Mid Cap Emerging Biopharmaceutical Companies: Valuations Do Matter For M&A

Valuation Models for Biopharma Stocks -M&A Update

In October 2013 we compared emerging biotech stocks after the acquistion of Onyxx Pharmaceuticals by Amgen (AMGN). Now that rumors are “out there” for the acquisition of Pharmacyclics (PCYC) by large healthcare companies such as Johnson and Johnson (JNJ) and Novartis (NVS) we can compare valuations. The $11B++ range is a tough valuation mark for M&A because many emerging biotech companies do not have a revenue base with growth potential to justify the return for a large healthcare company. Nevertheless technology platforms, mechanisms of action and product pipelines are weighted more heavily for any astute strategic investor (See Gilead below). The current market cap of Pharmacyclics is $16.4B but there are numbers being “thrown around” saying the Company is worth $19B. Here is a detailed analysis of their pipeline saying there are better values out there like Medivation (MDVN).

Amgen paid $10B Onyyx for Kyprolis a cancer drug for multiple myeloma with revenues of $330M in 2014. A recent study showed that Kyprolis has potential to take market share away from Velcade a $3B Takeda drug.

Recently Valeant Pharmaceuticals International (VRX) announced it would buy Salix Pharmaceuticals,Ltd. (SLXP) for about $10B at a Price to Sales Ratio of 7.27, 19 times book value and a 56 ratio of Price to Future Cash Flow (P/FCF). But Salix is not a “biotech” company and is focused in gastrointestinal diseases not cancer. And Valent (VRX) is an aggressive acquirer not averse to taking on a lot of debt to achieve growth, unlike many blue chip healthcare companies.

Alex Philippidus of Genetic Engineering and Biotechnology News summarized the Top M&A Deals of 2014 and among those the “pure” emerging biopharma deals are: Intermune by Roche $8.3B, Cubist by Merck $9.5B,

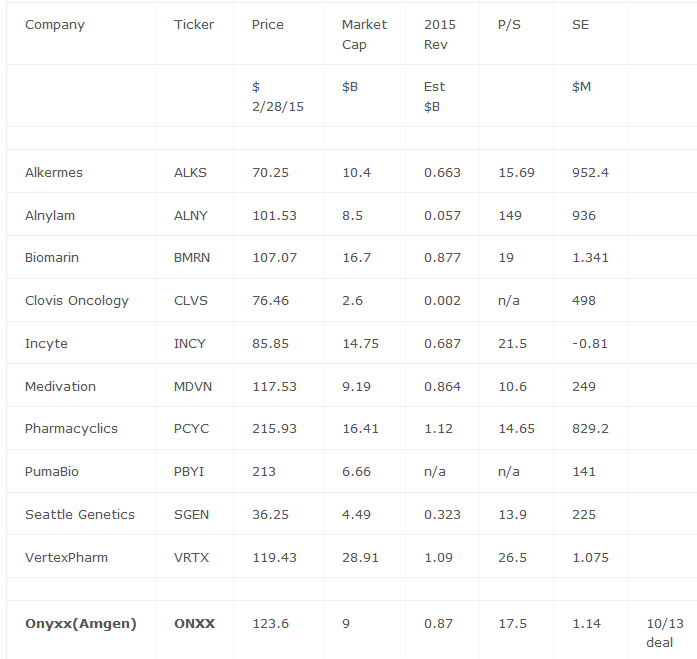

With the biotech bull market raging on and valuations much higher than two years ago it is more difficult to come up with a hit list for M&A. Nevertheless below we have compared 10 well known companies with strong R&D capabilities and pipelines that are attractive targets that can be compared to PCYC. Keep in mind that most of these companies have partners that have licensing rights to sell their products.

- Note that most of the stocks on our 10/13 list are up huge: Biomarin 69%, Incyte (INCY) 112%, Medivation (MDVN) 98%, and Puma (PBYI) 273%.

- Merck acquired Cubist a leading biotech Company in antibiotics for $8.4B last year plus $1.1B in debt for a total value of $9.5B. With a forecasted 2015 revenue of $1.2B for 2015 the Price to Sales for Cubist is about 7.9.

- The large cap biopharmaceuticals companies with valuations above $50B are too large to be acquired: Amgen (AMGN), Abbvie (ABBV), Gilead (GILD), Celgene (CELG), and Biogen BIIB) and will be acquiring smaller companies.

- Strategic M&A will be more important for example the Gilead Sciences (GILD) acquisition of Pharmasset (VRUS) for $11B.Pharmasset had no sales at the time but Gilead knew the HCV pipeline potential.

Ten Leading Mid-Cap Biopharmaceutical Companies

Disclosure: None.