More Pieces Of Impossible

On his company’s earnings conference call back on Valentine’s Day, T-Mobile CEO John Legere was unusually feisty. Never known for shyness, Legere had reason behind his bluster. T-Mobile had practically built itself up on price, being left the bottom tier of the wireless space practically to itself. That all changed, however, as both Verizon and Sprint were set to escalate the wireless price war.

Welcome to the game Verizon, let’s compete on price, let’s compete on network. We’re playing from a position of strength. Unlimited is who we are.

It was another of Legere’s statements, however, that has proved more intriguing. From T-Mobile’s perspective, the competition did seem a little panicked, in what “[could] only be deemed desperation.”

Many expected this price war to be settled rather quickly. It is for each company a destructive affair that in an open-ended format creates more disturbance than assurance. Shares of both Sprint and Verizon have sunk this year even though overall the stock market performs well. And still there is no end in sight, as unlimited plans now proliferate even more.

There are at root, of course, technological and demographic changes underneath. The old way of telecoms through cable and even satellite is steadily giving way to streaming and mobile. Customers are up for grabs. The idea of “cutting the cord” has never been so realistic and even easy, and it will only get better from here for consumers.

Like “brick and mortar” retailers, however, there does seem to be something else behind all the desperation, as John Legere boasted. There may be network parity, or at least enough network parity, but in 2017 price has taken the top consideration in much more than wireless telephony. Consumers have become suddenly fickle about goods and services that were even in this last decade almost untouchable.

Perhaps Apple Computer’s recent struggles are a good example. In their second quarter earnings statement, released in May, the company reported just 50.8 million iPhones sold, down from 51.2 million in its Q2 2016. For CY 2016, Apple reported its first ever decline in iPhone sales. The latest 7 plus model was supposed to reinvigorate demand, but outside of Q4 2016 it hasn’t, with the slump renewing very quickly after launch.

Apple CEO Tim Cook attributes the lack of enthusiasm to dreams of future products:

We’re seeing what we believe to be a pause in purchases on iPhone, which we believe are due to the earlier and much more frequent reports about future iPhones.

If the price of something falls precipitously, it can be as much an element of demand as supply (sales of iPads were down 13% in Q2). In other words, maybe Apple’s core customers are waiting for an iPhone Super 8 Double Plus Infinity model, or maybe they are more constrained than they have been since iPhones became mass market products (this is not strictly an Apple issue; Samsung sales were down in its mobile unit in Q2 as well). Being cautious about new devices, it would follow that they might also prioritize price for their wireless service.

Normally such business ins and outs wouldn’t be of much macro concern. Earlier this week, though, the Chairman of the Federal Reserve was forced to mention the ongoing price war for no other reason than that agency’s continued inability to generate inflation. Consumer prices are no small matter for a central bank, and they take on a much larger context for all of them who have been “printing money” over the last ten years. Having created trillions of what they classify as money in the form of bank reserves, there should have been long before today some evidence in the economy in the form of consumer prices.

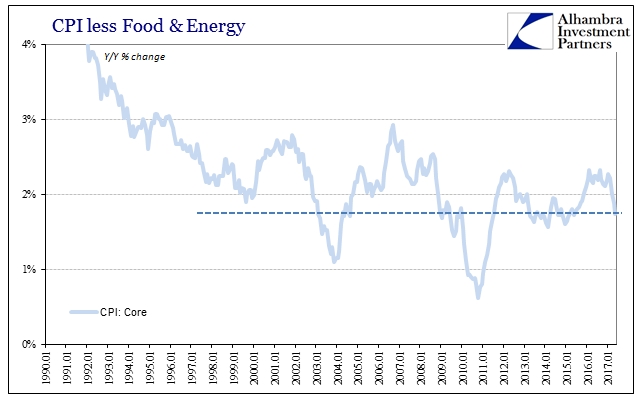

Core inflation–which excludes the volatile food and energy categories and tends to be a better indicator of future inflation–has also edged lower. The recent lower readings on inflation have been driven significantly by what appear to be oneoff reductions in certain categories of prices, such as wireless telephone services and prescription drugs.

