values.

Chicago Fed President Evans said that "long-run expectations for policy rates provide an anchor to long-run interest rates, so lower policy rate expectations act as a restraint on how much long-term rates could rise following a surprise over the near-term policy path."

German Jul retail sales rose +1.7% m/m, stronger than expectations of +0.5% m/m and the biggest increase in 2 years.

The Eurozone Aug CPI estimate rose +0.2% y/y, weaker than expectations of +0.3% y/y. The Aug core CPI rose +0.8% y/y, weaker than expectations of +0.9% y/y.

U.S. STOCK PREVIEW

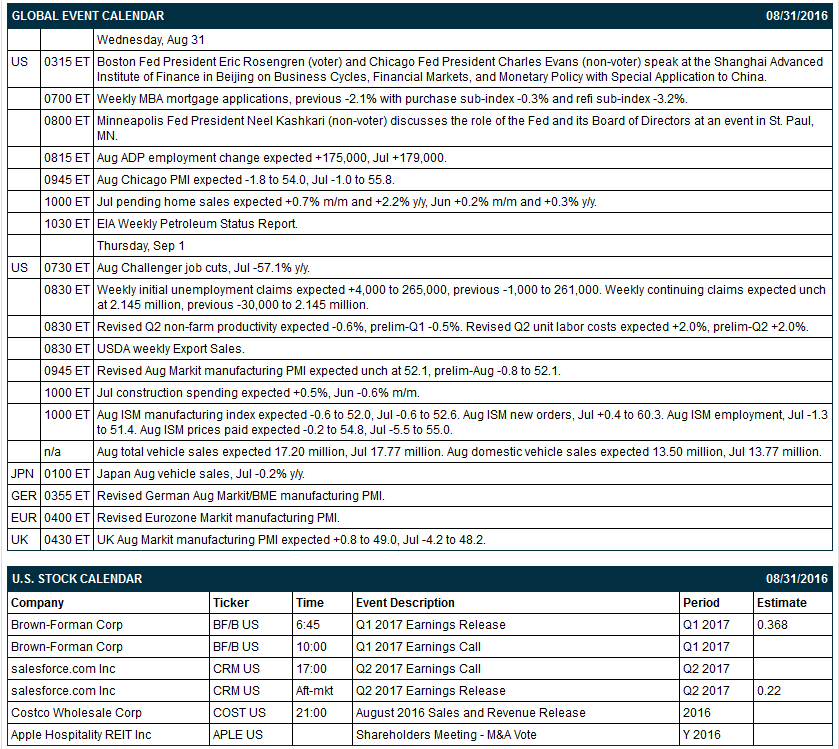

Key U.S. news today includes: (1) Boston Fed President Eric Rosengren (voter) and Chicago Fed President Charles Evans (non-voter) speak at the Shanghai Advanced Institute of Finance in Beijing on “Business Cycles, Financial Markets, and Monetary Policy with Special Application to China,” (2) weekly MBA mortgage applications (previous -2.1% with purchase sub-index -0.3% and refi sub-index -3.2%), (3) Minneapolis Fed President Neel Kashkari (non-voter) discusses the role of the Fed and its Board of Directors at an event in St. Paul, MN, (4) Aug ADP employment (expected +175,000, Jul +179,000), (5) Aug Chicago PMI (expected -1.8 to 54.0, Jul -1.0 to 55.8), (6) Jul pending home sales (expected +0.7% m/m and +2.2% y/y), Jun +0.2% m/m and +0.3% y/y), and (7) EIA Weekly Petroleum Status Report.

Russell 1000 companies that report earnings today: Brown-Forman (consensus $0.37), saleforce.com (0.22).

U.S. IPO's scheduled to price today: none.

Equity conferences during the remainder of this week include: 2016 Farm Progress Show on Mon-Wed, Simmons European Energy Conference on Tue-Wed, Jefferies LLC Semiconductor, Hardware and Communications Infrastructure Summit on Wed.

OVERNIGHT U.S. STOCK MOVERS

Under Armour (UA -1.31%) was downgraded to 'Hold' from 'Buy' at Argus.

Frontline Ltd (FRO unch) dropped nearly 6% in pre-market trading after it reported Q1 net income of $14.3 million, well below consensus of $46.9 million.

Pioneer Natural Resources (PXD -0.03%) was upgraded to 'Buy' from 'Hold' at Edward Jones.

