Mid Cap Best & Worst Report - November 5, 2014

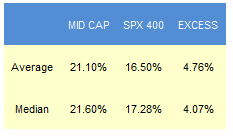

Since 2010, the best scoring names in our weekly mid cap reports have outpaced the S&P 400 by a median 4.07% in the following year. The best performers from our list from 1 year ago are ILMN up 104%, ARRS up 74%, ALXN up 65%, and IRF up 60%.

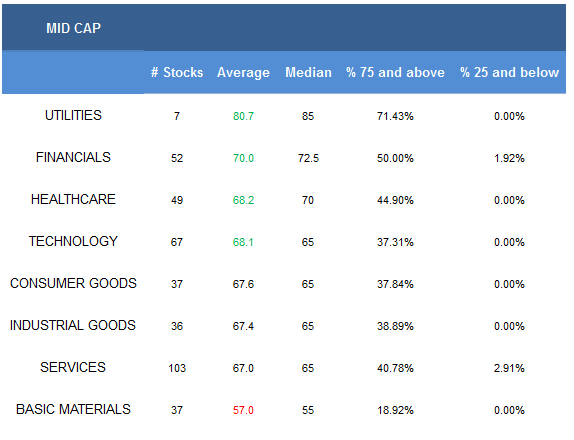

- The best scoring mid cap sector is utilities.

- The top scoring mid cap industry is trucking.

The average mid cap score is 67.08, above the four week moving average score of 60.21. The average mid cap stock is trading -14.22% below its 52 week high, 2.76% above its 200 dma, has 6.98 days to cover held short, and is expected to post EPS growth of 22.9% next year.

Utilities score best across mid cap. Financials, healthcare, and technology also score above average. Consumer goods, industrial goods, and services score in line with the average universe score. Basic materials score below average.

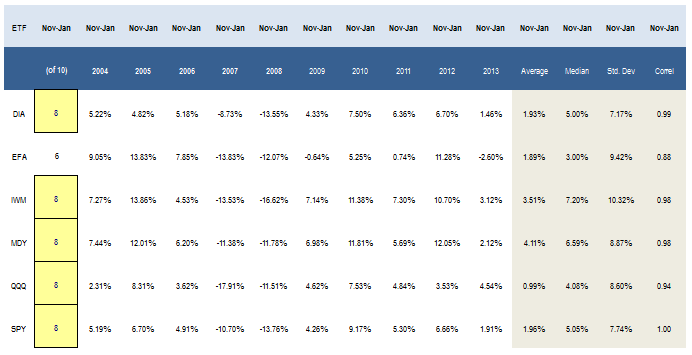

The following chart shows historical seasonality for major market ETF's for the three month period of November through January. Over the past 10 years, the S&P 400 (MDY) has gained eight times, producing a median 4.08% return.

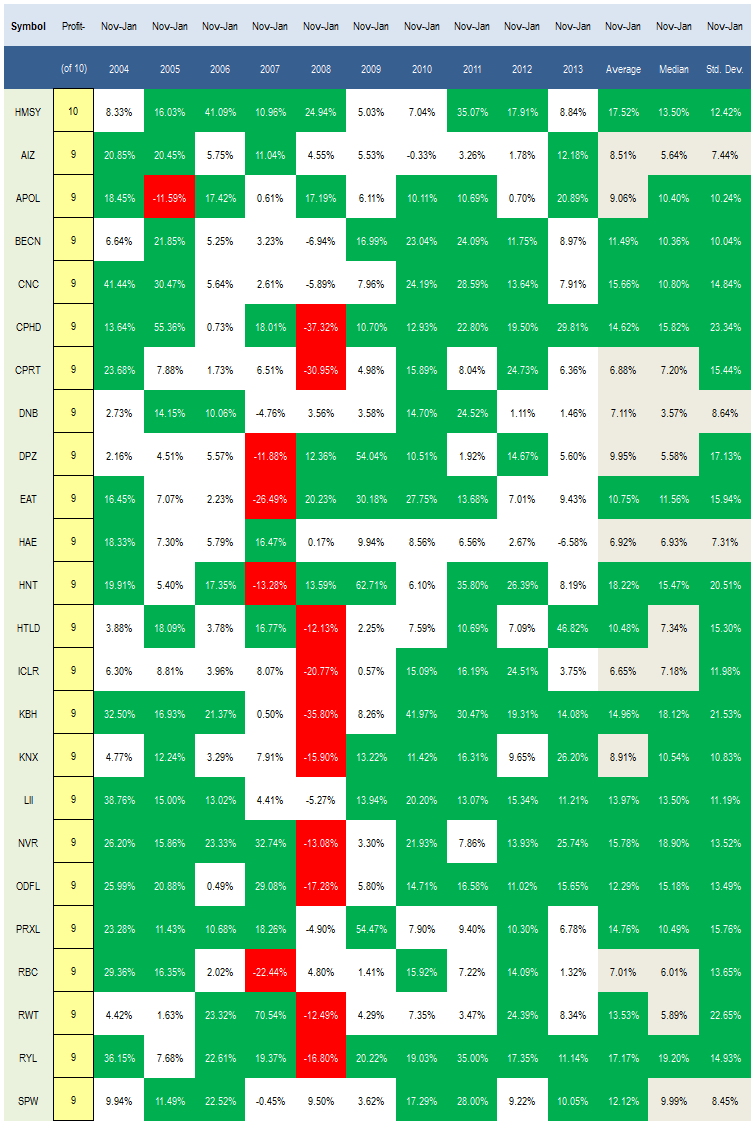

Trucking (ODFL, KNX, HTLD) is the top scoring mid cap industry. The ATA truck tonnage index remained at a record high in September for a second consecutive month. Tonnage is up 3.2% year-over-year in 2014. Ongoing commercial and industrial loan activity supports bank profits. In September, C&I loans held at commercial banks (OZRK, ASBC, FFIN, FHN, CYN, CATY) reached $1,732 billion, up from $1,676 billion in May. Business services (VPRT, MMS, GPN, HMSY, PRAA, HPY), technical & system software (CDNS, TYL), and investment brokers (GBL, MKTX, SF) round out our top mid cap industries.

In mid cap basics, buy synthetics (MTX, CMP) and industrial metals & minerals (ARLP). Business equipment (HNI, PAY) and processed & packaged goods (HAIN) score highest in consumer goods. The top financials baskets are regional banks, investment brokers, and accident & health insurance (AFL). In healthcare, focus on medical instruments (HRC, PODD, TFX, PKI, NUVA). Every mid cap industrials group is above average, led by residential construction (NVR, RYL) and industrial electrical equipment (RBC, AOS, BDC). Trucking, business services, and auto dealers (GPI, PAG) are best in services. The top technology industries are technical & system software, semi ICs (IRF), and business software (SSNC, PEGA, VRNT).

The following mid cap stocks offer the best seasonality for the three month period ending January.

Disclosure: None.