We’ve been here before, which is precisely the point. The Fed’s inflation policy is always beset by “oneoff” factors that form an unbroken string tracing back in time now five years. Each of these do, in fact, appear to be plausibly characterized in such a way, at least until put together in a more comprehensive review. Once that happens, their commonality is revealed always as weak consumers.

The most prominent of these “oneoffs” was, and is, oil. Here’s Yellen’s press conference remarks from March 18, 2015:

Declining import prices have also restrained inflation, and in light of the recent appreciation of the dollar, will likely continue to do so in the months ahead. My colleagues and I continue to expect that as the effects of these transitory factors dissipate and as the labor market improves further, inflation will move gradually back toward our 2 percent objective over the medium term…

That’s—that is, you know, a reason that many of my colleagues—most of my colleagues—are anticipating that it will be appropriate to begin to tighten policy sometime this year. In spite of the fact that they are projecting that inflation will be low, they’re looking forward and they see that, by the end of 2016 or 2017, with the labor market recovering, and assuming that inflation expectations remain stable and transitory influences no longer affecting inflation, they see inflation heading back to our 2 percent objective.

The Fed’s statistical models were apparently unable to forecast Verizon’s and Sprint’s entries into the unlimited data war – just as they were caught unaware of the looming oil price crash in 2014. For ferbus and the rest of the DSGE’s, consumers are always predicted to respond very favorably to whatever their handlers describe as “stimulus.”

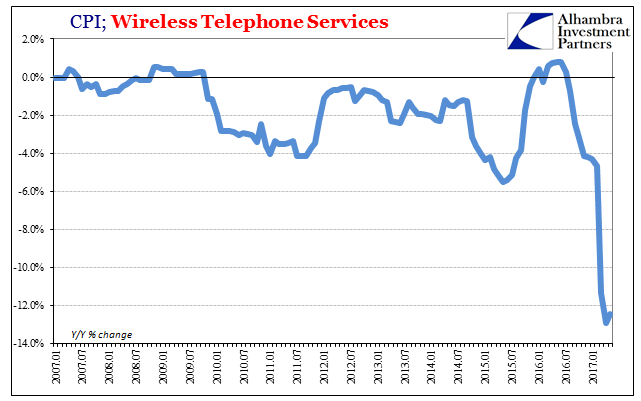

The scale of these effects is not small. According to the BLS, the aggregate pricing of telephone services is weighted at just 2.465% of the CPI-U; wireless telephone services, its now majority subset, only 1.738% of the CPI-U. And yet, in the latest monthly CPI report, the wireless wars accounted for subtracting 0.2% off the year-over-year growth rate in core inflation.

(Click on image to enlarge)

(Click on image to enlarge)

