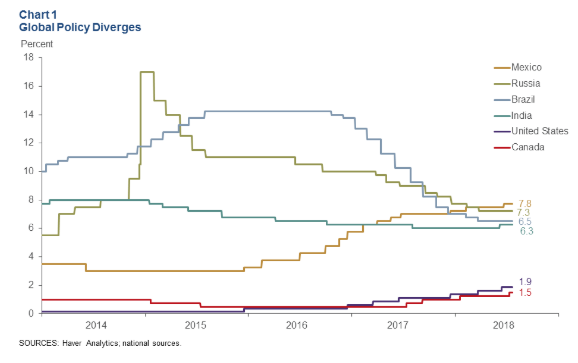

Monetary Policy In The Advanced Economies Is Normalizing, Which Means Further Rate Hikes In The U.S. And Canada

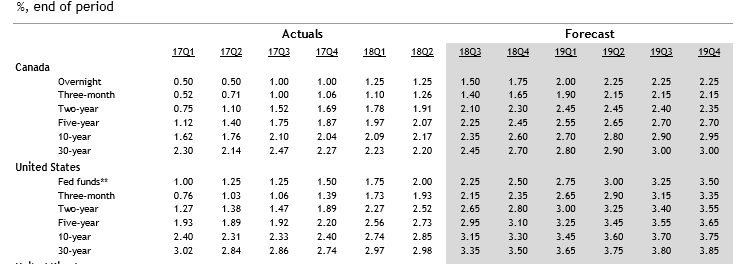

The Federal Reserve raised interest rates 25 basis points in June and signaled that two additional increases were on the way this year. Thus far the financial markets have shrugged off the U.S. rate hikes and the related quantitative tightening since the U.S. economy and its job market seems quite strong.

The Bank of Canada began raising its interest rates in mid-2017 and thus far has delivered four rate increases of 25 basis points each. The latest rate increase in July was prompted by the Bank’s assessment that the U.S. economy was performing stronger than expected and that despite trade risks, the Canadian economy was approaching full capacity.

The European Central Bank (ECB), Bank of England and the Bank of Japan have all left their policy rates unchanged at recent meetings.

The ECB left the refinancing rate at 0.00%, the marginal lending rate at 0.25% and deposit facility rate at minus 0.40%. As well, the ECB confirmed that it will scale back the monthly pace of its asset purchases from €30 billion to €15 billion, and completely end the program in December. The ECB also indicated that it intends to maintain its policy rate at its current low level through to the summer of 2019.

The Reserve Bank of India tightened policy by 25 basis points at its June 4–6 meeting, as its headline inflation was running at around 5% for most of 2018, while core consumer price inflation has escalated to over 6% in June.

While China’s central bank has not recently altered interest rates, it recently announced a series of measures designed to add to the liquidity to the banking system.

In June the PBOC announced a 50 basis-point cut in the required reserve ratio for the Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications and another dozen large banks.

The PBOC also cut the required reserve ratio by 50 basis points for other depository institutions with the objective of increasing the supply of credit to small- and medium-sized businesses.

Global Monetary Policy Diverges

RBC Interest Rate Outlook for Canada And the U.S. (September 12, 2018)

Disclosure: None.