Morning Call For August 1, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16 +0.10%) are up +0.06% at an all-time high. Gains in U.S. stock indexes were muted and European stocks are down -0.68% as banks stocks in Europe fell. Despite positive results on European bank stress tests, concerns over future bank profits are weighing on the sector with Barclays Plc down -2.0%, Deutsche Bank AG down -1.3% and UniCredit SpA down over -7%. Also weighing on stock prices is Chinese growth concerns after the China Jul manufacturing PMI unexpectedly contracted for the first time in 5 months. Asian stocks settled mixed: Japan +0.40%, Hong Kong +1.09%, China -0.87%, Taiwan +1.07%, Australia +0.45%, Singapore +0.83%, South Korea +0.93%, India -0.17%. The Shanghai Composite slid to a 4-week low after Chinese manufacturing activity unexpectedly contracted last month, while Japanese stocks closed higher on speculation Japanese Prime Minister Abe will unveil a 28 trillion yen ($273 billion) spending package on Tuesday.

The dollar index (DXY00 +0.20%) is up +0.19%. EUR/USD (^EURUSD) is down -0.10%. USD/JPY (^USDJPY) is up +0.19%.

Sep T-note prices (ZNU16 -0.15%) are down -6.5 ticks after New York Fed President Dudley said "it is premature to rule out further monetary policy tightening this year."

New York Fed President Dudley said investors "appear to be too complacent" on interest rates" and "it is premature to rule out further monetary policy tightening this year."

The Eurozone Jul Markit manufacturing PMI was revised upward to 52.0 from the originally reported 51.9.

The China Jul manufacturing PMI (National Bureau of Statistics) fell -0.1 to 50.0, weaker than expectations of no change at 50.0 and the first time manufacturing activity contracted in 5 months.

U.S. STOCK PREVIEW

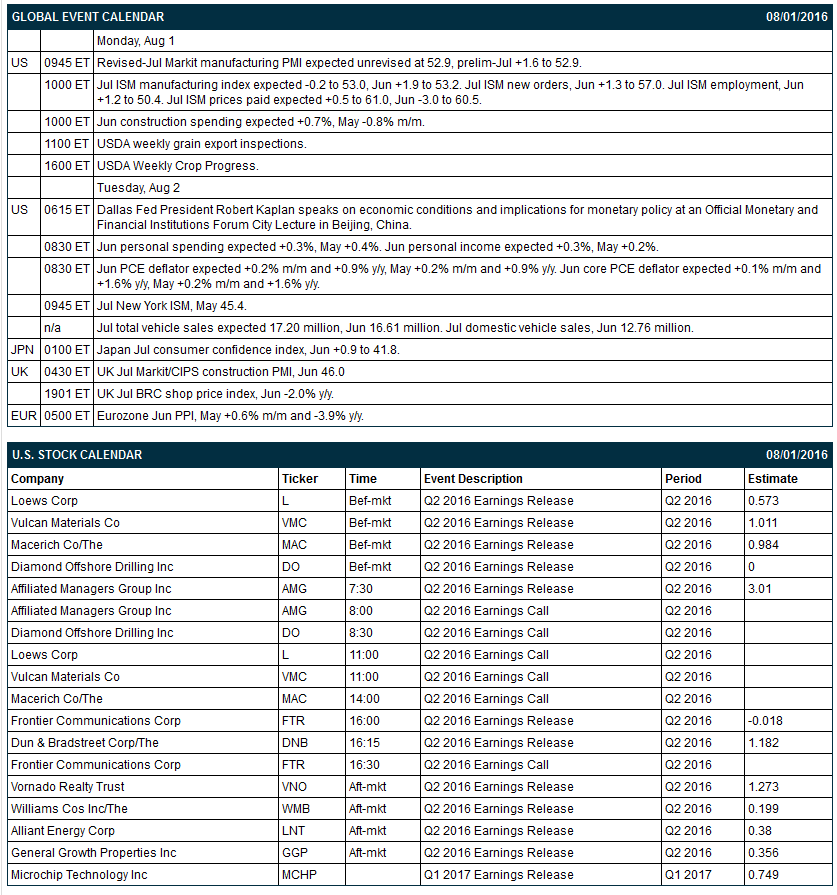

Key U.S. news today includes: (1) revised-Jul Markit manufacturing PMI (expected unrevised at 52.9, prelim-Jul +1.6 to 52.9), (2) Jul ISM manufacturing index (expected -0.2 to 53.0, Jun +1.9 to 53.2), (3) Jun construction spending (expected +0.7%, May -0.8% m/m), (4) UDA weekly grain export inspections, and (5) USDA Weekly Crop Progress.

