Mining Stocks’ 112% Surge Is Just The Beginning

As a guy who pays close attention to trends, I can say the S&P 500 bull market is getting long in the tooth.

It began back in March 2009 when it was down to 676 points. Today it’s all the way up to around 2,700 points.

That’s a huge gain. It’s had a few corrections on the way, of course. But other than those blips, the rise of the S&P is nothing short of incredible.

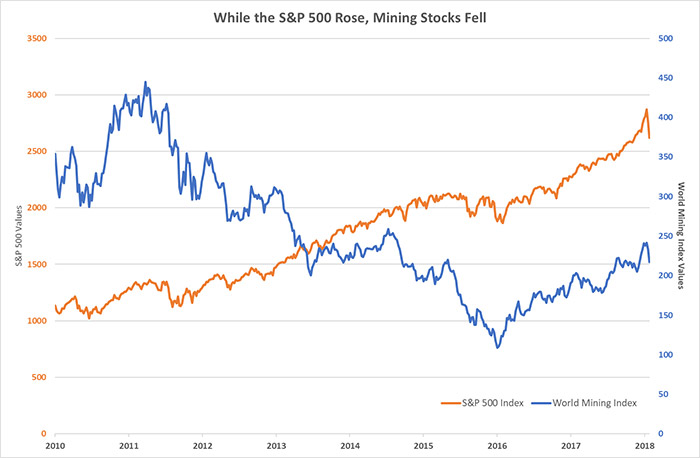

However, compare that trend to mining stocks. Since it bottomed in 2016, the World Mining Index is up 112%, compared to the S&P 500’s 43% gain.

A 43% gain is still fantastic. However, I would argue that mining companies offer us more upside over the next couple of years than the S&P stocks do.

It’s Time to Look at Mining Stocks

In the chart below, the gold line is the S&P 500. The blue line is the Bloomberg World Mining Index.

(Click on image to enlarge)

As you can see, from 2011 to 2016, the World Mining Index lost over 75% of its value. It’s only just begun to claw its way back.

The recent 10% drop over a couple days has some investors looking for a new place to park their cash. Mining stocks might be the place.

That’s because the price of the underlying metals — copper, lead, zinc, nickel, platinum, palladium, etc. — led the collapse in the mining stocks.

Today those same metal prices are moving higher. Zinc just hit a 10-year high. The copper price is up 57% over the last two years.

That’s why mining companies are ripping higher. Investors looking for a high-growth sector outside of the S&P 500 should look hard at a basket of mining stocks.

Fortunately, there are a couple of simple ways to do this.

The iShares MSCI Global Metals & Mining Producers ETF (PICK) and the SPDR S&P Metals and Mining ETF (NYSE: XME) both track baskets of the world’s best mining companies.

If you are looking for a way to hedge slowing growth in the S&P 500, look to mining stocks.