Morning Call For April 12, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 +0.29%) are up +0.34% and European stocks are up +0.37% as a +0.50% rally in crude oil to a 2-1/2 week high boosts energy producers. Mining stocks are higher as well, led by a 5% gain in Anglo American Plc, as the price of gold climbed +0.11% to a 3-week high and after Anglo's De Beers unit forecast stronger diamond sales. Asian stocks settled mixed: Japan +1.13%, Hong Kong +0.31%, China -0.34%, Taiwan-0.37%, Australia +0.89%, Singapore +0.19%, South Korea +0.68%, India +0.49%. Japanese bank stocks rallied helped pushed the Nikkei Stock Index higher after the BOJ reduced the portion of bank funds subject to negative interest rates. Also, exporters gained after the yen stabilized following a 7-day rally.

The dollar index (DXY00 -0.02%) is down -0.10% at a 7-1/2 month low. EUR/USD (^EURUSD) is up +0.06% at a 5-3/4 month high after German Mar wholesale price posted their largest monthly increase in 10 months. USD/JPY (^USDJPY) is up +0.36%.

Jun T-note prices (ZNM16 -0.23%) are down -9 ticks.

Bundesbank President Weidmann is quoted in a Financial Times interview as saying "the ECB has to deliver on its price stability mandate and thus an expansionary monetary policy stance is appropriate at this juncture regardlesss of different views about specific measures."

The German Mar wholesale price index rose +0.3% m/m, the largest monthly increase in 10 months. Year-on-year, Mar wholesale prices fell -2.6% y/y and matched the Jan 2015 decline as the largest year-on-year decline in 6-1/3 years.

U.S. STOCK PREVIEW

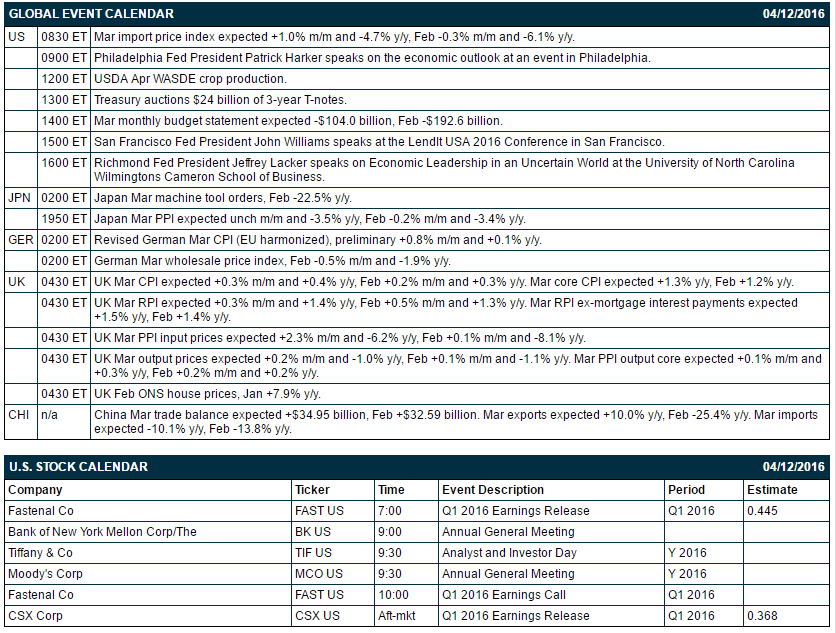

Key U.S. news today includes: (1) Mar import price index (expected +1.0% m/m and -4.7% y/y, Feb -0.3% m/m and -6.1% y/y), (2) Philadelphia Fed President Patrick Harker's speech on the economic outlook at an event in Philadelphia, (3) the Treasury's auction of $24 billion of 3-year T-notes, (4) Mar Treasury monthly budget statement (expected -$104.0 billion, Feb -$192.6 billion), (5) San Francisco Fed President John Williams' speech at the LendIt USA 2016 Conference in San Francisco, (6) Richmond Fed President Jeffrey Lacker's speech on “Economic Leadership in an Uncertain World” at the University of North Carolina Wilmington’s Cameron School of Business and (7) USDA Apr WASDE crop production.

There are 2 of the Russell 1000 companies that report earnings today: Fastenal (consensus $0.45), CSX (0.37).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: IPAA Oil & Gas Investment Symposium on Mon-Tue, Needham Healthcare Conference on Tue, Goldman Sachs Cars Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Corning (GLW +0.44%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs with a price target of $26.

