Markets: Wild Hunts

The rhythm of markets is like the tides of the ocean. The waves mix against the seasons creates the illusion of progress as prices bounce back with Oil up 4%, global equities up nearly 2% and the USD down. This is the power of the Trump/Xi truce and the Russia/Saudi high five – both events are acts of faith – like the yuletide log burning long enough to see the days longer, hoping for just a bit more sun in the future to beat back the darkness of geopolitical chaos. We are in the wild hunt stage of risk where the bounce needs to beat back the down trends to convince us all this isn’t too much G20 food and drink. The risk is we see the other headlines from the weekend nag us back to reality:

- Spain’s PM Sanchez under pressure as Andalusia votes in a far-right party. The Socialists may lose control of the southern region after the center-right Ciudadanos party on Monday ruled out any coalition with them after an inconclusive election in which far-right Vox won 12 seats in the 109-seat parliament.

- France President Macron looks for a solutions to “yellow-vest” crisis. After the worst riots in Paris since 1968, the President and PM are trying to defuse further protests. The unrest is hitting the economy: hotel reservations are down, retailers are suffering, unsettling investors, and Total said some of its filling stations were running dry. PM Philippe plans to meet with some leaders of the movement Tuesday afternoon. The WSJ reports Macron is considering an emergency crackdown.

- UK PM May vows to still have the job in 2-weeks. “I will still have a job in two weeks’ time,” May said in an interview with ITV television when asked if she would quit if she lost the vote. “My job is making sure that we do what the public asked us to: we leave the EU but we do it in a way that’s good for them.” May also said there would be no changes to the Brexit plan she has hammered out with other EU leaders.

For many, the CNY is the currency barometer of choice as it captures the noise over trade but the oil story reflects most loudly in INR which is having a very bad day. The best correlation on the day maybe in the EUR, which captures the political risks listed above on one side and the hope for USD alternatives on the other. The EUR has a long way to bounce to prove this isn’t just a wild hunt. Watching 1.14 and 1.15 for verification of today’s yuletide mood being more than a dream.

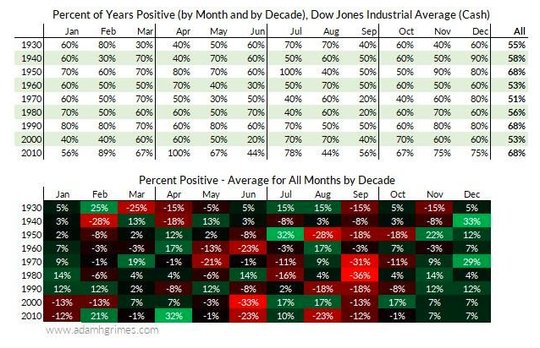

Question for the Day: Will this bounce hold? The drop in confidence in global growth has been blamed on US trade policy, US rate hike policy and politics globally. The role of higher energy prices in tightening profit margins and hitting consumers is also a factor but one that reversed in November. Many see today as the usual new month optimism wrapped up in a Christmas package for the year-end rally seasonals. The chart from adamgrimes.com is worth considering here.

The real economy still matters, however, and here is where the power of confidence shows up most clearly. The trends for business orders and production make for 2019 1Q growth. The central focus of weakness has been in Asia and today’s ASEAN manufacturing PMI rose to 50.4 from 49.8 – bouncing from 10-month lows. Output grew at June levels with 5 of the 7 nations improving. Employment remains weak and inflation slows after 4 months of gains. The key is that business confidence jumped to 6-month highs.

What Happened?

- Australia November AIG manufacturing PMI drops to 51.3 from 58.3 – worse than 56.6 expected – lowest since Oct 2017. Notable production fell 9.8 to 51.8, employment contracts by 3.2 to 49.4, new orders contract 10.1 to 48.7 and input prices rise by 2.2 to 75.By sector 5 of the 8 are still in expansion: chemicals rose 1.1 to 54.5, printing rose 4.6 to 67.6 and furniture rose 0.5 to 49.9 but wood/paper fell 3.6 to 56.8 and minerals fell 2 to 74.9.

- Australia 3Q corporate profits rise 1.9% q/q to A$90.22bn after 2.4% q/q – weaker than the 2.8% expected – weakest gain since 3Q 2017. Mining slowed to 3.4% from 5.2% and financials insurance 1.3% from 12.1%. Manufacturing slipped to -.51% after +1.7% q/q and retail trade -2% from +2.4%. The winners were real estate 3.1% from 2.3%, gas/electricity 7% from -2.7% and construction 9.7% from -2.8% q/q.

- New Zealand 3Q goods terms of trade -0.3% q/q after +0.4% q/q- as export prices rose 2.3% and import prices rose 2.6% even while volumes for exports rose 1.8% and imports fell 0.9%. Services terms of trade -4% q/q with export prices up 0.9% but import prices up 5.1%. Overall petroleum led the terms of trade shift even with mile prices up 6.5% and meat prices up 1.9%.

