Morning Call For August 26, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16 -0.02%) are unchanged and European stocks are down -0.15% ahead of this morning's highly anticipated speech by Fed Chair Yellen from Jackson Hole, WY, that may provide a clue as to the direction of U.S. interest rates. Losses in Italian bank stocks are leading European equities lower with UniCredit SpA, Banca Popolare di Milano Scarl and Banco Popolare SC all down more than 2%. Losses were limited after a gauge of German consumer confidence unexpectedly increased to match a record high. Asian stocks settled mixed: Japan -1.18%, Hong Kong +0.41%, China +0.06%, Taiwan +0.18%, Australia -0.48%, Singapore -0.67%, South Korea -0.40%, India -0.19%. Japan's Nikkei Stock Index tumbled to a 3-week low on deflation concerns after Japan Jul national CPI ex food & energy rose at the slowest pace in 2-3/4 years.

The dollar index (DXY00 -0.13%) is down -0.10%. EUR/USD (^EURUSD) is up +0.04%. USD/JPY (^USDJPY) is down -0.08%.

Sep T-note prices (ZNU16 unch) are up +1 tick.

German Sep GfK consumer confidence rose +0.2 to 10.2, stronger than expectations of no change at 10.0 and matched the record high from Jun 2015.

Japan Jul national CPI fell -0.4% y/y, right on expectations. Jul national CPI ex fresh food fell -0.5% y/y, weaker than expectations of -0.4% y/y and the biggest decline in 3-1/3 years. Jul national CPI ex food & energy rose +0.3% y/y, weaker than expectations of +0.4% y/y and the slowest pace of increase in 2-3/4 years.

U.S. STOCK PREVIEW

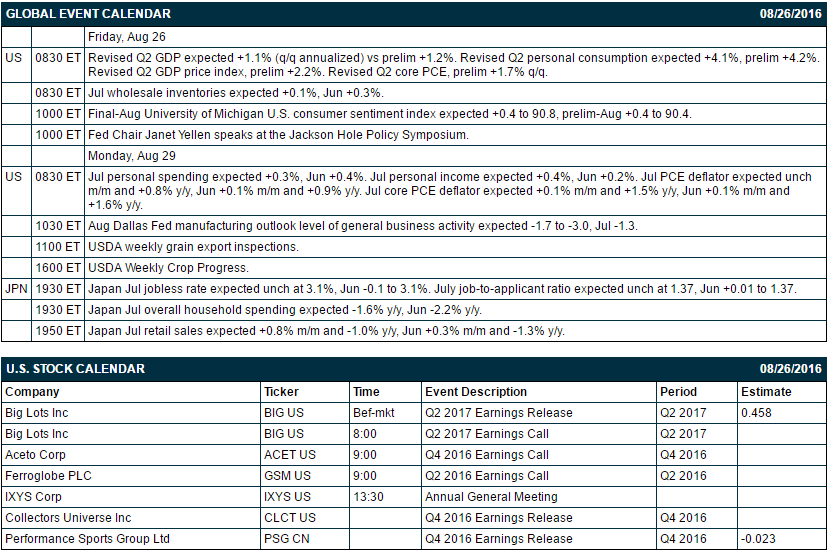

Key U.S. news today includes: (1) revised Q2 GDP expected +1.1% (prelim +1.2%), (2) Jul wholesale inventories (expected +0.1%, Jun +0.3%), (3) final-Aug University of Michigan U.S. consumer sentiment index (expected +0.4 to 90.8, prelim-Aug +0.4 to 90.4), (4) Fed Chair Janet Yellen speaks at the Jackson Hole Policy Symposium.

Russell 1000 companies that report earnings today: none.

U.S. IPO's scheduled to price today: none.

Equity conferences today: none.

OVERNIGHT U.S. STOCK MOVERS

Burlington Stores (BURL +3.12%) were upgraded to 'Buy' from 'Neutral' at MKM Partners with a 12-month target price of $94.

Autodesk (ADSK +0.84%) gained over 1% in after-hours trading after it reported a surprise Q2 adjusted EPS profit of 5 cents, much better than consensus of a -13 cent loss, and said it now sees a full-year adjusted loss of -55 cents to -70 cents, narrower than a May 19 view of -70 cents to -95cents.

GameStop (GME +1.42%) slid over 7% in after-hours trading after it reported Q2 revenue of $1.63 billion, below consensus of $1.71 billion, and said Q2 comparable sales fell -10.6%, weaker than consensus of -5.3%.

