Morning Call For August 14, 2015

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU15 -0.29%) are down -0.22% and European stocks are down -0.73% as a fall in crude oil prices CLU15 +0.17%) to a new 6-1/3 year low pressures energy producers. Another negative for European stocks was slower than expected economic growth last quarter after Eurozone Q2 GDP rose +1.2% y/y, weaker than expectations of +1.3% y/y. Asian stocks closed mixed: Japan -0.37%, Hong Kong -0.12%, China +0.27%, Taiwan -0.07%, Australia -0.58%, Singapore +0.73%, South Korea closed for holiday, India +1.88%. Chinese stocks closed higher as the yuan halted a 3-day slide, bolstered by comments Thursday from the PBOC who said there’s no basis for depreciation to persist and it will step in to curb large fluctuations. The PBOC raised its daily yuan fixing by 0.05% today, after three cuts of more than 1.0% each from Tuesday through Thursday. Stocks in Hong Kong recovered most of their early losses after Hong Kong Q2 GDP rose +0.4% q/q, double estimates of +0.2% q/q.

The dollar index (DXY00 -0.35%) is down -0.19%. EUR/USD (^EURUSD) is up +0.21%. USD/JPY (^USDJPY) is down -0.25%.

Sep T-note prices (ZNU15 +0.12%) are up +4 ticks.

Eurozone Q2 GDP rose +0.3% q/q and +1.2% y/y, weaker than expectations of +0.4% q/q and +1.3% y/y.

German Q2 GDP rose +0.4% q/q, less than expectations of +0.5% q/q and rose +1.6% y/y (nsa), right on expectations.

U.S. STOCK PREVIEW

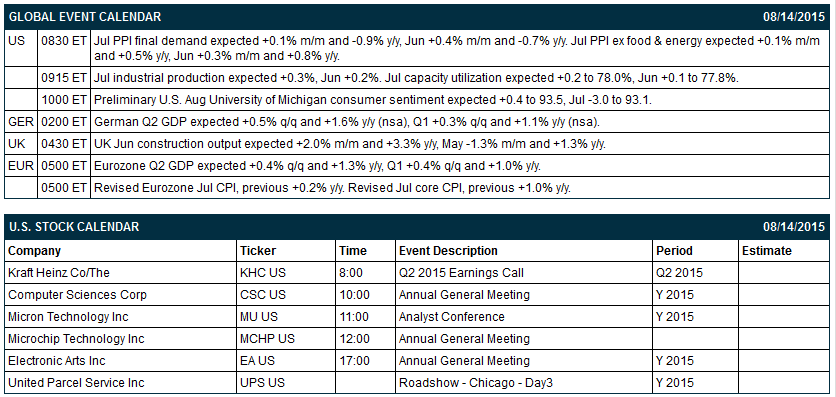

Key U.S. news today includes: (1) July final-demand PPI (expected -0.9% vs June's -0.7% y/y) and core PPI (expected +0.5% vs June's +0.8% y/y), (2) July industrial production (expected +0.3%, Jun +0.2%), and (3) preliminary-Aug U.S. consumer sentiment index from the University of Michigan (expected +0.4 to 93.5, Jul -3.0 to 93.1).

There is 1 of the Russell 1000 companies that reports earnings today: JC Penney (consensus -$0.50).

U.S. IPO's scheduled to price today include: none.

Equity conferences today include: none.

OVERNIGHT U.S. STOCK MOVERS

Kohl's (KSS -8.76%) was downgraded to 'Neutral' from 'Buy' at UBS.

Kinder Morgan (KMI -2.10%) was upgraded to 'Conviction Buy' from 'Buy' at Goldman Sachs.

DuPont (DD -0.47%) was upgraded to 'Overweight' from 'Neutral' at JPMorgan Chase.

CF Industries (CF +2.56%) was upgraded to 'Overweight' from 'Neutral' at Barclays.

PG&E (PCG +0.34%) announced that it has paid a $300 million fine levied by the California Public Utilities Commission in association with the 2010 natural gas transmission pipeline explosion in San Bruno, CA.

Reuters reports that 8 banks that include Barclays (BCS +0.17%) , Bank of America (BAC +0.57%) , BNP Paribas (BNPQY -0.59%) , Citigroup (C +0.74%) , Goldman Sachs (GS -0.19%) , HSBC (HSBC -0.02%) , Royal Bank of Scotland (RBS -1.41%) , and UBS (UBS +0.09%) agreed to pay $2 billion to settle a currency rigging suit.

Paulson & Co. reported a 19.4% stake in Overseas Shipholding Group (OSGB unch) .

Darling (DAR -0.65%) reported Q2 EPS of 2 cents, well below consensus of 7 cents.

Heritage Insurance (HRTG -1.49%) was approved to write property and casualty insurance in North Carolina.

Party City (PRTY -0.58%) reported Q2 EPS of 12 cents, right on consensus, although Q2 revenue of $495.50 million was below consensus of $507.75 million.

Nordstrom (JWN -0.78%) climbed over 5% in after-hours trading after it reported Q2 EPS of $1.09, better than consensus of 90 cents.

King Digital (KING -2.75%) reported Q2 adjusted EPS of 49 cents, higher than consensus of 43 cents.

Applied Materials (AMAT -1.45%) dropped over 2% in after-hours trading after it reported Q3 EPS of 33 cents, right on consensus, although Q3 revenue of $2.49 billion was below consensus of $2.54 billion.

MARKET COMMENTS

Sep E-mini S&Ps (ESU15 -0.29%) this morning are down -4.50 points. Thursday's closes: S&P 500 -0.13%, Dow Jones +0.03%, Nasdaq -0.20%. The S&P 500 on Thursday closed slightly lower on the +5,000 rise in unemployment claims to 274,000 and on weakness in energy producers after crude oil slumped to a 6-1/3 year low. Stocks found support on the strong U.S. July retail sales report of +0.6% (+0.4% ex-autos) and on the stabilization of the Chinese yuan as the PBOC said the adjustment was already basically over.

Sep 10-year T-note prices (ZNU15 +0.12%) this morning are up +4 ticks. Thursday's closes: TYU5 -15.50, FVU5 -10.75. Sep T-notes on Thursday closed lower as the strong July retail sales report supports the case for the Fed to raise interest rates. There was also supply pressure from the 30-year bond auction. T-notes found support on the decline in the 10-year T-note breakeven inflation rate to a 6-1/2 month low.

The dollar index (DXY00 -0.35%) this morning is down -0.185 (-0.19%). EUR/USD (^EURUSD) is up +0.0023 (+0.21%). USD/JPY (^USDJPY) is down -0.31 (-0.25%). Thursday's closes: Dollar Index +0.183 (+0.19%), EUR/USD -0.0009 (-0.08%), USD/JPY +0.22 (+0.18%). The dollar index on Thursday closed higher on the strong U.S. July retail sales report which increases the likelihood for a Fed rate hike. The stabilization of the yuan also reduced talk that the Fed may need to delay a tightening due to Chinese-induced financial market stresses.

Sep crude oil (CLU15 +0.17%) this morning is down -14 cents (-0.33%) at a new 6-1/3 year low and Sep gasoline (RBU15 -1.74%) is down -0.0274 (-1.60%). Thursday's closes: CLU5 -1.07 (-2.47%), RBU5 -0.00539 (-3.06%). Sep crude oil and gasoline on Thursday closed lower with Sep crude at a fresh 6-1/3 year low on the stronger dollar and on the ongoing U.S. crude oil supply glut with crude inventories 93 million bbl above their 5-year average.

Click on picture to enlarge

Disclosure: None.