MMM Offers 16.10% Return P.A. For Value Investors

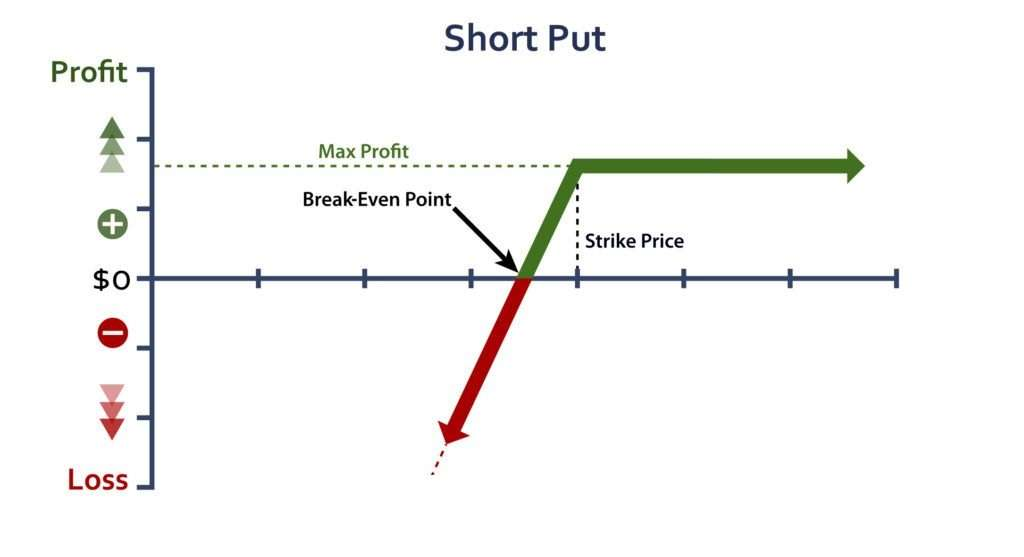

Selling put options is an easy place for investors to start out with options. They are very similar to a covered call and are quite easy to understand once you understand the basics.

Cash-secured puts are best rather than trading naked puts which can be very risky. Like any strategy, position size is crucial.

The current bull market has been very profitable for put sellers. It’s a bullish bet and continues to work well, but investors need to be aware that this will not be a good strategy once the next bear market comes around.

A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock. The goal is to be assigned and acquire the stock below the current price.

Traders that sell options want to sell options with a lot of option premium. Generally, volatility will spike when a stock sells off so this provides a double bonus for investors in the form of a cheaper entry point and higher option premiums.

3M Co. (MMM) is one stock that shows good potential for cash-secured puts. The stock is significantly cheaper than it was a few months ago and looks to be forming a long-term base. It has just recaptured the 200 day moving average and the moving average is sloping upwards for the first time since February.

With the stock trading at 201.60, investors could sell an October 19th $200 put for $7.80.

An investor selling this put would receive $780 into their account which would be theirs to keep. If MMM falls below $200 by October 19th, they would be forced to buy the stock for $60. The effective net cost of the position would be $192.20 thanks to the option premium received.

That’s 4.66% below today’s price.

If the stock stays above $2000 at expiry, the puts expire worthless leaving the trader with a healthy 16.10% return p.a. on capital at risk.

The main risk with the trade is similar to outright stock ownership. That is, if the stock falls precipitously, the trader will suffer a loss, but the loss will be partially offset by the premium they received for selling the put.

I do not hold any positions in MMM

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would ...

more