Caleres (CAL -5.71%) slid 7% in after-hours trading after it reported Q2 adjusted EPS of 46 cents, below consensus of 51 cents, and then cut its 2016 fiscal sales view to $2.57 billion-$2.60 billion from a prior view of $2.60 billion-$2.63 billion.

PAREXWL International (PRXL +1.27%) fell over 3% in after-hours trading after it delayed reporting a 10-K on funds misappropriation report.

H&R Block (HRB -1.43%) dropped over 6% in after-hours trading after it reported a Q1 adjusted loss of -55 cents a share, wider than consensus of -53 cents.

Textron (TXT +0.07%) said it approved a plan to restructure via job cuts, facility consolidations and other actions that will be mostly completed by March 2017.

Palo Alto Networks (PANW +1.39%) slid 3% in after-hours trading after it said it sees Q1 adjusted EPS of 51 cents-53 cents, below consensus of 56 cents.

Veeva Systems (VEEV -2.66%) reported Q2 adjusted EPS of 15 cents, higher than consensus of 13 cents, and then raised its view on full-year adjusted EPS to 60 cents-61 cents from a prior estimate of 55 cents-57 cents.

Aerovironment (AVAV -0.17%) sank 13% in after-hours trading after it reported a Q1 adjusted loss of -51 cents a share, much weaker than consensus of -15 cents.

Concurrent Computer (CCUR +2.18%) jumped 8% in after-hours trading after it reported Q4 revenue of $17.4 million versus $13.8 million y/y.

Medicines Co. (MDCO -0.22%) slumped 10% in after-hours trading after it said an interim analysis of the first 40 patients completing treatment with its MDCO-216 for acute coronary syndrome showed the data were inconclusive at first look.

Globalstar (GSAT +4.83%) climbed nearly 6% in after-hours trading after it signed a strategic agreement with Carmanah Technologies to collaborate on the design and manufacture of new solar powered M2M satellite solutions.

MARKET COMMENTS

Sep E-mini S&Ps (ESU16 unch) this morning are down -1.00 point (-0.05%). Tuesday's closes: S&P 500 -0.20%, Dow Jones -0.26%, Nasdaq -0.32%. The S&P 500 on Tuesday closed lower on weakness in energy producing stocks after the price of crude fell -1.34% to a 2-week low. There was also weakness in mining stocks and raw-material producers after the price of copper dropped -0.27% to a 2-1/4 month low. Stocks found some underlying support from news that the U.S. Aug consumer confidence index from the Conference Board unexpectedly rose +4.4 to 101.1, stronger than expectations of -0.3 to 97.0 and the highest level in 11 months.

Sep 10-year T-notes (ZNU16 -0.07%) this morning are down -2 ticks. Tuesday's closes: TYU6 -2.00, FVU6 -0.50. Sep T-notes on Tuesday closed lower on hawkish comments from Fed Vice Chair Fischer who said that next month's Fed interest rate decision is not necessarily "one and done." T-notes were also undercut by the increase in U.S. Aug consumer confidence to an 11-month high.

The dollar index (DXY00 +0.04%) this morning is down -0.019 (-0.02%). EUR/USD (^EURUSD) is down -0.0006 (-0.05%). USD/JPY (^USDJPY) is up +0.33 (+0.32%) at a 1-month high. Tuesday's closes: Dollar index +0.474 (+0.50%), EUR/USD -0.0046 (-0.41%), USD/JPY +1.04 (+1.02%). The dollar index on Tuesday posted a 3-week high and settled higher on Fed Vice Chair Fischer's comment that the U.S. is close to full employment, which bolsters the case for a Fed rate hike. The dollar also found support on the unexpected increase in U.S. Aug consumer confidence to an 11-month high. EUR/USD fell to a 2-week low after Eurozone economic confidence fell to a 5-month low.

Oct crude oil (CLV16 -0.80%) this morning is down -31 cents (-0.67%) at a 2-week low and Oct gasoline (RBV16 -1.46%) is down -0.0209 (-1.52%) at a 2-week low. Tuesday's closes: CLV6 -0.63 (-1.34%), RBV6 -0.0213 (-1.53%). Oct crude oil and gasoline on Tuesday fell to 2-week lows and closed lower on the rally in the dollar index to a 3-week high and on expectations for Wednesday's weekly EIA crude inventories to climb +1.5 million bbl.

(Click on image to enlarge)

Disclosure: None.