Markets: Two-Sided

Tails I win, heads you lose? Hopes for an easy Monday for risk in perhaps the quietest week for economic news this summer have been dashed with the two-sided coin of FX. Is this USD strength or foreign weakness? The drivers of USD support are the FOMC rate hike path – 4 in 2018, 2-3 more in 2019 – driving the rate spreads above much of the world (including EM). The US stock market earnings in 2Q and its ability to shrug off trade drama also stands out. Trade war themes have been USD supportive and global risk negative. Over the weekend, Trump tweeted” “Tariffs are working big time,” and in a rally Saturday, said China was “doing poorly against us” and tariffs “are really hurting their economy.” The bigger stories overnight are about rates, growth and politics driving the USD:

- CNY drops to May 2017 lows – despite PBOC Friday action to raise cost of forwards, options and swaps – CNY fell 0.2% on the day to 6.8425 reversing from early gains of 0.45%. The 1-year swap rate drops to 2.62% below the US rate for the first time since 2009.

- GBP at 11-month lows after UK. International Trade Secretary Liam Fox told the Sunday Times that a no-deal Brexit is now more likely than not at 60% chance. Brexit hopes remain in play, however, as the FT reports, The EU may soften Irish backstop powers to avoid a no-deal Brexit including potential revisions like giving the European Court of Justice only indirect authority over Northern Ireland.

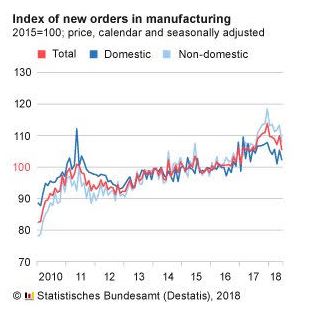

- EUR on worst losing streak since May – back to 1.1510 June 21 and May 29 lows – after German factory orders fall 4% m/m. The good news about Italy FM Tria with soothing comments post a budget meeting were lost but BTPs did have some relief.

- CAD back lower over 1.30 after Saudi Arabia halted new trade and investment dealings with Canada in an escalation of a dispute over the kingdom’s arrest of a women’s rights activist

The risk connection of USD to stocks remains in flux with the CNY not working outside of Asia but the EUR and GBP seem to also be losing their correlations.The breakdown of GBP looks important today and worth watching for larger moves and more knock-on effects like FTSE up, EUR lower. Watching 1.30 as the pivot with 1.3090 for upside against 1.2750 bear target.

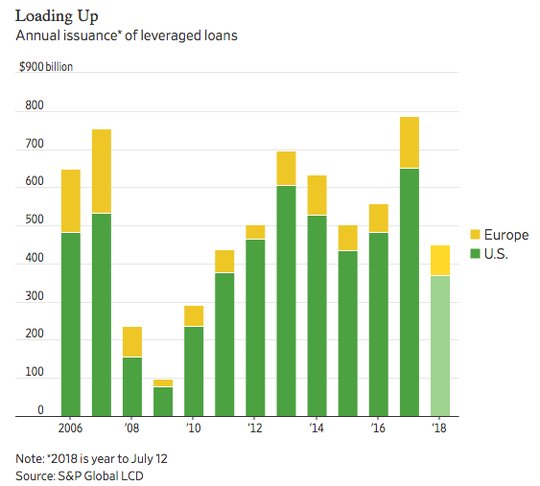

Question for the Day: Are leveraged loans suggesting FOMC tightening matters? The rising yields in new leveraged debt is worth considering with some suggesting this is an early warning signal about liquidity retreating from low-quality debt. The drop in standards (cov-lite) has been well discussed but the supply onslaught thanks to central bank buying (read as the ECB and others) has been offsetting fear. This maybe changing and given the US rate focus this week thanks to the supply of bills and 3-10-30Y debt its going to be more important.

What Happened?

- German June Manufacturing Orders -4% m/m, -0.8% y/y after +2.6% m/m, +4.7% y/y – weaker than -0.2% m/m expected. The domestic orders -2.8% m/m, foreign orders -4.7% m/m with Eurozone -2.7% m/m and outside EU -5.9% m/m. By type orders fell across the board: Capital goods -4.7% m/mm, consumer goods -4.5% m/mm, basic goods -2.3% m/m. Turnover -1% m/m after +0.9% m/m.

