Morning Call For April 6, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.75%) this morning are sharply lower by -14.25 points (-0.69%) due to last Friday's weaker-than-expected March payroll report of +126,000. The European markets are closed today for Easter Monday. Asian stocks today settled mixed with some markets closed for the holiday: Japan -0.19%, Singapore (-0.02%), South Korea (+0.07%), India +0.86%, Turkey -0.40%. The dollar index (DXY00 +0.07%) this morning is slightly higher by +0.13 points (+0.13%), while EUR/USD (^EURUSD) is up +0.0016 (+0.15%) and USD/JPY (^USDJPY) is up +0.11 (+0.09%). The euro is receiving a boost today after Greece Finance Minister reassured IMF Director Lagarde late last week that Greece will make the 450 million euro payment that is due to the IMF this Thursday (April 9). Jun T-note prices (ZNM15 unch) are down -1.5 ticks.

Commodity prices are up +1.01% this morning due to a rally in energy and metals. May crude oil (CLK15 +2.48%) is up +1.43 (+2.91%) and May gasoline (RBK15 +2.23%) is up +0.0444 (+2.52%) on some short-covering after last Thursday's losses on the Iran agreement and on today's news that Saudi Arabia is raising prices for its Asian customers for May sales. Jun gold (GCM15 +1.48%) is up +18.1 (+1.51%), May silver (SIK15 +2.54%) is up +0.429 (+2.57%), and May copper (HGK15 +1.85%) is up +0.054 (+1.98%). Grain prices this morning are mixed.

Last Friday's March payroll report of +126,000 was substantially weaker than market expectations of +245,000, but much of the weakness was due to bad weather. The payroll report also showed a total of -69,000 in downward revisions for Jan-Feb payrolls. The March unemployment rate of 5.5% was unchanged from Feb's 6-3/4 year low. The U.S. stock exchanges were closed last Friday for Good Friday.

Saudi Arabia raised its pricing for May sales to its Asian customers for the second straight month, suggesting that global oil demand is increasing. Higher Saudi oil prices also reflect higher refining margins in Asia.

Japan's preliminary-Feb leading indicator fell by -0.4 points to 105.1 from 105.5 in Jan, which was weaker than market expectations of -0.2 to 105.3. The preliminary-Feb coincident index fell by -2.8 points to 110.5 from Jan's 113.3, which was a bit weaker than market expectations of -2.6 to 110.7.

U.S. STOCK PREVIEW

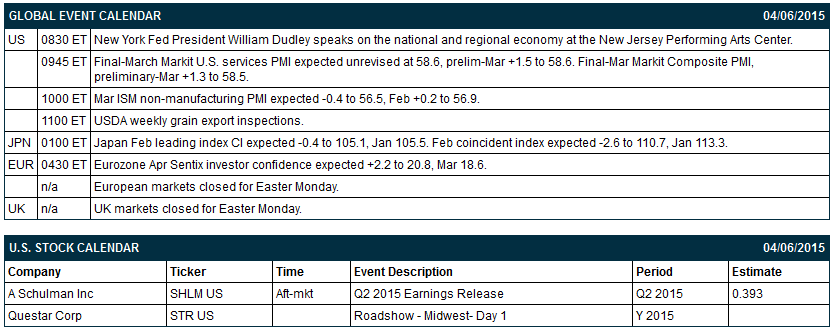

Key news today includes (1) the March ISM non-manufacturing PMI (expected -0.4 to 56.5 after Feb's +0.2 to 56.9), (2) the final-March Markit U.S. services PMI (expected unrevised from early-March at 58.6), and (3) comments by New York Fed President William Dudley on the the national and regional economies at the New Jersey Performing Arts Center.

None of the Russell 1000 companies report earnings today.

There are no U.S. IPO's that scheduled to price or trade today.

Equity conferences this week include: Internet of Things (IoT) Asia 2015 on Wed-Thu, and JP Morgan Spring Fling Conference on Thu

Jun E-mini S&Ps this morning are down -14.25 points (-0.69%) on last Friday's weaker-than-expected March payroll report of +126,000 (versus expectations of +245,000). Thursday's closes: S&P 500 +0.35%, Dow Jones +0.37%, Nasdaq +0.11%. The stock market on Thursday closed higher on the unexpected -20,000 decline in U.S. weekly initial unemployment claims to a 2-month low of 268,000 and strength in consumer companies after a +9% jump in CarMax on better-than-expected Q4 earnings.

OVERNIGHT U.S. STOCK MOVERS

- Barrick Gold's chairman (ABX -1.08%) said the company is open to sell-offs and joint ventures, according to the Financial Times.

- UnitedHealth (UNH -0.08%) shares are expensive at current levels and are ripe for profit taking, according to a weekend Barron's article.

- Monsanto (MON -0.56%) deserves a second look, according to a weekend Barron's article.

- Gabelli reported a 21.51% stake in Myers Industries (MYE +0.62%).

- Cadian Capital reported a 9.1% passive stake in Workiva (WK +0.92%).

- Blue Holdings I reported a 14.3% stake in J.M. Smucker (SJM +0.46%).

MARKET COMMENTS

Jun 10-year T-notes this morning are down -1.5 ticks after closing +24 ticks higher during last Friday's abbreviated electronic session on the weak payroll report. Thursday's closes: TYM5 -6.50, FVM5 -1.75. June 10-year T-notes on Thursday closed lower due to the larger-than-expected decline in U.S. weekly jobless claims to a 2-month low and the unexpected increase in U.S. Feb factory orders.

The dollar index this morning is slightly higher by +0.13 points (+0.13%), while EUR/USD is up +0.0016 (+0.15%) and USD/JPY is up +0.11 (+0.09%). The euro is seeing some strength this morning after Greek officials are making assurances that Greece with make this Thursday's 450 million euro payment to the IMF. Thursday's closes: Dollar index -0.749 (-0.76%), EUR/USD +0.01167 (+1.08%), USD/JPY -0.043 (-0.04%). The dollar index on Thursday closed lower on long liquidation pressure ahead of Friday's payroll report, but gained support from the decline in the U.S. Feb trade deficit to a 5-1/3 year low of -$35.4 billion.

May crude oil is up +1.43 (+2.91%) and May gasoline is up +0.0444 (+2.52%) on some short-covering after last Thursday's losses on the Iran agreement and on today's news that Saudi Arabia is raising prices for its Asian customers for May sales. Thursday's closes: CLK5 -0.95 (-1.90), RBK5 -0.0595 (-3.25%). May crude oil and gasoline prices on Thursday closed lower on negative carry-over from Wednesday’s +4.77 mln bbl increase in U.S. crude oil inventories to a record high and +2.63 mln bbl increase in Cushing crude oil inventories to a record high 58.9 million bbl. Crude oil prices were also undercut by Thursday’s framework Iranian nuclear agreement, which if finalized by the end-June deadline could lead to the lifting of sanctions on Iranian oil production and exports by year-end.

Disclosure: None.