Markets Weaken With Russell 2000 Leading Lower

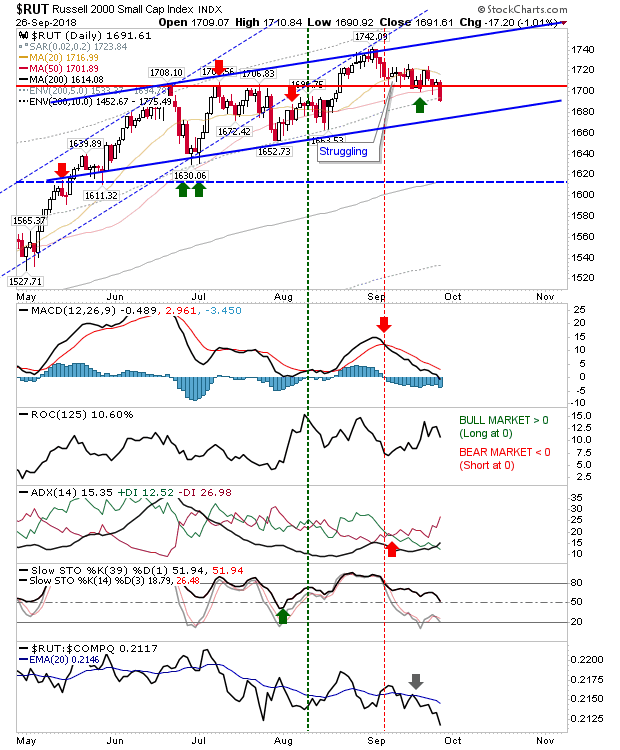

That one-day bounce in the Russell 2000 last week is looking like a long time ago as today finished with a cut below its 50-day MA. Technicals are fading fast as relative performance begun a cliff fall. While other indices haven't shown this same level of weakness it's a worrying start as Small Caps typically lead. The slower channel remains intact so it's not a full on reversal yet.

The Nasdaq 100 started brightly and looked to have generated a solid move to challenge its bull trap before sellers pushed it back to its starting point - leaving a 'gravestone doji'. While the Russell 2000 struggled the weak finish for the Nasdaq 100 wasn't enough to register as a support break.

The Nasdaq had already lost support prior to today but there was no acceleration to the downside.

The S&P left another 'bull trap' in its wake but didn't give up (newer) channel support; it's still a long way from the long-standing summer channel - illustrated by the thin blue line.

For tomorrow, keep an eye on the Russell 2000. It looks like it wants to lead lower and this will be bad news for other indices. If there is to be a bullish surge then the Nasdaq 100 will be the index most likely to lead out.