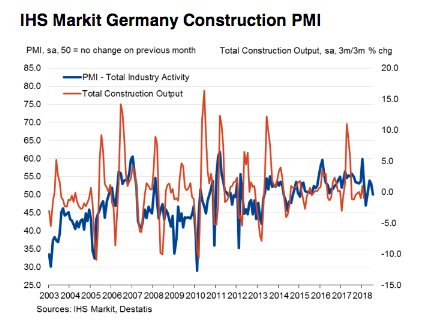

- German July Construction PMI falls to 50 from 53 – lowest in 4-months. The result is also below the 6-month average of 52.9. Marginal rise in new orders with sharp rise in purchasing costs – linked in part to toll roads.Growth in housing and commercial activity offset by downturn in civil engineering work.

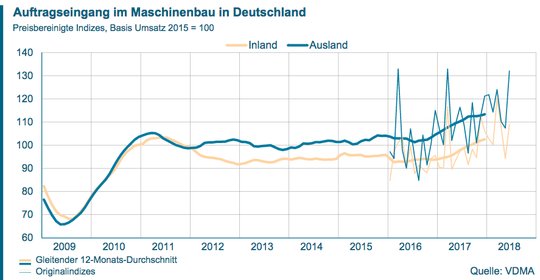

- German June VDMA total machine orders up 13% y/y.Domestic orders up 12% y/y, foreign orders up 13% y/y. Orders from outside the EU rose +16% while inside EU was 7%. The 3M rolling average rises to 8% y/y with 11% y/y domestic and 7% abroad.

- Eurozone August Sentix Investor Confidence rises to 14.7 from 12.1 – trade worries diminish. Investors reward the signs of relief in the EU's trade dispute with the US. This also benefits the data for Germany, where the overall index rose by 4.2 points. Overall, the robust condition of the situation values is surprising, especially for the USA, where we are measuring an all-time high. It seems that investors have become particularly aware this month that the global economy is in much better shape than they feared three months ago. Accordingly, investors no longer expected a turnaround, but only saw a cooling off.

Market Recap:

Equities: US S&P500 futures are up 0.09%.The Stoxx Europe 600 is up 0.5% with Italy leading while the MSCI Asia Pacific lags with US/China focus – China early rally reversed.

- Japan Nikkei off 0.08% to 22,507.32

- Korea Kospi off 0.05% to 2,286.50

- Hong Kong Hang Seng up 0.52% to 27,819.56

- China Shanghai Composite off 1.26% to 2,705.84

- Australia ASX up 0.52% to 6,359.00

- India NSE50 up 0.23% to 11,387.10

- UK FTSE so far up 0.2% to 7,674

- German DAX so far up 0.3% to 12,653

- French CAC40 so far up 0.2% to 5,493

- Italian FTSE so far up 0.45% to 23,938

Fixed Income: Focus is still on US/China trade and risk mood but US auctions and Italy finance remain bearish backdrops. The Italian Treasury announced after European trading hours on Friday that it had bought back €950m of government debt with maturities of between two and four years. It did not state a reason — in previous buybacks it said it was putting spare cash to work – but this looks different. Since May, Italy has bought over E2bn in debt back. EU bonds open quietly with German Bunds seeing bull flattening on weaker factory orders.10Y Bund yields off 1bps to 0.40%, French OATs off 2bps to 0.72%, UK Gilts off 2bps to 1.31%.Periphery rallied - Italy off 3bps to 2.90%, Spain off 2bps to 1.40%, Portugal off 2bps to 1.76%, Greece off 3bps to 4.08%.

- The Dutch sold E1.97bn of 6M Jan 2019 DTC at -0.64% with 1.48 cover – previously -0.65% with 1.48 cover.

- US Bonds mixed into big supply and more data – 2Y up 0.6bps to 2.636%, 10Y flat at 2.95%.

