Mid Cap Best & Worst Report - December 2, 2015

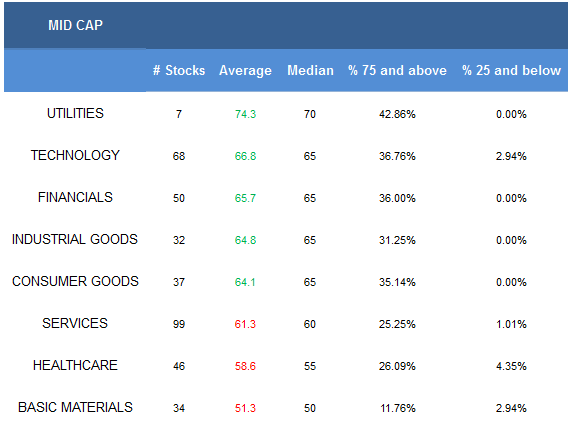

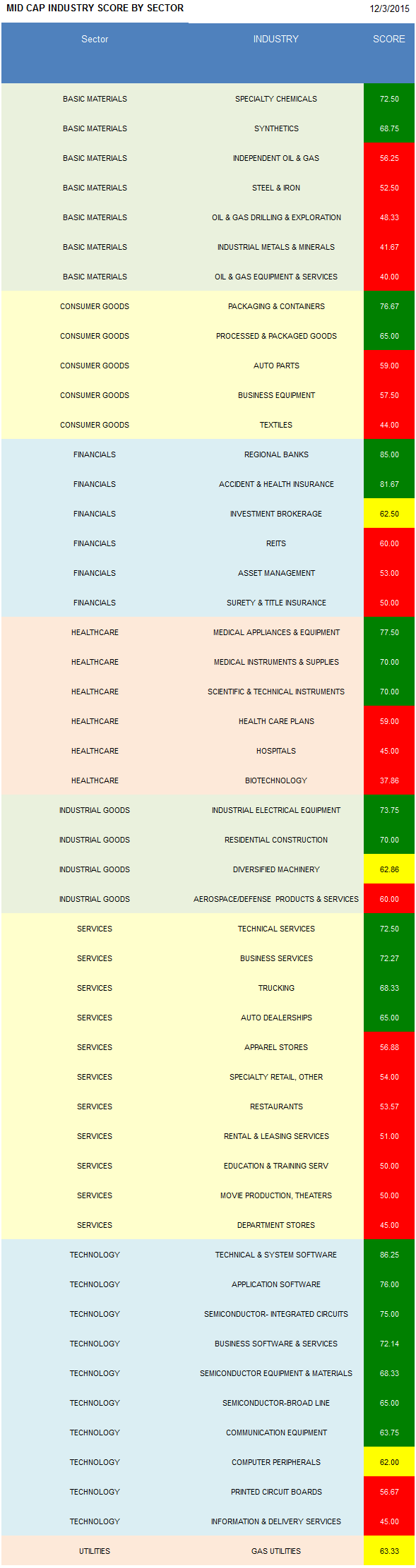

- The top mid cap sectors are utilities and technology.

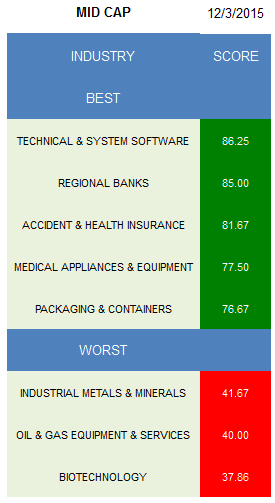

- Technical & system software is the best industry.

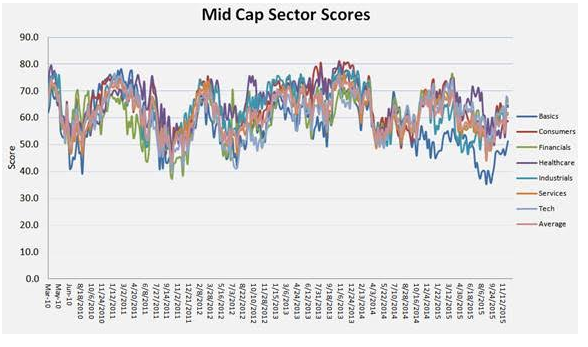

The average mid cap score is 62.45 and that's above the four week average score of 60.18. The average mid cap stock in our universe is trading -20.9% below its 52 week high, -2.04% below its 200 dma, has 6.47 days to cover held short, and is expected to grow its EPS by 15.3% in the coming year.

