Markets: Uneven

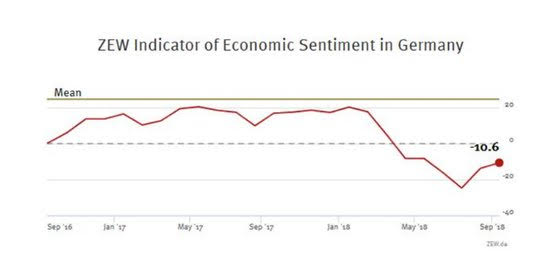

Driving requires a good road and a good operator. Trading requires a good market and balanced risk-takers. There is an interesting divergence in moods for business and consumers around the world. The compare and contrast clearly helps to explain why the USD, US rates and US stock market has a different momentum and trajectory for now, but for how long. The better moods in the US reflect the better economy and better profits, however, we all know that markets trade on future expectations not present ones. The balancing act is when the rest of the world matters. Overnight there was little economic data in Asia other than Australia business confidence – with the mood there at 2-year lows – lower because of trade and politics at home. The data in Europe was less with French employment lower in 2Q, UK jobs also showed a bit of wobble with claimant count higher and wages higher – labor costs going up mean BOE will be on watch later this week. But the balancing act against this was the German ZEW where moods are improving as well. So here is the see-saw going into the US open:

- Less Fear – NAFTA talks resume, EU talks with US on trade progress, US Republicans push for more tax cuts, North Korea Kim and US Trump set up plans for another meeting, EU Barnier says its realistic for a Brexit deal in 6-8 weeks.

- More Fear – The NYT reports China faces sanctions from US over Uighur re-educations camps, WSJ highlights focus on Indonesia as next domino risk in EM. Hurricane Florence is going to disrupt US East Coast – worst storm to hit mid-Atlantic since 1989. China takes US to WTO

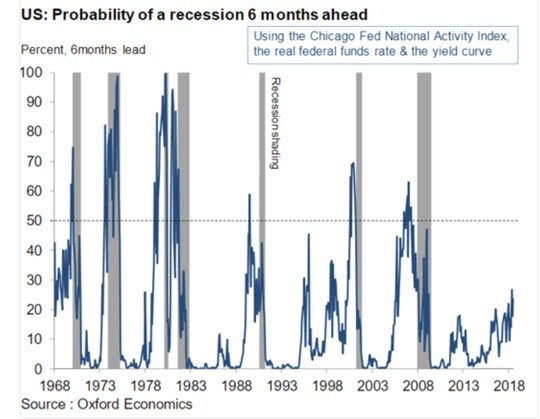

The biggest question is about how the data in the week may change reaction functions of the Fed, ECB, and BOE and whether the risk of growth is best understood by the mood or the actual forward-looking data. The chart to consider is using the Chicago National US activity index and its telling us that there is a 1 in 4 chance for a recession.

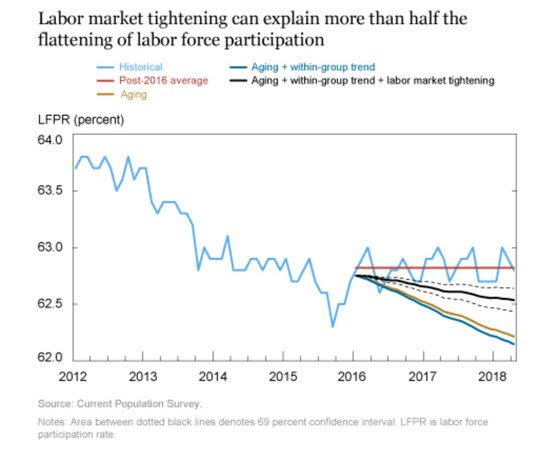

Question for the Day: Can growth break away from demographics? The long-term arguments for Emerging Markets has always rested on the better growth story. This links up to demographics – India, Indonesia, Africa in general, Brazil – all, in general, are seen as in the sweet spot of demographics in the next 10 years and so likely to outperform on growth. The present pain trades in that list is notable. The compare and contrast to the present US situation is important and one that is behind the FOMC decisions ahead. The NY FED Liberty Street Blog has an important read on this debate and one that has a chart worth considering, putting into someplace the path of labor tightening and its limits on wages and growth.

What Happened?

- Australia July NAB business confidence 4 from 7 – weaker than 5 expected and 2-year lows - but conditions index bounces to 15 from 13 as expected. Retail was the sole sector with negative conditions. Forward orders bounce to 5 from 2. Profitability rises to 16 from 10.

- French 2Q Payrolls 0% q/q after +0.2% - weaker than 0.2% expected. 1Q revised up to 47,500 from 46,000 while 2Q estimated at +12,500 – statistically 0%.

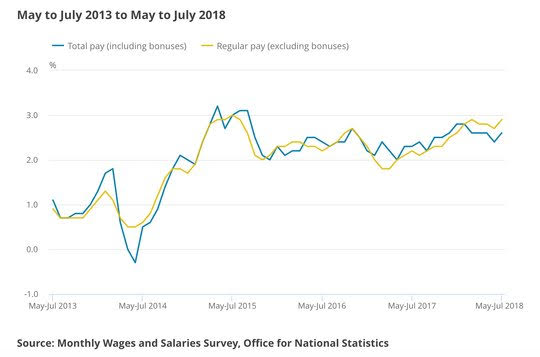

- UK August claimant count jobless rose 8,700 after revised 10,200 – worse than -5,000 expected. Total August Earnings 2.6% from 2.4% - more than 2.5% expected. The regular ex-bonus also higher at 2.9% from 2.7% y/y – more than the 2.8% y/y expected. The ILO 3M July unemployment steady at 4.0%. pickup in nominal and ex-bonus wages was led by strong growth on a single-month basis over the month of July, flattered by weak growth in the same month a year ago. Employment grew by its lowest level since the three months to October of 2017. Furthermore, the inactivity count picked up by a considerable 108k over the 3m to Jul, pushing the rate up 0.3pp to 21.2%, explained by more not wanting a job and declaring themselves long-term sick. Vacancies, however, were up 14k 3m/3m to a new series-high 833,000.