- Japan JGBs trade in narrow range with US/China trade focus – 10Y flat at 0.105%, 20Y off 0.5bps to 0.615% - long end of curve focus but supported with 30Y sale Thursday key.

- Australian bonds closed for cash – futures slightly bid. Sydney holiday.

- China PBOC skips open market operations, leaves liquidity neutral. There are no reverse repos maturing this week. Monday market rates fell with O/N off 3bps to 1.78% and 7-day off 5bps to 2.33%. 1Y swap rates fell 6bps to 2.62% - near Oct 2016 lows – while 10Y bond yields rose 1bps to 3.47%.

Foreign Exchange: The US dollar index is up 0.3% to 95.42 with 95.53 and 95.65 next resistance. In Asia EM FX, USD mostly lower – KRW up 0.35% to 1124 reflecting CNY Friday move, TWD up 0.25% to 30.63, INR off 0.25% to 68.79. Notable IDR up 0.1% to 14,480 with earthquake offset by GDP 5.27% in 2Q from 5.06% - better than 5.12% expected. In EMEA, USD bid – RUB off 0.55% to 63.645, ZAR off 0.65% to 13.40, TRY

- EUR: 1.1550 off 0.15%. Range 1.1542-1.1580 with focus on 1.1510 next and then 1.1450. Italy, Germany politics, rate spreads, growth doubts.

- JPY: 111.45 up 0.2%. Range with EUR/JPY 128.65 flat. Key support is 200-day at 110.03 against 112.20 resistance. Dead calm with focus on stocks and risk mood – rates, Abe uptick in polls helping.

- GBP: 1.2945 off 0.4%. Range 1.2930-1.3010 with EUR/GBP .8920 up 0.3%. All about Brexit with 1.2950 break opening 1.2750 next.

- AUD: .7390 off 0.1%. Range .7380-.7410 with NZD .6735 flat. China, RBA talk of lowering inflation target in SOMP and metals driving. .7340-.7420 key. NZD waiting for milk auction, more data, RBNZ.

- CAD: 1.3015 up 0.25%. Range 1.2988-1.3025 with Saudi story one factor countering BOC hike in Sept with Friday jobs key vs. US rates, oil. 1.2880 vs. 1.3050 guideposts.

- CHF: .9970 up 0.30%. Range .9940-.9971with EUR/CHF 1.1510 up 0.15%. Tracking EUR and liking better Italy story with $1.00 pivot

- CNY: 6.8513 fixed 0.28% weaker – lowest since May 2017 - from 6.8322, trades off 0.2% to 6.8425 was up early 0.45%. CNH off 0.2% to 6.8590. CFETS RMB index off 0.32% to 92.39 – back to May 2017 lows.

Commodities: Oil up, Gold lower, Copper off 1.7% to $2.7570.

- Oil: $69.50 up 1.5%. Range $68.50-$69.55 with Brent up 1.2% to $74.03. WTI watching $70.43 July 30 highs for upside momentum against $67.87 Friday lows. Brent watching $75.25 55-day for real upside movement.

- Gold: $1210 off 0.35%. Range $1209.50-$1215.50. USD driving with $1204.6 base against $1220 Friday highs. Silver flat at $15.41 – watching $15.248 Friday lows against $15.554 Friday highs, Platinum off 0.6% to $830.30, Palladium off 0.7% to $902.00.

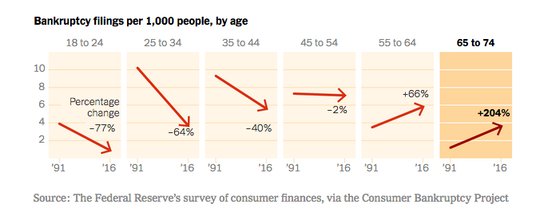

Conclusions: Does the NYT bankruptcy story matter? The rise in bankruptcy in the US for retired people seems to strike at the heart of the US social security problem and risks as the baby boomers grow and the budget risks follow. If you haven’t read this story – its worth it given the US borrowing over $250bn this week.

Economic Calendar:

- 1130 am US sells 3M $51bn and 6M bills $45bn

- 0200 pm US Fed Senior Loan Officer Survey (Due this week)

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

Good stuff.