Mobile Giant Verizon Loses Customers, But Beats Expectations For Q1

Verizon Communications (VZ), formed by the merger of Bell Atlantic and GTE, is one of the world's leading providers of high-growth communications services. Verizon companies are the largest providers of wireline and wireless communications in the United States. Verizon is also the world's largest provider of print and on-line directory information.

Some heavy hitters are reporting Q1 earnings this week and the latest big player to post is Verizon. The company posted lower earnings year-over-year, but beat analyst expectations. The company lost phone subscribers due to tough fights with competitors, but it added more than 500k new tablet subscribers. The company also added @212k FiOS Video and Internet subscribers--which was significantly more year-over-year.

In a company press release, Verizon Chairman and CEO Lowell McAdam noted that “Verizon is off to a strong start in 2015 with another quarter of profitable growth. We expanded our base of customers seeking a premium experience, and we grew revenues, earnings and cash flow during a quarter in which we also took significant steps to sharpen our strategic focus. We are confident in our ability to maintain momentum and continue to add value for customers and shareholders.”

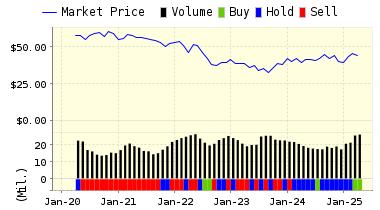

Verizon shares have been mixed lately, with flat results over the past few months. We have included the stock in our VE Dividend Newsletter for the month and currently it is up @0.5%. ValuEngine continues its BUY recommendation on VERIZON COMMUNICATIONS for 2015-04-20. Based on the information we have gathered and our resulting research, we feel that VERIZON COMMUNICATIONS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Volatility.

Below is today's data on VZ:

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

49.67 | 0.58% |

|

3-Month |

49.39 | 0.02% |

|

6-Month |

50.04 | 1.33% |

|

1-Year |

52.82 | 6.97% |

|

2-Year |

44.57 | -9.75% |

|

3-Year |

47.40 | -4.00% |

|

Valuation & Rankings |

|||

|

Valuation |

11.65% undervalued |

Valuation Rank |

|

|

1-M Forecast Return |

0.58% |

1-M Forecast Return Rank |

|

|

12-M Return |

2.92% |

Momentum Rank |

|

|

Sharpe Ratio |

0.58 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

8.99% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

15.46% |

Volatility Rank |

|

|

Expected EPS Growth |

7.80% |

EPS Growth Rank |

|

|

Market Cap (billions) |

204.91 |

Size Rank |

|

|

Trailing P/E Ratio |

14.27 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

13.24 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.83 |

PEG Ratio Rank |

|

|

Price/Sales |

1.61 |

Price/Sales Rank |

|

|

Market/Book |

14.98 |

Market/Book Rank |

|

|

Beta |

0.30 |

Beta Rank |

|

|

Alpha |

-0.01 |

Alpha Rank |

|

Disclosure: None

As a bonus, we are offering a FREE DOWNLOAD of one of our Stock Reports. Read our Complete Detailed Valuation Report on United States Steel more