Markets: Throttled

We all know the euphoria of speed, racing fast with no fear, dashed with the throttle back as the joy-killer, the brake back to reality, forced usually by some mechanical limitation rather than some regard for the actual speed limit. The balancing act of rates against equities is back in play today, as the gridlock joy of the US election fails to sustain with debt markets everywhere waiting for the FOMC decision. While few expect anything today, most see a December hike and the meeting statement remains important as to guiding views for 2-3 hikes for 2019. The throttle back of growth in the US follows with less government spending, higher rates and ongoing fears about trade wars with China lingering. The mid-term certainty isn’t sufficient. There was a significant amount of overnight news to digest and that adds to the view that the bounce back in risk is more a correction than a new trend.

- RBNZ rate cut hopes are dwindling after decision and statement – keeps NZD bid

- Australia Payne and China Wang meeting make clear US/China relations still key for AUD

- China trade surplus shows big imports ahead of tariffs – and less metals and oil

- Japan Ecowatchers index bounces with government spending on natural disasters but Reuters Tankan weaker, core machinery orders lower and BOJ summary of opinions adds to BOJ policy tweaking fears for 2019. Leaves JPY watching 114 expiries but no momentum

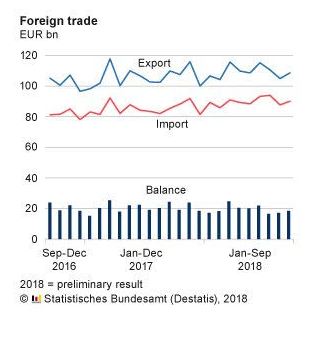

- German trade surplus shows less exports and more doubts about overseas demand

- ECB Bulletin keeps expansion talk and QE end path despite seeing higher uncertainty and lower growth.

- Italy hit with EU commission growth outlook cuts – BTPs suffer on budget doubts that follow

While each one of these points is hardly enough to turn markets, the total effect mixed with US natural doubts about the election meaning make the reversal of mood more like a throttle back – as the speed of change and news needs to moderate, like that of the USD selling from yesterday, today’s buying throttles the downtrend talkers – and with it hope for a simple, low-volatility leap higher in risk.

Question for the Day:Are the EU commissions the key for the day? The FOMC meeting maybe on the agenda, but the price action so far is about growth outlooks dropping for 2019. The pain trade for Italy returns as the growth hopes dwindle – this isn’t that different than the US where higher growth is used to push up hopes for cutting the deficit.

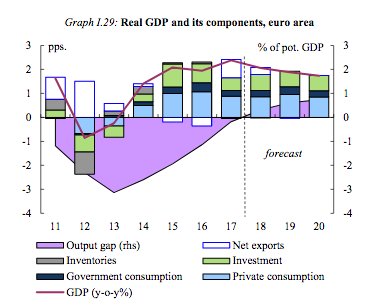

The EU commissions forecast headline says it all – less dynamic growth amid high uncertainty. The commission argues that European growth peaked last year. “From 2.4% in 2017, euro area GDP growth is forecast to moderate to 2.1% this year and 1.9% in 2019, slightly below the growth rate projected back in the summer. It is then expected to ease smoothly to 1.7% in 2020.” Blame for much of the uncertainty is put on the US trade policy and on the US risk of overheating and a FOMC policy mistake.

The key for Europe, and perhaps for the world, is the shift in dependence on trade to one of domestic demand for being the key driver for growth. This puts many back to demographic and productivity analysis for where to put their money in the medium and long-term. The EU commission makes clear that growth is going to be home-grown and this puts the Italian budget efforts at loggerheads with the mechnical limits set on debt.

What Happened?

- RBNZ leaves cash rate unchanged at 1.75% -as expected – sees next move as data-dependent but expects steady policy through 2019 and into 2020. “There are both upside and downside risks to our growth and inflation projections. As always, the timing and direction of any future OCR move remains data dependent,” RBNZ Governor Orr noted in the statement following the decision. He downplayed the 2Q GDP gains, noting: “The pick-up in GDP growth in the June quarter was partly due to temporary factors, and business surveys continue to suggest growth will be soft in the near term. Employment is around its maximum sustainable level. However, core consumer price inflation remains below our 2 percent target mid-point, necessitating continued supportive monetary policy.”

- Japan November Reuters Tankan 26 from 28 – hit on trade war fears, geopolitical troubles. Manufacturing sentiment dragged lower by precision machinery and chemicals makers. The February outlook drops to 24. The Service-sector survey rebounded to 30 from 24 – bouncing from 2-year lows led by retailers and transport on recovery from natural disasters. The outlook for February rises to 32.

- Japan October EcoWatchers survey – current condition jump to 49.5 from 48.6 – better than 48.9 expected. The expectations fell to 50.6 from 51.3. Households improved current conditions to 48.9 from 47.1 while businesses slipped to 49.7 from 50.5. Employment also moderated to 53.2 from 54.