There are 12 of the S&P 500 companies that report earnings today with notable reports including: General Growth Properties (consensus $0.36), Williams Cos (0.20), Loews (0.57), Vulcan Materials (1.01), Dun & Bradstreet (1.18), Alliant Energy (0.38).

U.S. IPO's scheduled to price today: Gemphire Technologies (GEMP).

Equity conferences this week include: Wells Fargo Services Conference on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

SolarCity (SCTY -0.67%) jumped over 7% in pre-market trading after Reuters reported that the company may merge with Tesla Motors as soon as today.

Cubic (CUB +0.20%) was upgraded to 'Buy' from 'Hold' at Needham & Co.

First Business Financial Services (FBIZ -3.15%) was downgraded to 'Hold' from 'Buy' at Sandler O'Neill.

GNC Holdings (GNC +0.64%) was downgraded to 'Neutral' from 'Outperform' at Wedbush.

Leggett & Platt (LEG -3.59%) was downgraded to 'Market Perform' from 'Outperform' at Raymond James.

Harley-Davidson (HOG +3.74%) was upgraded to 'Outperform' from 'Market Perform' at BMO Capital Markets.

Caesars Entertainment Group (CZR -1.99%) will sell its online casino games unit Playtika Ltd for $4.4 billion to an investor group led by Shanghai Giant Network Technology Co.

Apple (AAPL -0.12%) shares have "gotten too cheap" based on free cash flow and other metrics, according to Barron's.

Publicis Groupe (PGPEF +1.01%) announced that Saatchi & Saatchi Chairman Kevin Roberts was placed on leave due to comments on gender equality.

Deutsche Bank (DB +1.43%) scored higher in bank stress tests released last Friday than in previous years.

Keycorp (KEY +0.43%) fell by -1.3% in after-hours trading on Friday after news that the First Niagra Financial Group.

MARKET COMMENTS

Sep E-mini S&Ps (ESU16 +0.10%) this morning are up +1.25 points at a fresh all-time high. Friday's closes: S&P 500 +0.16%, Dow Jones -0.13%, Nasdaq +0.14%. The S&P 500 on Friday closed slightly higher on deferred expectations for a Fed rate hike after the weak Q2 GDP report and the slightly weaker-than-expected final-July U.S. consumer sentiment index of +0.5 to 90.0 (vs expectations of +0.7 to 90.2). Stocks were undercut by the weaker-than-expected U.S. Q2 GDP report of +1.2% and the +1.1% upward rebound in Sep oil prices on Friday that provided a little relief for petroleum stocks.

Sep 10-year T-notes (ZNU16 -0.15%) this morning are down -6.5 ticks. Friday's closes: TYU6 +15.5, FVU6 +10. Sep 10-year T-notes on Friday closed moderately higher on the much weaker-than-expected U.S. Q2 GDP report of +1.2% (versus expectations of +2.0%), which caused market participants to significantly defer expectations for the timing of the Fed's next rate hike.

The dollar index (DXY00 +0.20%) is up +0.181 (+0.19%). EUR/USD (^EURUSD) is down -0.0011 (-0.10%). USD/JPY (^USDJPY) is up +0.19 (+0.19%). Friday's closes: Dollar index -1.21 (-1.25%), EUR/USD +0.0096 (+0.86%), USD/JPY -3.24 (-3.08%). The dollar index on Friday closed sharply lower on deferred Fed rate-hike expectations after the much weaker-than-expected U.S. GDP report of +1.2%. In addition, the yen rallied sharply after the BOJ on Friday announced much weaker-than-expected new monetary policy stimulus measures.

Sep WTI crude oil (CLU16 -1.39%) this morning is down -54 cents (-1.30%) and Sep gasoline (RBU16 -0.61%) is down -0.0065 (-0.49%). Friday's closes: CLU6 +0.46 (+1.12%), RBU6 +0.0183 (+1.41%). Sep crude oil and gasoline on Friday closed higher on the sharp drop in the dollar index and on pre-weekend short covering after the sharp decline seen over the past several weeks. However, bearish sentiment continued based on the world oil glut and the third straight rise in U.S. oil production.

(Click on image to enlarge)

Disclosure: None.