Minor Changes: Yesterday's And Weekend Comments Remain Valid

I don't want to overplay today's action as little changed in the broader scheme of things. Days like today are welcomed and help shape up swing trades for those trading in near term timeframes.

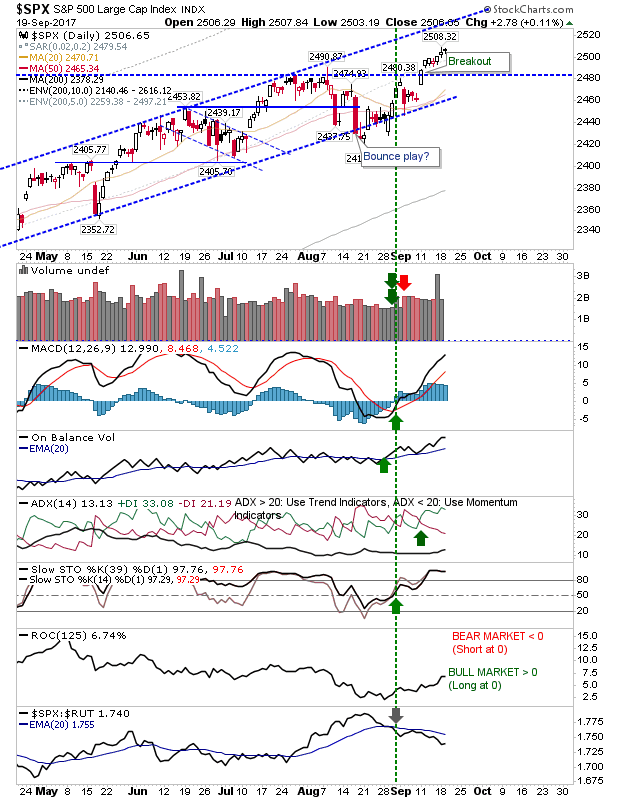

The tight doji in the S&P could be used for a swing trade; buy a break of the high/short loss of low - stop on flip side. High whipsaw risk but look for 3:1 risk:reward and maybe trail stops if deciding to go with partial profits.

(Click on image to enlarge)

Tech averages are still set up for a breakout. While not an ideal play, aggressive traders may look to short a loss of 6,445 with a stop above 6,450. Should the latter occur, look to take profits at the 50-day MA.

(Click on image to enlarge)

The Russell 2000 stalled a little before making a challenge on 1,450. Again, swing trade the doji and play for a move to 1,450 on the upside or 1,425 on the downside.

(Click on image to enlarge)

For tomorrow, watch how markets emerge from these doji and follow the momentum as determined by the market.