- German September ZEW current conditions 76 from 72.6 – better than 72 expected. The economic sentiment improved to -10.6 from -13.7 – also better than -12.7 expected. “During the survey period, the currency crises in Turkey and Argentina intensified, while German industrial production and incoming orders were surprisingly low in July. Despite these unfavorable circumstances, economic expectations for Germany improved slightly. The considerable fears displayed by the survey participants regarding the economic development have diminished somewhat, which may in part be attributable to the new trade agreement between the USA and Mexico,” noted ZEW President Professor Achim Wambach.

- Eurozone 2Q employment 0.4% q/q, 1.5% y/y after 0.4% q/q, 1.5% y/y – as expected. 1Q annual rate revised from 1.4% y/y.

Market Recap:

Equities: The US S&P500 futures are off 0.2% after a 0.19% gain yesterday. The Stoxx Europe 600 fell 0.45% after opening up 0.1%. The MSCI Asia Pacific fell 0.2% with Japan and Australia up but rest of region down with FX and trade focus key.

- Japan Nikkei up 1.3% to 22,664.60

- Korea Kospi off 0.24% to 2,282.20

- Hong Kong Hang Seng off 0.72% to 26,422.55

- China Shanghai Composite off 0.18% to 2664.80

- Australia ASX up 0.61% to 6.287.60

- India NSE50 off 1.38% to 11,280.65

- UK FTSE so far off 0.65% to 7,232

- German DAX so far off 0.7% to 11,901

- French CAC40 so far off 0.2% to 3,662

- Italian FTSE so far off 0.6% to 20,793

Fixed Income: Supply focus for the week continues – trading ahead of ECB still constrained with Italy still the main mover. German 10-year Bund yields up 1bps to 0.41% - ZEW key driver in the morning. The Italian BTP off 1bps to 2.90% with a test of 2.85% failing.

- The Dutch DTSA sold E0.875bn of 20Y Jan 2037 4% DSL at 0.85% - upper end of size expected.

- Spain syndicates a new 15-year Nov 2033 benchmark bond with IOI over E13bn, MS 137bps over July 2033. Most expect E3.5bn issue.

- Spain sold E4.5bn of 6M and 12M bills as expected – E370.1mn of 6M Mar 2019 Letra at -0.425% with 7.6 cover and E4.175bn of new 12M Sep 2019 Letra at -0.372% with 1.67 cover.

- US Bonds holding into supply – 10Y rates up 2bps to 2.95%.

- Japan JGB bid after solid 30-year auction – MOF sold Y578.9bn of 30Y bonds at 0.838% with 4.231 cover – previously 0.85% with 4.679 cover. 10Y fell 0.5bps to 0.115% back to flat at close

- Australian bonds back to flat after supply – issuance from South Australia Financing, NSW Tcorp absorbed. 10Y flat at 2.58%.

- China PBOC skips open market operations for 15th day – no change to liquidity. There are no reverse repos maturing this week. 10Y bond yields up 3bps to 3.687%.

Foreign Exchange: The US dollar index off 0.1% to 95.12 with focus on 94.95-94.55.

- EUR: 1.1605 up 0.1%. The EUR failure in early Europe means focus on US data and risk of 1.1550 again.

- JPY: 111.35 up 0.25%. EUR/JPY 129.25 up 0.3%. Nothing to see here? 110.70-111.80 key.

- GBP: 1.3035 up 0.05%. EUR/GBP .8905 flat. Better Brexit hopes mean 1.3050 and 1.3100 in play.

- AUD: .7105 off 0.15%. NZD .6520 off 0.1%. A$ wobbles with .7050-.7200 consolidation.

- CAD: 1.3155 flat. Waiting for NAFTA and more data.

- CHF: .9710 off 0.1%. EUR/CHF 1.1300 flat. Less Italy and EM fears.

- CNY: 6.8488 fixed 0.16% weaker from 6.8389, trades off 0.15% to 6.8655.

Commodities: Oil up, Gold off, Copper off 0.45% to $2.6580.

- Oil: $67.75 up 0.3%. Range $67.51-$67.92. WTI watching $66 support against $71.40 Sep 4 highs. Brent $77.94 up 0.6% - watching $79.72 Sep 4 highs against 55-day at $75.08.

- Gold: $1194 off 0.15%. Range $1192.50-$1201. Gold watching $1214.4 Aug 28 highs against $1183.2 Aug 24 lows. Silver $14.09 off 0.5% with $14.55 resistance holding against $13.984 Aug 26 lows.

Conclusions: Markets are geared up for change. The risk is that today it just doesn’t happen. The power of central bankers is in play this week and their ability to maintain financial stability is clearly in play against global politics. If we learned anything about value vs. growth outside of equities – think Sweden. The tied election, the negative rates, and the Riksbank willingness to wait have left the SEK the anomaly. Value is not the driver – fear and doubt about money flows remaining negative drive. Lessons are obvious for both the USD, EUR, and GBP in the days ahead.

Economic Calendar:

- 0600 am US August NFIB small business optimism 107.9p 105e

- 0815 am Canada Aug housing starts 206.3k p 210k e

- 1000 am US July JOLTS job openings 6.662m p 6.646m e

- 1000 am US July wholesale inventories 0.1%p 0.3%e

- 0100 pm US Treasury sells 3Y notes

- 0430 pm US weekly API inventories -1.2mb p +0.15mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.