Morning Call For April 15, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 +0.23%) this morning are up +0.20%, led by a +3.6% increase in Intel in pre-market trading, after the company late yesterday forecast Q2 earnings that weren't as dire as some analysts' predicted. European stocks are up +0.78% ahead of today's ECB meeting and comments from ECB President Mario Draghi. Asian stocks settled mostly lower after China's economy in Q1 grew at the slowest pace since 2009: Japan -0.20%, China -1.24%, Taiwan -1.06%, Australia -0.64%, South Korea +0.08%, India -0.84%.

The yield on Greece's 10-year bond climbed to a 2-year high of 12.249% as time is running out for Greece to secure the next tranche of EU aid to avoid default. Eurozone finance ministers will meet in Latvia on Apr 24 to assess whether Greece has made enough progress to warrant additional bailout funds. Concern over a Greek default has hammered Greek bank stocks which fell over 4% today to their lowest level in at least 20 years.

Commodity prices are mixed. May crude oil (CLK15 +1.01%) is up +1.09% at a 1-3/4 month high and May gasoline (RBK15 +1.37%) is up +1.33% at a 3-week high after Iran joined Libya in calling for cuts in OPEC oil production. Metals prices are weaker as the dollar strengthened. Jun gold (GCM15-0.07%) is down -0.10%. May copper (HGK15 -0.56%) is down -0.37%. Agriculture prices are mixed.

The dollar index (DXY00 +0.41%) is up +0.51% and EUR/USD (^EURUSD) is down -0.57% on speculation ECB President Draghi will reiterate his commitment to easy monetary policy when he speaks later today. USD/JPY (^USDJPY) is up +0.06%.

Jun T-note prices (ZNM15 +0.04%) are up +2 ticks on carry-over support from a rally in European government bonds as yields in Germany, France, Belgium, Austria, Finland and Ireland all fell to record lows. The 10-year bund yield dropped to an all-time low of 0.124%.

China Q1 GDP rose +7.0% y/y, right on expectations and the slowest pace of expansion since Q1 2009.

China Mar industrial production climbed at a +5.6% y/y pace, weaker than expectations of +7.0% y/y and the slowest pace since Nov 2008.

U.S. STOCK PREVIEW

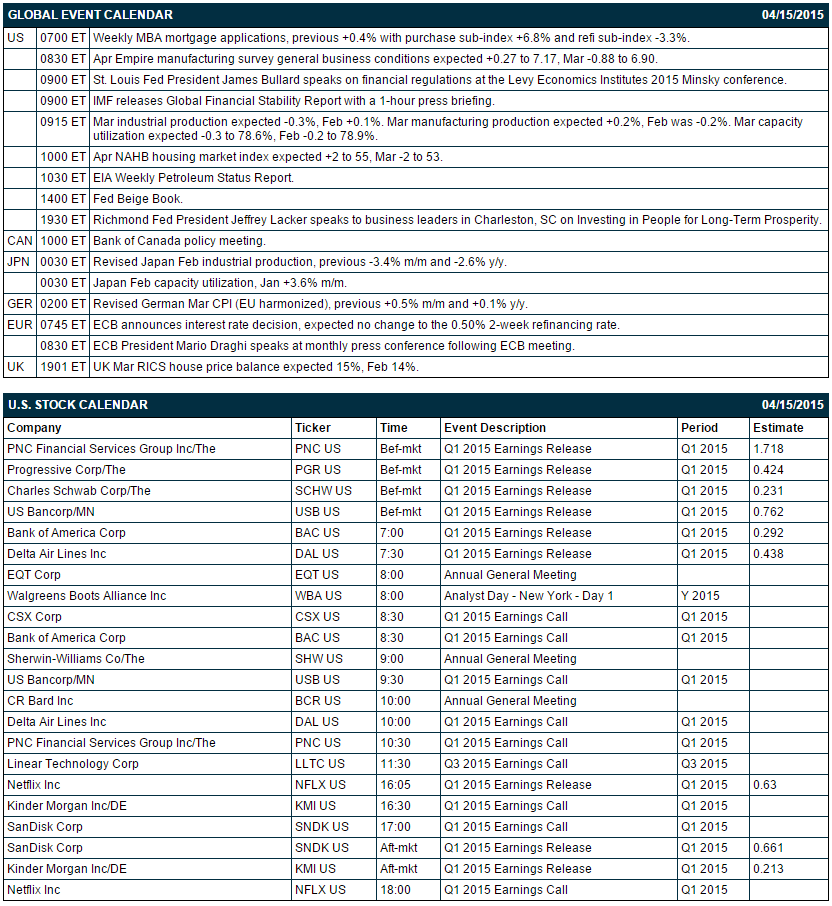

Key U.S. news today includes (1) the weekly MBA mortgage applications report, (2) the April Empire manufacturing index (expected +0.27 to 7.17 after March's -0.88 to 6.90), (3) the March industrial production report (expected -0.3% after Feb's +0.1%), (4) the April NAHB housing market index (expected +2 to 55 after March's -2 to 53), (5) the Fed's Beige Book report on the U.S. economy, (6) St. Louis Fed President James Bullard's speech on financial regulation at the Levy Economics Institute’s 2015 Minsky conference, and (7) Richmond Fed President Jeffrey Lacker's speech to business leaders in Charleston, SC on “Investing in People for Long-Term Prosperity.”