Mettler-Toledo (MTD +0.52%) may be active today after it was announced that it will replace Johnson Controls in the S&P 500 after the close of trading on Friday, September 2.

Nautilus (NLS -0.81%) climbed 4% in after-hours trading after it was announced that it will replace Outerwall in the S&P SmallCap 600 after the close of trading on Thursday, September 1.

Dollar General (DG -17.63%) was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

Splunk (SPLK +1.35%) dropped over 6% in pre-market trading after it reported Q2 license revenue growth rose 32% y/y, a slower pace than the 41% y/y growth in Q1.

Bottomline Technologies (EPAY +4.52%) rallied 9% in after-hours trading after it reported Q4 core EPS of 37 cents, higher than consensus of 30 cents.

Synaptics (SYNA -0.61%) dropped over 4% in after-hours trading after it filed to delay reporting its 10-K for 2016 citing "matters arising late in the year end reporting process."

American Software (AMSWA +2.84%) fell 4% in after-hours trading after it reported Q1 revenue of $27.4 million, less than consensus of $27.8 million.

Pure Storage (PSTG +1.89%) jumped over 7% in pre-market trading after it reported a Q2 adjusted loss of -16 cents, a smaller loss than consensus of-23 cents.

Ocwen Financial (OCN -2.15%) climbed over 6% in after-hours trading after it said it will pay the Washington State Department of Financial Institutions $900,000 to conclude a matter related to the Washington Consumer Loan Act without admitting or denying any wrongdoing.

Talend SA (TLND +5.52%) slumped over 20% in after-hours trading after it reported its Q2 adjusted EPS loss widened to -$1.84 a share and that it sees a full-year adjusted loss of -93 cents to -$1.01 a share.

MARKET COMMENTS

Sep E-mini S&Ps (ESU16 -0.02%) this morning are unchanged. Thursday's closes: S&P 500 -0.14%, Dow Jones -0.18%, Nasdaq -0.17%. The S&P 500 on Thursday closed lower on the unexpected -0.5 point decline in the U.S. Aug Markit services PMI to 50.9 (weaker than expectations of +0.4 to 51.8 and the slowest pace of expansion in 6 months) and on long liquidation pressure ahead of Friday's speech by Fed Chair Yellen at the Fed's annual symposium in Jackson Hole, WY. Stocks received a boost from the +1.6% increase in Jul capital goods orders non-defense ex-aircraft, a proxy for capital spending, stronger than expectations of +0.2% and the largest increase in 6 months.

Sep 10-year T-notes (ZNU16 unch) this morning are up +1 tick. Thursday's closes: TYU6 -5.00, FVU6 -3.25. Sep T-notes on Thursday closed lower on the stronger-than-expected U.S. economic data on weekly jobless claims and Jul durable goods orders. In addition, there was long liquidation pressure ahead of Fed Chair Yellen's speech on Friday in Jackson Hole, where she may prep the markets for a rate hike within in the next few FOMC meetings.

The dollar index (DXY00 -0.13%) this morning is down -0.099 (-0.10%). EUR/USD (^EURUSD) is up +0.0004 (+0.04%). USD/JPY (^USDJPY) is down-0.08 (-0.08%). Thursday's closes: Dollar index -0.014 (-0.01%), EUR/USD +0.0021 (+0.19%), USD/JPY +0.08 (+0.08%). The dollar index on Thursday closed little changed. The dollar index was undercut by the unexpected decline in the U.S. Aug Markit services PMI to its slowest pace of expansion in 6 months and by long liquidation pressure ahead of Fed Chair Yellen's Jackson Hole speech on Friday. The dollar index was boosted by the stronger-than-expected U.S. Jul durable goods orders report and by hawkish comments by Kansas City Fed President George (voter) who said the "time is right" for a near-term interest rate hike.

Oct crude oil (CLV16 -0.40%) this morning is down -16 cents (-0.34%) and Oct gasoline (RBV16 -0.30%) is down -0.0035 (-0.25%). Thursday's closes: CLV6 +0.61 (+1.30%), RBV6 +0.0053 (+0.37%). Oct crude and gasoline on Thursday closed higher on the weaker dollar and Iranian Oil Minister Zanganeh's statement that he will attend an informal meeting by OPEC members in Algiers next month, which bolstered speculation that OPEC will be able to agree on a production freeze.

Disclosure: None.