Utilities, technology, financials, industrial goods, and consumer goods score above average. Services, healthcare, and basics score below average.

(Click on image to enlarge)

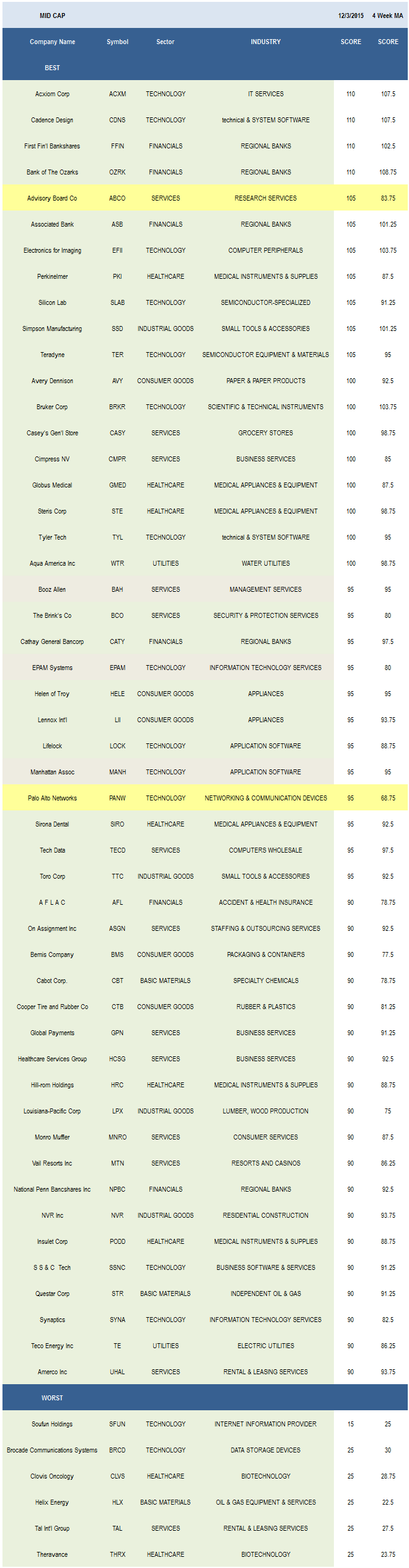

The top scoring mid cap industry is technical & system software (CDNS, TYL, ACIW). Regional banks (OZRK, FFIN, ASB, CATY, NPBC, FHN), accident & health insurance (AFL, CNO), medical appliances (STE, GMED, SIRO, MASI), and packaging & containers (BMS, TUP) can also be bought.

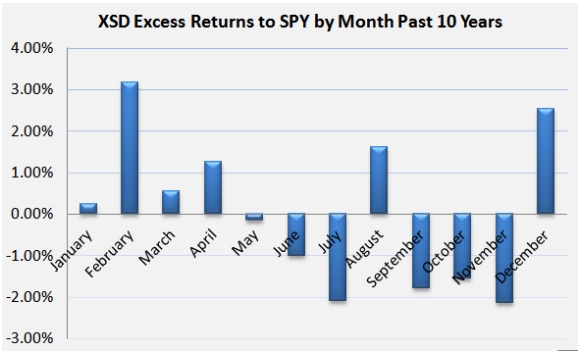

Specialty chemicals (CBT) and synthetics (CMP) are the only above average scoring basics baskets. Packaging & containers and processed & packaged foods (FLO, GIS) can be bought in consumer. The best financials industries are regional banks and accident & health insurance. Medical appliances and medical instruments (PKI, PODD, HRC) are top scoring across healthcare. In industrial goods, focus on industrial electrical (BDC, AOS) and residential construction (NVR). Technical services (CACI), business services (CMPR, HCSG, GPN, HPY, DLX), and trucking (ODFL, KNX) are top scoring in services. Focus on technical & system software, application software (MANH, LOCK, NUAN), and semi ICs (MSCC) in technology. Semi tailwinds typically return in December as the book-to-bill begins to lift and related stocks tend to put up market beating returns through April.Since its inception in 2006, the XSD has generated average excess return to the SPY in every month between December and April.

Disclosure: None.