- Japan September C/A surplus narrows -6.6% to Y1.334trn after -3.8% to Y1.428.8trn. The trade balance flipped to deficit –Y159.4bn after Y34.2 surplus.

- Japan BOJ Summary of Opinions from Oct 30-31 meeting: Sees need to continue highly accommodative financial conditions. There was clearly debate over the October stock market drop as the summary notes: “Some argue that the recent fall in stock prices reflects projections for possible losses resulting from the trade friction between the United States and China, but its effects are not clear yet.” Also some in market focused on push for more flexible bond buying comments.

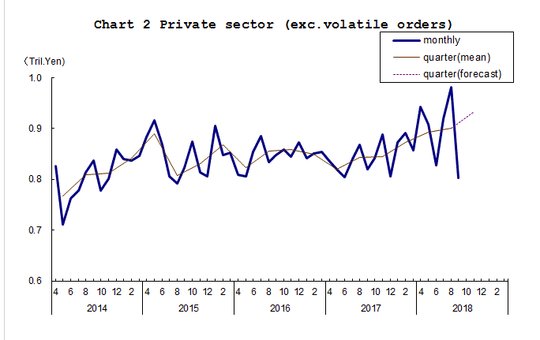

- Japan September core machinery orders drop 18.3% m/m after +6.8% - weaker than -10% m/m expected, However, for the 3M rolling average orders are up 0.9% from 0.7% q/q and 3.6% from 3.0% y/y. The forecast for Oct-Dec is +3.6% q/q. Also notable, the foreign orders fell 12.5% m/m after +7.8% m/m while government orders rose 2.4% from -21.1% m/m reflecting trade and response to natural disasters.

- China October Trade Surplus $34.01bn after $31.69bn – less than the $36.2bn expected. Exports rose 15.6% to $159.72bn after +12% y/y – more than the 12% expected. Imports jumped 21.4% y/y to $131.82bn after +14.3% y/y – also more than the 14% expected. Exports to the US slowed to $31.78bn from $34.13bn. Exports of aluminum rose 37.7% y/y but fell 3.6% m/m while exports of steel rose 10.4% y/y but off 7.6% m/m. Copper imports rose 28.2% y/y but fell 18.7% m/m. Iron Ore rose 11.2% y/y but down 5.4% m/m. Oil imports rose 31.5% y/y and up 9.6% m/m. Soybean imports rose 18.1% y/y and off 13.6% m/m – with Brazil the main beneficiary.

- Swiss October unemployment rate steady at 2.5% - as expected. The unadjusted rate was 2.4% - unchanged for the 5thmonth – and the best since Sep 2008. Unemployment rose 0.7% to 107,315 on the month but is off 20.4% y/y down 27,485. Jobseekers rose 2.8% to 183,446 for the month but off 7.8% y/y.

- German September trade surplus E18.4bn after E18.3bn – less than E21.2bn expected. On a seasonally adjusted basis trade surplus was E17.6bn after E18.2bn – also less than E18bn expected. Exports fell 0.8% m/m, -1.2% y/y to E109.1bn while imports -0.4% m/m, +5.3% y/y to E90.7bn. The EU trade showed exports -0.4% y/y and imports up 5.8% y/y. Outside the EU exports fell 2.2% y/y to E44.4bn while imports rose 4.7% to E38.6bn.

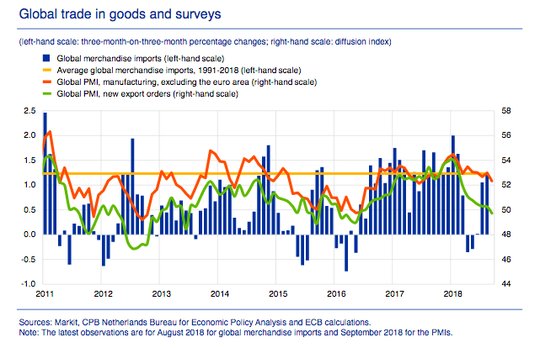

- ECB October Economic Bulletin: Weaker than expected growth but still expanding. The report sees global economy risks to the downside with US/China trade a key issue. Global trade has moderated but outlook steady in the near-term.

Market Recap:

Equities: The US S&P500 futures are off 0.5% after a 2.12% gain yesterday. The Stoxx Europe 600 is up 0.2% to 367.20 paring larger gains from earnings surprises as rates/growth worries drive. The MSCI Asia Pacific rose 0.9% - best in 3 weeks – despite China lagging. The MSCI EM rose 0.4% best in 5-weeks.

- Japan Nikkei up 1.82% to 22,486.92

- Korea Kospi up 0.67% to 2,092.63

- Hong Kong Hang Seng up 0.31% to 26,227.72

- China Shanghai Composite off 0.22% to 2,635.63

- Australia ASX up 0.57% to 6,015.90

- India NSE50 on holiday

- UK FTSE so far up 0.25% to 7,137

- German DAX so far off 0.2% to 11,554

- French CAC40 so far off 0.1% to 5,133

- Italian FTSE so far off 0.55% to 19,431

Fixed Income: The EU bond market flips from very offered on risk-on in equities and catch-up to US moves, to slightly bid for the core as EU commission doubts on growth hit Italy. Draghi, Couere speeches next key then the FOMC statement. German 10Y Bund yields are up 1.2bps to 0.455%, French OATs up 1.3bps to 0.82%, UK Gilts up 2.5bps to 1.555% while in the periphery – Italy up 5.5bps to 3.385%, but Spain off 0.5bps to 1.595% and Portugal off 0.5bps to 1.915% while Greece up 1bps to 4.27%.