There are 9 of the S&P 500 companies that report earnings today: Bank of America (consensus $0.29), Schwab (0.23), US Bancorp (0.76), PNC Financial (1.72), Progressive (0.42), Delta Airlines (0.44), Kinder Morgan (0.22), Netflix (0.63), SanDisk (0.66).

U.S. IPO's scheduled to price today include: Etsy (ETSY) Party City Holdco (PRTY), National Storage Affiliates (NSA), Virtu Financial (VIRT), Aduro Biotech (ADRO), Immune Design (IMDZ), KemPharm (KMPH), Horizon Pharma (HZNP), WCI Communities (WCIC). U.S. IPO's that are scheduled to trade today include: XBiotech (XBIT).

Equity conferences during the remainder of this week include: Cantor Fitzgerald First Annual ETF and Indexing Forum on Wed.

OVERNIGHT U.S. STOCK MOVERS

Delta Air Lines (DAL +0.02%) reported Q1 adjusted EPS of 45 cents, better than consensus of 44 cents.

Nokia (NOK -4.10%) was upgraded to 'Market Perform' from 'Underperform' at Bernstein.

Staples (SPLS -0.12%) was upgraded to 'Buy' from 'Hold' at BB&T with a price target of $21.

American Eagle Outfitters (AEO -2.07%) was initiated with a 'Buy' at Guggenheim witha proce target of $20.

Discover (DFS +0.95%) was upgraded to 'Overweight' from 'Neutral' at JPMorgan Chase.

Cummins (CMI +0.32%) was downgraded to 'Hold' from 'Buy' at Stifel.

PNC Financial Services Group (PNC +0.32%) reported Q1 EPS of $1.75, better than consensus of $1.72.

Bank of America (BAC +0.13%) reported Q1 EPS of 36 cents, higher than consensus of 29 cents.

US Bancorp (USB -1.27%) reported Q1 EPS of 76 cents, right on expectations.

Piper Jaffray keeps an 'Overweight' rating on L Brands (LB -0.01%) and raised its price target on the stock to $102 from $91.

Ulta Salon (ULTA +0.98%) , Nike (NKE +0.26%) , and GoPro (GPRO +0.59%) were all upgraded to 'Overweight' from 'Neutral' at Piper Jaffray.

CSX (CSX +0.39%) rose almost 3% in after-hours trading after it reported Q1 EPS of 45 cents, better than consensus of 44 cents.

Intel (INTC -0.76%) reported Q1 EPS of 41 cents, right on consensus, although Q1 revenue of $12.8 billion was below consensus of $12.9 billion and the company said it sees fiscal 2015 revenue approximately flat, below consensus of $55.69 billion.

MARKET COMMENTS

June E-mini S&Ps (ESM15 +0.23%) this morning are up +4.25 points (+0.20%). Tuesday's closes: S&P 500 +0.16%, Dow Jones +0.33%, Nasdaq-0.26%. The S&P 500 index on Tuesday closed mildly higher on oil sector strength sparked by the rally in oil prices and on financial sector strength prompted by a new 15-year high in JPMorgan's stock on its better-than-expected Q1 earnings results. The stock market was able to shake off the weaker-than-expected U.S. March retail sales report of +0.9% and +0.4% ex-autos and the IMF's cut in its U.S. 2015 GDP forecast to 3.1% from 3.6%.

Jun 10-year T-notes (ZNM15 +0.04%) this morning are up +2 ticks. Tuesday's closes: TYM5 +10.50, FVM5 +5.75. June 10-year T-note prices on Tuesday closed higher on the weaker-than-expected U.S. retail sales report, the fall in the 10-year German bund yield to a record low of 0.13%, and the IMF's cut in its U.S. GDP forcast to +3.1% from +3.6%.

The dollar index (DXY00 +0.41%) this morning is up +0.507 (+0.51%). EUR/USD (^EURUSD) is down -0.0061 (-0.57%). USD/JPY (^USDJPY) is up +0.07 (+0.06%). Tuesday's closes: Dollar Index -0.757 (-0.76%), EUR/USD +0.00879 (+0.83%), USD/JPY -0.728 (-0.61%). The dollar index on Tuesday closer lower on the weaker-than-expected U.S. retail sales report. The dollar showed weakness against the yen after a consultant to Japanese Prime Minister Abe said that a dollar/yen rate of 105 yen would be "appropriate," which suggested little political pressure for additional BOJ easing.

May WTI crude oil (CLK15 +1.01%) this morning is up +58 cents (+1.09%) at a 1-3/4 month high. May gasoline (RBK15 +1.37%) is up +0.0244 (+1.33%) at a 3-week high. Tuesday's closes: CLK5 +1.38 (+2.66%), RBK5 +0.047 (+2.60%). May crude oil and gasoline settled higher on Tuesday on the weaker dollar, short-covering, and doubts about an Iranian nuclear deal as Congress moved closer to veto-proof legislation requiring Congressional review. May crude oil prices were capped by expectations that Wednesday's weekly EIA report will show a +3.5 million bbl increase in U.S. crude oil inventories to a new record high.

Disclosure: None.