- Japan November final manufacturing PMI 52.2 from 52.9 – better than 51.8 flash – still lowest since Aug 2017. New orders are the lowest gain in 2-years and business confidence drops for the 6th month. Input cost pressures from fuel, steel and food cited – keeping index near 91-month highs.

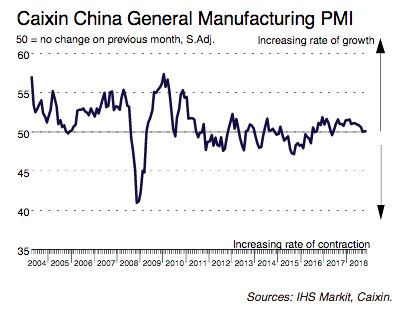

- China November Caixin manufacturing PMI 50.2 from 50.1 – better than 50.0 expected. New orders increased marginally, but export orders fell further – down for 8th month. Inflation eased to 7-month lows, employment fell, inventories climbed. Modest sales and stricter environmental rules kept production unchanged. Confidence stays near 11-month lows.

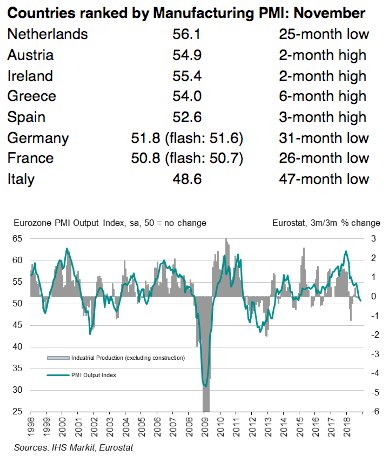

Eurozone November manufacturing final PMI 51.8 from 52.0 – better than 51.5 – still weakest since Aug 2016. Growth of production was still marginal at 5 ½ year lows with demand faltering as orders contracted for second month. Business confidence stays near 6-year lows with trade and political worries cited.

- Spain manufacturing PMI 52.6 from 51.8 – better than 51.6 expected – best in 3 months. Output and new orders rose linked to domestic demand. Business expectations lowest since June 2013.

- Italy manufacturing PMI 48.6 from 49.2 – weaker than 48.8 expected – worst since Apr 2013. Business confidence weakest since May 2013. Input prices at 16-month lows.

- France manufacturing final PMI 50.8 from 51.2 – better than 50.7 flash – weakest since Sep 2016. New orders contract – first time in 26-months

- German manufacturing final PMI 51.8 from 52.2 – better than 51.6 flash – still 31-month lows. Output prices dip to 16-month lows.

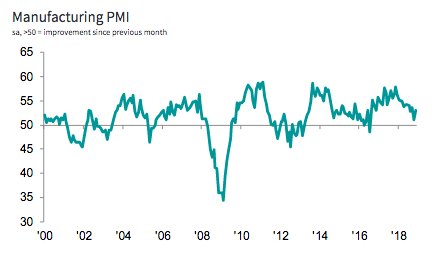

- UK November manufacturing PMI 53.1 from 51.1 – better than 51.5 expected – 2 month high after 27-month lows. Domestic demand linked to new product launches and stock building. Exports fell again with Brexit worries ongoing. Confidence fell to 27-month lows but was still positive with 46% seeing higher output and 10% lower.

Market Recap:

Equities: The S&P500 futures are up 1.7% after a 0.82% gain Friday. The Stoxx Europe 600 is up 1.6% - best in 3 weeks – lead by autos and miners. The MSCI Asia Pacific Index rose 1.6% while the EM index rose 2% - best in 2 months.

- Japan Nikkei up 1.00% to 22,574.76

- Korea Kospi up 1.67% to 2,131.93

- Hong Kong Hang Seng up 2.55% to 27,182.04

- China Shanghai Composite up 2.57% to 2,654.80

- Australia ASX up 1.86% to 5,856.30

- India NSE50 up 0.06% to 10,883.75

- UK FTSE so far up 2.15% to 7,129

- German DAX so far up 2.45% to 11,532

- French CAC40 so far up 1.50% to 5,078

- Italian FTSE so far up 2.0% to 19,570

Fixed Income: Italy gains on hopes for a deal while risk-on mood in equities and oil drives core bonds lower. UK Gilts focus on Brexit still – 10Y Gilt yields off 2bps to 1.34% while German Bunds up 0.7bps to 0.32% and French OATs up 1.5bps to 0.695% on yellow-vest crisis. The Italy BTPs off 5.5bps to 3.15%, Spain off 0.5bps to 1.49%, Portugal off 2bps to 1.80% and Greece off 6bps to 4.17%.

- US Bonds sold off with equities leading – Clarida comments – 2Y up 4.9bps to 2.835%, 5Y up 5.7bps to 2.87%, 10Y up 4.5bps to 3.033%, 30Y up 3.4bps to 3.324%.