- France sold E8.87bn of bonds with moderate demand. E1.72bn of 8Y 0.25% Nov 26 OAT at 0.54% with 2.05 cover, E3.76bn of 10Y 0.75% Nov 2028 OAT at 0.82% with 1.81 cover; E1.465bn of 12Y 2.5% May 2030 OAT at 0.92% with 2.05 cover and E1.926bn of 28Y 4.5% Apr 2041 OAT at 1.43% with 1.56 cover.

- Spain sold E3.7bn in Bonds with strong demand– E1.22bn of 3Y 0.05% bonds at 0.102% with 2.17 cover, E1.419bn of 5Y 0.35% Jul 2023 bonds at 0.565% with 1.95 cover, E553mn of 20Y 4.2% 2037 bonds at 2.224% with 2.05 cover and E800mn of 50Y 3.45% Jul 2066 bonds at 3.03% with 2.37 cover,

- US Bonds see bull flattening into FOMC with risk-off mood– 2Y off 0.5bps to 2.953%, 5Y off 0.7bps to 3.073%, 10Y off 1.7bps to 3.219% and 30Y off 1.6bps to 3.424%.

- Japan JGBs see curve steeper with equities bounce, talk of BOJ doing less in future. 2Y off 0.8bps to -0.143%, 5Y up 0.1bps to -0.089%, 10Y up 0.1bps to 0.113%, 30Y up 0.3bps to 0.881%. The MOF 1-5Y enhanced liquidity auction sold Y398.7bn at -0.005% spread average with 5.69 cover up from 2.93 in October.

- Australian bonds sold in risk-on, US catch-up trade– 3Y up 3.5bps to 2.105%, 10Y up 3bps to 2.755%.

- China PBOC skips open market operations, keeps liquidity neutral. China bonds continue to rally sharply – 2Y off 1.6bps to 2.88%, 5Y off 3bps to 3.28%, 10Y off 1.7bps to 3.47%.

Foreign Exchange: The US dollar index is up 0.25% to 96.23 with range 96.06-96.34 with focus back on 95.90 base for 97 retests. In EM USD mixed – EMEA: ZAR off 0.6% to 13.987, TRY off 1% to 5.417, RBU off 0.25% to 66.40; ASIA: TWD up 0.2% to 30.657, KRW up 0.6% to 1116.5, INR up 0.15% to 73.

- EUR: 1.1425 flat. Range 1.1404-1.1445 with 1.13-1.15 holding again focus is on growth and rates with Draghi vs. FOMC headlines next.

- JPY: 113.65 up 0.1%.Range 113.48-113.75 with EUR/JPY 129.80 up 0.1% - 130 pivot still – equities and US rates driving with 114 expiries

- GBP: 1.3105 off 0.15%.Range 1.3088-1.3150 with EUR/GBP .8720 up 0.15% - still about Brexit and rates.

- AUD: .7295 up 0.25%.Range .7265-.7298 with RBNZ, China headlines driving despite metals. .7250-.7400 next consolidation? NZD flat at .6790 with .68 pivot for .6880 next.

- CAD: 1.3100 off 0.1%.Range 1.3088-1.3126 with oil, rates and crosses driving but 1.3050-1.3150 holding with FOMC and data next key

- CHF: 1.0025 flat. Range 1.0003-1.0036 with EUR/CHF 1.1455 flat. No fear plays here.

- CNY: 6.9163 fixed 0.14% weaker, trades lower with RMB basket off 0.2% to 92.34 according to Bloomberg trackers. Now off 0.2% to 6.9320 with range 6.9211-6.9362.

Commodities: Oil up, Gold down, Copper off 0.7% to $2.7910.

- Oil: $61.75 up 0.1%.Range $61.61-$62.42 with focus on risk-mood and $60 WTI holding. Brent flat at $72.09 with focus on $71.50-$73.50 consolidation.

- Gold: $1223.85 off 0.2%.Range $1222-$1228. Focus is on USD holding/rates against broader risk doubts returning. Silver off 0.5% to $14.51 with $14.50 the pivot point for $14.45 and $14.28 support. Platinum off 0.15% to $871.50 and Palladium off 1% to $1124.50.

Economic Calendar:

- 0830 am Canada Oct housing starts 189k p 195k e / prices 0.4%p 0.3%e

- 0830 am US weekly jobless claims 214k p 215k e

- 0915 am ECB Coure speech

- 1200 pm US WASDE report

- 0200 pm FOMC rate decision – no change from 2.25% expected

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.