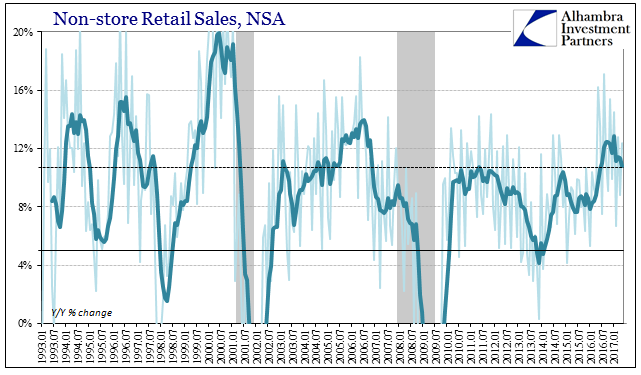

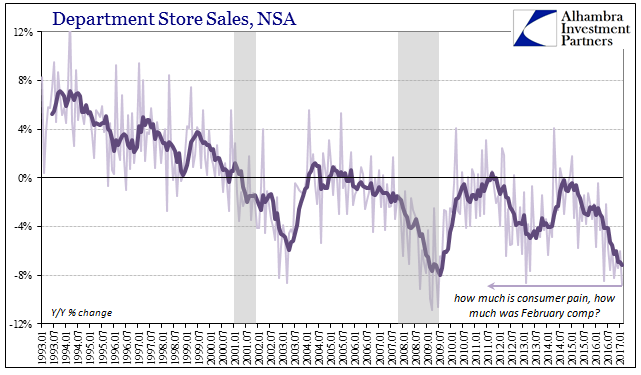

It’s not the only place where we detect such a major change. In the middle of last year, online retail sales suddenly skyrocketed while sales at “brick and mortar” department stores plummeted. As telecoms, there are demographic and industry changes at work, but the timing of their appearance and really the scale over the short run argues for this “something” else.

(Click on image to enlarge)

(Click on image to enlarge)

Here, too, enough parity in service and quality has left pricing as the most important marginal factor for consumers making the switch. There is a growing sensitivity to prices in both segments that reflects demand far more than industry supply changes in retail as well as wireless services. In the latter case, it is showing up as a clear drag on consumer prices, even if the reason for that is more complicated in total.

(Click on image to enlarge)

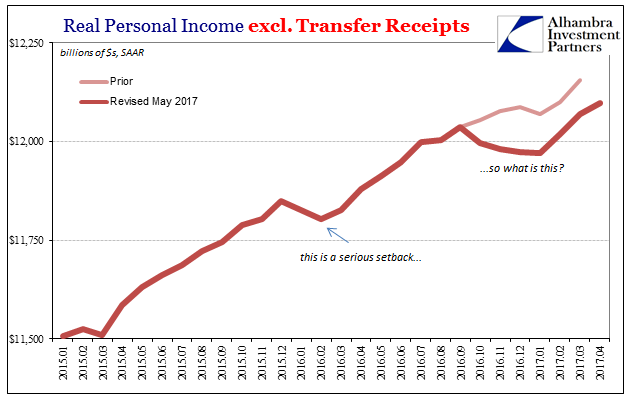

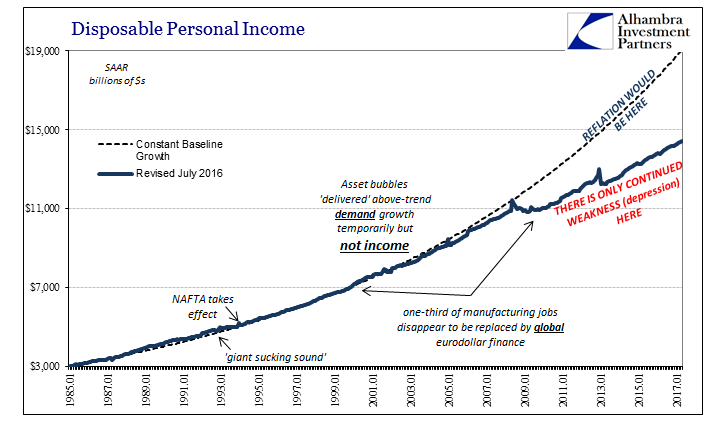

If that is or was the case (“was” if Yellen is right), we don’t really have to wonder why that might be (or have been). Over the past few years, consumers have been hit with almost regular (not “residual seasonality”) shocks to incomes that seem to be increasing in intensity as well as duration. These are, in effect, downturns within a downturn; short run drops or contractions inside an already lost decade. Acceleration of cheap might actually be the most logical of outcomes.

(Click on image to enlarge)

It would only make sense that we detect the chain of causation from economy to consumer prices that instead remains missing from the policy end. In short, there are legitimate concerns as to what may be keeping inflation below the 2% target for such an extended period of time, five years and counting, far more than any tangible proof that monetary policy is or was ever effective let alone pure “money printing.”

This matters in setting our expectations for what comes next, and not just in the context of “reflation.” The US and global economy remains structurally unsound. Though the telecom price wars or the huge increased interest in online shopping are not alone pure evidence of consumer duress, taken together with many other indications included in consumer prices it adds up to explaining the impossible.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more