Alcoa (AA +3.95%) slid over 4% in pre-market trading after it reported Q1 revenue of $4.95 billion, below consensus of $5.2 billion.

Starbucks (SBUX -0.23%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

ADT Corp. (ADT +0.02%) was downgraded to 'Sell' from 'Hold' at Argus Research.

Juniper Networks (JNPR -0.16%) dropped over 6% in after-hours trading after it lowered guidance on Q1 adjusted EPS to 35 cents-37 cents from a January estimate of 42 cents-46 cents, below consensus of 45 cents. Cisco Systems (CSCO -0.25%) fell over 1% and F5 Networks (FFIV -0.17%) dropped nearly 2% in after-hours trading after the Juniper news.

Mohawk Industries (MHK +0.23%) was rated a new 'Buy' at MKM Partners with a price target of $244.

Retrophin (RTRX -2.50%) was rated a new 'Outperform' at BMO Capital Markets with a 12-month price target of $25.

Yandex (YNDX +4.19%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs

Dycom Industries (DY +0.43%) was rated a new 'Buy' at Canaccord Genuity with a price target of $75.

Affimed NV (AFMD +2.37%) was rated a new 'Outperform' at BMO Capital Markets with a 12-month price target of $7.

Pandora Media (P -0.97%) gained over 2% in after-hours trading after it was rated a new 'Buy' at Citigroup with a price target of $16.

Marathon Oil (MRO -0.93%) climbed nearly 2% in after-hours trading after it said it will divest all of its Wyoming upstream and midstream assets for $870 million, ex-closing adjustments.

Sprint Realty Capital (SRC -0.95%) fell over 3% in after-hours trading after it began a 27 million share secondary offering of common stock.

MARKET COMMENTS

June E-mini S&Ps (ESM16 +0.29%) this morning are up +7.00 points (+0.34%). Monday's closes: S&P 500 -0.27%, Dow Jones -0.12%, Nasdaq -0.36%. The S&P 500 on Monday erased an early rally and closed lower on long liquidation pressure ahead of Q1 corporate earnings results that are expected to show a -7.6% y/y decline, the worst since the Great Recession ended. Stocks were also undercut by weakness biotechnology stocks. Stocks initially opened higher on the +1.64% rally in China's Shanghai Composite on signs of economic improvement after China Mar producer prices increased month-on-month for the first time in 2-1/2 years.

June 10-year T-note prices (ZNM16 -0.23%) this morning are down -9 ticks. Monday's closes: TYM6 unch, FVM6 +0.50. Jun T-notes on Monday closed little changed. T-notes were undercut by supply pressures as the Treasury auctions $56 billion of T-notes and T-bonds this week starting with Tuesday's $24 billion auction of 3- T-notes. After early weakness, T-notes rallied back later in the session on increased safe-haven demand as stocks sold off and as the 10-year T-note breakeven inflation expectations rate fell to a 1-1/2 week low.

The dollar index (DXY00 -0.02%) this morning is down -0.097 (-0.10%) at a 7-1/2 month low. EUR/USD (^EURUSD) is up +0.0007 (+0.06%) at a 5-3/4 month high. USD/JPY (^USDJPY) is up +0.39 (+0.36%). Monday's closes: Dollar Index -0.285 (-0.30%), EUR/USD +0.0009 (+0.08%), USD/JPY -0.13(-0.12%). The dollar index on Monday sold off to a 7-1/2 month low and closed lower on strength in the the crude-oil currencies of Canada and Russia after crude oil prices rose to a 2-week high. In addition, there was weakness in USD/JPY, which sank to a new 17-1/2 month low.

May WTI crude oil (CLK16 +0.89%) is up +20 cents (+0.50%) at a 2-1/2 week high. May gasoline (RBK16 +0.04%)is down -0.0036 (-0.24%). Monday's closes: CLK6 +0.64 (+1.61%), RBK6 +0.0440 (+3.01%). May crude and gasoline on Monday closed higher with May crude at a 2-week high and May gasoline at a 3-week high. Crude oil prices were boosted by the slide in the dollar index to a 7-1/2-month low and positive carryover from Friday's news that Baker Hughes U.S. active oil rigs in the week ended Apr 8 fell by -8 rigs to a 6-1/3 year low of 354 rigs.

Disclosure: None.