- Japan JGBs hold bid despite equity bounce – BOJ leaves buying amounts unchanged. 1-3Y bond cover fell to 2.43 – lowest since Nov 2017 while the 3-5Y cover slips to 1.63 – lowest since Sep 2017. Set up for tomorrow’s 10Y sale now key. 2Y off 0.4bps to -0.14%, 5Y off 0.7bps to -0.117%, 10Y off 0.8bps to 0.073%, 30Y off 0.1bps to 0.802%

- Korea sells 600mn of 5Y 2.25% bonds at 1.98% with 2.883 cover –previously 2.095% with 2.963 cover.

- Australian bonds track US move – ignore weaker PMI – 3Y up 1bps to 2.015%, 10Y up 2.5bps to 2.61%.

- China bonds extend rally, curve steeper. 2Y off 9bps to 2.66%, 5Y off 3.5bps to 3.10%, 10Y flat at 3.36%.

Foreign Exchange: The US dollar index off 0.15% to 97.12 with 96.71-97.16 range. USD mostly offered in emerging markets – EMEA: ZAR up 1.4% to 13.675, TRY off 0.45% to 5.2360, RUB up 0.6% to 66.645; ASIA: KRW up 0.9% to 1110.25, TWD up 0.3% to 30.71, iNR off 1.25% to 70.457.

- EUR: 1.1335 up 0.15%. Range 1.1319-1.1380 with focus on Italy and France vs. US rates. 1.1320-1.1400 keys.

- JPY: 113.60 flat. Range 113.38-113.85 with EUR/JPY 129.75 up 0.25% - risk on but USD flat watching 114 again

- GBP: 1.2720 off 0.2%. Range 1.2708-1.2825 with EUR/GBP .8910 up 0.4% - all about Brexit fears with 1.27 pivot for 1.2550 in play.

- AUD: .7370 up 0.9%. Range .7348-.7393 – all about US/China and trade hopes with commodities leading .7450 next. NZD .6915 up 0.65% - same but terms of trade issues.

- CAD: 1.3195 off 0.75%. Range 1.3160-1.3268 with oil leading, but BOC key this week and 1.3150 important pivot.

- CHF: .9985 up 0.1%. Range .9965-.9998 with EUR/CHF 1.1320 up 0.15% - all about risk with Italy and China stories driving.

- CNY: 6.9431 fixed 0.11% weaker, trades up 1% to 6.8890 with range 6.8795-6.9370.

Commodities: Oil up, Gold up, Copper up 1.15% to $2.8580

- Oil: $53.12 up 4.3%.Range $52.03-$53.85 with focus on OPEC Thursday, break of $52 opens $55 next. Brent up 3.8% to $61.70 with $62 and $63.60 next.

- Gold: $1228.50 up 0.65%.Range $1221.50-$1231.50 with focus on USD and risk-on mood - $1225 minor base for $1236 retests. Silver up 1.2% to $14.38 with $14.50 key. Platinum up 1.25% to $808 and Palladium up 1.6% to $1199.75.

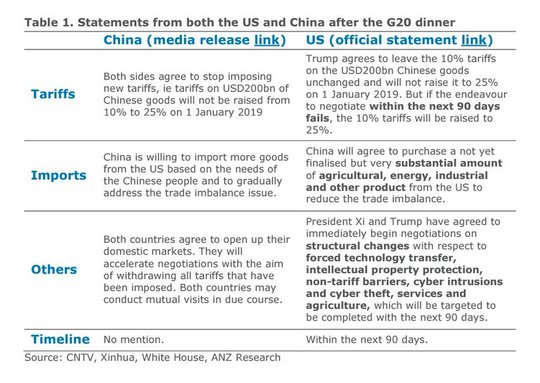

Conclusions: Can the US and China find a deal in 3-months? The US press coverage of the Trump/Xi deal is complicated. There is a cynical view that this is a truce that will fall apart. There is a hope that some progress can be made but few see it resolved in the time-line laid out. The biggest fear is that both China and the US rushed to save face but talked past each other with no real interest in resolution of their differences.

This is how the FT puts it – “In exchange for the US not imposing higher tariffs on about half of Chinese exports from January 1, Beijing has agreed to discuss a long list of concessions that would, if fully implemented, fundamentally alter the very nature of the Chinese system.”

Economic Calendar:

- 0930 am Canada Nov manufacturing PMI 53.9p

- 0945 am US Nov manufacturing final PMI 55.4 flash

- 1000 am US Nov ISM manufacturing 57.7p 57.8e

- 1000 am US Oct construction spending 0%p 0.4%e

- 1030 am Fed Brainard Speech

- 0100 pm Dallas Fed Kaplan Speech

- 0330 pm US Nov total vehicle sales 17.57mn p 17.30mn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.