Monday - Sector Strength

What is this spreadsheet telling us?

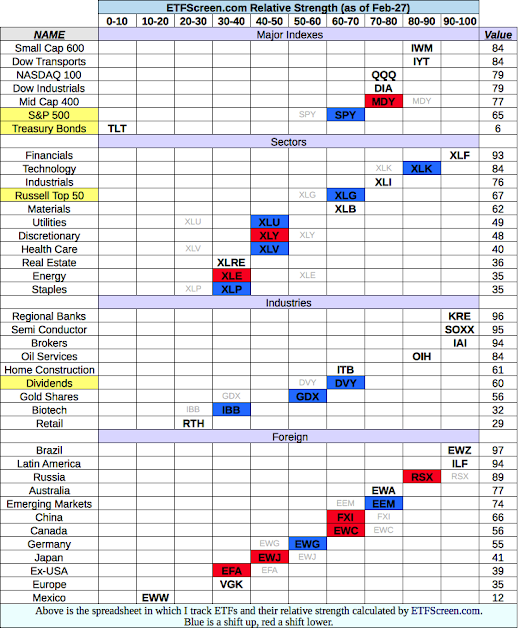

Small caps are still in the lead among the major indexes, and 20Y+ Treasuries are still rock bottom. That is a set up in a very bullish stock market.

Financials, Technology, Industrials are still strong leaders within the sectors, but the defensive groups, Utilities, Staples, Health Care, have gained some strength. That is also a bullish set up although the strength of the defensive groups means we are in the latter stage of the medium-term cycle. Or, usually it does, but who knows in this cycle.

The two most sensitive cyclicals Semiconductors and Transports are leaders. Another bullish setup.

The foreign ETFs (all denominated in US dollars) are leaning to center-right. I think that reflects better world growth and a recently somewhat weaker US Dollar.

There are serious concerns in the global stock markets such as excessive valuations and cold war style tensions. But just looking at this spreadsheet, at the moment at least, the bulls are solidly in control.

Sector Focus

The table below shows the ETFs that are, in my opinion, outperforming at the moment.

I have been whipsawed by biotech which was down last week, but is back up today. Not too surprising though from a such a volatile area of the market.

Biotech is a bit of a judgment call, because it ended last week near the weekly lows, and now here it touching the highs.

Home Builders are breaking out from a base.

Not the best day for Gold Miners.

Do the Gold Miners lead EEM and the other Emerging Market ETFs such as EWZ and ILF ? I am not sure if the miners have led in past cycles, but in the current cycle I think the answer is yes. Which means, keep an eye on your emerging market stocks for signs of weakness.

Bottom line: I would much rather buy leading stocks, but at the cycle lows such as last October. But who knows when the next cycle low is going to appear. So in the meantime, I am trying to participate, but I am also being very cautious.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more

Sounds advice. Thanks Douglas!